Market Morsel: Wheat in the red

Market Morsel

The wheat market has been interesting, to say the least, over the past couple of months. This is a period we will all remember for a long time.

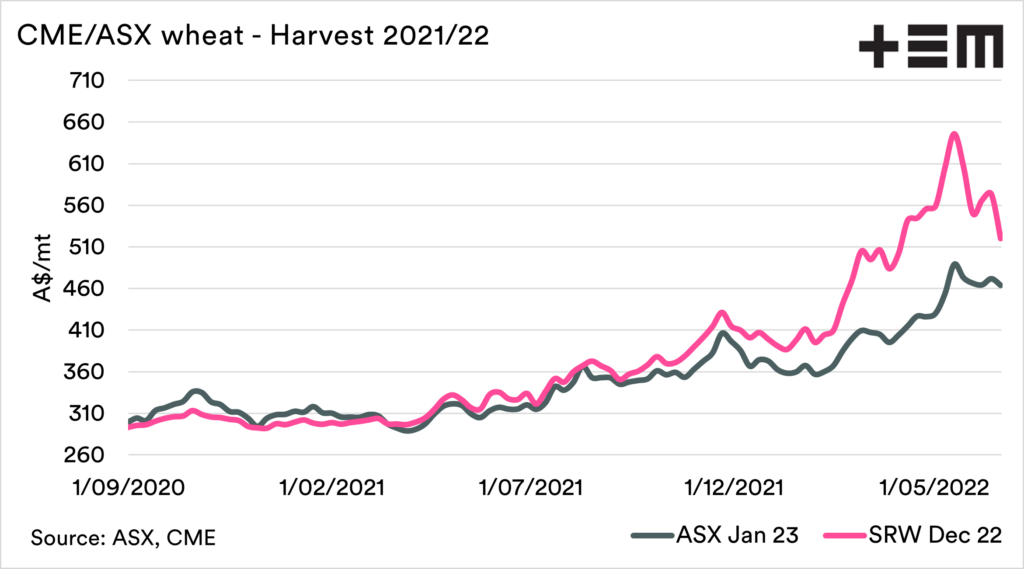

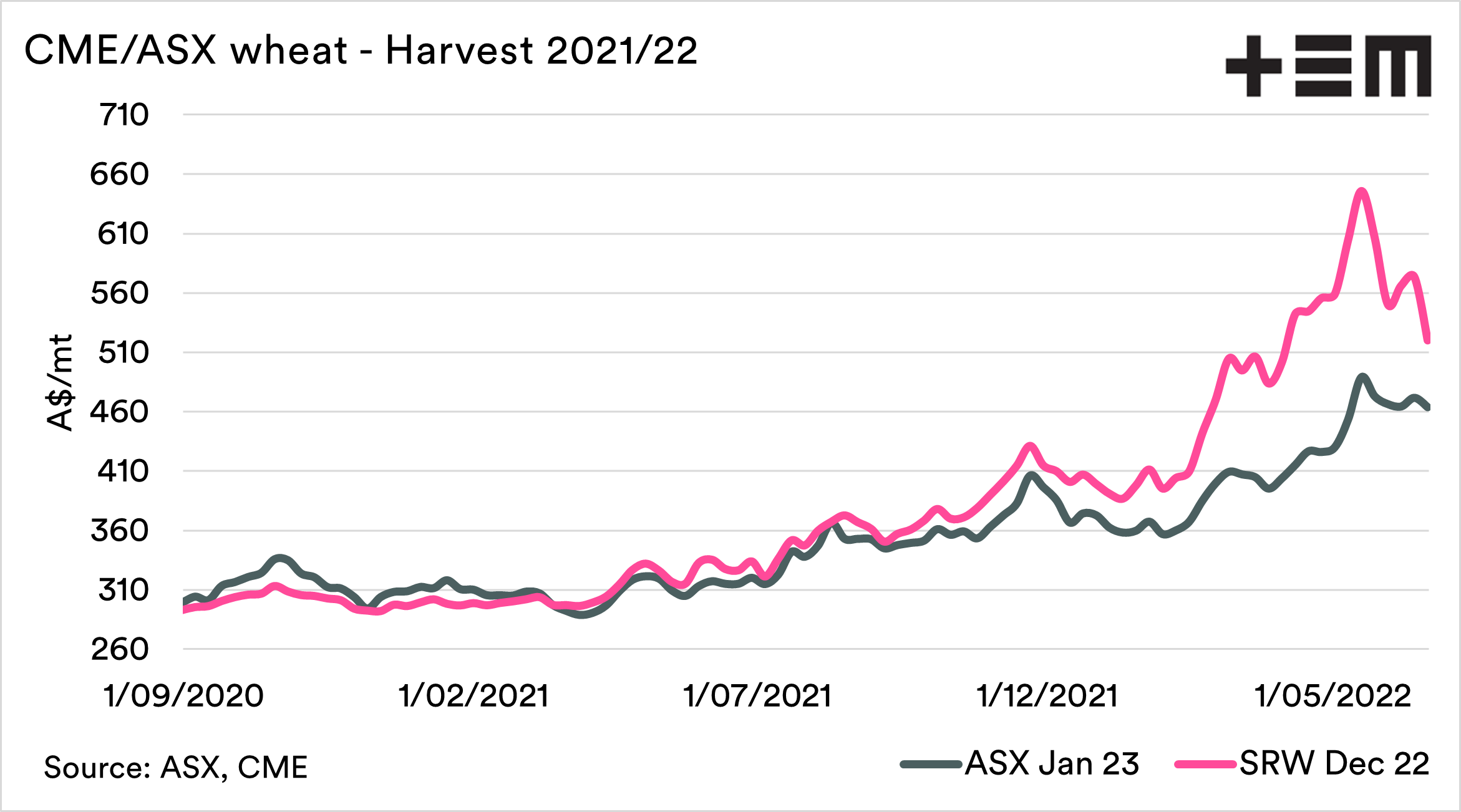

The past week or so has been pretty traumatic. CBOT wheat futures for the December contract have fallen A$72 since the 17th of June.

They have been trading in a huge range in the past two months, at the peak of the year, on the 18th of May, it was trading at A$675, and it is now at A$503.

What is driving it downward?

There has been a move lower across a range of commodities as concerns mount of a looming economic recession. Will we see demand destruction start to impact in food which is largely inelastic this can become an issue. However, with so much of the world’s grains converted to industrial processes, this may start to have an impact.

The speculators in the market have continued to reduce their net long positions. Overall, they are reducing their ‘bet’ that the market will increase.

In other news, there is pressure coming on from the northern hemisphere harvest as supplies come onto the market. The Russian wheat crop is also estimated to be a record high of 89.2mmt, by guest contributor, Sovecon.

The market has provided some great pricing opportunities to hedge for the coming harvest. At present, values are still very strong, although a lot of potential value has been lost. In our discussions with farmers around the country this week, most have not performed any forward sales.

I think it is important that farmers consider their options when marketing grain, especially with the market being so high in recent months, and I’ll refer to this important report.

