Market Morsel: Will we be the winners of the Canada-China fight?

Market Morsel

Last week, I wrote about the news of Canada being investigated by China for dumping canola. You can read about it here.

So, let’s delve a little bit further into the situation and why it may be positive for Australian producers.

When the Australian barley tariff was introduced, Australia had to find new homes and China had to find new supply routes. This meant that countries like France increased their trade volumes in China. Normally, however, they wouldn’t be competitive.

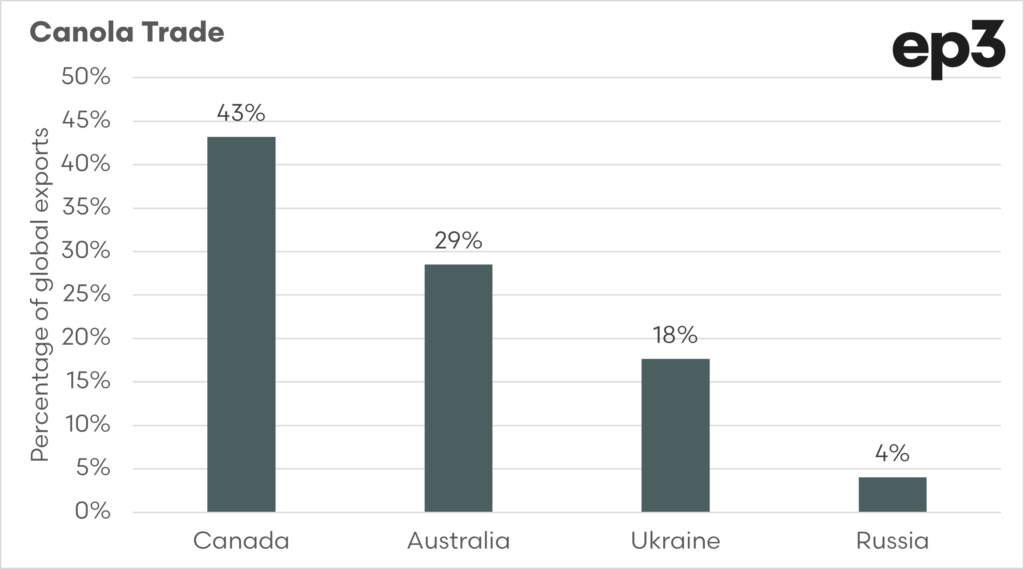

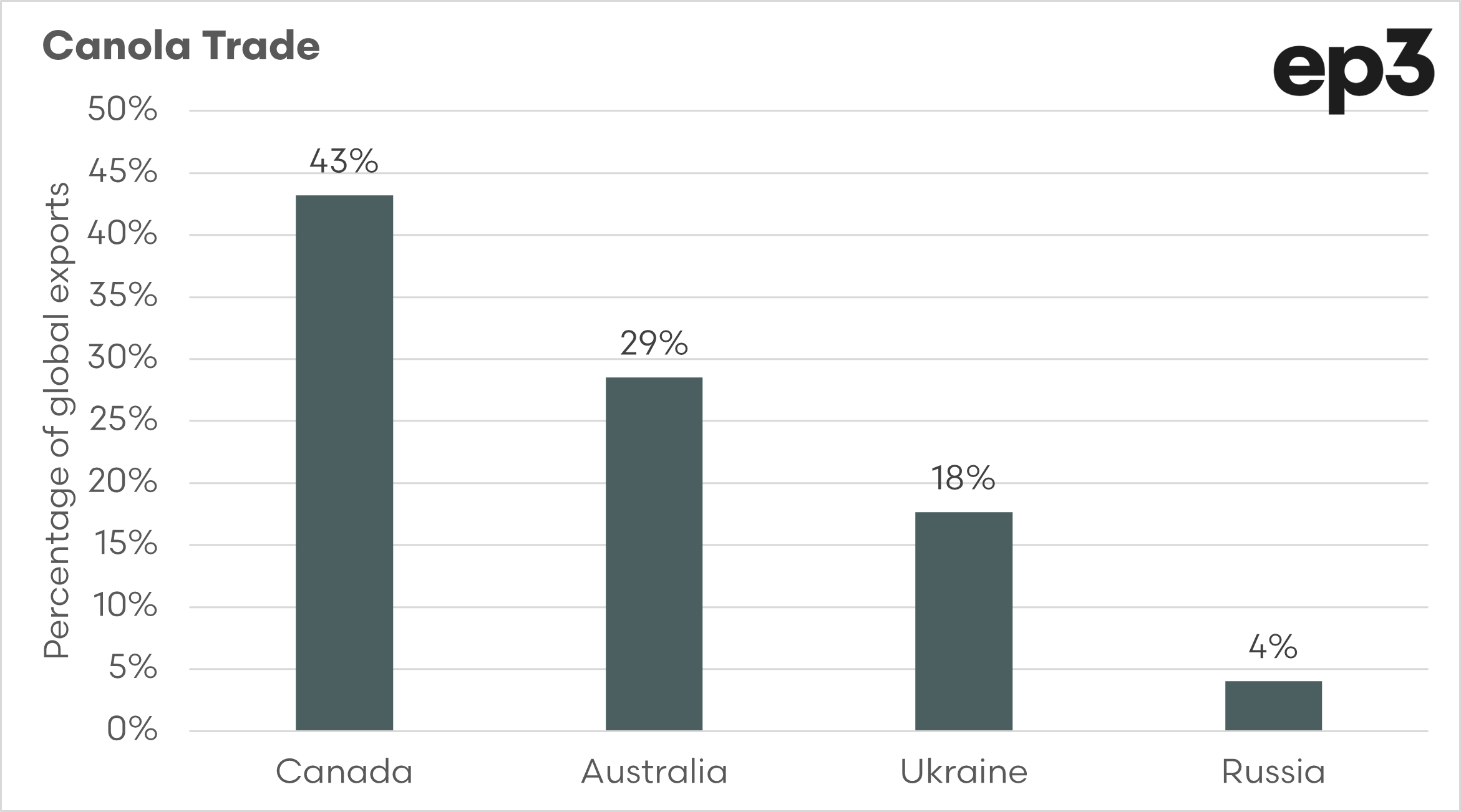

The situation with canola is quite similar, but China has far fewer options. In the first chart below, the top four exporters of canola/rapeseed are displayed as a five-year average.

This represents the total of the overall global exports, and these four countries make up 93% of all trade. This means that by removing Canada, China will only have Australia and Ukraine to make up the big volumes.

