Market Morsel: Where could the wheat price go?

Market Morsel

Firstly, I don’t like writing this article. We talk regularly to analysts worldwide to share ideas, and it’s tough to talk about markets at a time like this. It’s horrible to think of our friends struggling in Ukraine. I also suggest you listen to this podcast, for at least the first 20 minutes (listen here).

While we don’t want to see the humanitarian disaster that will follow from this disaster, there is still a market to report on.

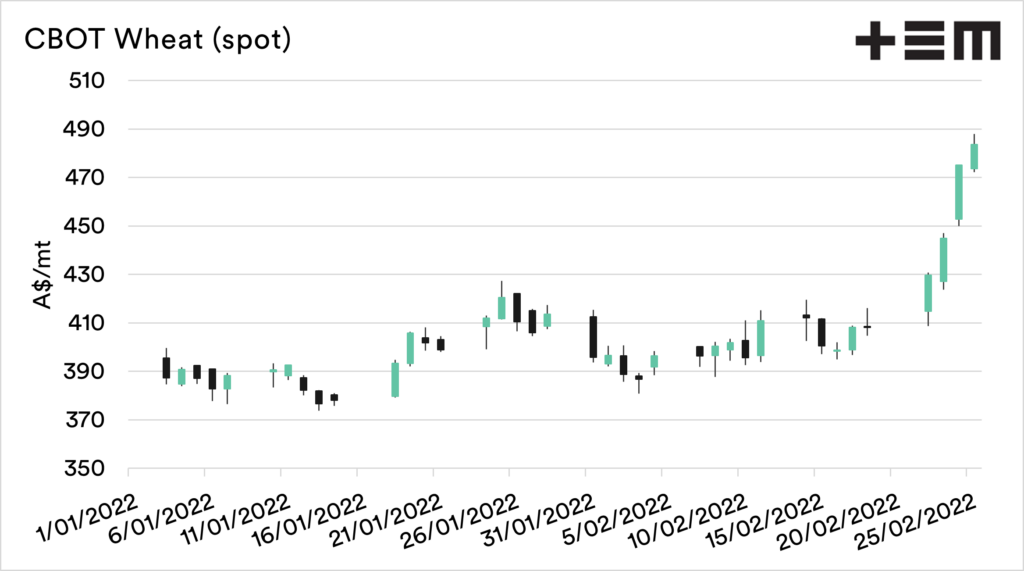

When the invasion commenced, the wheat futures market (CBOT) ended up shortly moving to limit up. There is a limit on futures markets that rules how far the market can move up or down.

So yesterday, the CBOT price rose by A$30/mt, and today in the first thirty minutes of trading, there has been another A$9 added.

CBOT wheat futures have risen A$85 since the middle of last week. I don’t expect that the price increase will flow through immediately. The grain price in Australia has not reflected the moves on a like for like basis.

If we look at our basis in Australia, the CBOT rally of the past week has really pushed it down to extreme lows. On a weekly average, Kwinana has dropped to -A$90, versus -A$44 the week prior. If the Australian wheat basis was at typical levels, then our wheat price would currently be north of A$500.

Is this gouging by the trader? No, I don’t think it necessarily is. The basis levels have been extremely low for some time, but this current crash in basis can be attributed potentially to a few factors:

- The trade was surprised by the recent actions and have had very little time to react to events.

- Australia is still working through last year’s monster crop in order to get it out of the country. Most ports are at capacity.

The impact on pricing will depend on the severity, extent and length of the invasion. The shutdown of the Azov and the rocket attack on grain vessels are really bringing the worst fears forward. That is a full logistical breakdown.

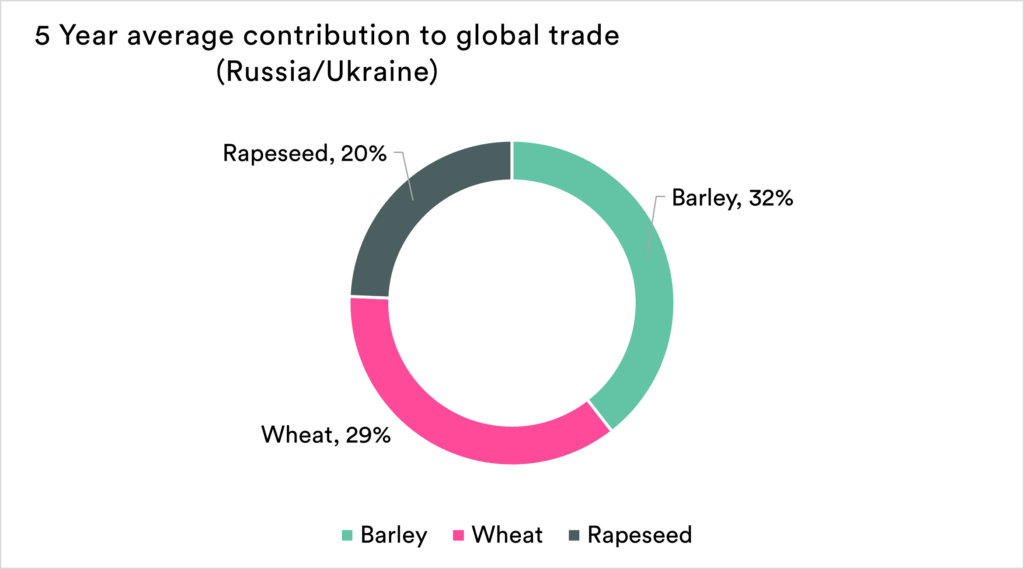

The second chart below shows the Ukraine/Russian contribution to global grain, and it is clearly a huge volume. These volumes being reduced from world supply, even for a couple of months will have huge ramifications.

If this event continues and exacerbates, further rises are inevitable. Putting a number on it is impossible.