Market Morsel: Wheat futures are not equal

Market Morsel

Wheat futures are a tool which buyers and sellers of grain can use to manage their pricing risk. In reality, very few farmers in Australia use futures as a risk management tool, but they are valuable, which is why we cover their use in our articles.

Generally, when people are discussing wheat futures, they will be referring to Chicago wheat (CBOT). However, that isn’t the only option available to use. There are many different futures exchanges around the world.

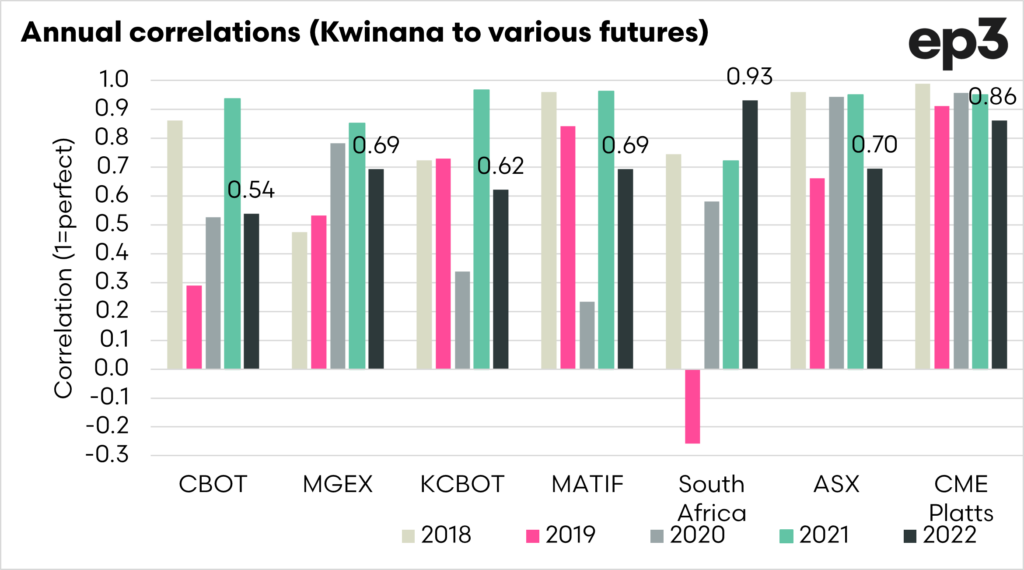

This morning, I wanted to take a quick look at what exchanges have the strongest correlation with Australian prices. When choosing a futures hedge, selecting an exchange with a strong correlation is advisable, as it is more likely to follow a similar trajectory to the local physical price. If you choose an exchange with limited correlation, you could actually add more risk.

Correlations measure a relationship between two pricing points and a number is assigned:

- 1 = Perfect correlation

- 0 = No correlation

- -1 = Negative correlation

I have produced the chart below, which examines Kwinana APW1 prices against various futures markets on an annual basis since 2018, using monthly average data.

What we can see in the data is that most contracts have a consistent high correlation. Interestingly, during 2022, the South African wheat contract has shown the strongest correlation. It would be important to point out that it has a low consistency over time.

The two showing consistency are the ASX east coast Australia contract, and the CME/Platts west coast Australia contract.

It make sense that they have a high and consistent correlation as they are based on Australian pricing points. Therefore they should have a very strong relationship with the local physical contract.

Local contracts generally have a closer correlation between physical and local, the only issue is a lack of volume. However, if buyers and sellers were to utilise these contracts, they would be valuable tools for risk management as volume grows.