Market Morsel: Wheat gets some love.

Market Morsel

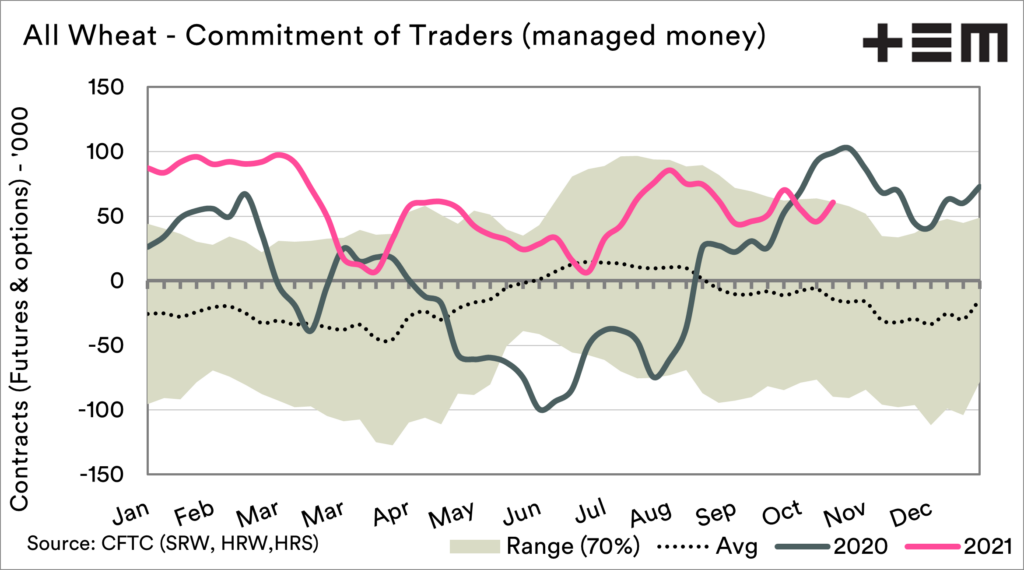

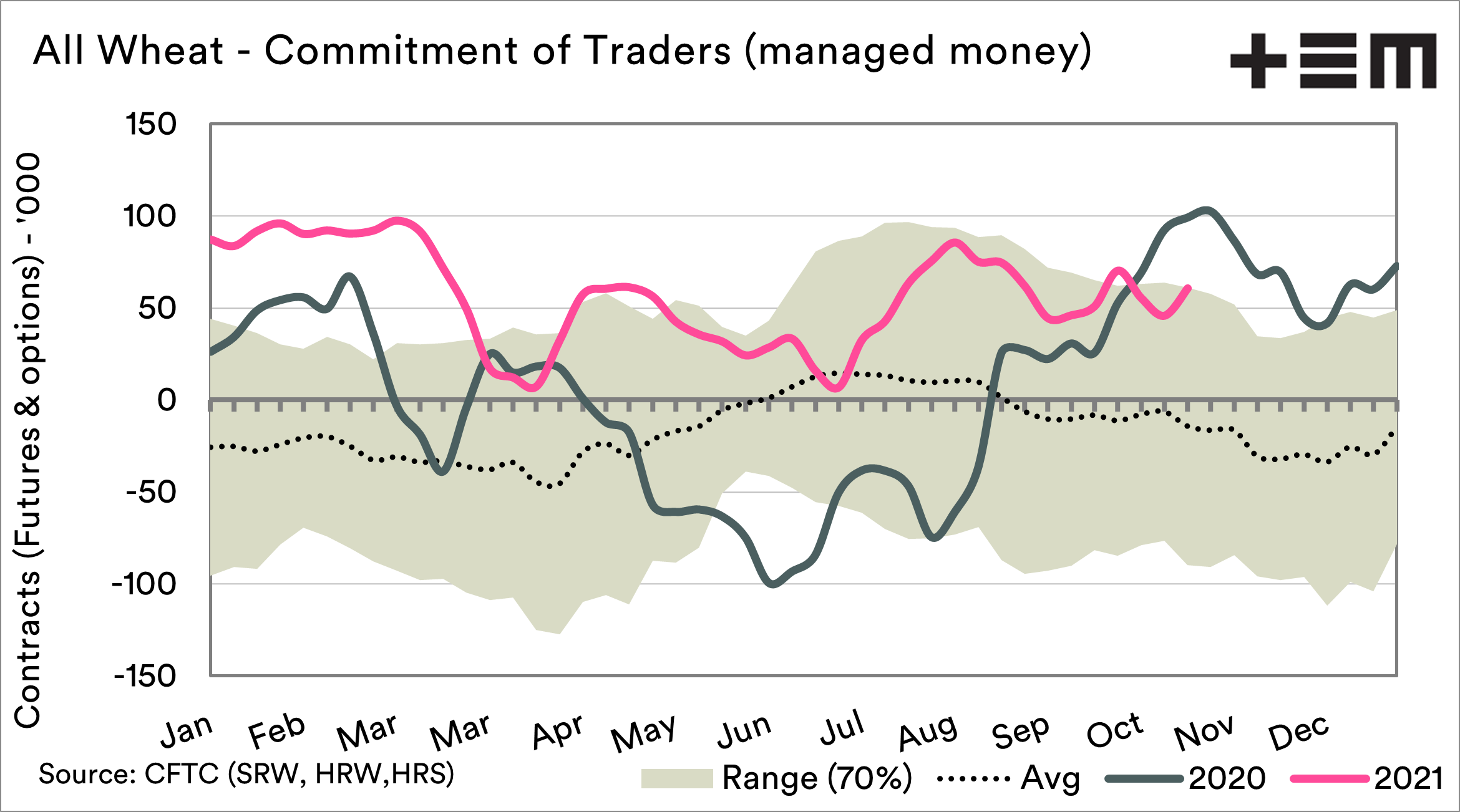

Speculators in the grain space have a big impact on pricing. The commitment of traders report gives an insight into their thought process.

We tend to look at their net position and whether they are overall long (bought) or short (sold). If the market is bought, then they are betting on a rising market. If they are overall sold they are expecting to make money from a falling market.

