Market Morsel: Wheat remaining strong

Market Morsel

Harvest is pretty much upon us now. The lie detectors will be in the paddock, and we will get an indication of whether this crop is as big as expected. What is happening in the wheat market?

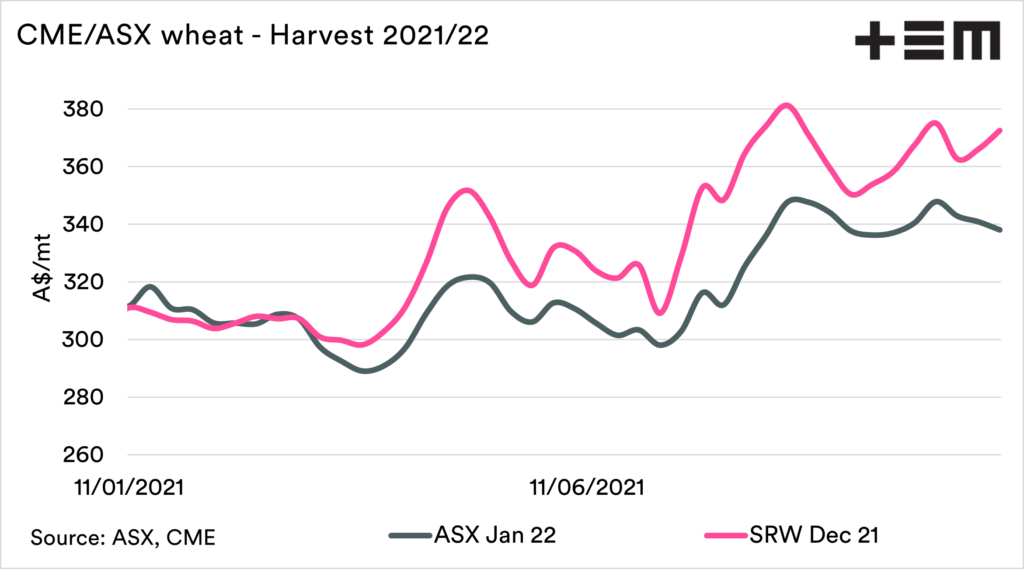

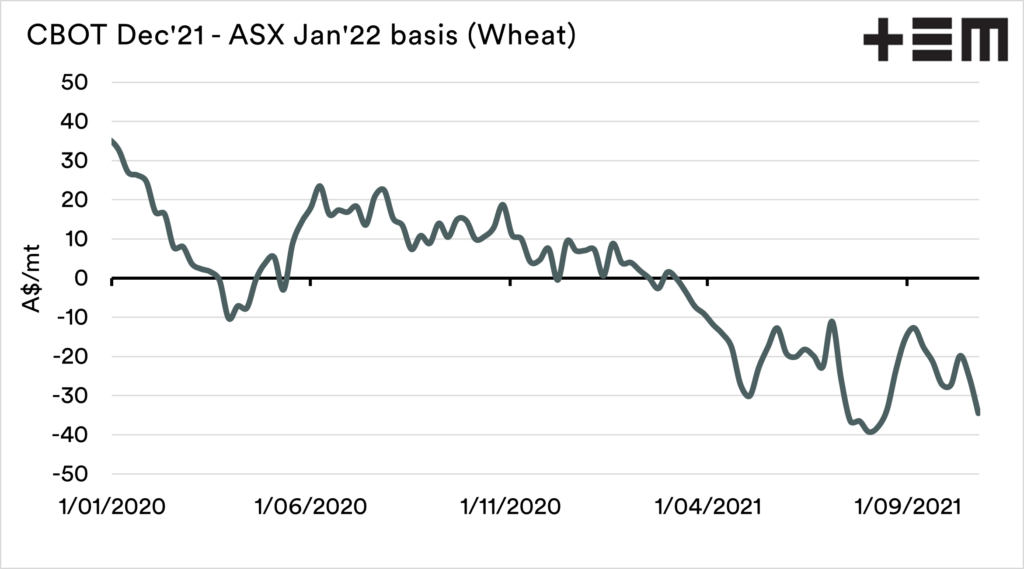

Four weeks ago, we had a strong rally in CBOT wheat futures, with the market reaching A$375 for this harvest. Gravity started to take effect, and we ended up falling back to A$362 the next week. Luckily we have seen an uptick, and we are close to the early October highs at A$372.

