Market Morsel: Will live sheep ban impact wheat?

Market Morsel

In the past week, I have been asked a few times whether the phaseout of sheep live exports would impact our wheat trade.

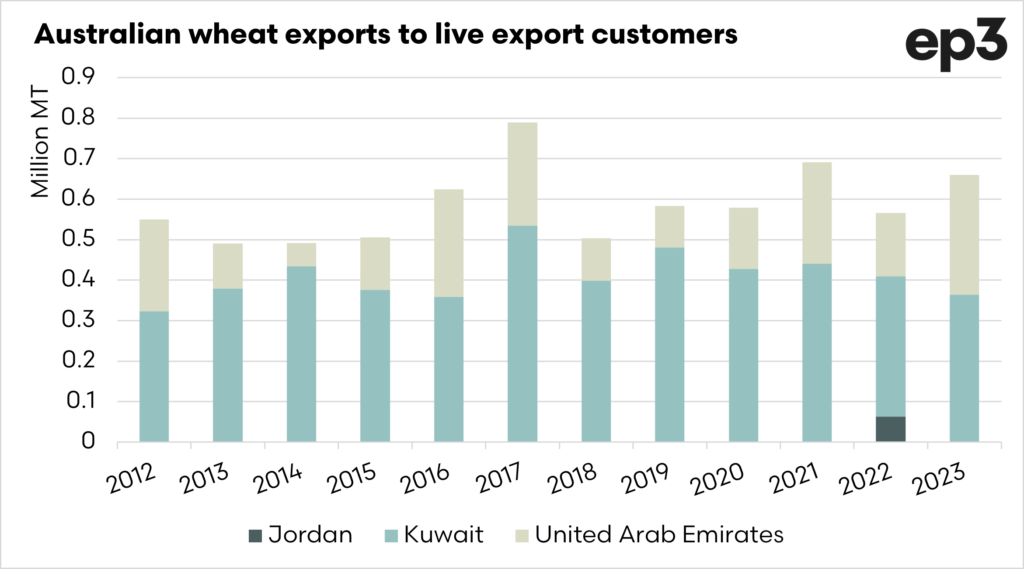

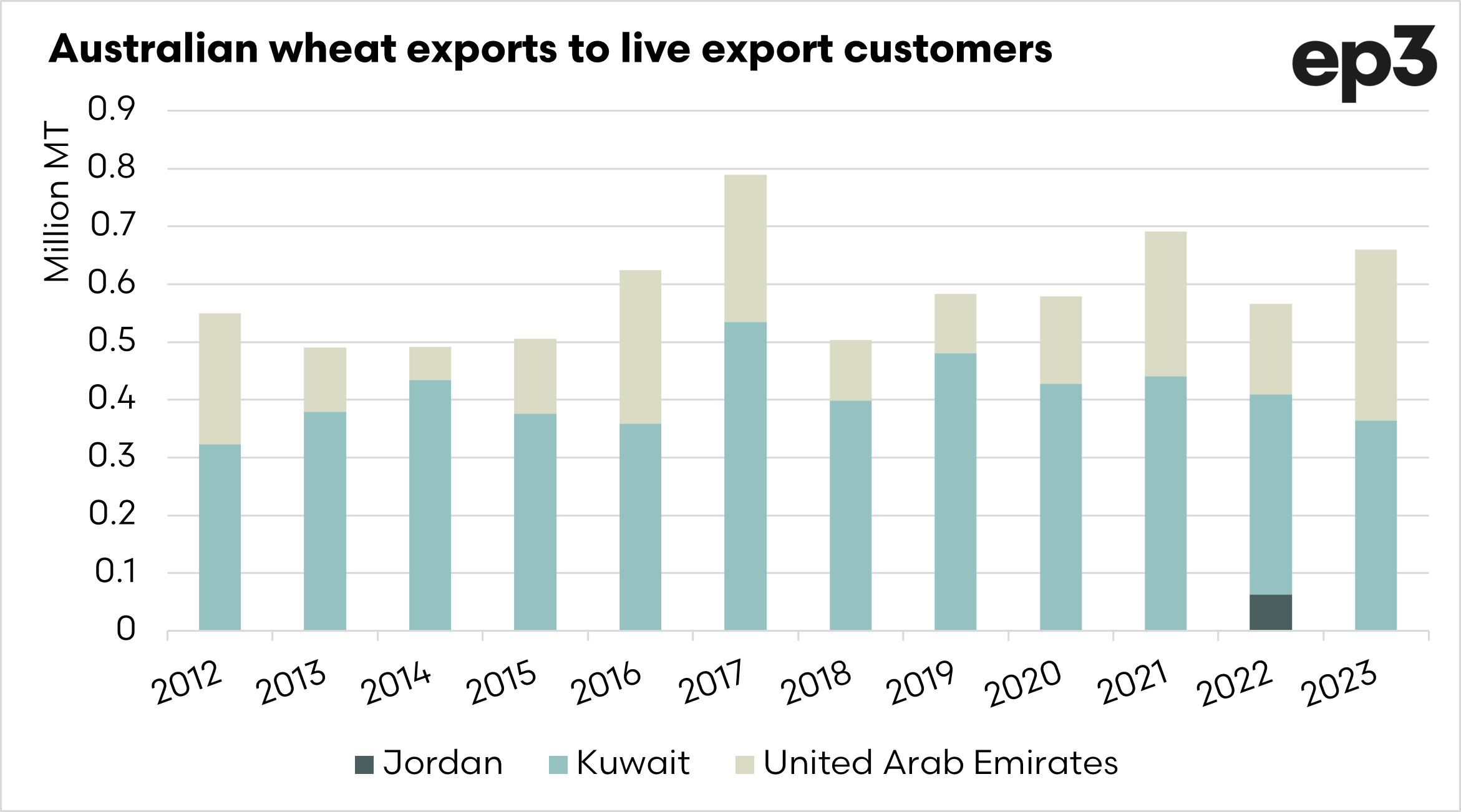

If we look at the chart below, the three major live export customers, who also import wheat from Australia, is displayed. Over the past twelve years, Australia has exported an average of 586kmt to these nations. This isn’t insubstantial, but it’s not a huge volume of our overall trade.

