Merci beaucoup, me old China.

The Snapshot

- Barley prices are remaining strong relative to recent years. This masks some of the hurt being felt in barley pricing.

- We have dropped to the largest discount against French barley since at least 2010.

- This fall occurred immediately after the announcement of the Chinese barley tariff.

- French barley exports to China have ramped up, and they have won large volumes.

- Our barley pricing on paper is strong, because demand for feed grains are healthy. This has caused a ‘rising tide lifts all boats’ effect.

- If we were available to China, their buyers would be rushing to buy our barley.

- There is money left on the table.

The Detail

The loss of China isn’t impacting upon us. That’s the consensus that I get when speaking to people.

It’s easy to understand this feeling. Barley pricing at present is still relatively strong compared to history. As an example, large parts of the country are pricing above decile 8.5 for 2016 to the present. Is it all as it seems? Let’s take a look.

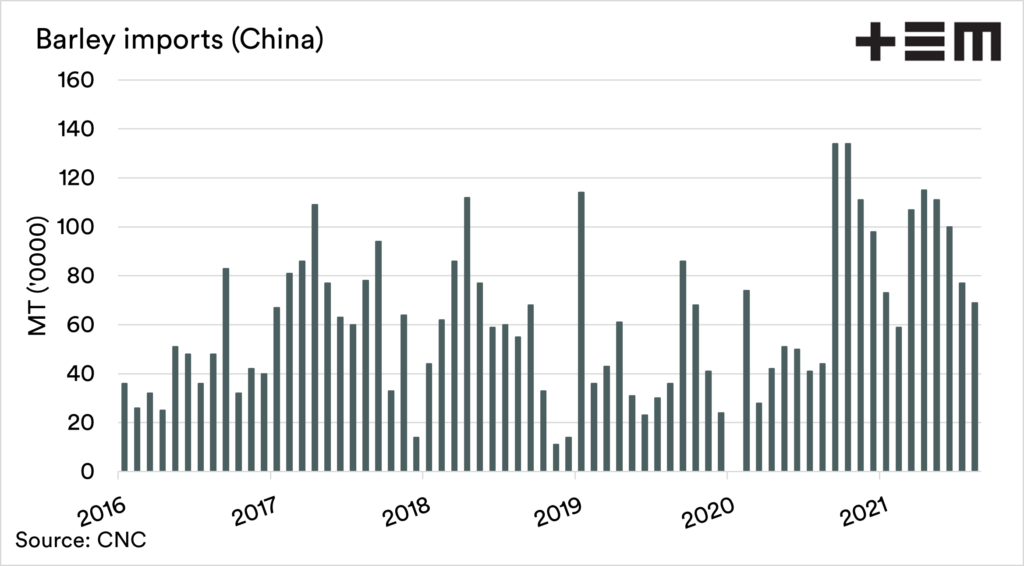

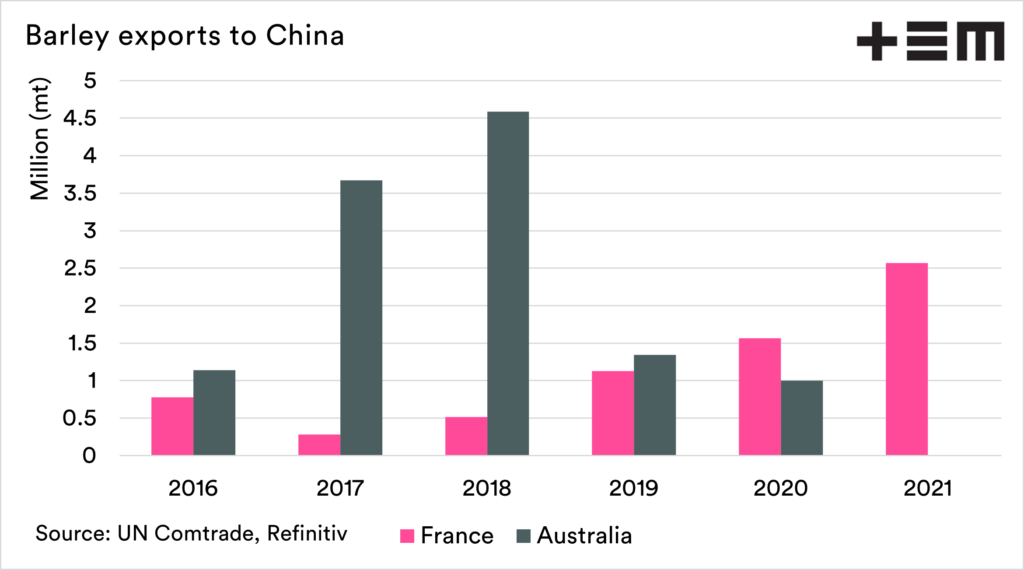

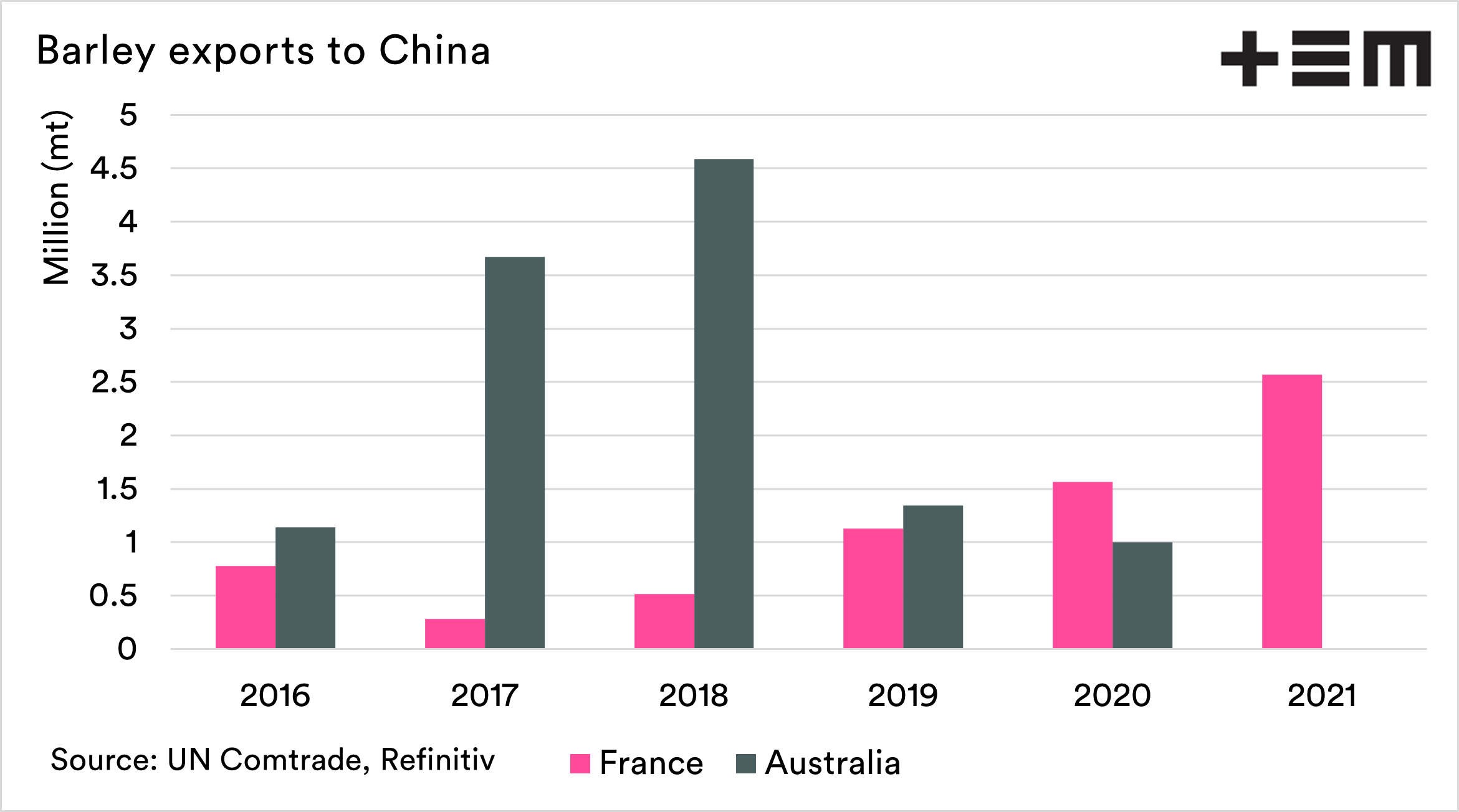

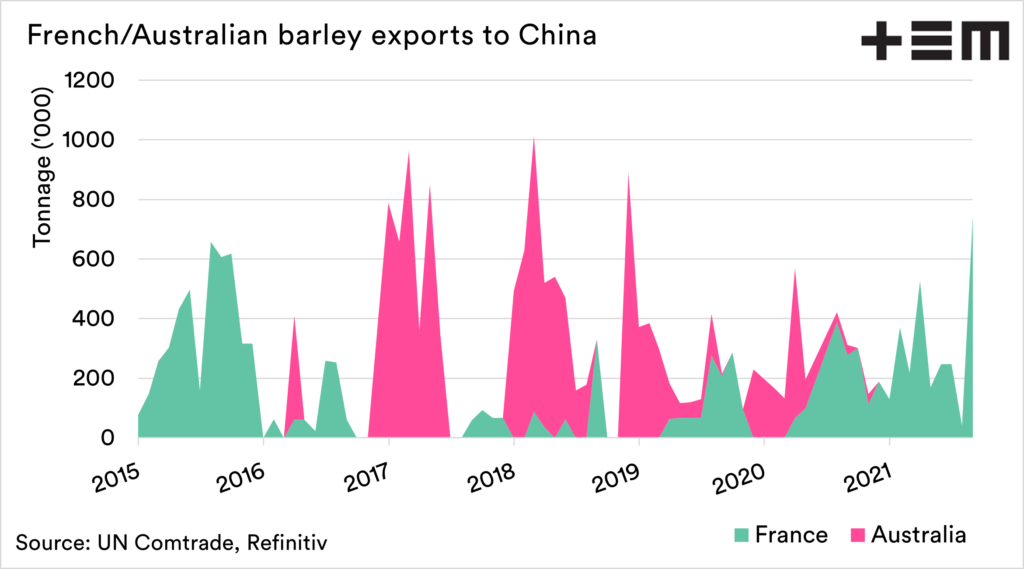

China is still buying barley. In fact, at the current pace, imports will likely be a record high in 2021. They just aren’t buying any from Australia.

One of the places they are buying substantial volume from is France. In part this has assisted French growers, as they have a return to the Chinese market, which for so long Australia had been dominant.