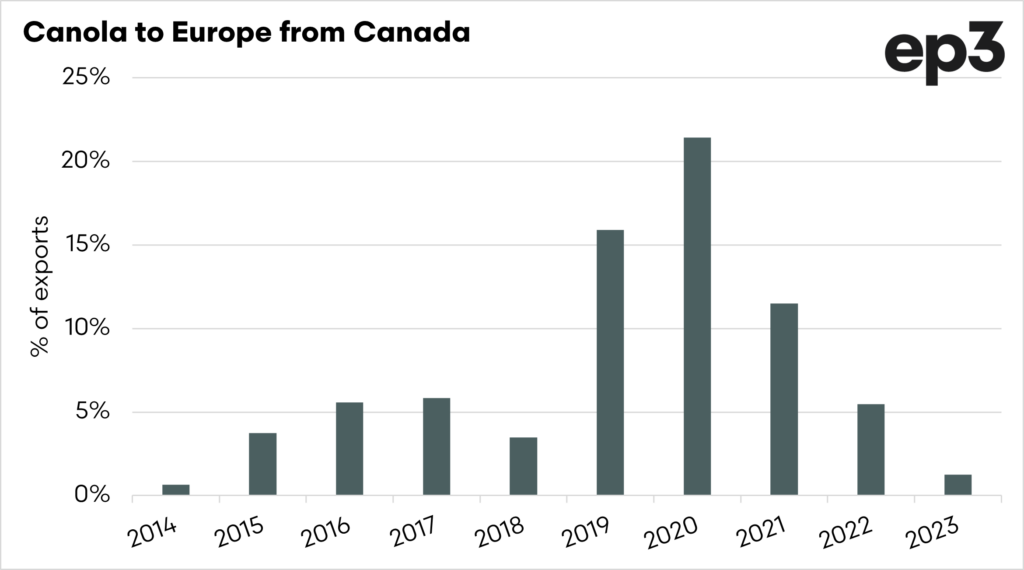

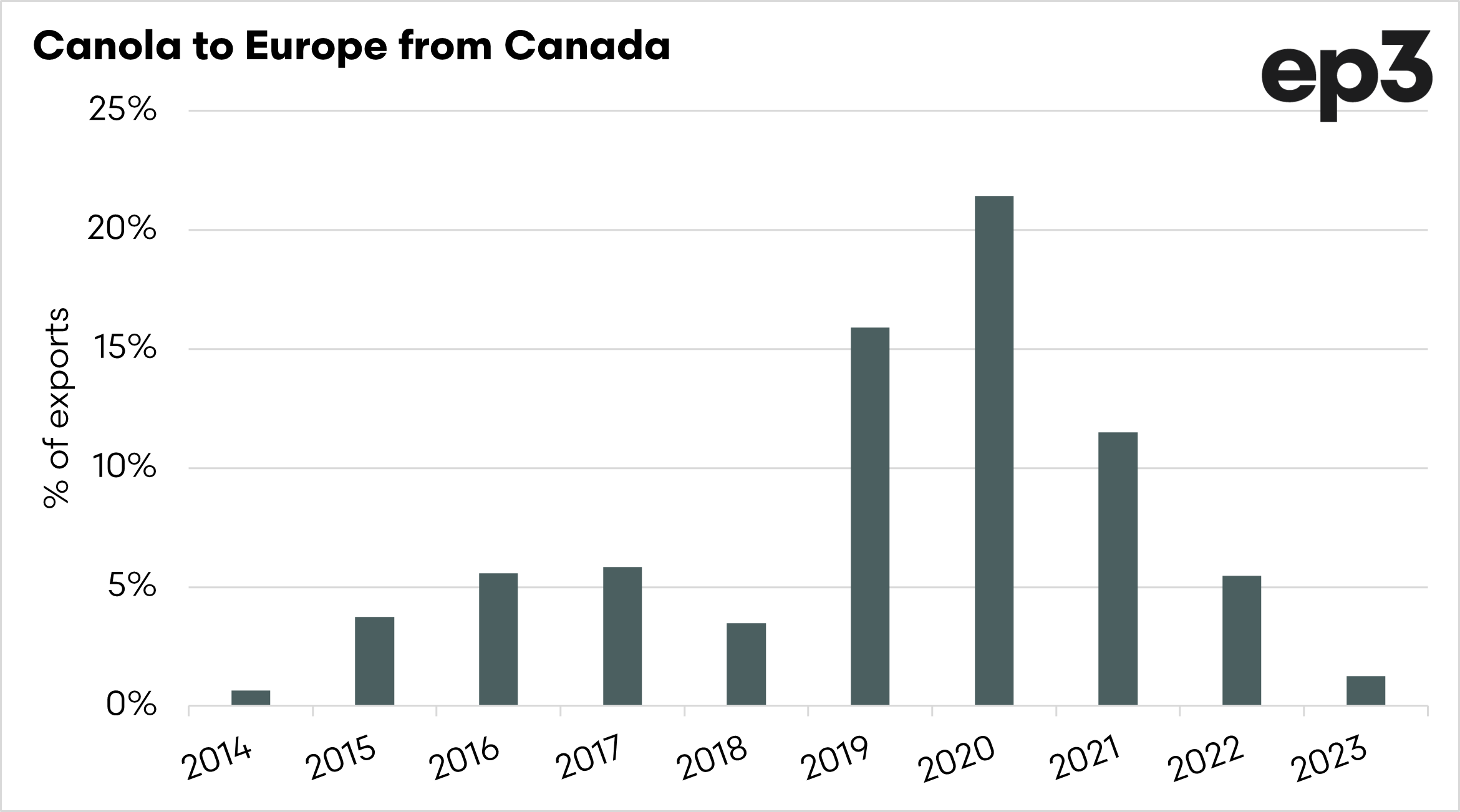

The picture gets trickier as well for Canada. If we look at the Canadian trade with Europe, who are our biggest customer, we can see that they tend to do very little.

This is in part due to the high volume of GM canola grown in Canada. In contrast, Australia is still cultivating non-GM for the most part.

If, and that is still an if, China introduces a tariff, then it could be positive for Australian producers.

This is because, provided China still wants canola, then they will have to come to Australia. What makes it more interesting is that the demand from Europe may not be picked up by Canada, in the same way that trade flows changed with barley.

China may want our canola, at the same time as France. This is good news, provided China will still want canola and will not switch to alternative oilseeds.