Market Morsel: Fertiliser takes off like a rocket

Market Morsel

Fertiliser has been an area which I have taken an interest in over recent years. Fertiliser is a vital input cost for Australian farmers. It is important to shine a light on pricing to assist in making purchasing decisions.

EP3 focuses on the markets for farm produce; we also think it is important for farmers to become more aware of what is happening in their input markets. This will assist in making better purchasing decisions, and hopefully reducing costs.

The majority of farmers purchase their fertiliser in the first quarter of the year. Unfortunately this year this has coincided with a very strong rally in pricing levels.

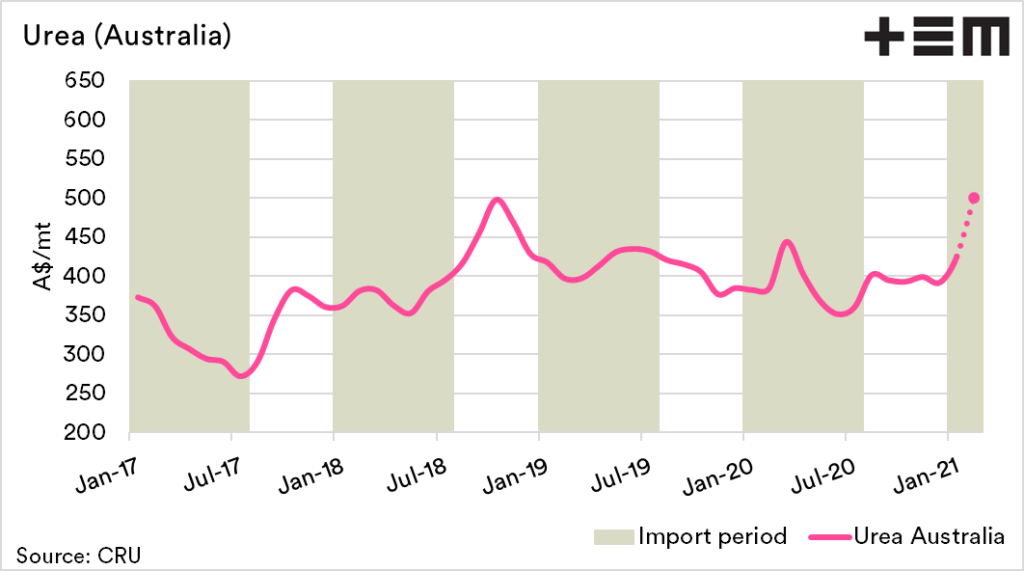

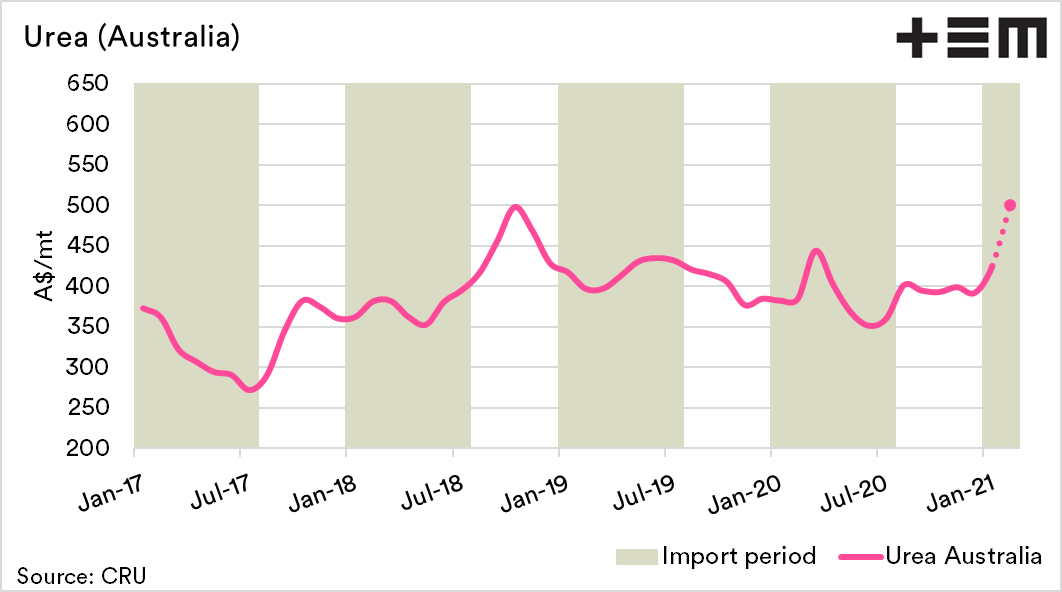

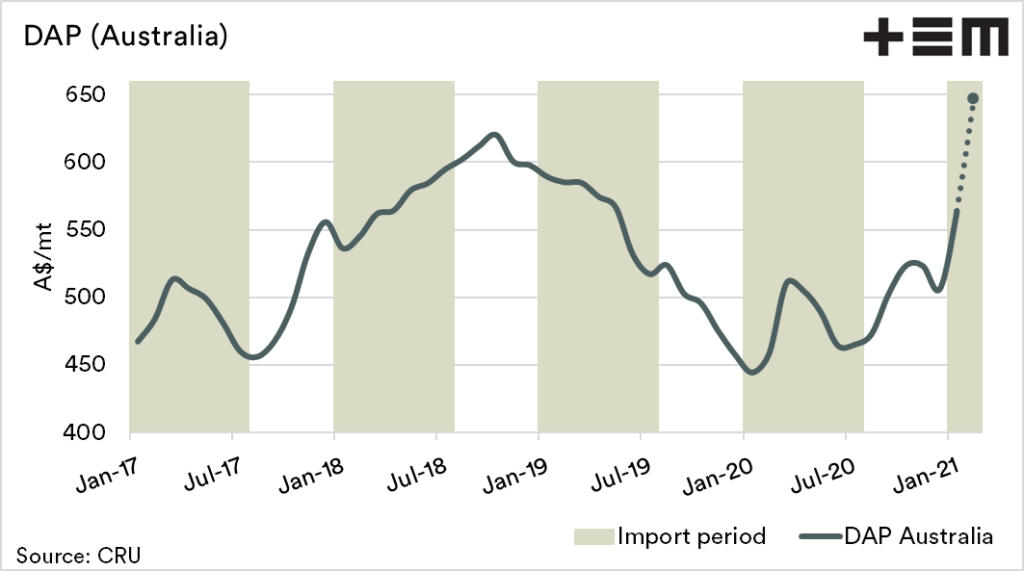