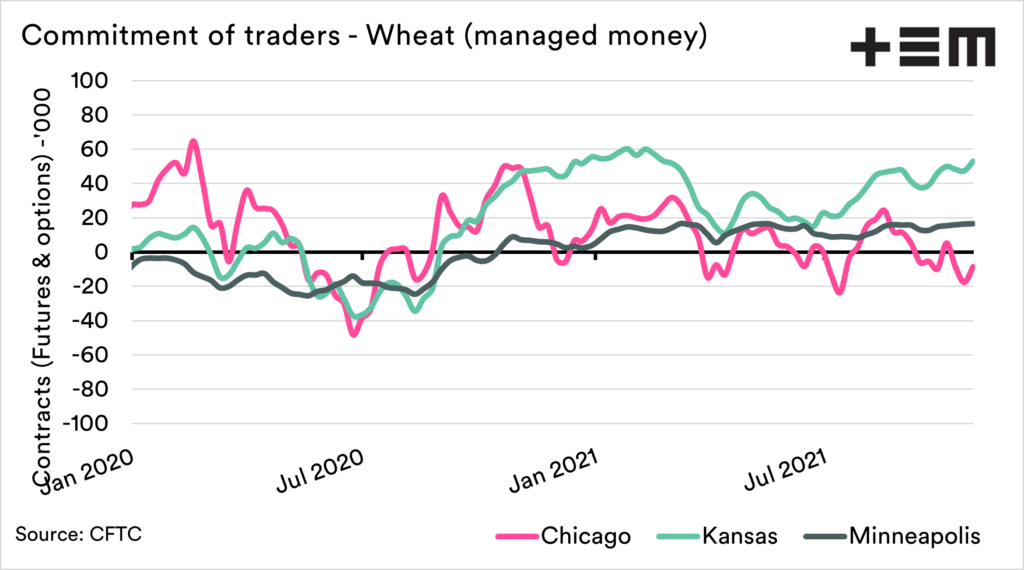

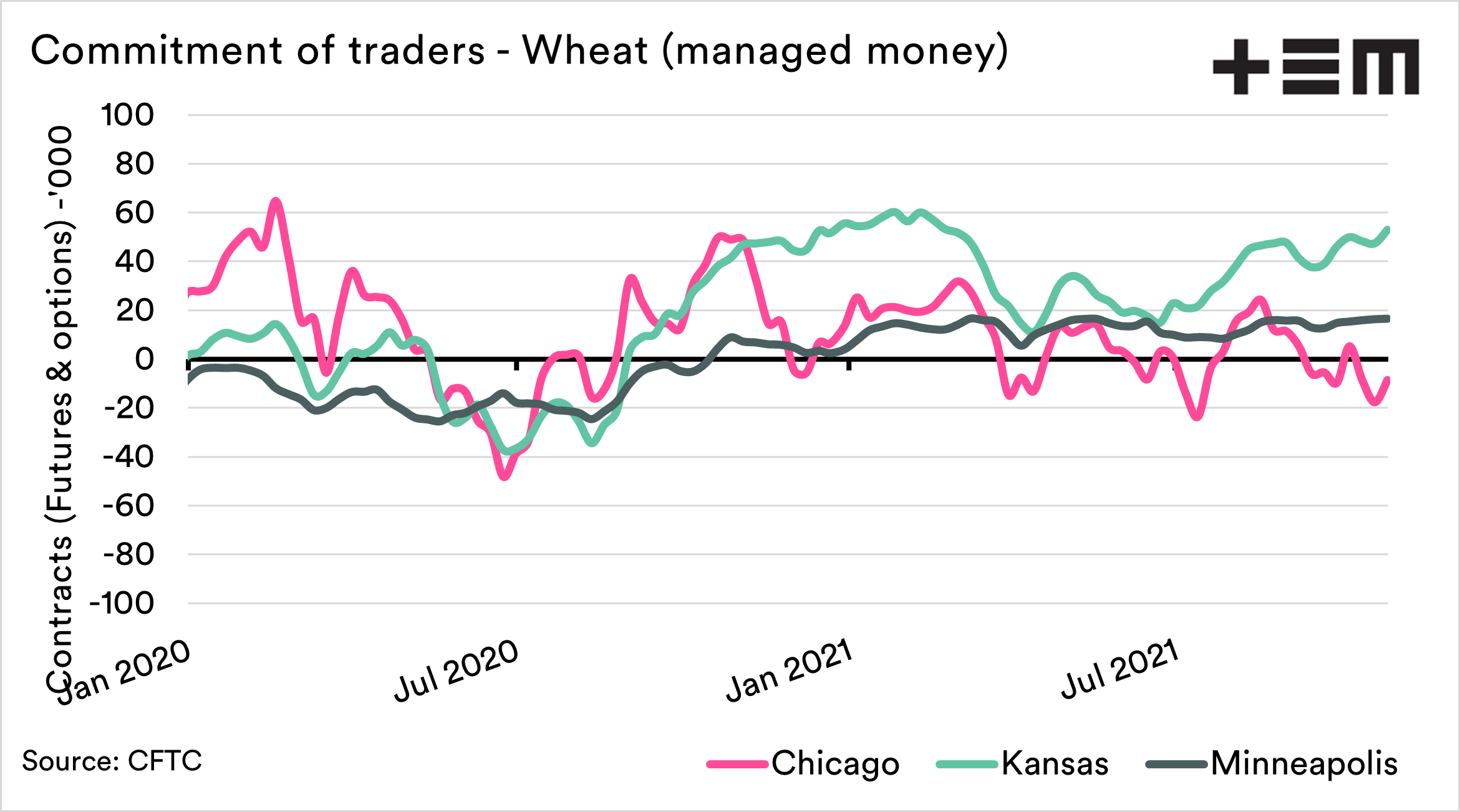

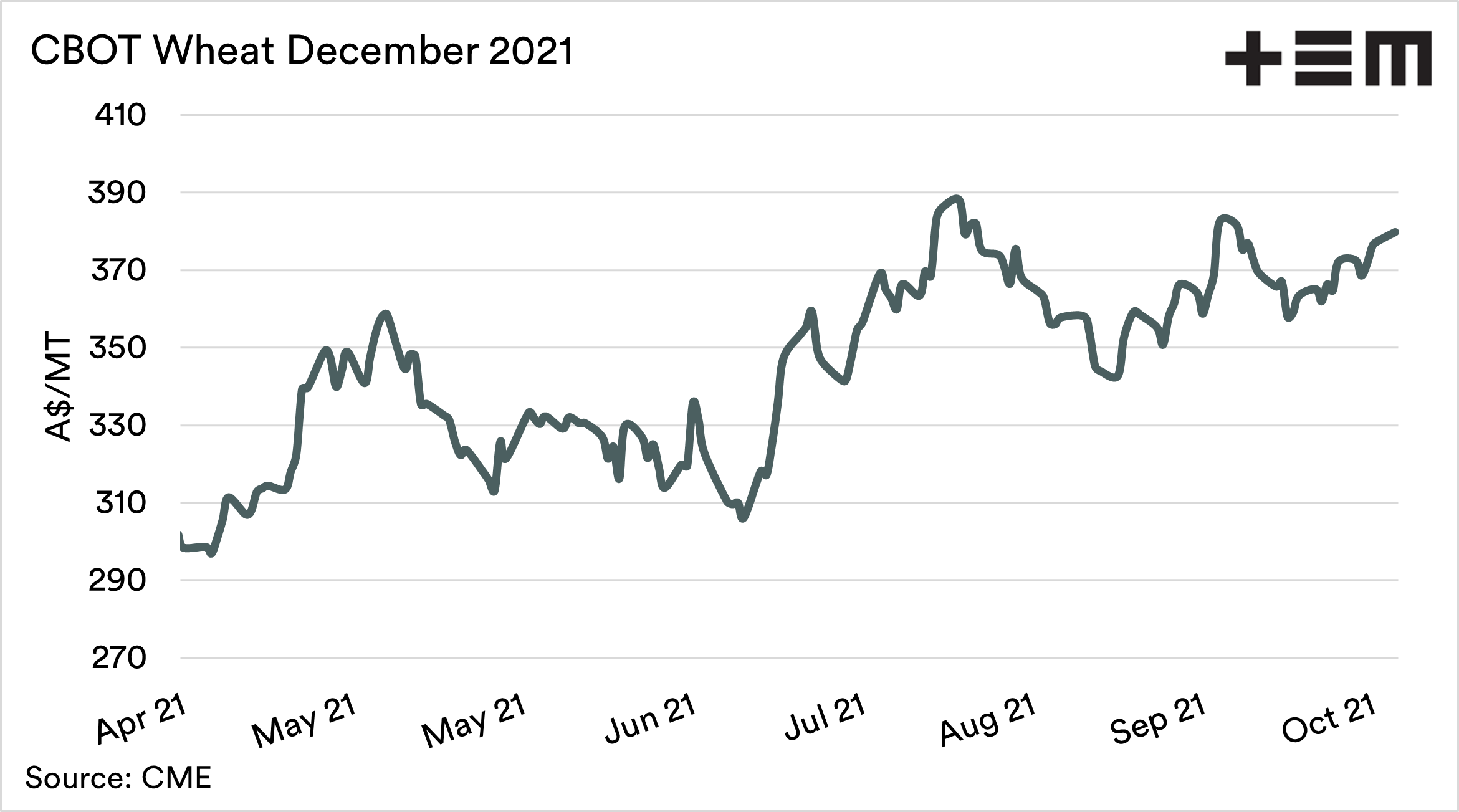

The speculators in the wheat market have overall increased their net long position. The majority of the move has come from the Chicago contract.

