Market Morsel: Why are we surprised by the actions of China?

Market Morsel

This time of year is generally a quiet time for grains, with the exception of Australia. The big news of the past week has been the eager purchases of US wheat by China.

In the US, purchases are reported to the USDA. From Monday to Wednesday, China purchased just over a million tonnes of wheat.

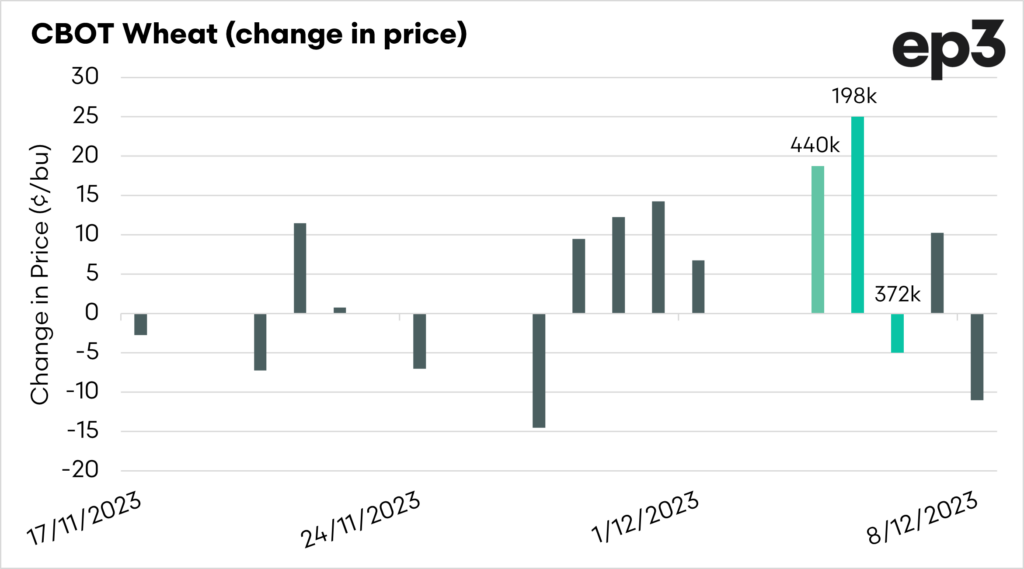

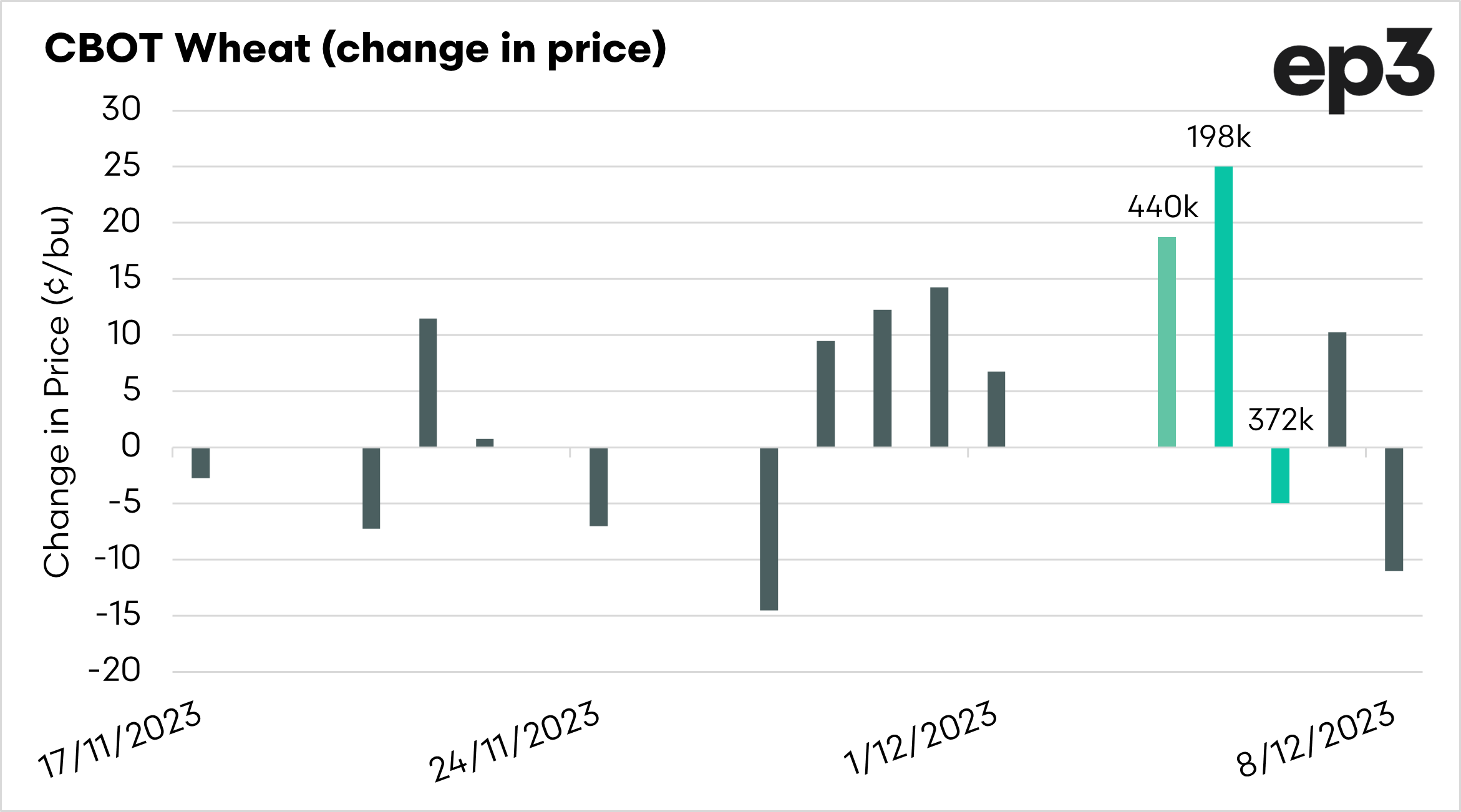

In the chart below, we can see the reaction of the market. We had two very strong days, followed by a little fall.

Chinese purchases of soft red winter wheat are not all that common, but its not out of the realms of reality.

