Market Morsel: Worthless WASDE?

Market Morsel

There is one statement in the WASDE report this month, which I think is the most important, and really sets the scene:

NOTE: Russia’s recent military action in Ukraine significantly increased the uncertainty of agricultural supply and demand conditions in the region and globally. The March WASDE represents an initial assessment of the short-term impacts as a result of this action.

The reality is that in the current conflict environment, their numbers are open are sketchy at best. This isn’t a dig at the USDA; it’s just that with such a volatile situation, the numbers are likely to be inconstant.

Let’s have a look at some of the more significant numbers for wheat.

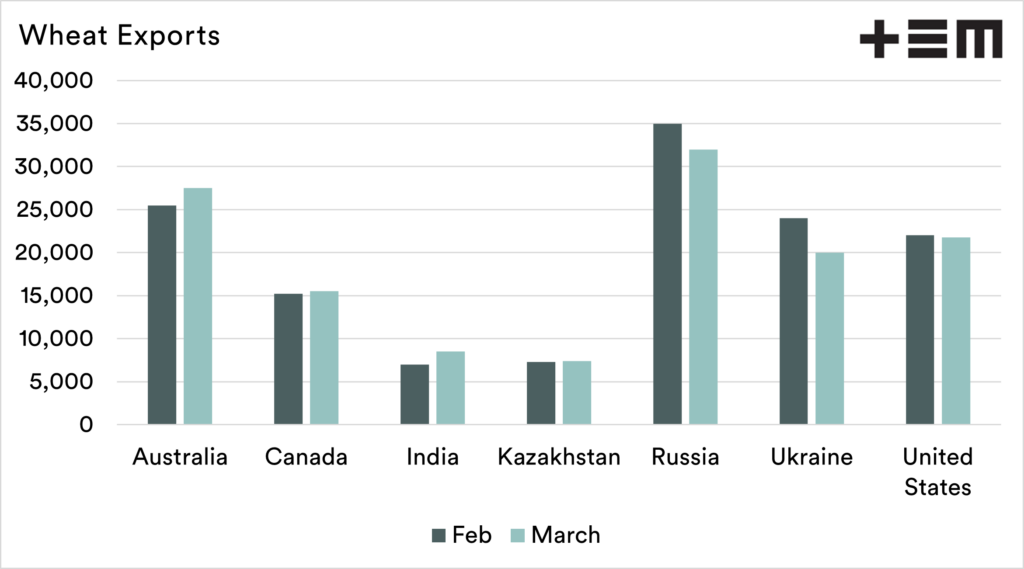

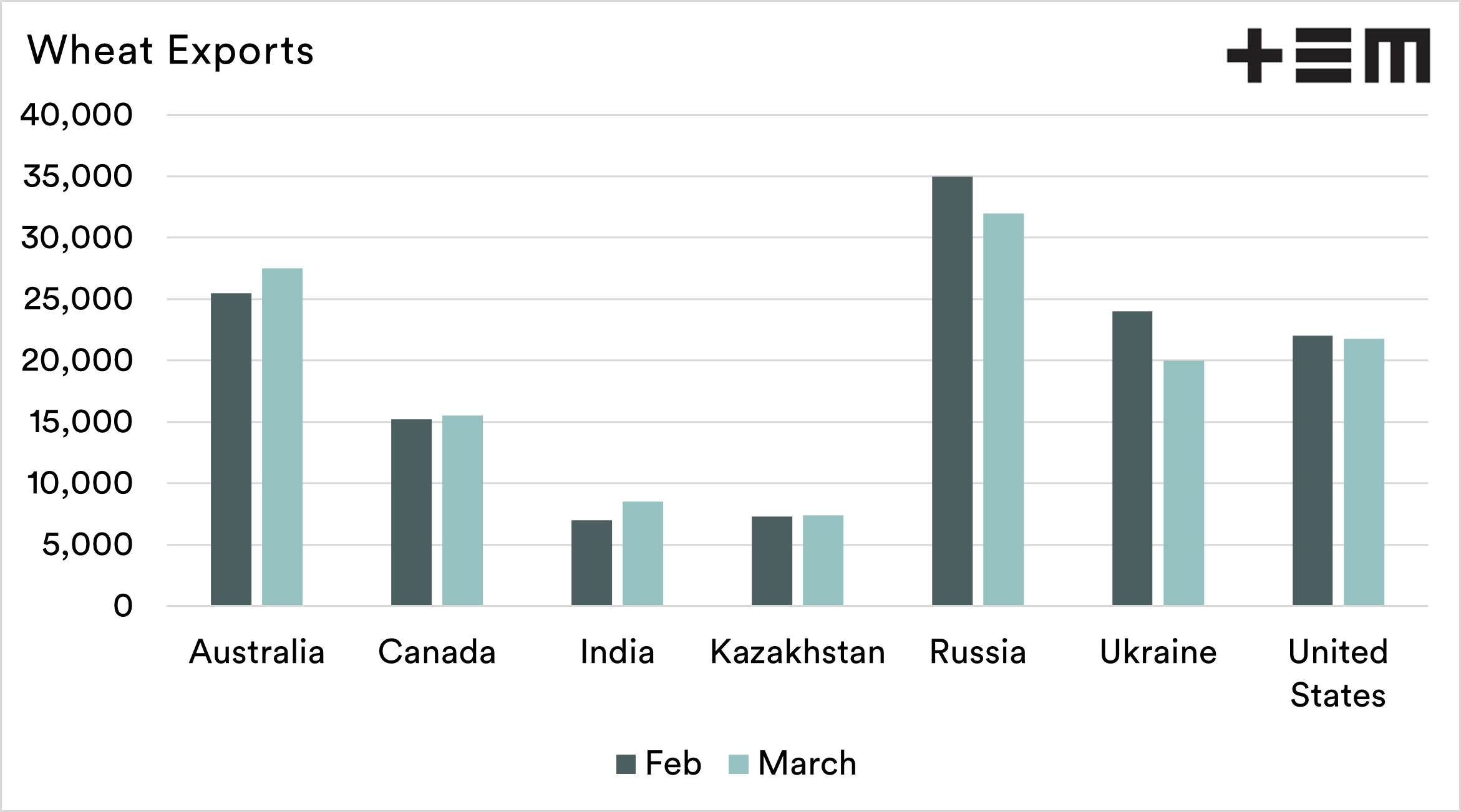

The biggest call out from the data was the change in exports. Clearly, with Russia and Ukraine engaged in a conflict, the volume of exports would decline. The total decline anticipated is 7mmt, 3mmt from Ukraine and 4mmt from Russia.

In part, this has been balanced by an increase in exports from Australia of 2mmt and India of 1.5mmt. The result is that ending stocks within the major exporters is increasing from 51mmt to 56mmt.

