Taking some time oat to look at oats.

The Snapshot

- The oat market has followed a similar pattern to other grains, with our local prices inflated due to drought conditions.

- Milling oats are at the 63rd percentile

- Feed oats are at the 70th percentile

- There is an oat futures contract on CBOT.

- Unfortunately, the correlation between Australian and CBOT oats is low.

- Using CBOT oats as a hedge has the potential to add as much risk as it removes.

The Detail

This week, one of our customers asked EP3 to provide some pricing and deciles on oats in Western Australia. As I was putting together the data, I thought that I might as well write a very short piece on oats.

Oats are a favoured grain in my home country. Coincidentally one of the main ingredients in our national dish set to be devoured on burns night next week (25th January) – haggis.

Enough with the nostalgia of Scotland.

Pricing

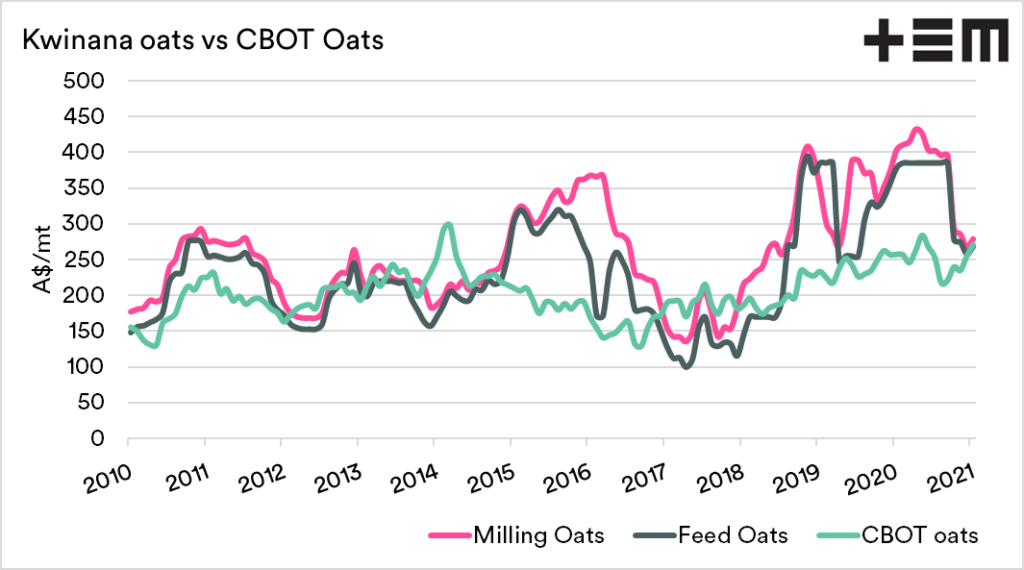

In recent years oats have followed a very similar pattern to all other grains in Australia. The drought conditions have lead to high prices, which since the start of this harvest have lost ground.