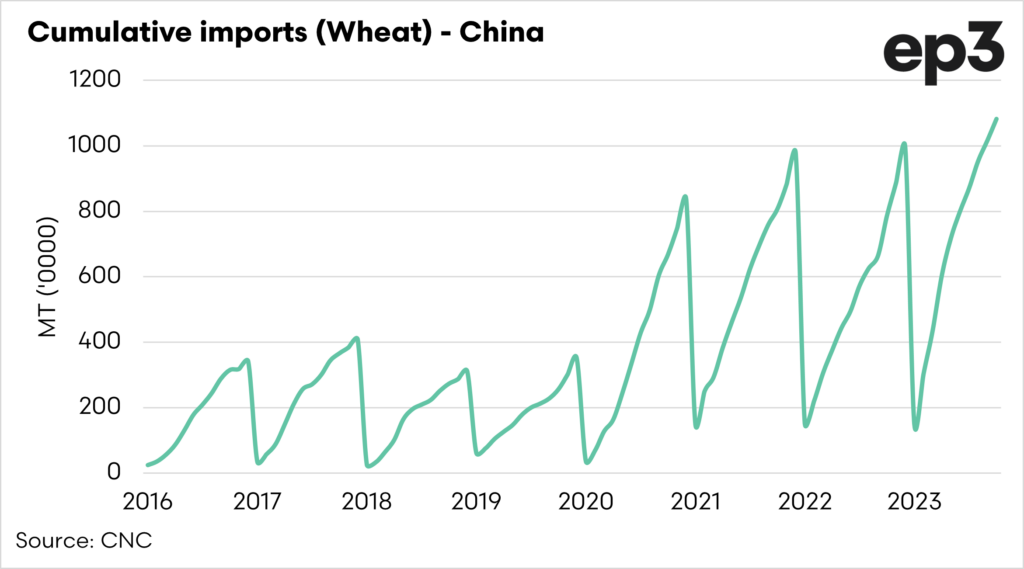

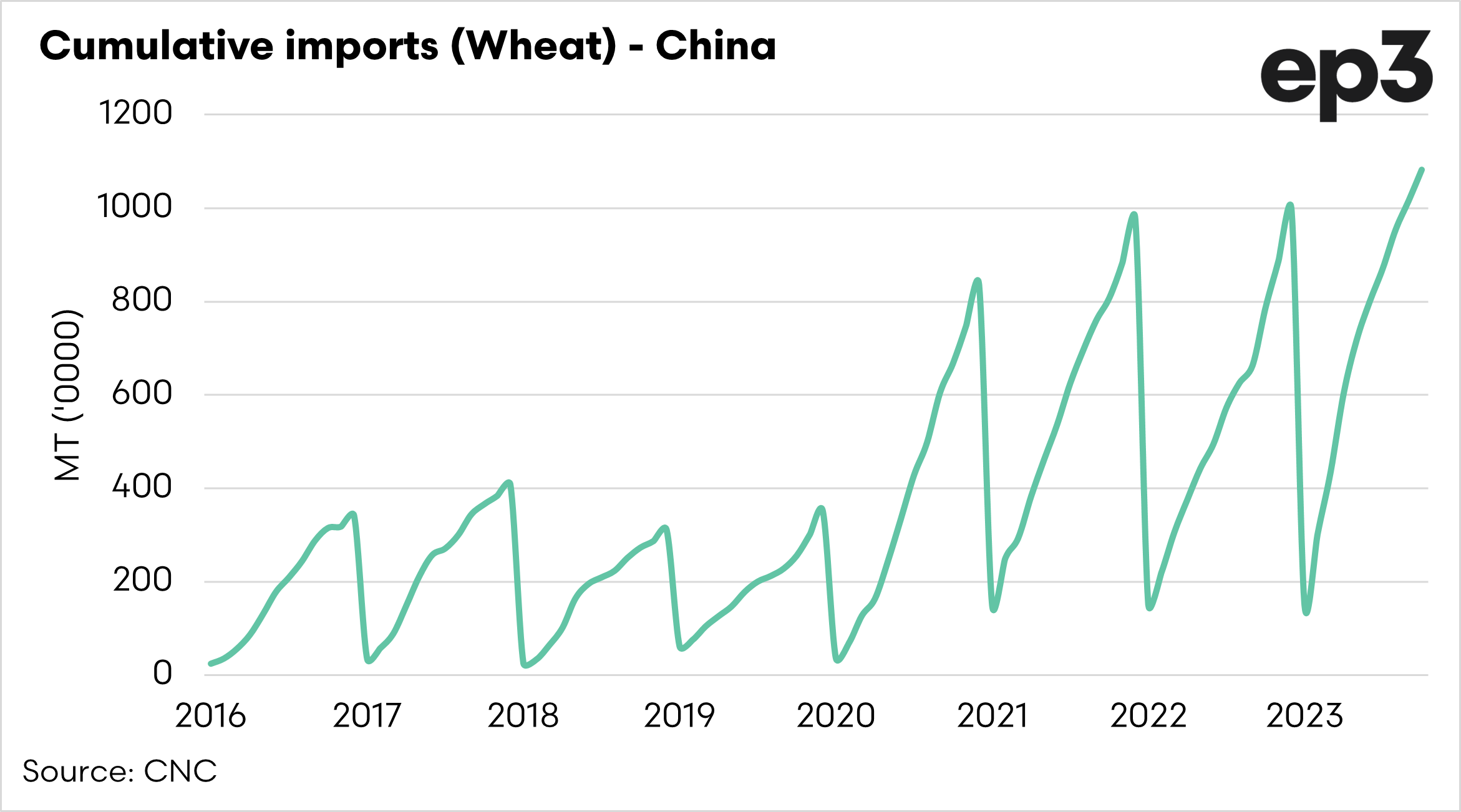

At EP3, we have regularly discussed how much China has been increasing its purchases of wheat (and other grains).