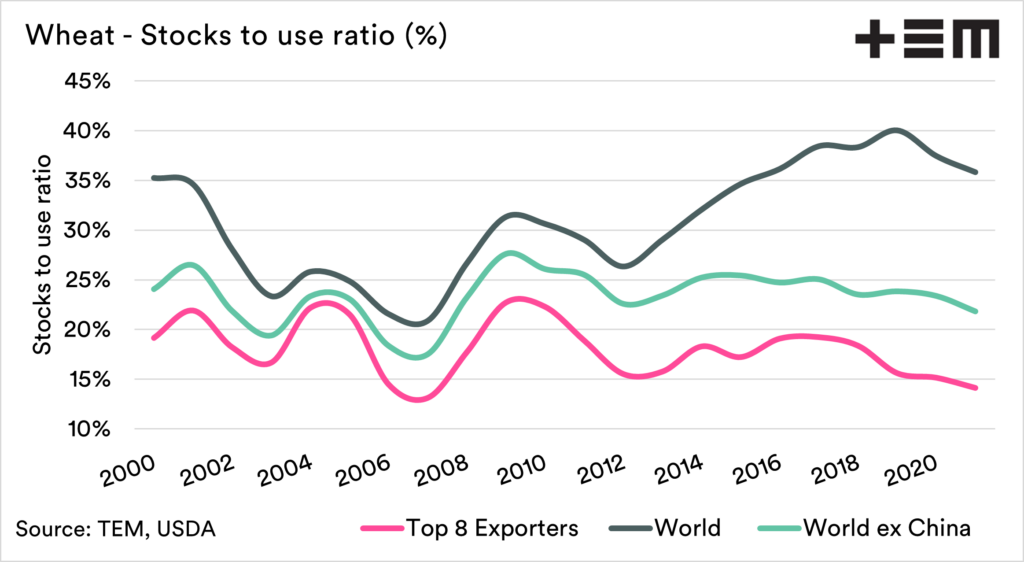

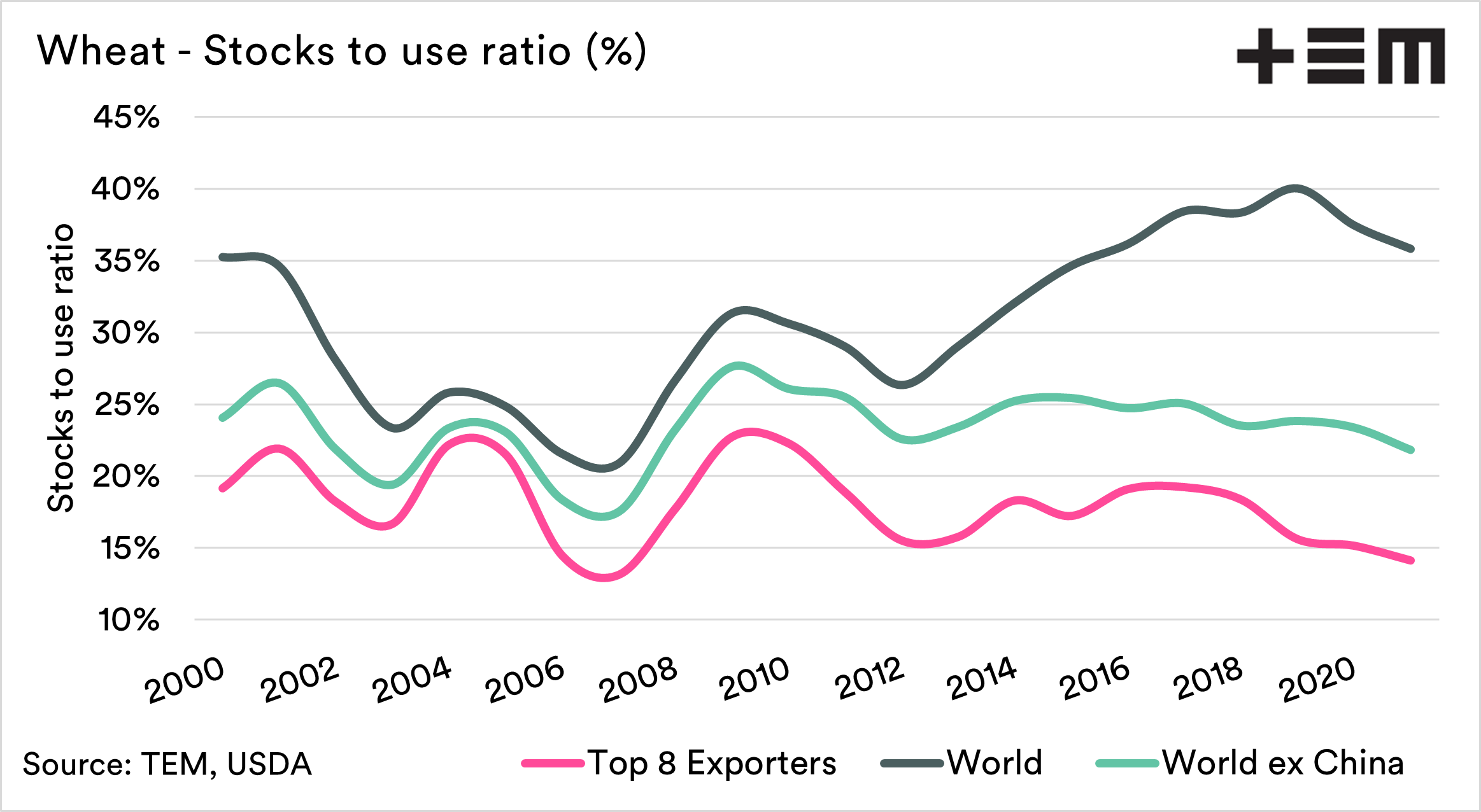

The result is that exporters’ Stocks to use ratio is back up above 14%. This remains at a low level. Again important to note that this is a rubbery number and could revert down quickly if situations resolve in the black sea region.

The market reacted overnight, whether that was the report or the potential of improved dialogue between Ukraine and Russia is anyone’s guess. CBOT wheat was down A$24 for the December contract to a still long term a healthy number of A$486.