More than one set of fireworks in Washington DC.

The Snapshot

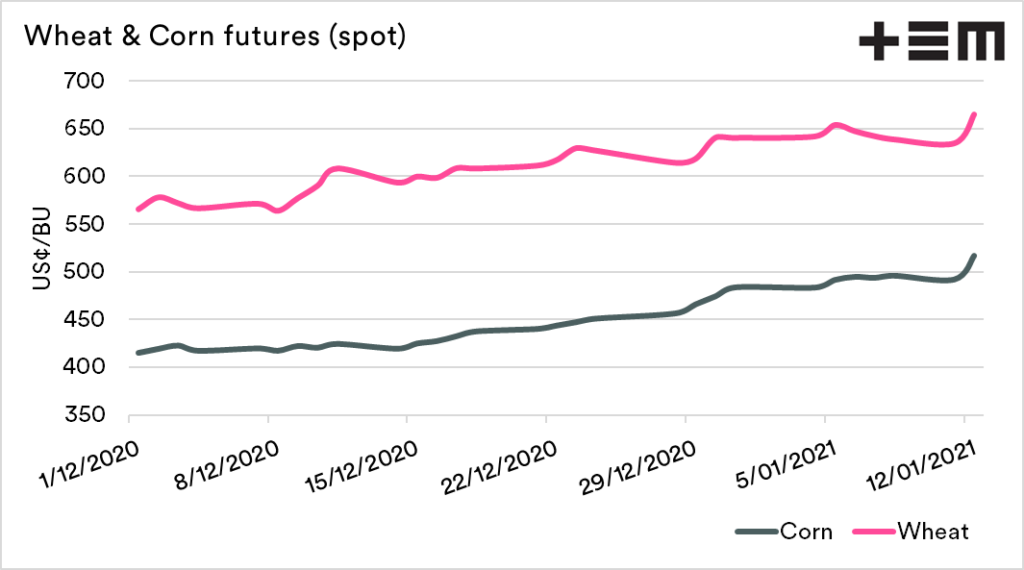

- Wheat and corn futures rose 5% after the 1ST 2021 WASDE report was released.

- There were reductions to global wheat production by 1mmt.

- Russian wheat production was increased to record levels.

- Australia was kept at 30mmt of wheat, which will be increased upwards in future revisions.

- Corn was the real driver of the cereals markets. Production was dropped by 8mmt, which still remains strong.

- End stocks were reduced to the lowest level since 2013, as Chinese imports ramp up.

The Detail

The monthly ‘World Agricultural Supply and Demand estimates’ were released overnight. It provided the kind of reaction we like to see coming out of Washington.

The wheat and corn market have reacted strongly to the report, with both futures markets up 5%. In this article, I’ll take a quick look at the significant data points from each market.

Wheat

The wheat picture at this point of the year is relegated mainly to tinkering around the edges. Global production for this season was reduced by just a touch over 1mmt.

In terms of increases, Russia had its production ramped up to 85.3mmt, now a record production year. This was offset by drops in China (-1.75mmt) and Argentina (-0.5mmt). Interestingly Australia was maintained at 30mmt, which means that future updates will see an upgrade of between 1-2mmt. This will nullify any bullish data in production.

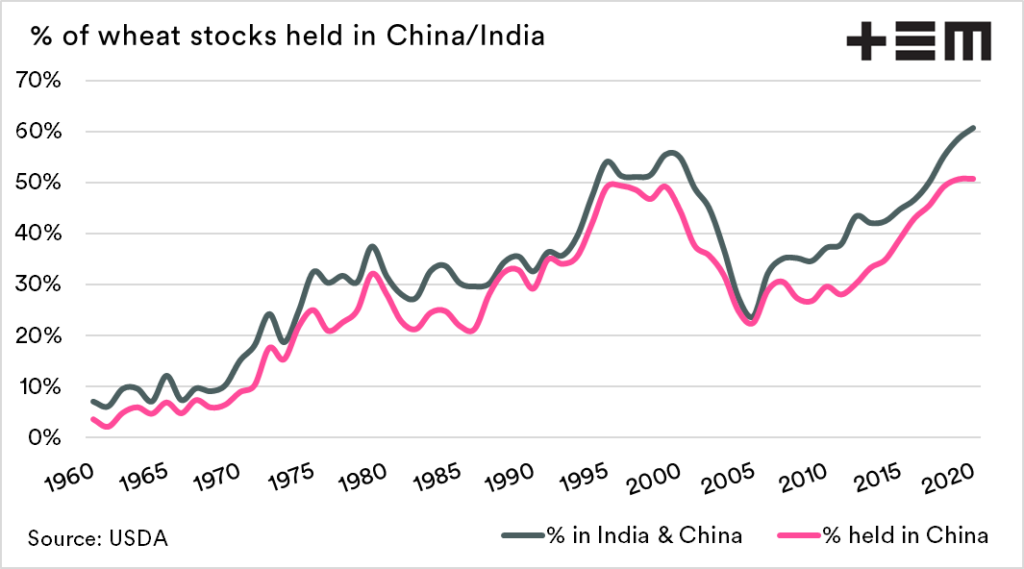

Ending stocks were dropped to 313mmt, a drop of 3mmt. This remains a record high level of reserves, albeit with 60% of all wheat stocks held in two countries (India & China).

