Market Morsel: Wheat takes the throne.

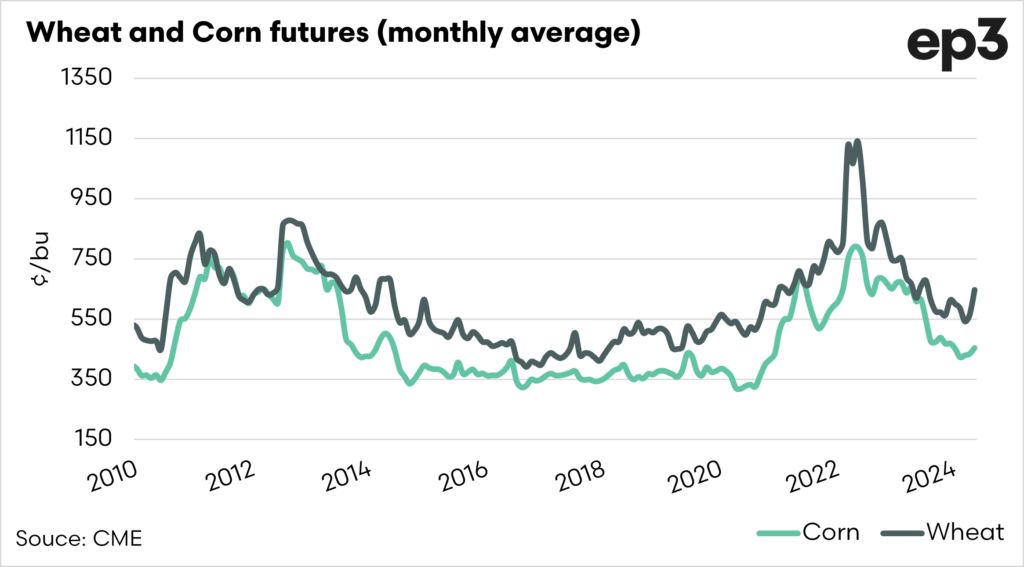

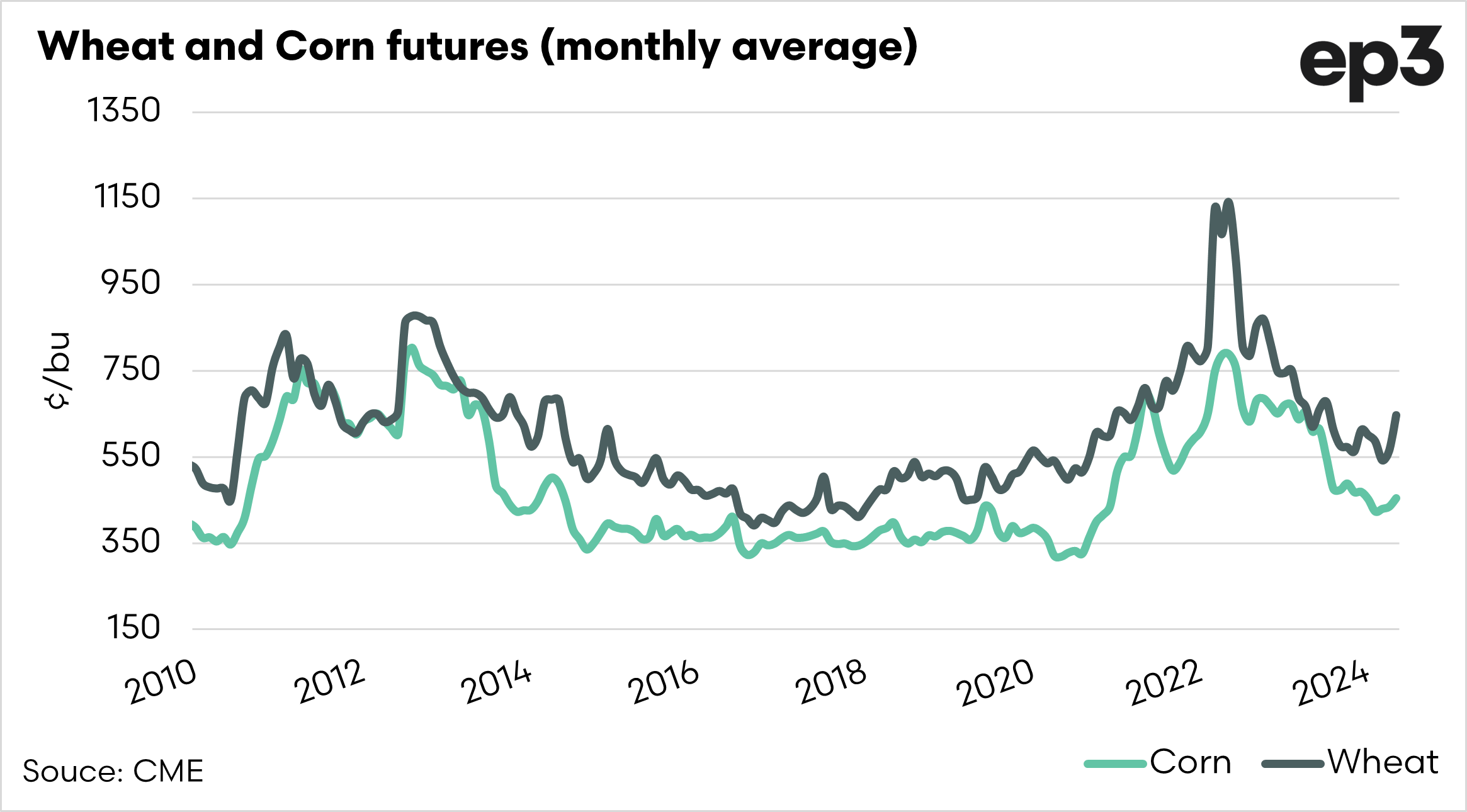

We don’t grow all that much corn/maize in Australia. The rest of the world is another matter. Corn is the world’s most grown grain, and it is important not only for biofuels but also for animal feeds.

In many ways, it competes for demand with what. That is why we look closley at corn, as changes in corn can impact wheat.