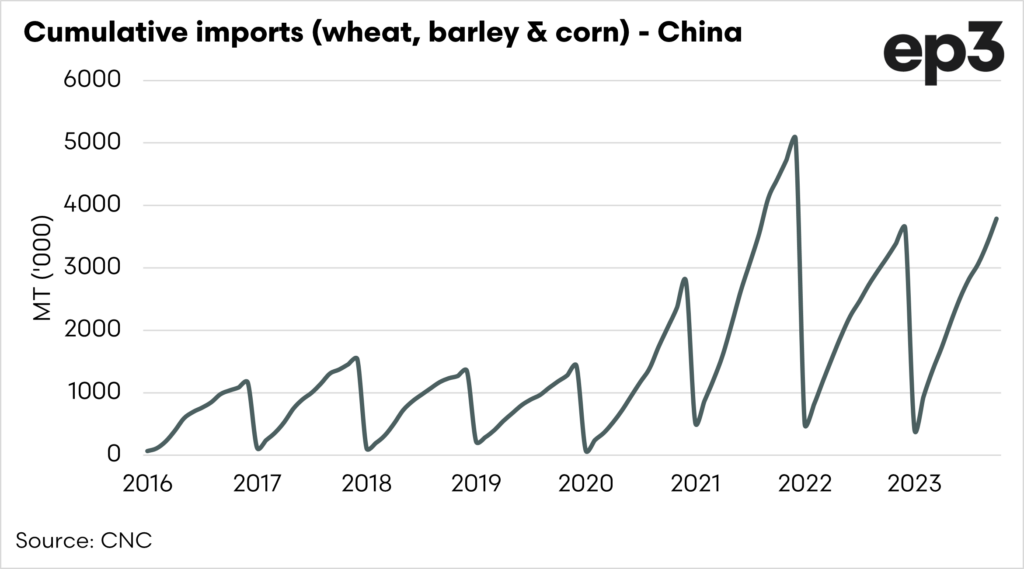

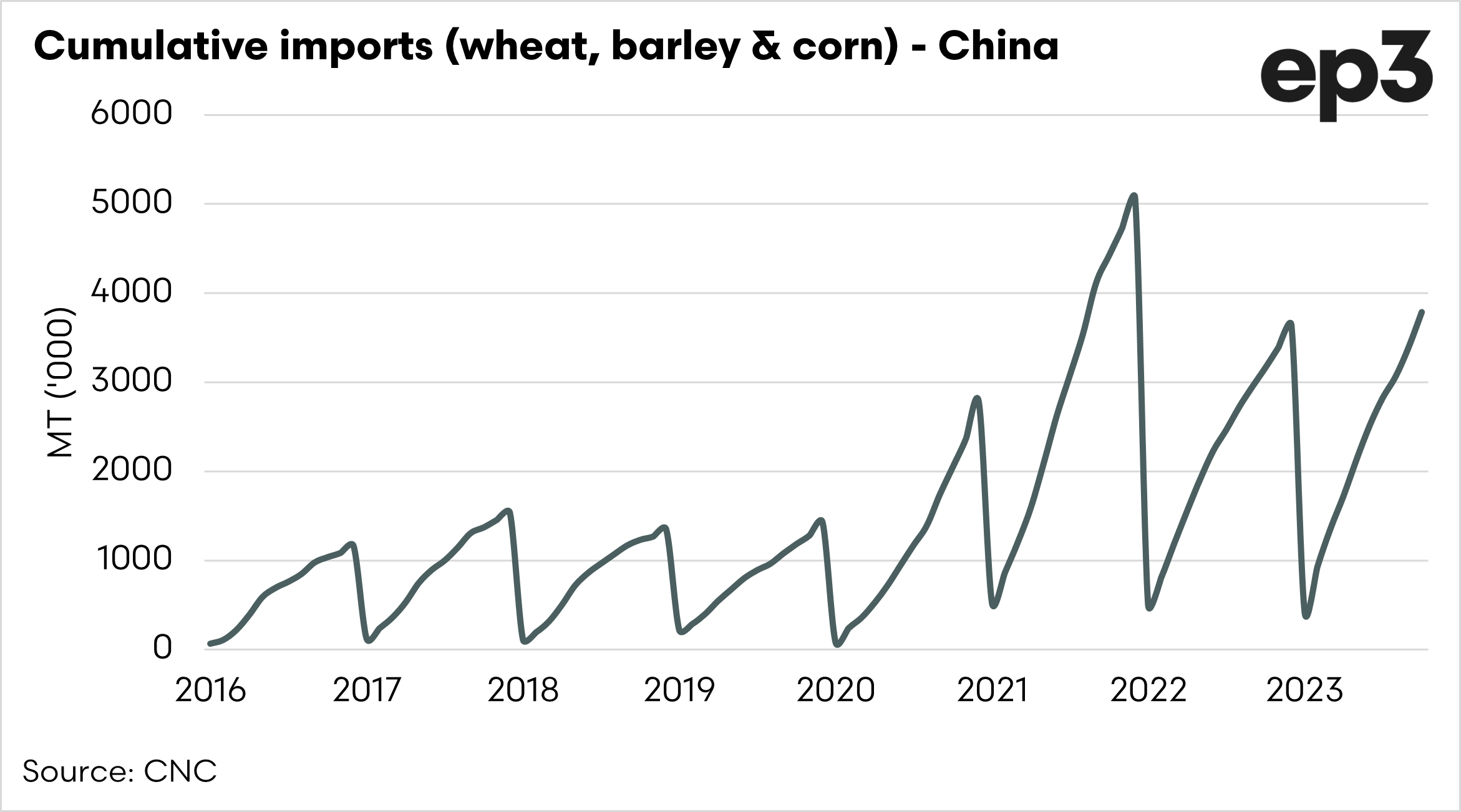

The second chart below shows the cumulative imports of grain (wheat, barley and corn) combined. To the end of October, China has imported more than last year and will have the second-highest import program in 2023.

If we look specifically at wheat, 2023 will be the record year for imports. A large percentage of this volume is from Australia.

The last few years have seen huge import programs. China is buying SRW because it is cheap; they will gravitate towards cheap grain. If they continue buying, then the market will stay bullish.

In recent times, China has been a huge buyer of wheat, and I don’t really understand why it is surprising many.

(AI-Generated cover image)