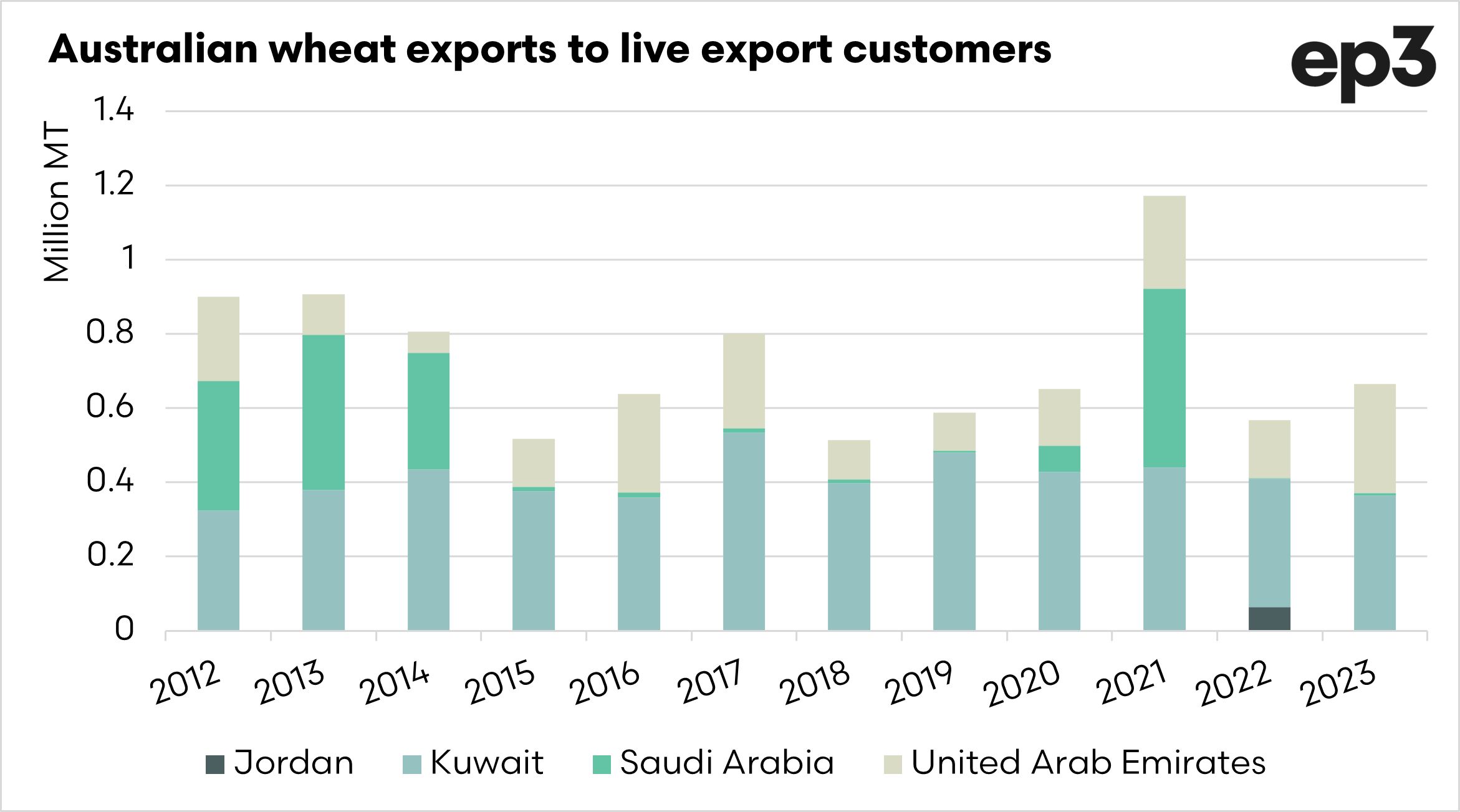

Another nation which had previously stopped buying sheep is Saudi Arabia. They have only just got back into the market and purchased a small volume of sheep in the past season.

Saudi Arabia has been an on-off buyer of Australian wheat. If we include Saudi Arabia, the average for these countries increased to 727kmt.

Wheat is largely a homogenous commodity, and buyers will fixate on price. This is especially the case in price-sensitive markets. If we are cheaper, they will buy more from Australia; if we are move expensive, they will purchase elsewhere (black sea etc).

If the Middle East is concerned about food security and the impact of the live export sheep trade, it would be inadvisable for them to place restrictions on purchases of wheat (or other grains) from Australia as a tit for tat action.

This would only limit their available markets and place them over a barrel, so to speak. You can never say never, but I feel that counter restrictions by these nations are probably unlikely. Our wheat trade will come down to price.