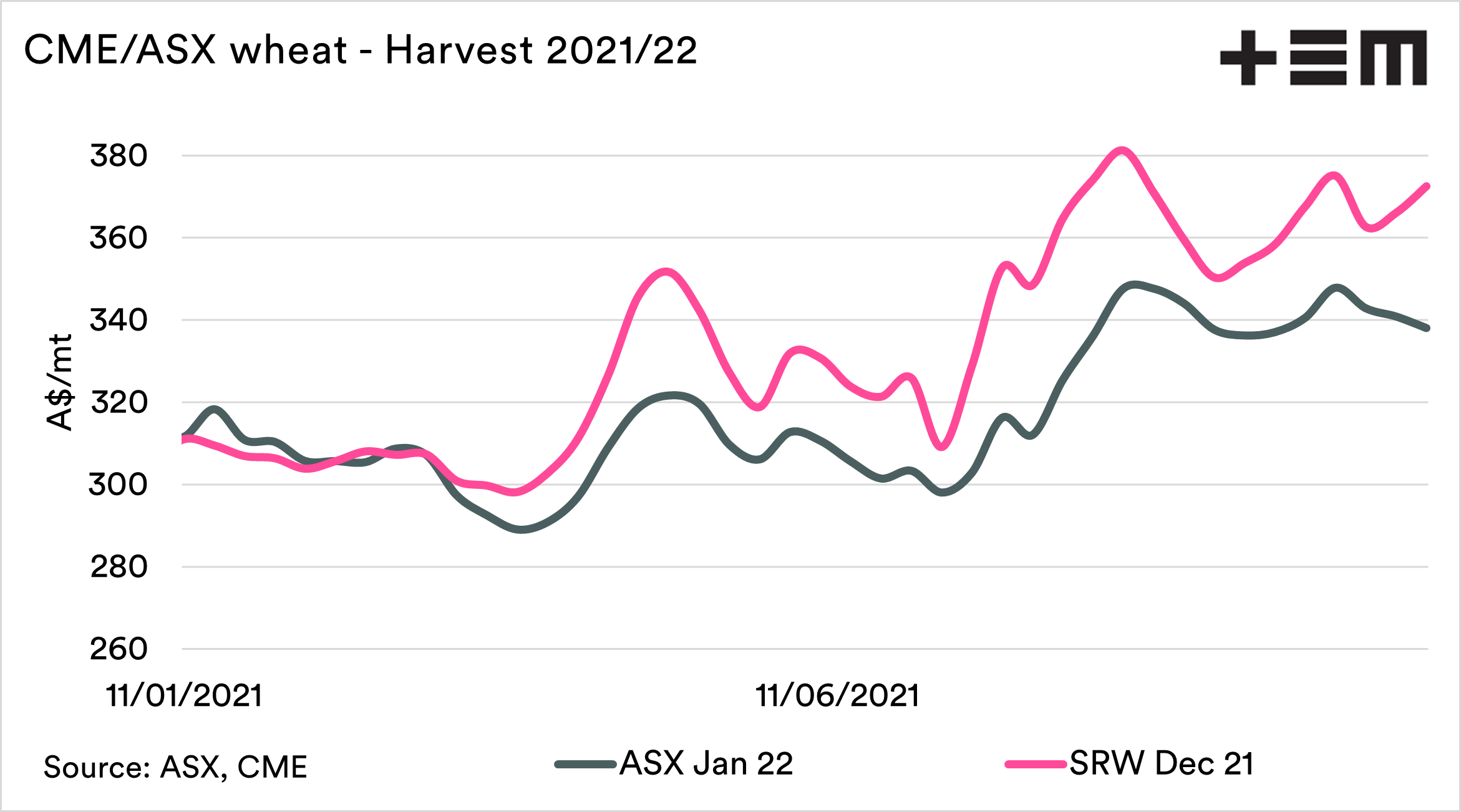

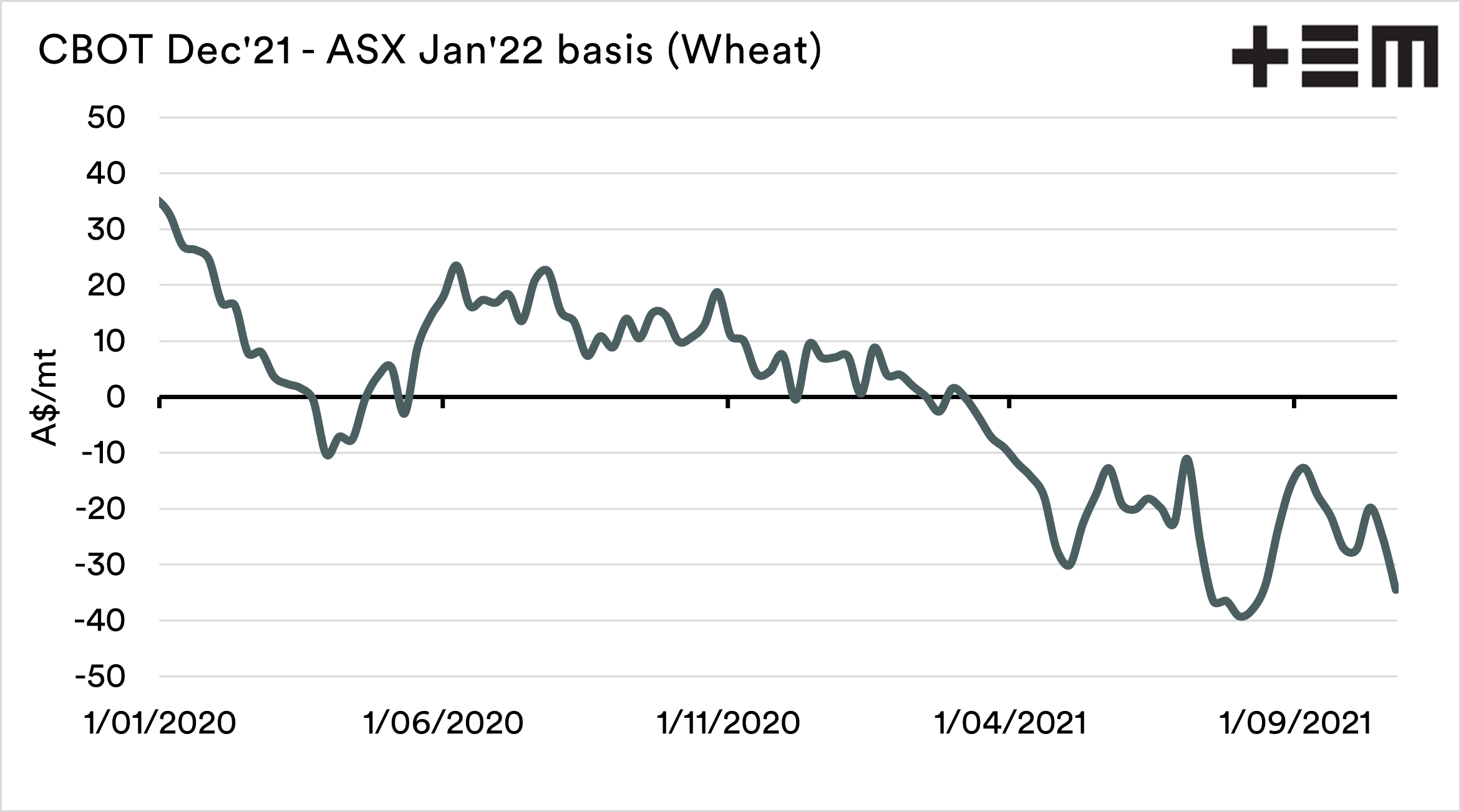

The ASX contract has followed a different trajectory, losing value in recent weeks. The result is that basis levels have declined. The discount to ASX from CBOT is A$34.

Typically Australian wheat would trade at a premium to CBOT. Since last harvest, our pricing has generally been trading at a discount due to the pressure of a large crop.

This discount is likely to persist. Last week I wrote about how our pricing was tracking to our major customers compared to our competition (see here). At the moment, we are competitive, but not too competitive.

Pricing is currently attractive on a flat price basis, due to the strength of global values. This provides the ability to price at prices that would be historically agreeable.

The big question will be, will the basis fall further as we come under harvest pressure in the coming weeks. As growers start to flood the market, this produces an additional ‘supply’ that could flow through to less pressure on buyers.