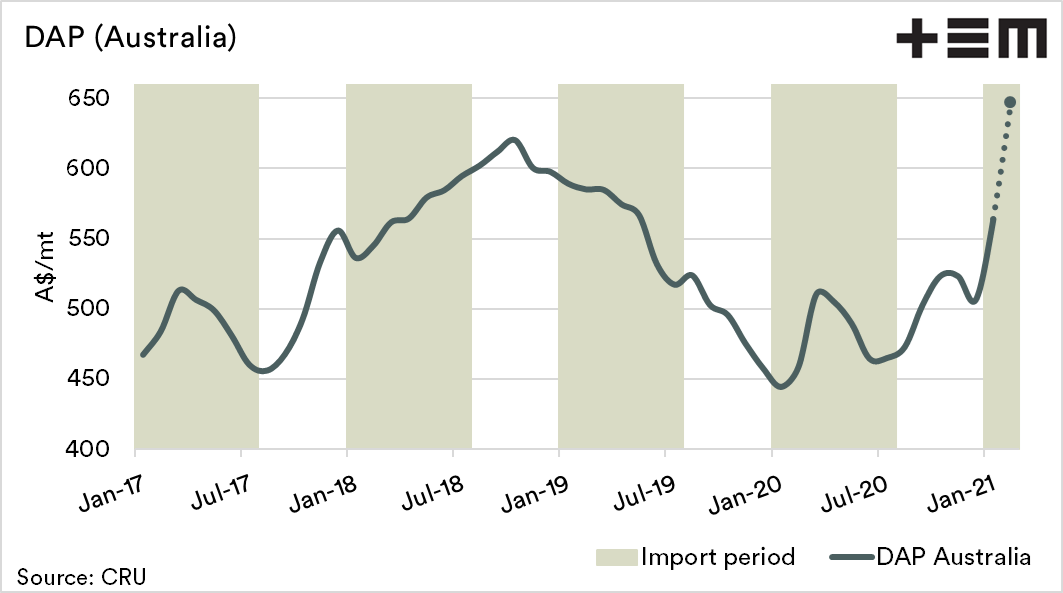

The first two charts below show the fertiliser cost at the origin, plus the average monthly cost of freight to Australia converted to A$. The sources are Saudi Arabia for Urea, and China for DAP. These are where the bulk of Australian fertilisers originate.

These charts give an idea of the trend, and there will be a degree of variability between these prices and what you pay. These include additional local logistics, administration and retailing costs

Many factors influence fertiliser prices, including the cost of other commodities (energy). Still, these charts should inform on the general trend.

Whilst we are only into the second week of the month, the rise so far in February has been quite stratospheric.

