Market Morsel: Wheat peaks and crashes

Market Morsel

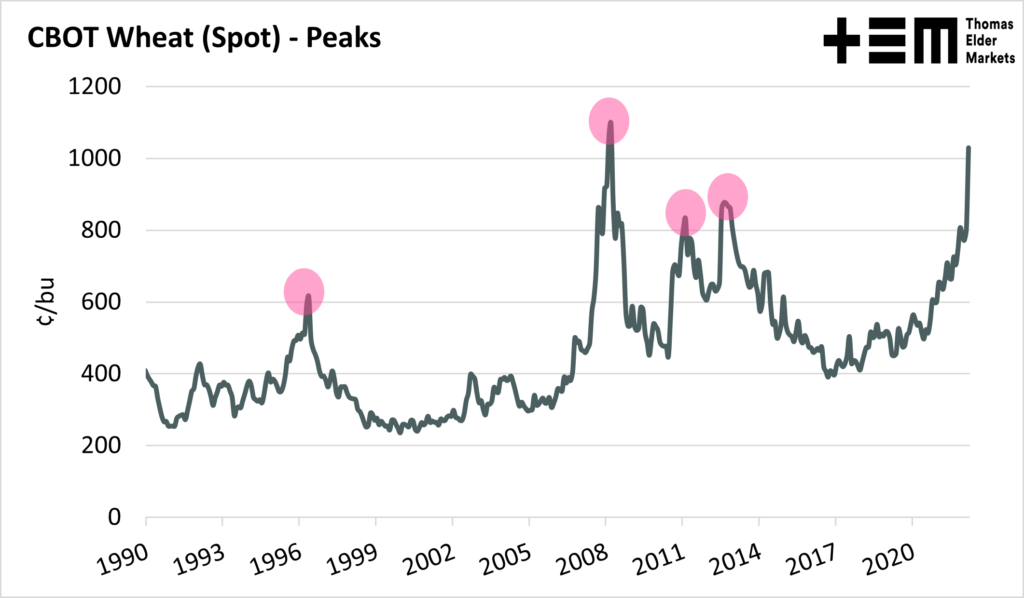

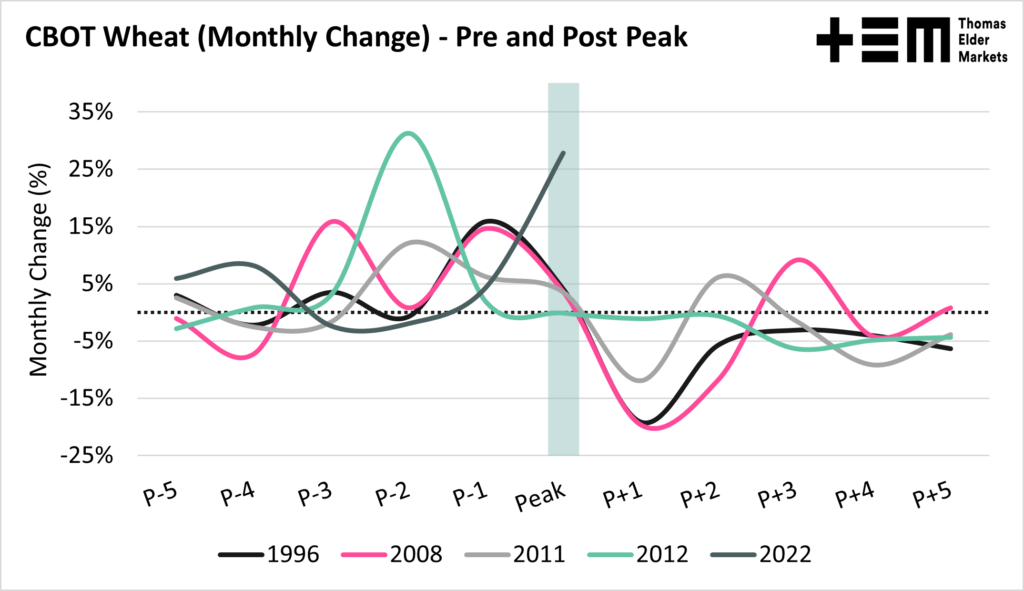

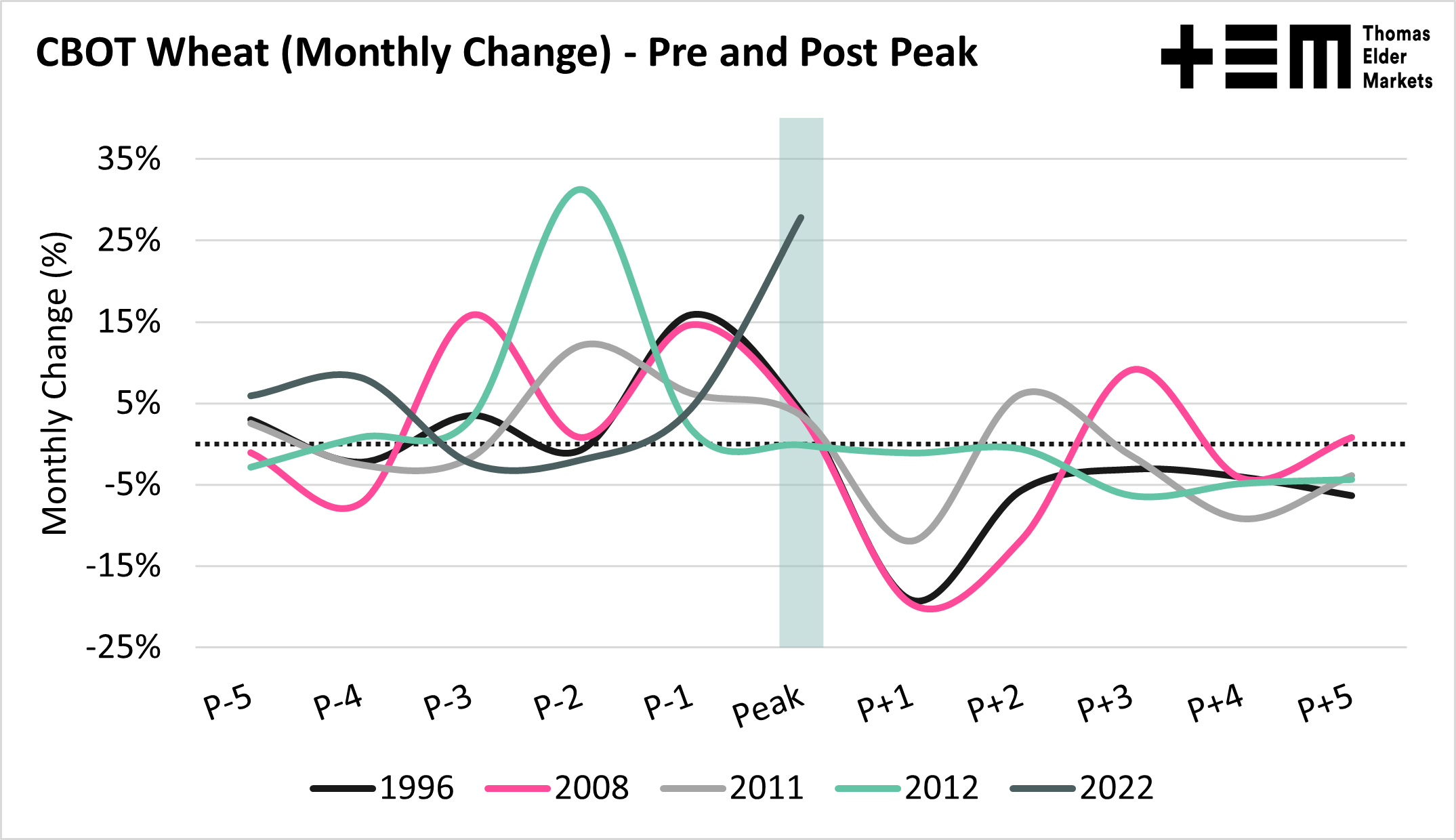

I was musing over some wheat charts and it got me thinking about how the market is characterised by memorable peaks. I have highlighted some of the peaks that stand out since 1990 in the first chart. These are times when the market rallies very strongly above the general pricing environment.

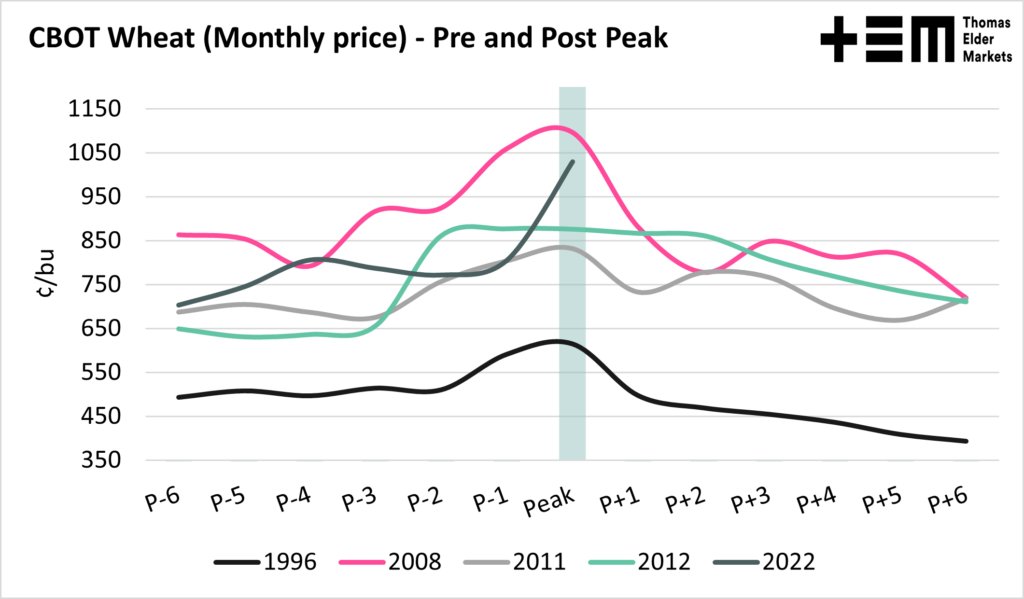

Those peaks all had strong rises, but the biggest month was 1 or 2 months prior to the actual peak, followed by a sharp retraction.

They have tended to have very sharp crashes in the month after the peak.

- 1996 -19%

- 2008 -20%

- 2011 -12%

The exception was 2012 which stayed stable for a few months post-peak.

I’m not saying that we are near a peak, or that the same type of crash may come. Just musings on what has occurred in the past. Ukraine is one factor but also poor moisture in the USA, SA and parts of North Africa, along with a tight exporter balance sheet drive this market.

There are so many variables driving the market at present – even before the invasion. The next six months are going to be memorable for those in the markets.

The market is watching any peace talks with bated breath