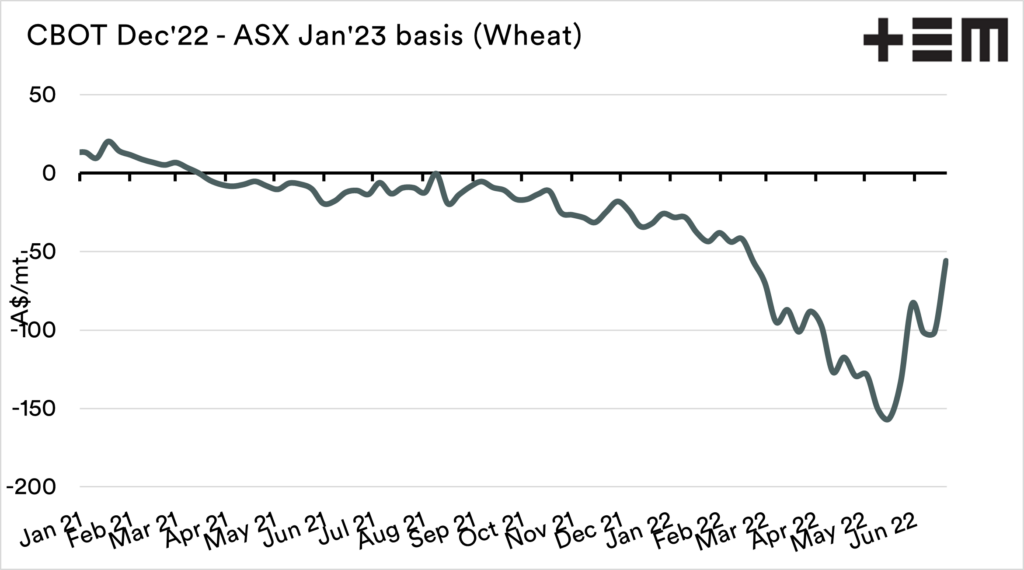

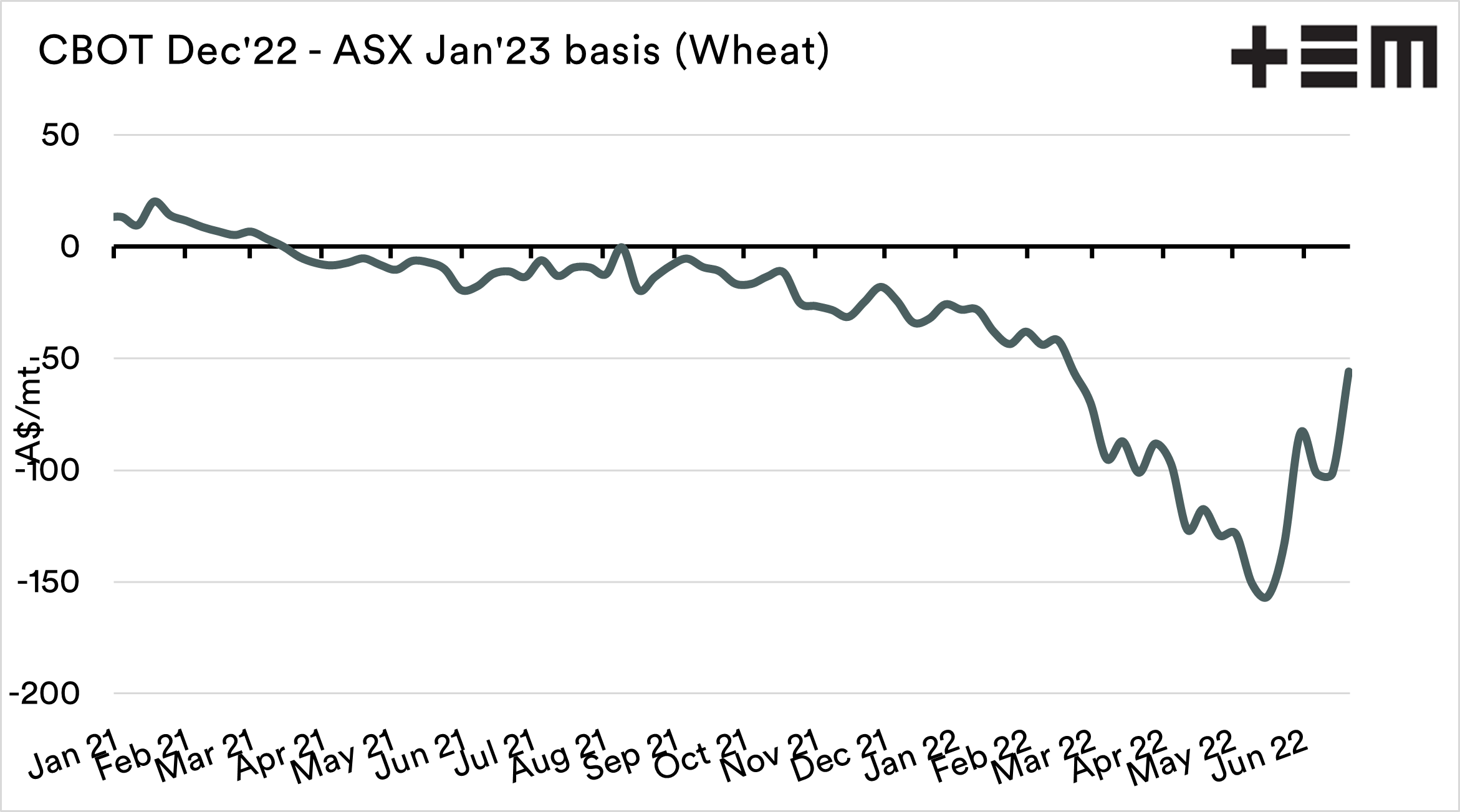

The price of wheat in Australia has fallen at a lower decline than overseas which has help improve our basis for new crop.