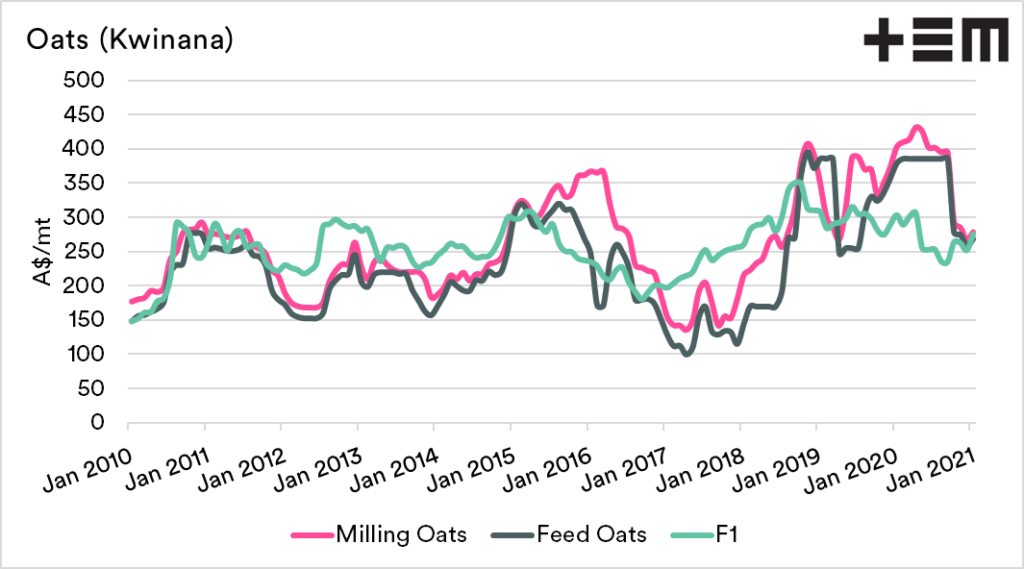

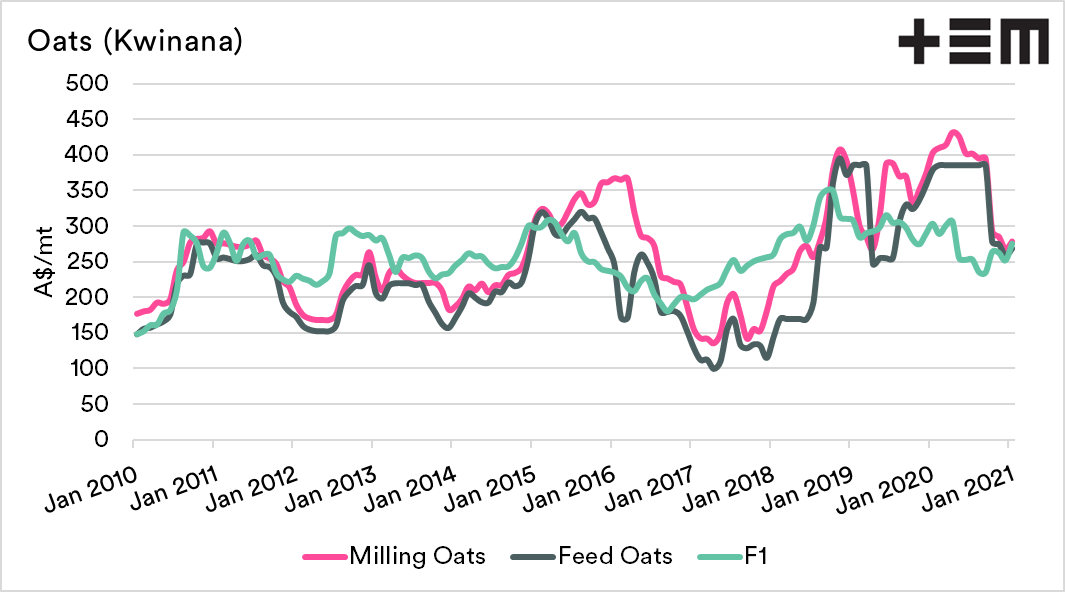

In the first chart below, milling and feed oats for Kwinana have been overlaid with F1 barley. As we can see, they generally follow a similar pattern. This makes sense especially between F1 barley and feed oats, as the usage is similar.