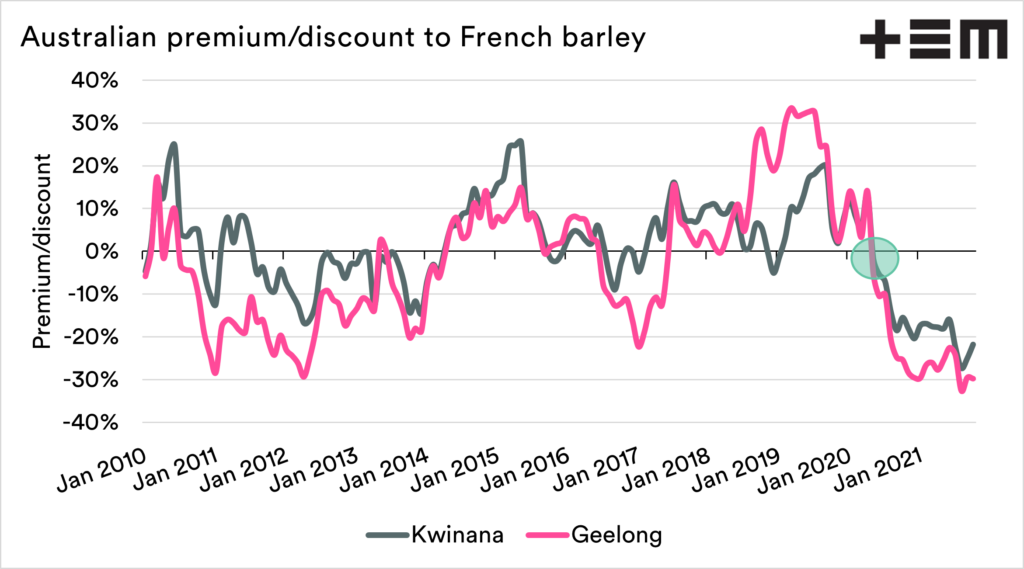

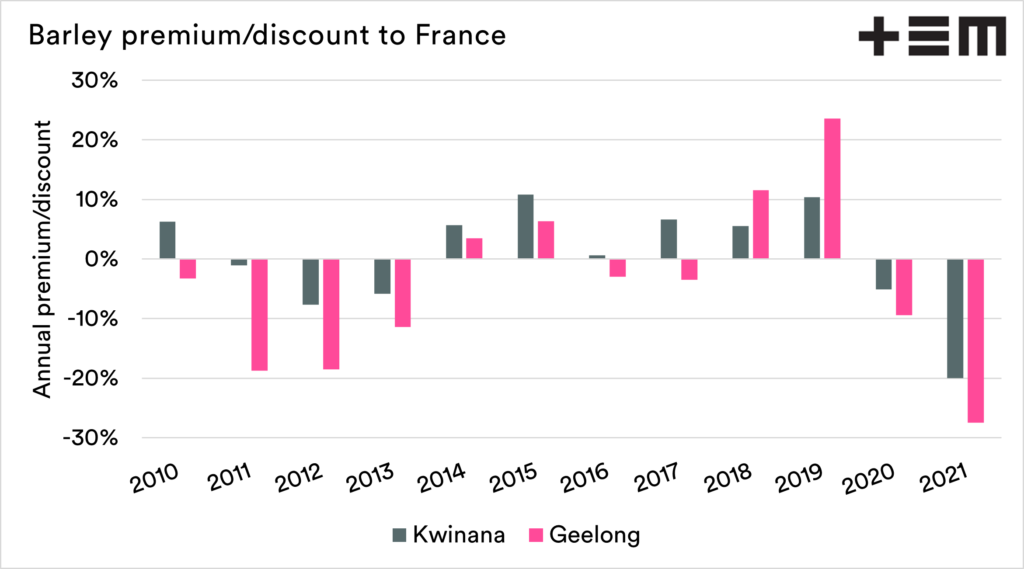

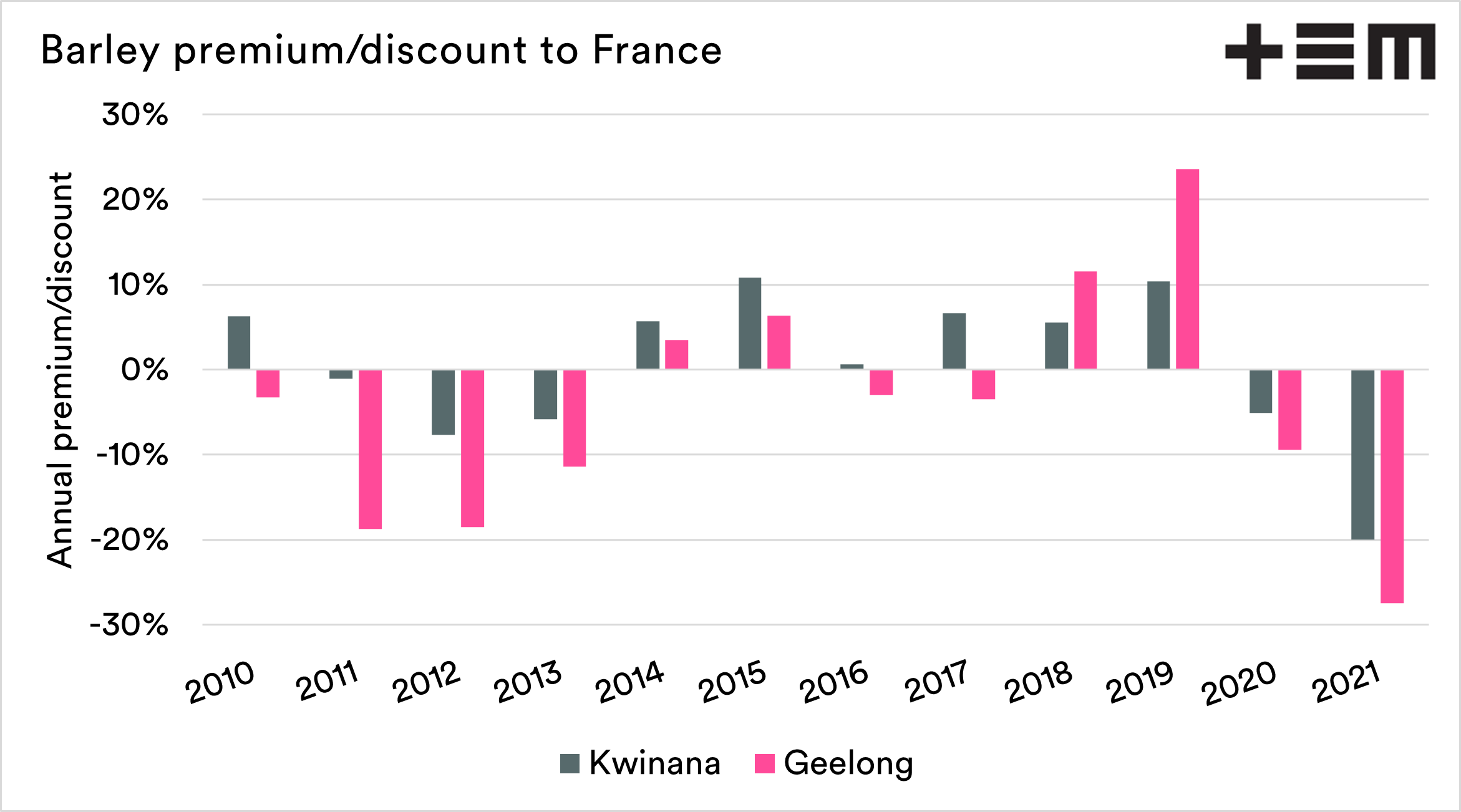

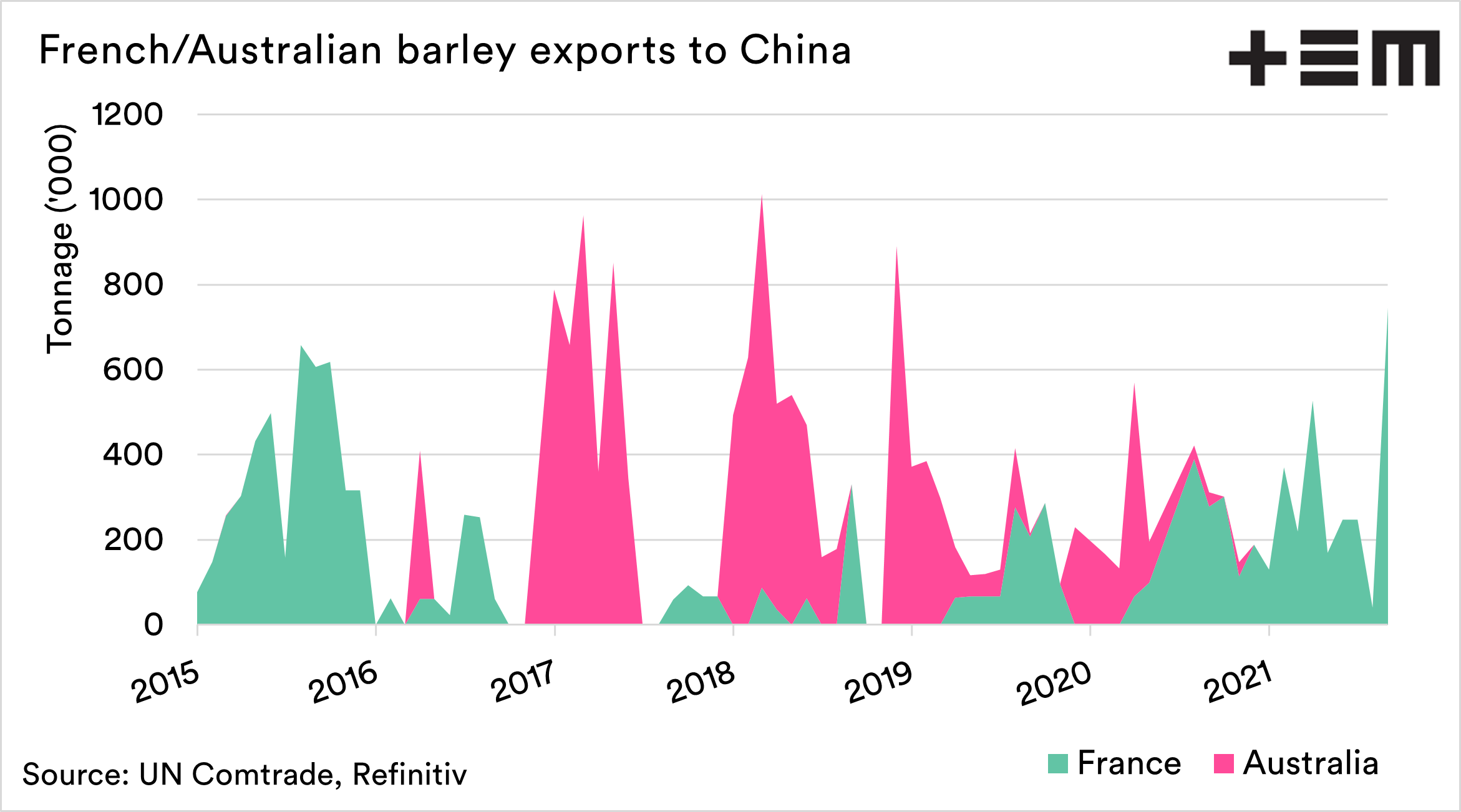

The chart below shows the premium/discount between feed barley in Australia (Geelong/Kwinana) against French supplies (Rouen).

I have circled a dot on the chart, which was the point that China announced the Chinese tariff. Almost immediately, we saw our barley drop to a very large discount.

The discount to French barley has fallen this season to average the largest discount since at least 2010.

Our pricing levels are strong, as a result of the flow-on effect of demand for feed grains. This is the old ‘a rising tide lifts all boats’ effect.

However, the reality is that if China was still available, our pricing levels would be higher. Chinese buyers would be flocking here if given a choice, as we have a distinct freight advantage compared to western Europe.

The chart below shows barley exports from Australia and France to China as we can see Australia had dominance, especially after the big crop in 2016. In 2021, we have sent nothing.

France have so far sent over 2.5mmt in this calendar year, with most of this dataset being old crop. The majority of French exports are headed to China this season.

The main message I have is that we cannot and must not ignore the tariff. Whilst many say, ‘to hell with China’, the reality is that we have a good price, but we have money left on the table.

As a miserly Scotsman, I don’t want to see money in another’s pocket that could be in the Australian industry.

The big concern is if China slows down their imports and demand returns to average. We will then see the full impact of this barley tariff on our grain payments.

If you liked reading this article and you haven’t already done so, make sure to sign up for the free Episode3 email update here. You will get notified when there are new analysis pieces available and you won’t be bothered for any other reason, we promise. If you like our offering please remember to share it with your network too – the more the merrier.