Speculators continue betting on a falling wheat market

Gaining an understanding of how speculators are positioned is valuable, as it provides a market signal and offers insight into market sentiment. The Commodity Futures Trading Commission (CFTC) provides a weekly report called the Commitment of Traders (COT), which provides this insight.

The COT report is released every Friday. The weekly data is the positions held as of Tuesday; therefore, there is a delay.

The full report provides details on the number of contracts held in short (sold) or long (bought) positions for a range of different trader types. The type of trader that we are interested in viewing is the ‘managed money’, which is a proxy for speculators

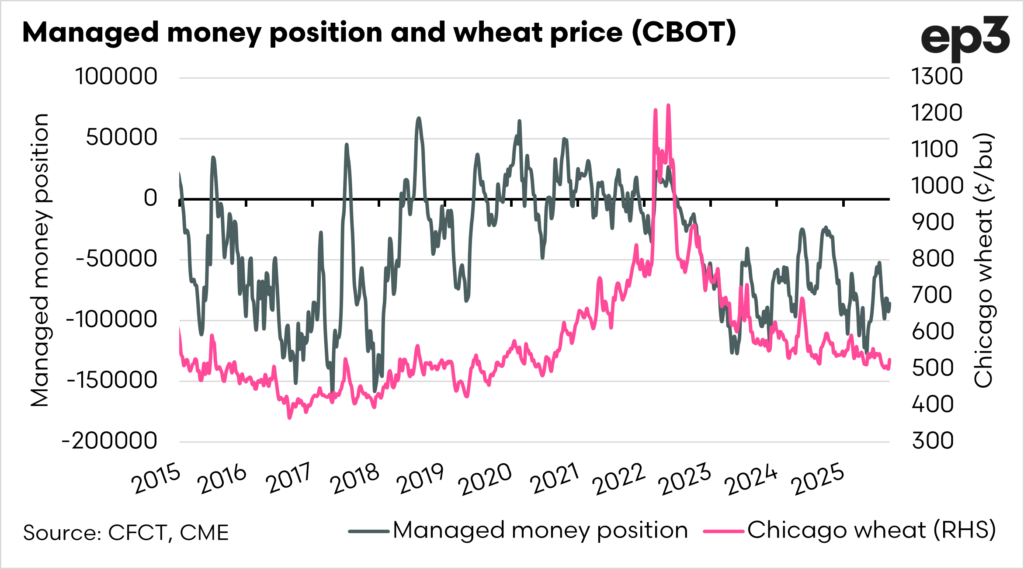

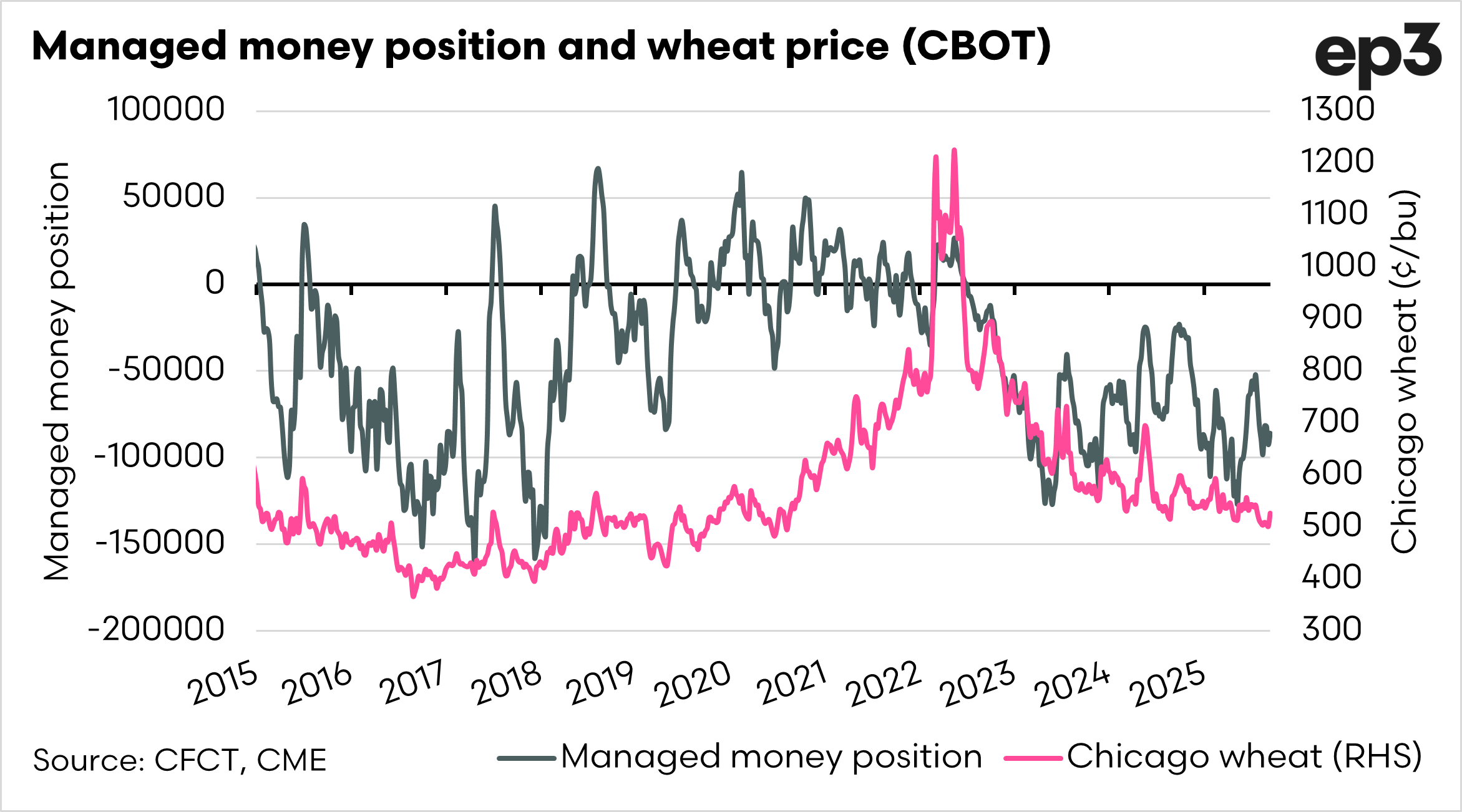

When we examine the report, we add the sold and bought positions for futures (and options), to provide a net position. This gives us an indication of the overall market sentiment. When the market has a negative position, speculators are overall bearish on the market, and vice versa when the position is positive.

