Market Morsel: Where should you focus your grain price risk?

Market Morsel

Generally, farmers in Australia do not use derivatives as part of their grain marketing strategy. They aren’t some kind of panacea, but they can be used to reduce your risk when pricing grain.

It is important when using futures to choose a market which corresponds with our own pricing. Generally, you want to choose a market that moves in line with what happens in Australia.

If you choose a market where Australian prices didn’t follow, then you would actually be adding risk.

In this short piece, I am going to look at how local pricing correlates with different future markets. I have chosen Port Kembla and Kwinana prices, as they represent both the west and east coasts and are distinct in terms of their markets (exports vs domestic).

A correlation of 1, means that the contract has a perfect correlation. The closer to 1, the better it is for use as a hedge.

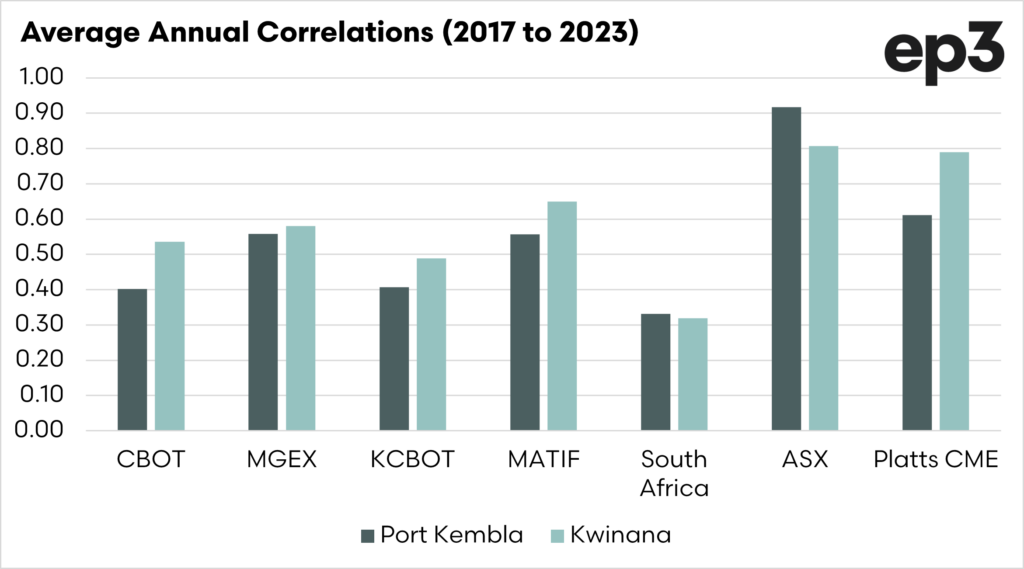

The chart below shows the average correlation between the futures contracts and local pricing. The two with the highest correlations are ASX and Platts (WA contract). This makes sense as both contracts are Australian pricing from Australia.

By looking at the longer-term average, you’d think that overseas futures don’t have a strong relationship with our pricing. However, it is important to note that when selecting a futures contract to use for hedging, it is not a set-and-forget. You can’t just choose the same thing every year and hope for the best.

In some years, when we have drought, our pricing won’t correlate all that well with overseas futures.

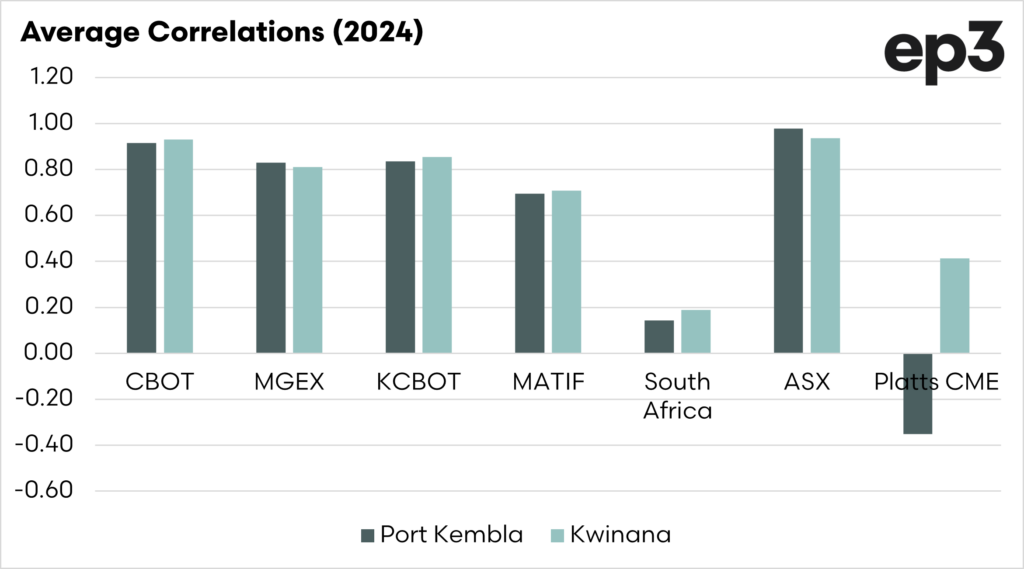

In the second chart, the current correlations for 2024 are displayed. We can see in these charts that the US-based futures, and French have a stronger correlation this year than the longer-term average. This is due to our market largely being driven by events overseas.