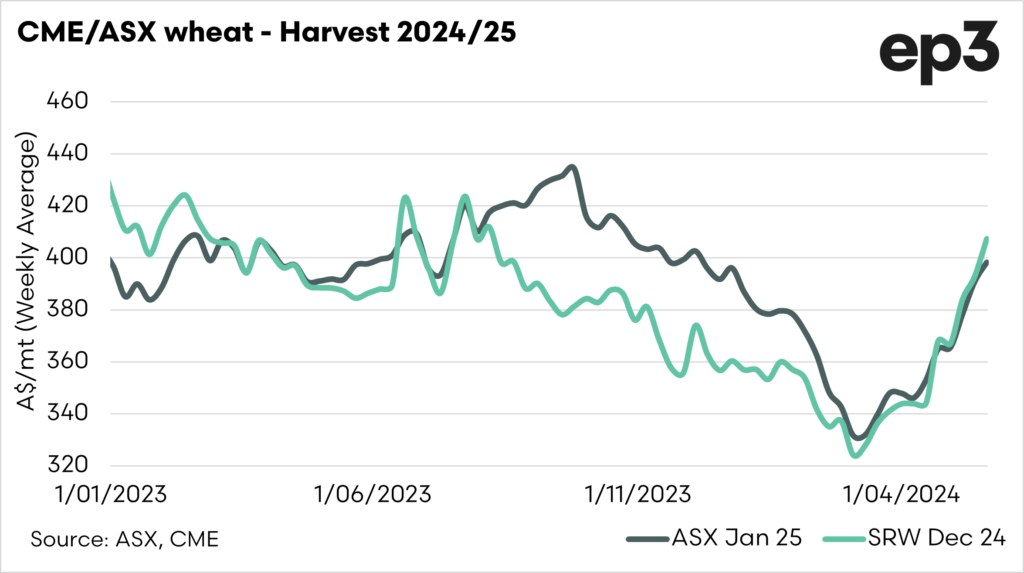

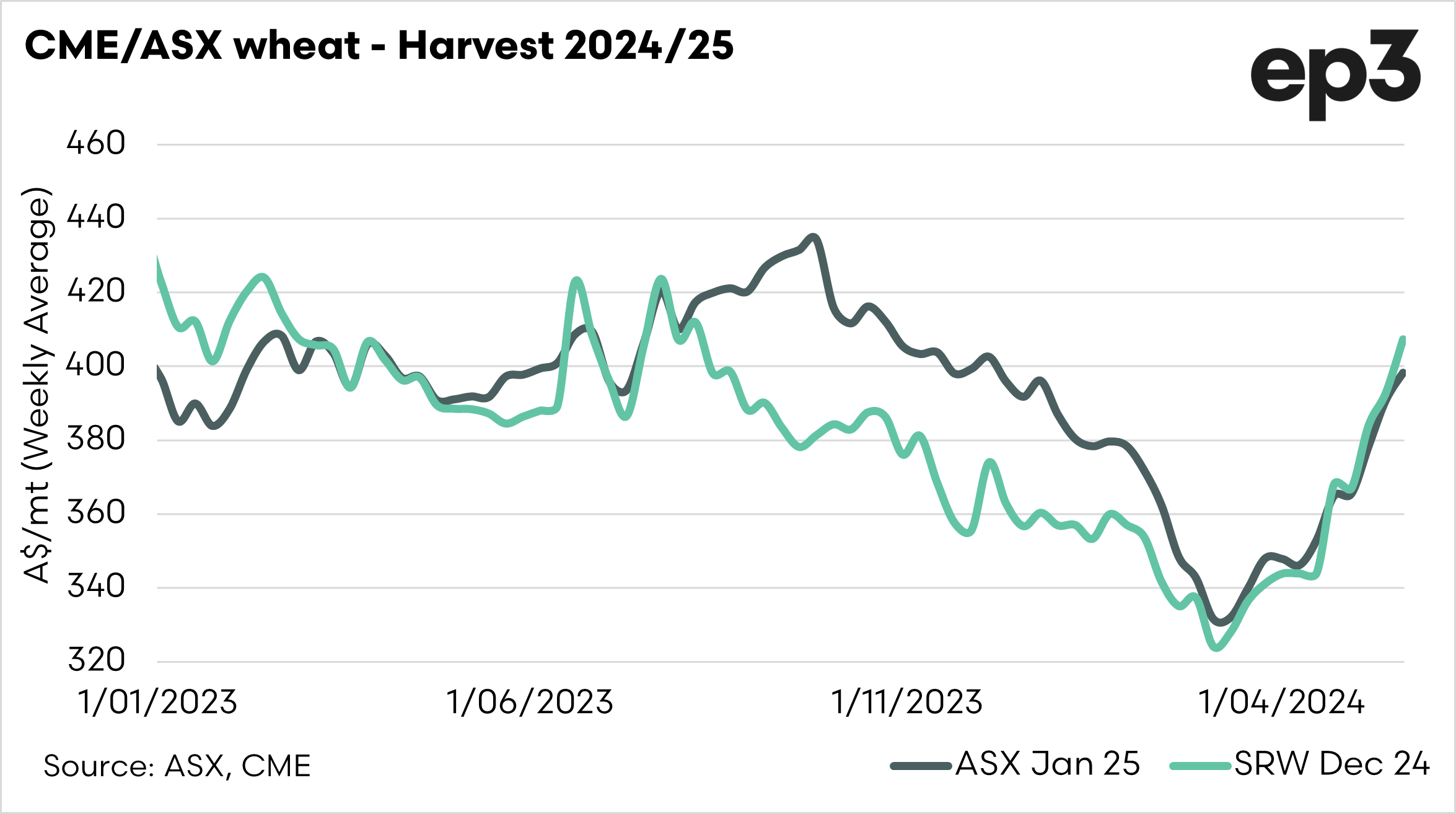

In recent weeks, we have seen wheat pricing rise dramatically, which is great for farmers as we drill the crop. If we look at the first chart below, we can see that ASX, which is a reasonable proxy for Australian pricing, offers A$400 per tonne. The basis level is still negative, which should move to a more positive level if the rains don’t arrive.