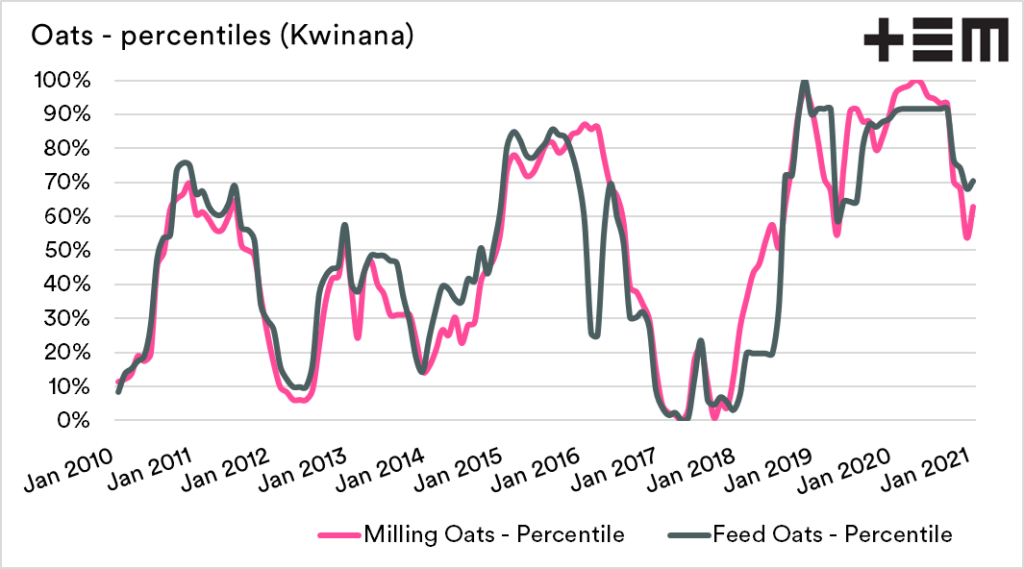

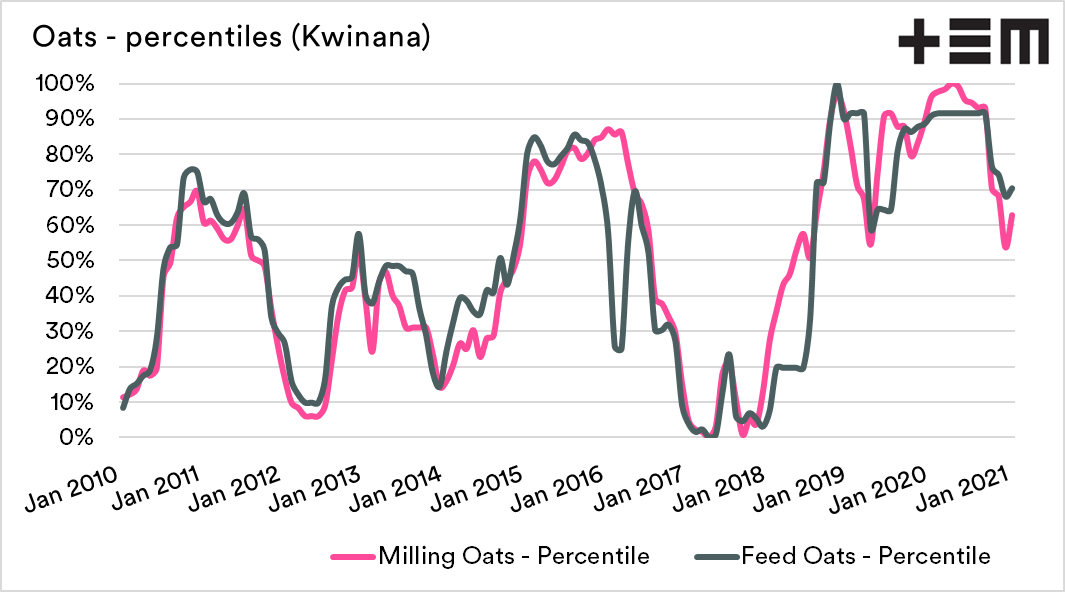

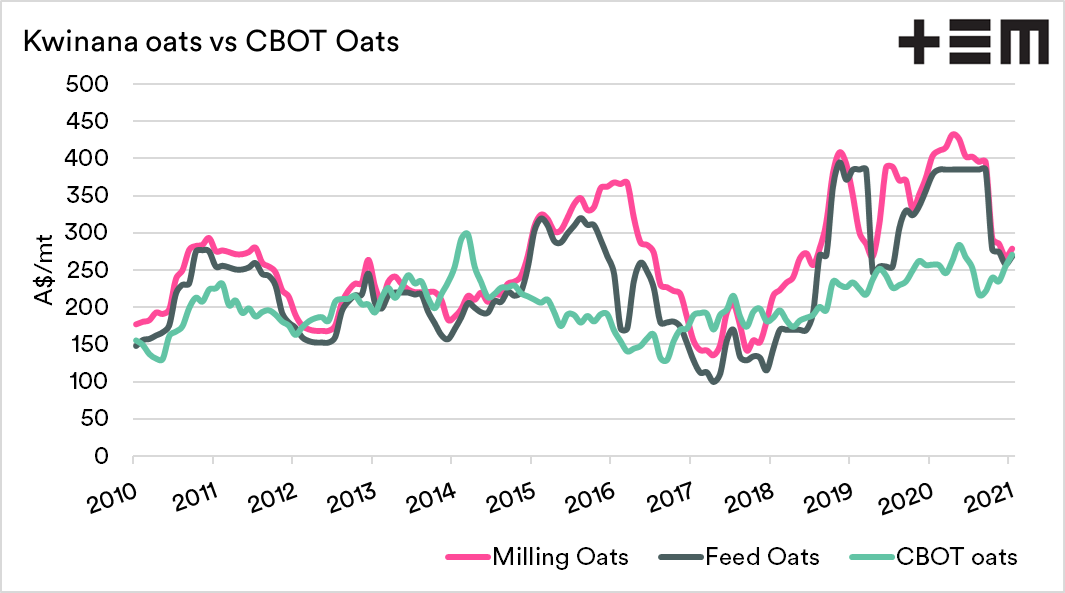

The second chart shows the deciles for milling and feed. At present feed, oats are at the 70th percentile, and milling is at the 63rd. The levels for oats are quite comparable to F1 barley.

Can we hedge Australian oats?

Oats are a commodity which has its own futures contract, but not one which gets much attention. This contract is traded on CME (or CBOT).

This should make an excellent option for growers in Australia to consider hedging. It’s actually not quite the case.

The correlation is quite low between Australian oats and CBOT oats. A perfect correlation would be 1, and no correlation would be 0. In the case of milling oats, the correlation since 2010 is 0.36, whilst feed oats are 0.5. In fact, F1 barley has a higher correlation to CBOT oats at 0.55

This relatively low correlation would put me off hedging with CBOT oats. There is no point hedging if the futures contract can add more risk than what you are attempting to remove.