So overall the picture isn’t necessarily bullish for wheat prices. That’s when you look at wheat in isolation.

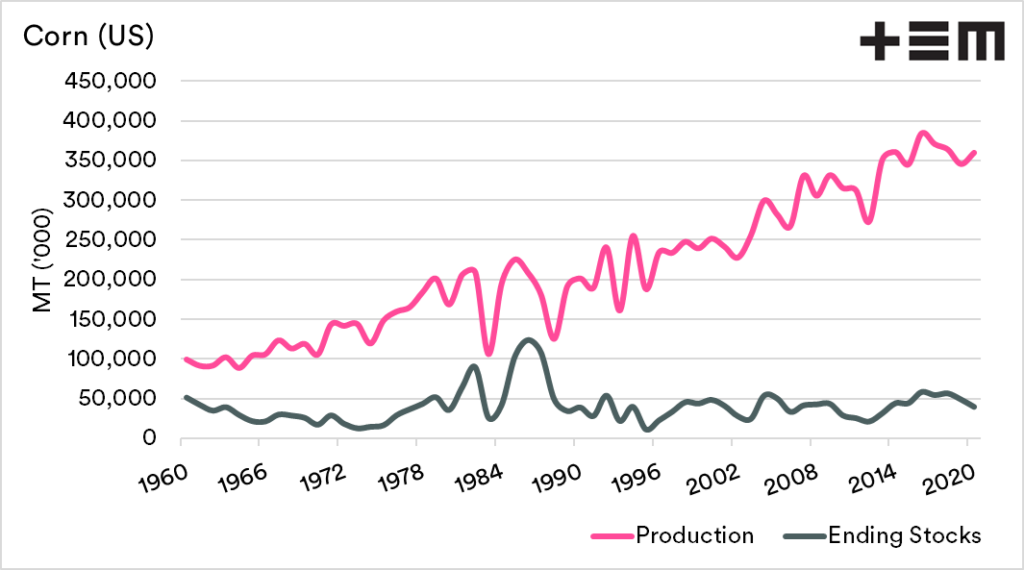

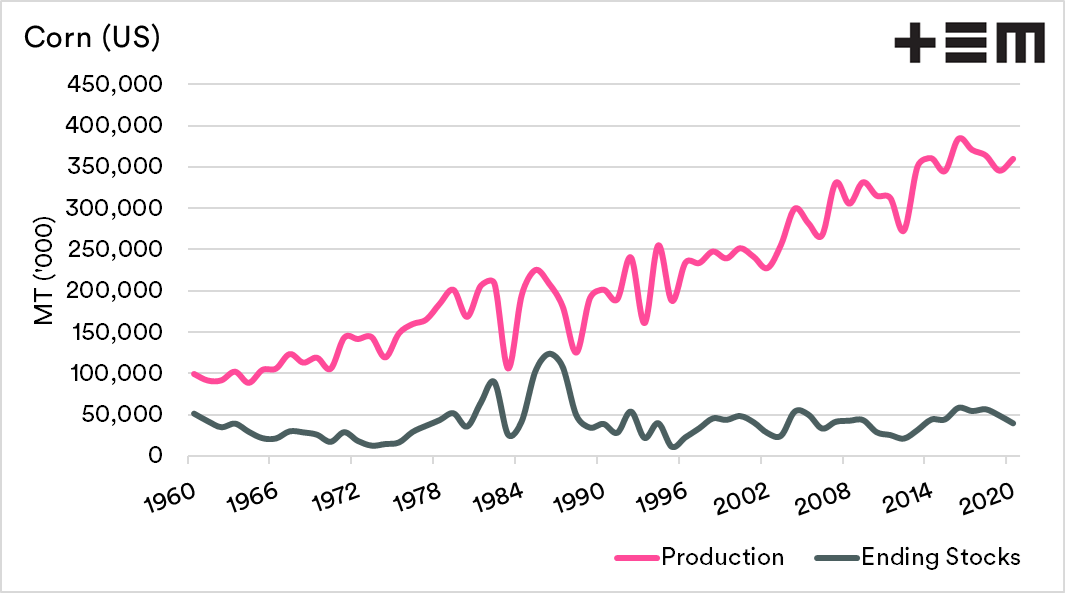

Corn

If you want to thank anything for the overnight rally, then thank corn. In recent months, the wheat market has primarily been driven by corn (with the exception of Russian tariffs)

The corn market was driven by large drops in US production, with 8mmt dropped since last month. The reality is that this remains pretty high production levels, and remain 14mmt higher than the previous year.

The increase in Chinese imports has seen forecasts rise to 17.5mmt, a huge rise and well above the levels of the low duty rate on imports. This has resulted in ending stocks dropping to the lowest level since 2013.