Market Morsel: Wheat goes up must go down.

Market Morsel

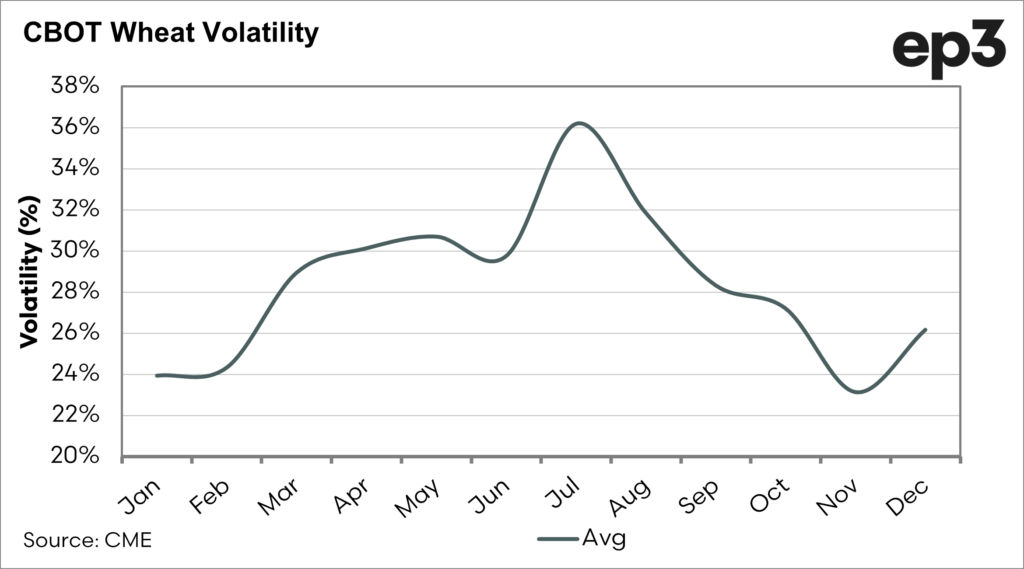

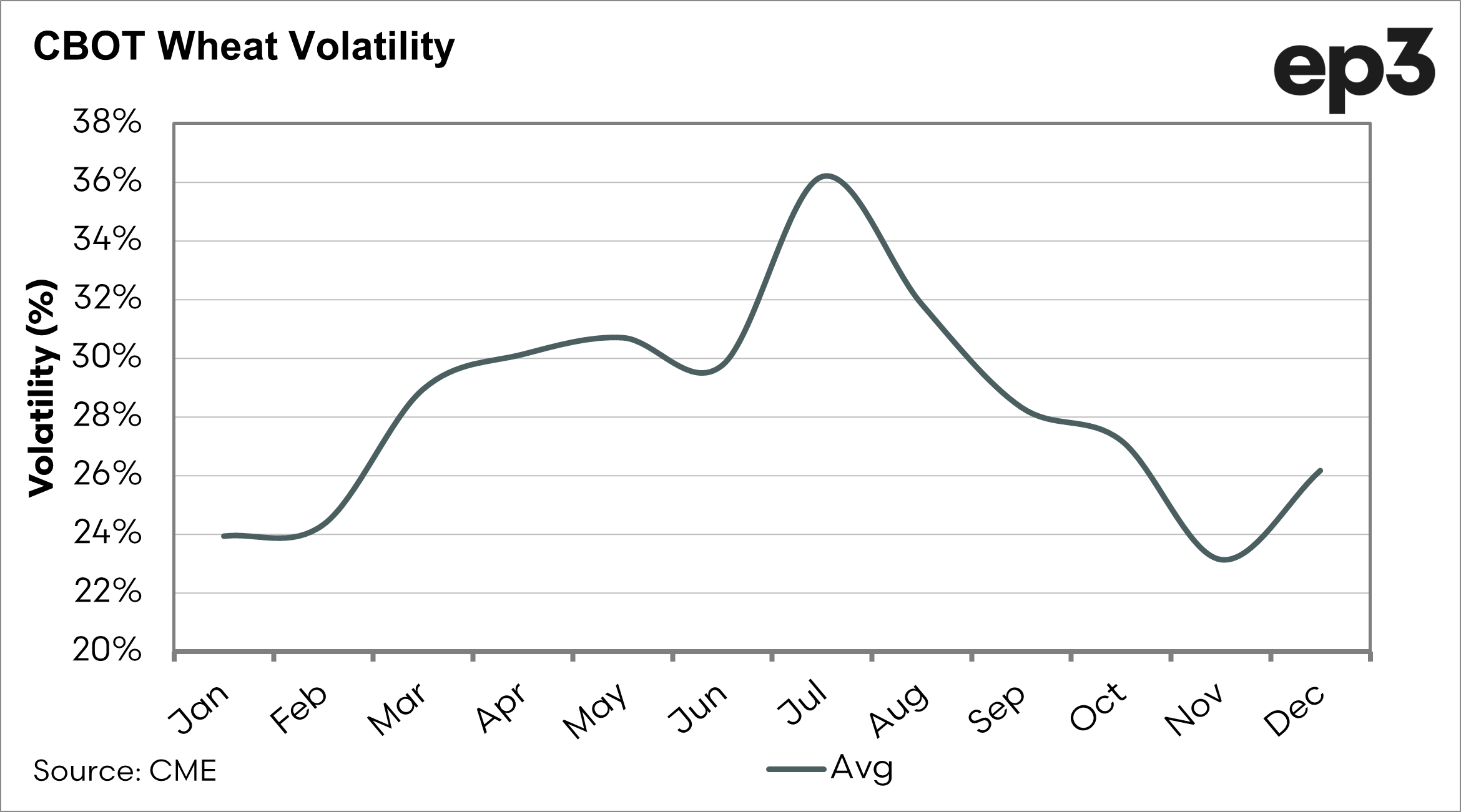

We always say that the June-August period is the most volatile for pricing wheat, whether you are a buyer or a seller. The first chart below shows the average wheat volatility over the past decade on a monthly basis.

