Russian wheat crop downgraded on lower yields

Market Morsel

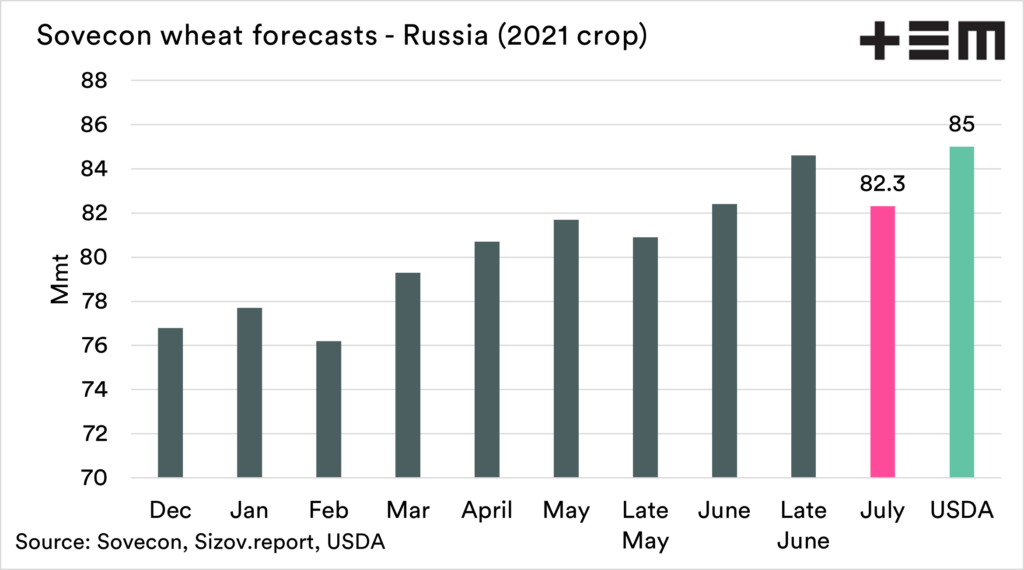

SovEcon, the leading Black Sea agricultural markets research firm, cut Russian wheat crop estimate by 2.3 MMT to 82.3 MMT on low starting yields. Russia is #1 world wheat exporter.

Barley crop estimate remained at 18mmt. Corn crop estimate was upped to 15.9mmt from 15.75mmt. Total grains crop estimate was down to 128.9mmt from 131mmt.

The estimate of the all-Russian yield of winter wheat was down from 3.7mt/ha to 3.56mt/ha on lower southern yield estimates. Kuban, #2 wheat grower, reports starting wheat yield at 6.2 mt/ha (91 bu/ac); this is close to a record-high. However, Rostov (#1) starting yields at the moment are relatively low – just 3.4 mt/h (50 bu/ac), only 3% higher than a year ago, which was a bad year for the South. Rostov yields are expected to rise but are to finish substantially below record-high levels. Early yields in the Black Earth and the Volga Valley are also relatively modest.

Recent abundant rains in the South slowed down the harvest and led to yield losses in some cases as well as quality issues.

Winter wheat area estimate remained at 16.8 mln ha, inc around 0.5 mln ha in Crimea. Yesterday, USDA cut the Russian winter wheat area substantially, by 0.7 mln ha to 16.3 mln ha (ex. Crimea), now it’s in line with SovEcon’s number. This was the main reason behind USDA’s smaller crop number, which was cut by 1mmt to 85mmt.Weather conditions were friendly for the new winter wheat crop in Russia. However, it seems that plants couldn’t fully recover after a very dry fall, especially in the South. We feel that the market could be too optimistic about the new Russian wheat crop.

Sizov.report: we are helping funds, traders, and buyers to trade and manage their risk better by providing consistent data and accurate analysis of the Black Sea grain market.