The Kansas and Minneapolis futures contracts (both higher protein) are both showing a net long. Chicago remains net short but improving.

It’s always important to note that speculators are not always right. Just because they are betting on the price rising (or falling) doesn’t mean it will go in their direction.

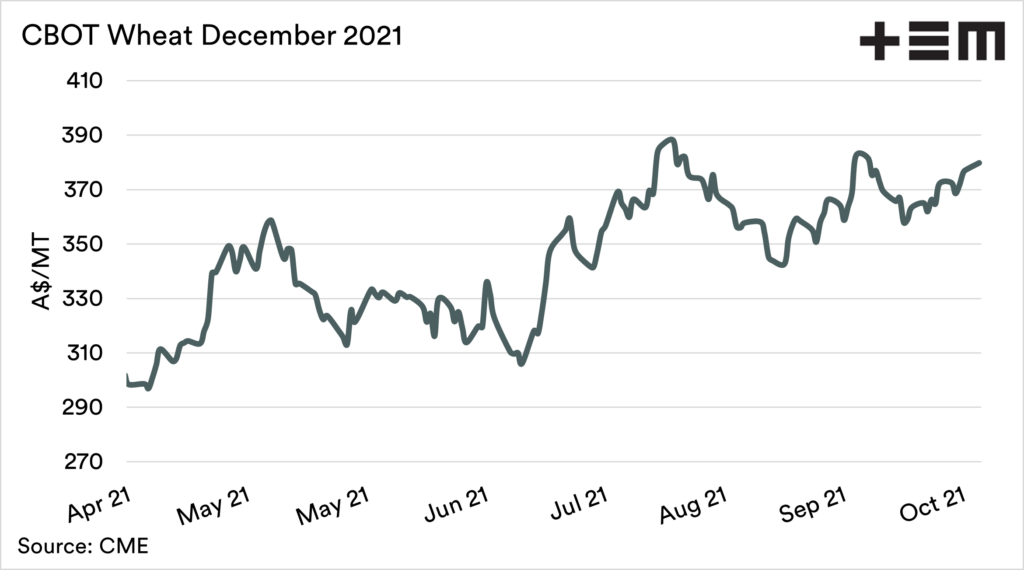

In recent weeks, we have seen a gradual increase in wheat pricing, after having fallen from the highs in early October. The current December contract is trading at A$379.