Market Morsel: Who doesn’t like curves?

Market Morsel

Like a broken record, we often discuss the importance in grain market of keeping an eye on the present and one on the future.

There are times, not always, when opportunities in the market present themselves for forward selling, either physical or through derivative markets (futures, swaps, options etc).

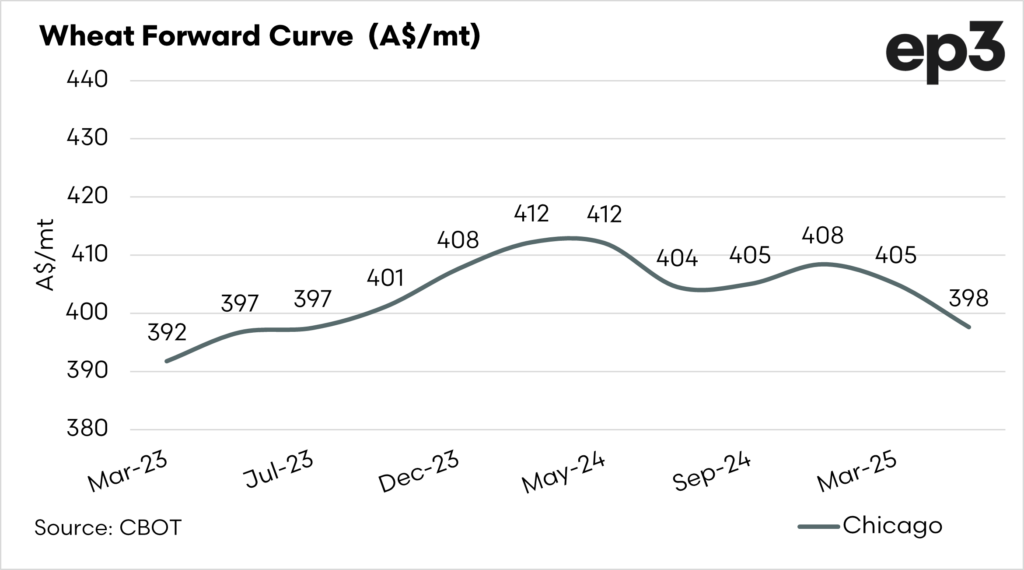

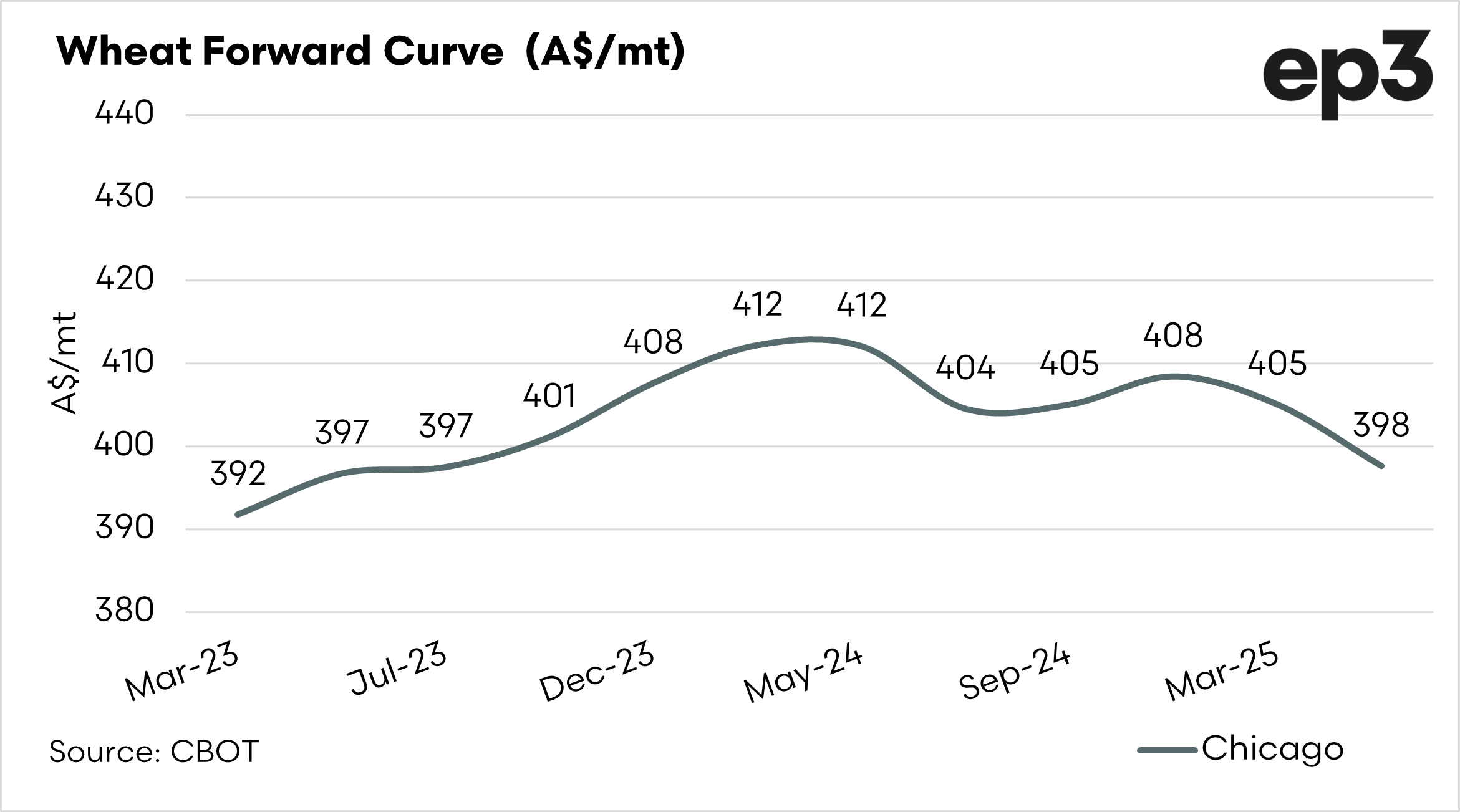

The chart below shows the Chicago wheat futures forward curve. The forward curve represents each of the delivery periods for a futures contract.

In the chart, we can see that the forward months are priced at a premium to the current (or spot) period. The term for this is contango; the opposite would be backwardation.

What we can see is at the moment, you can price in a futures level of >A$400/mt for the coming 2023 harvest. It is important to note that when using futures you MUST consider basis.

Those who read our articles would know that typically our basis has been at a premium to Chicago, but in recent years with the large harvests – this premium has evaporated.

So dependent on how this year’s crop progresses, it could be a A$400 +/-. Always take into account the possibility of a lower number.

Explanation of Contango and Backwardation

Contango:

A forward curve is in contango when the forward futures months are at a premium to the spot level. In the above chart, the market is in contango, as each of the months ahead is higher than the September contract.

The futures market in contango is effectively paying a premium for the seller to carry the crop.

Backwardation:

As you might expect, backwardation is the opposite of contango. The forward curve is in backwardation when the forward market is trading at a discount to the spot market.

When in backwardation, the market is effectively wanting access to grain as soon as possible and does not want to pay you to carry the grain