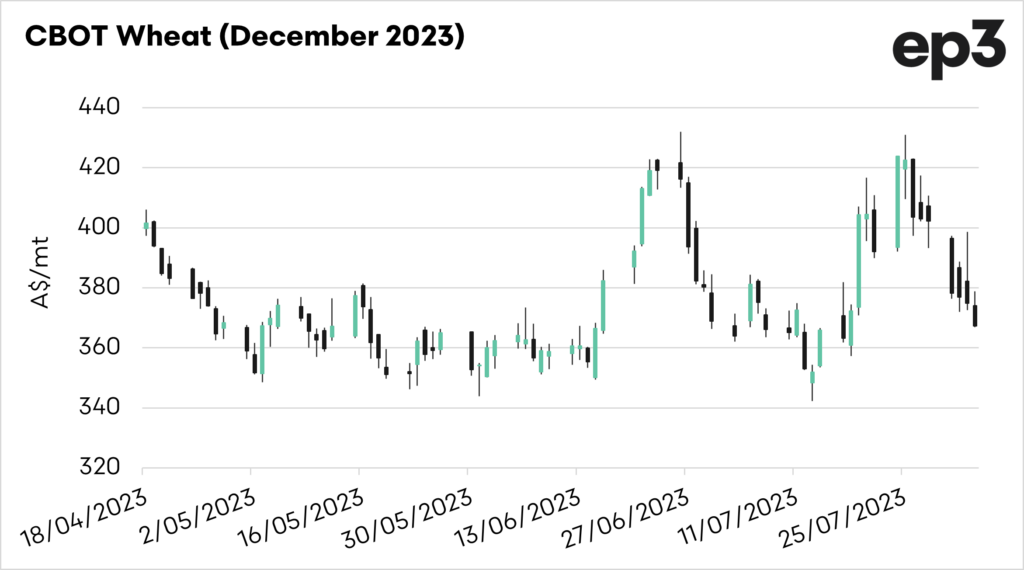

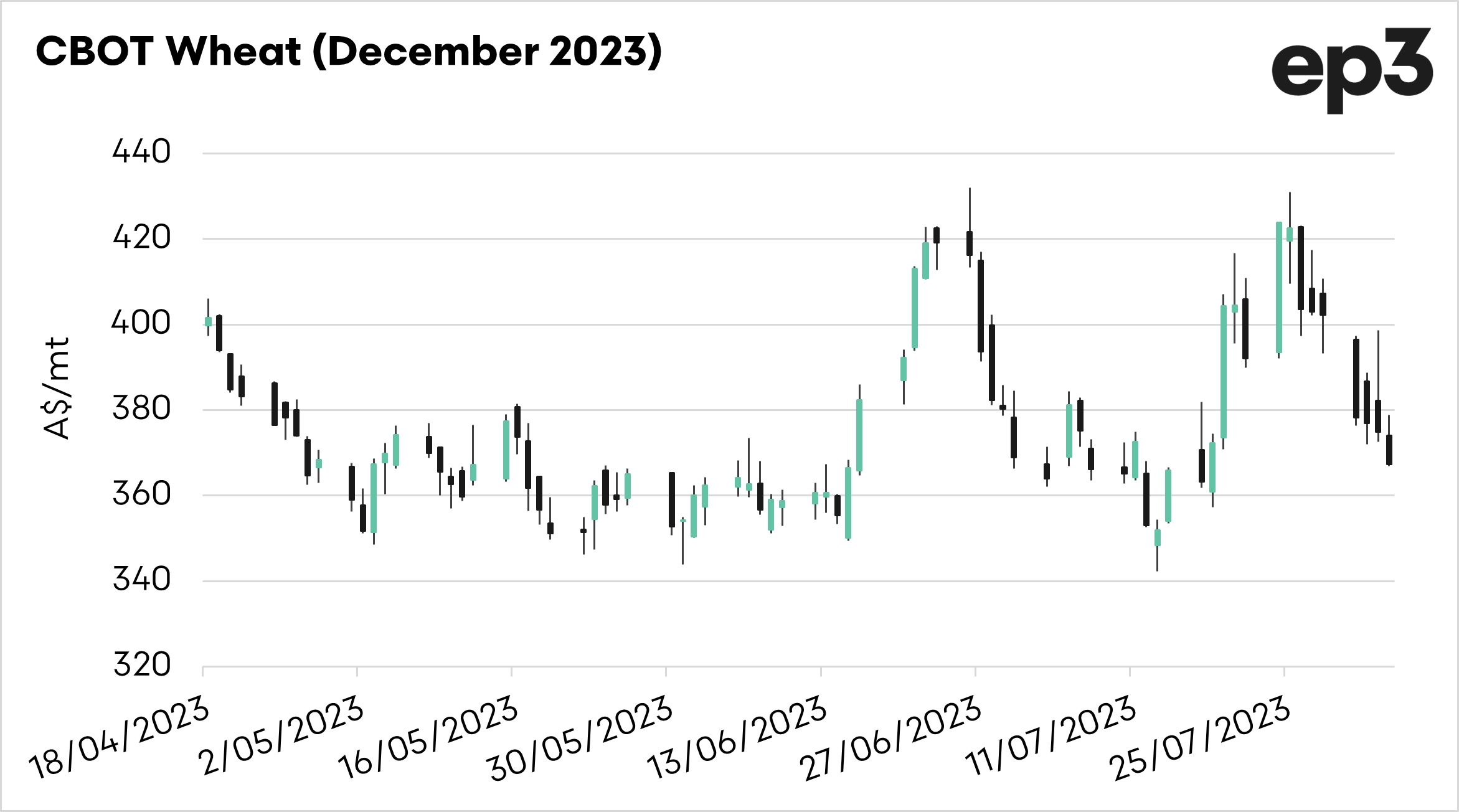

The Ukrainian grain export deal was reneged on by Russia, and the market rallied strongly. CBOT wheat futures for December rose A$72 from A$351 just before the deal expiry, to A$423, before falling back to A$367.

We did see a significant proportion of the rise flowing through in many port zones (see here). The fall locally has actually been less considerable than CBOT wheat futures, which can be seen in the third chart. This means our basis is strengthening against CBOT.

So why is it falling when supplies in the black sea are at risk? Here is a quick summary:

- Russian supplies are expected to flow.

- Further Russian attack on the Danube.

- Weather is amenable to US corn crop.

- US to do ‘whatever is necessary’ to assist all parties if grain deal is revived.

- Ukrainian grain/oilseed crop increased by 8mmt

- Good corn conditions in Brazil.