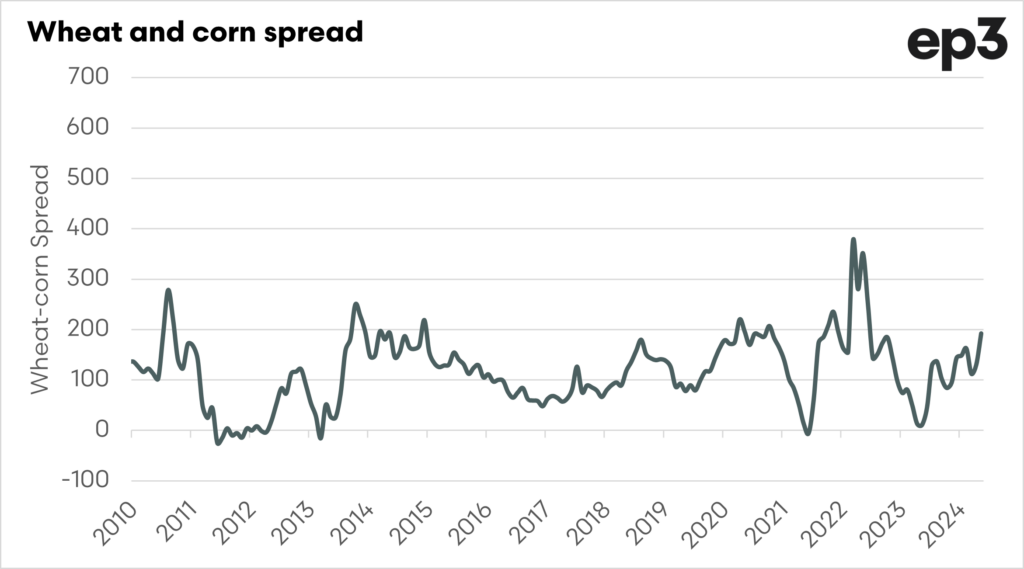

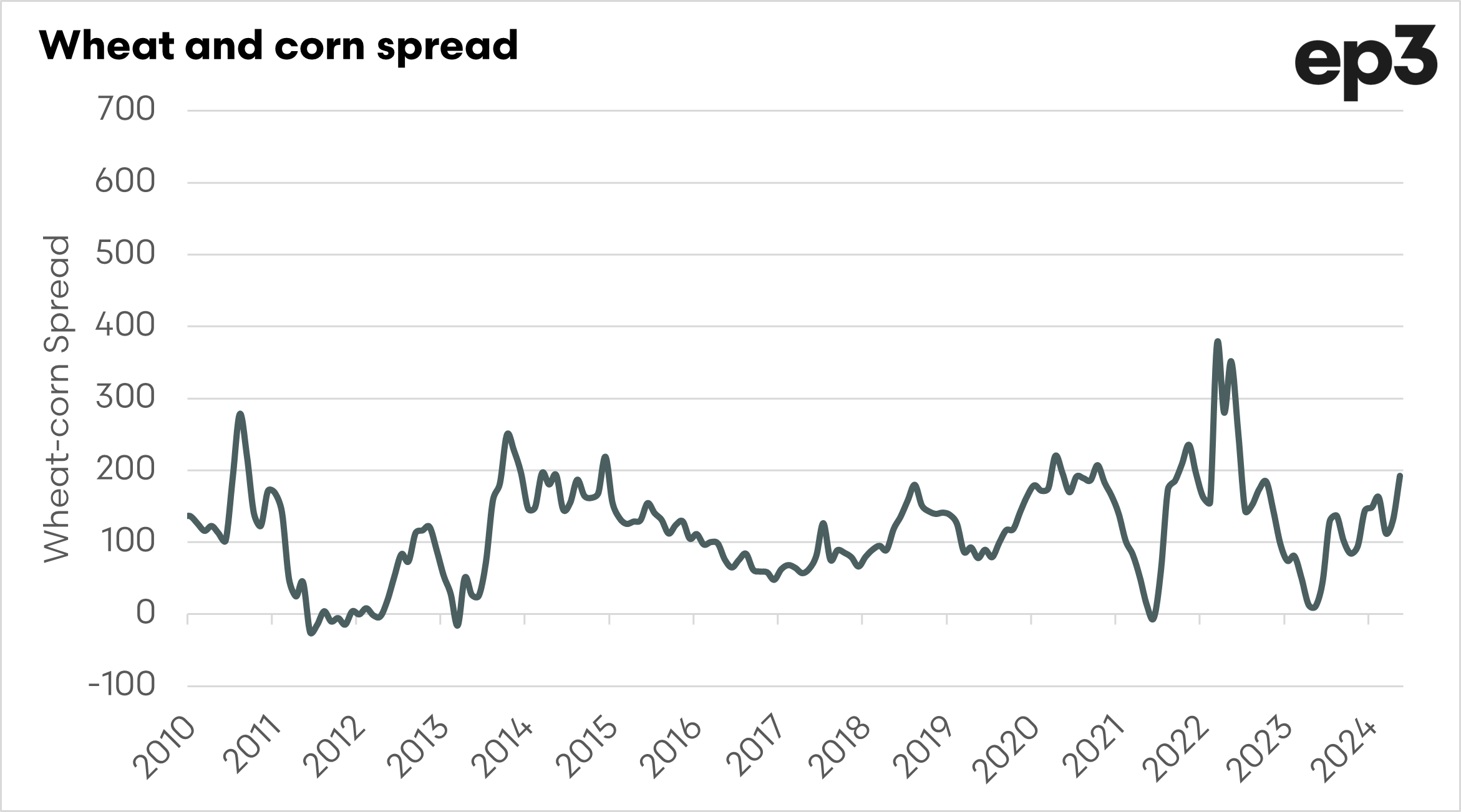

Commodity subsets tend to have a lot of interchangeability; for example, sunflower oil can replace canola oil, and vice versa. If a commodity becomes too expensive relative to another, then the cheaper one will replace it, where possible.

The spread between wheat and corn has grown, with wheat pricing at a premium not achieved since 2022. This means that there is a high chance that with wheat being expensive relative to corn, feed consumers will replace wheat with corn.

This may put a bit of a handle on the continued rise of wheat, but the eyes will still be on Russia and Ukraine as they suffer through poor weather conditions.