The average theoretical price landed for DAP was A$564 in January, but recent numbers show that it has jumped to A$647. The Urea price has increased during the same period from A$425 to A$500. The recent rise is substantial, and one which unfortunately coincides with our buying period.

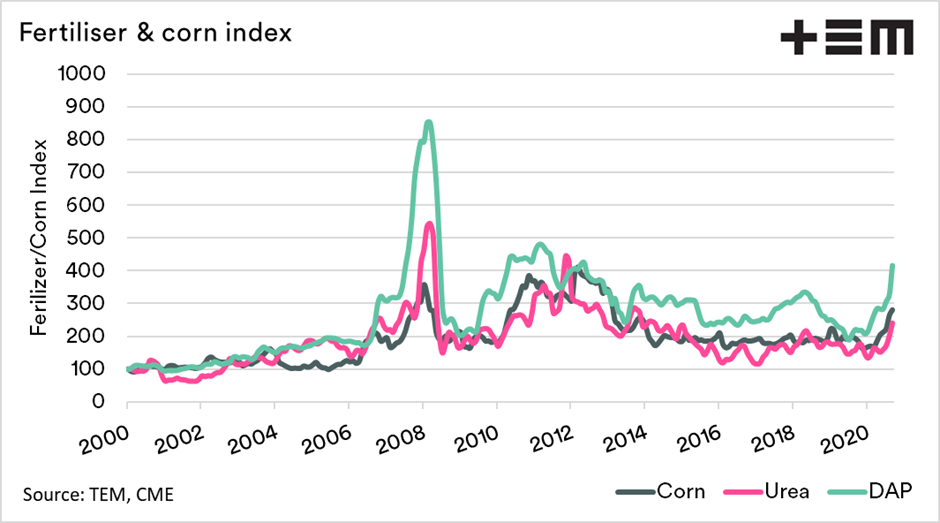

The cost of energy has increased in recent months after the lows of 2020, at the same time, demand has been rising with higher grain pricing. We have produced a long term index of corn, urea and DAP.

We can see that fertiliser and corn pricing tends to follow a relatively similar pattern. This is potentially a sign that as grain prices rise, so do fertiliser prices.

Matt and I had a chat with Chris Lawson (CRU) on our personal podcast ‘Ag Watchers‘ about the fertiliser market back in November. In this podcast, Chris had discussed the possibility of higher prices in the first half of 2021.