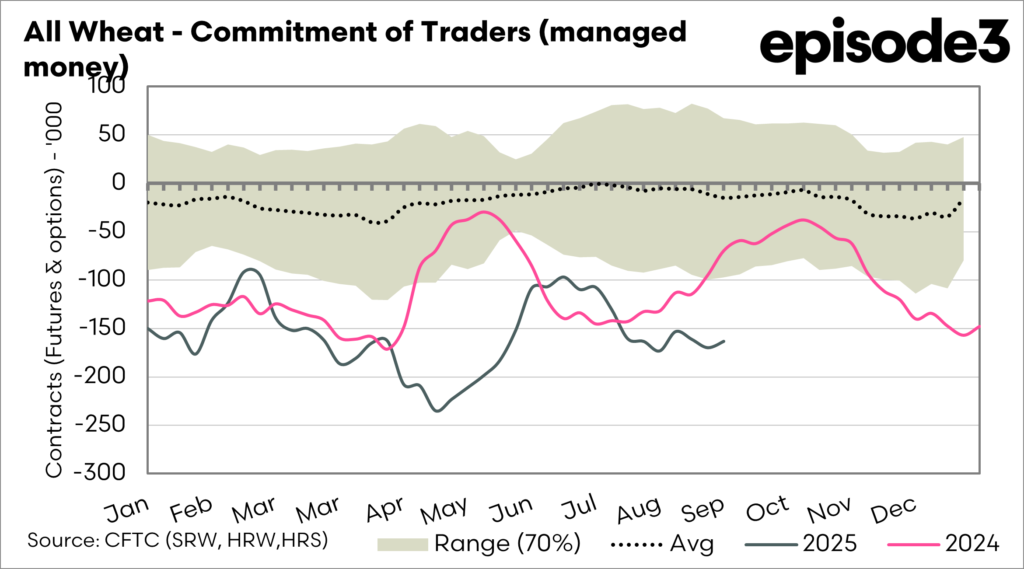

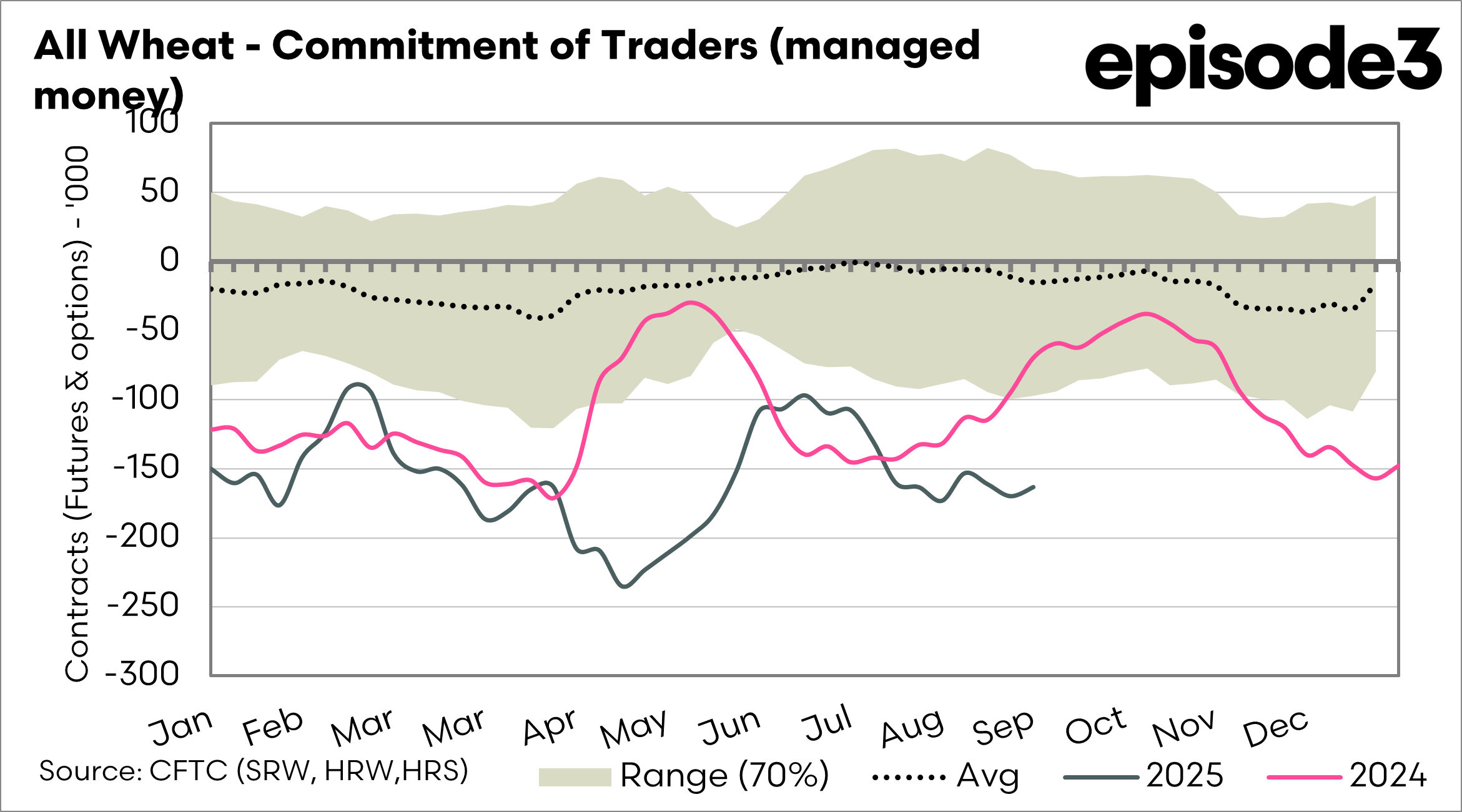

The first chart below shows the seasonality of the all wheat position (Chicago, Kansas and Minneapolis), it shows that they are betting on the wheat market falling further. That doesn’t mean they are right.

A short-covering rally in wheat occurs when speculators who have bet against the price of wheat (by taking short positions) are forced to buy back their contracts as wheat prices rise. This happens when the market moves against their expectations, often due to factors like unexpected weather events, supply disruptions, or bullish news. As speculators rush to cover their short positions, they buy wheat futures, which increases demand and pushes prices even higher. The greater the number of short positions in the market, the more significant the potential for a short-covering rally, as the buying from short-covering adds extra upward pressure on prices.

The reality, though, at the moment is that the majority of the world’s grain is either in the bin or close to being in it. There are little opportunities for large price rallies in an environment like this.