The difference between wheat sales and purchase price.

Market Morsel

On EP3, we have written at great length about the price differentials of Australian grains and oilseeds versus other origins.

The drought in 2018 and 19, provided Australian farmers with a huge increase in value for grains, albeit at a time when there was very little volume to sell. Recent years have provided a huge surplus of production; in this period, prices were low relative to the rest of the world.

This is a pretty good example of supply and demand. When production is high, basis (premium or discount) to the rest of the world falls negative, and vice versa when we have low production.

I thought now that we were moving into the new season, and conditions are not quite as conducive as recent starts; it was time to review in a couple of short articles.

In this article, I have opted to look at the pricing level with a slightly different comparison. Whilst it is impossible to access the data on what individual transactions for exports are made at, we can create a rudimentary value for the average price sold for export each month.

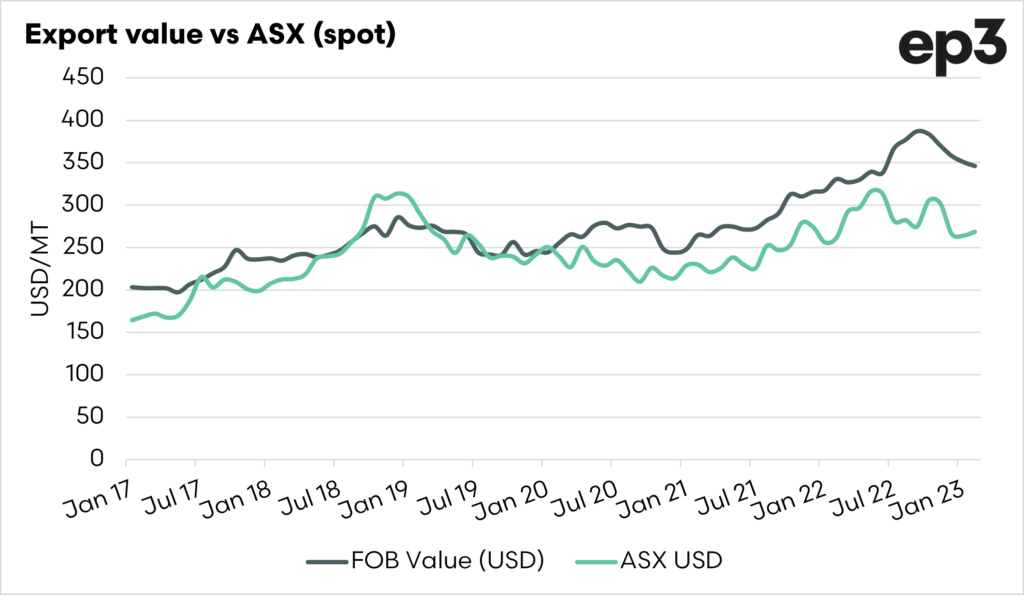

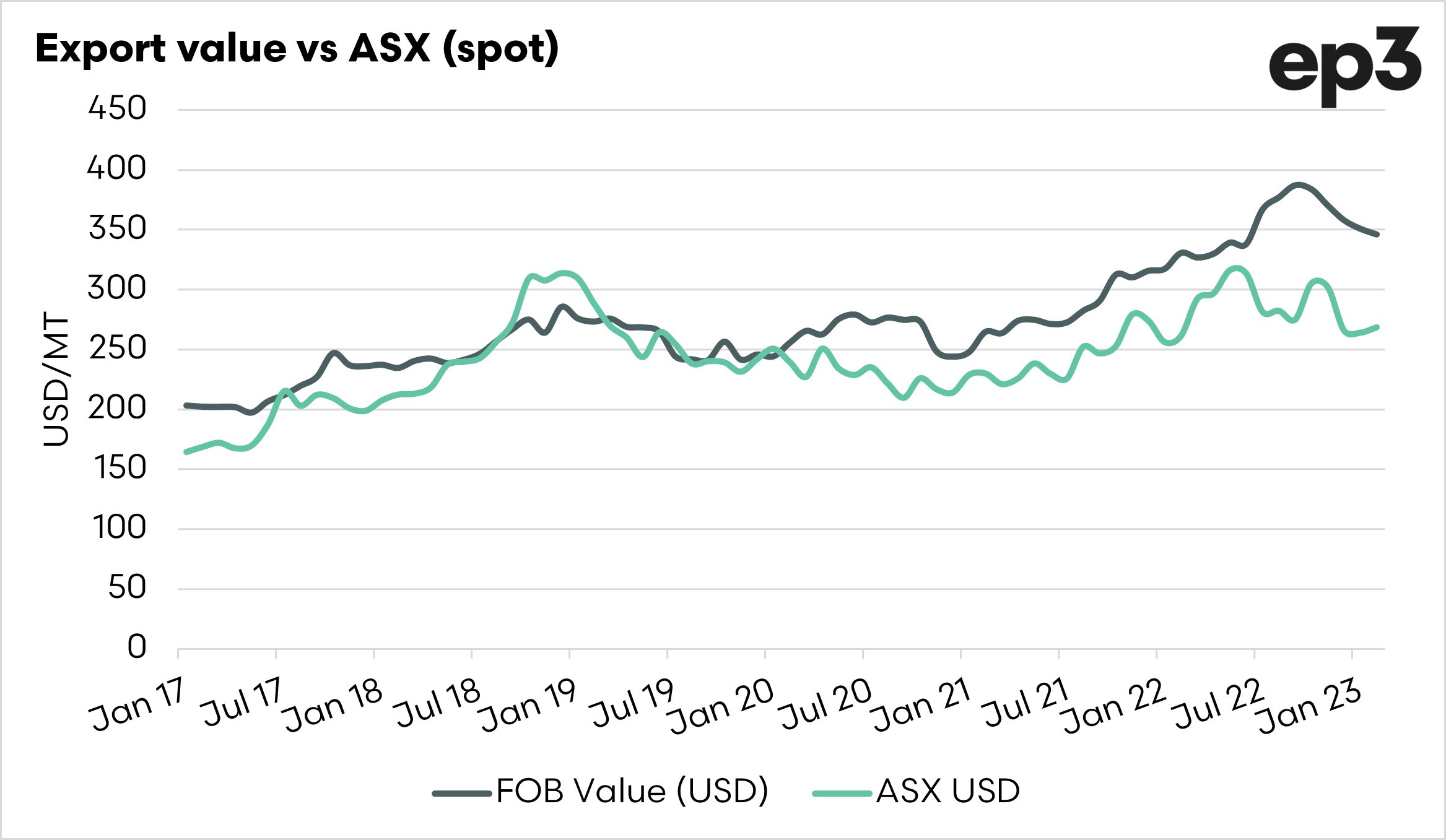

The chart below tracks the average FOB (Free on board) value for each month of data from 2017 to the present; this is compared against the average ASX value.

We can see that when the drought broke at the start of 2020, the price for grain sold by exporters climbed considerably compared to the ASX value.

This, in theory, shows a large disconnect between ASX, which closely aligns with grower bids, and with the values being achieved on the export market.

It is important to note that this is theoretical, with both these pricing points at a spot level and doesn’t take into account the time difference between purchase and sale, and the sale value used is an average of all sales. It does, however, show a growth in the difference between these two pricing points.

This is a perfect example of supply and demand. There is plenty of supply, and that pulls down pricing. As we move into more typical years, then we will likely see basis return to premiums.