The future is currently strong for wheat prices!

The Snapshot

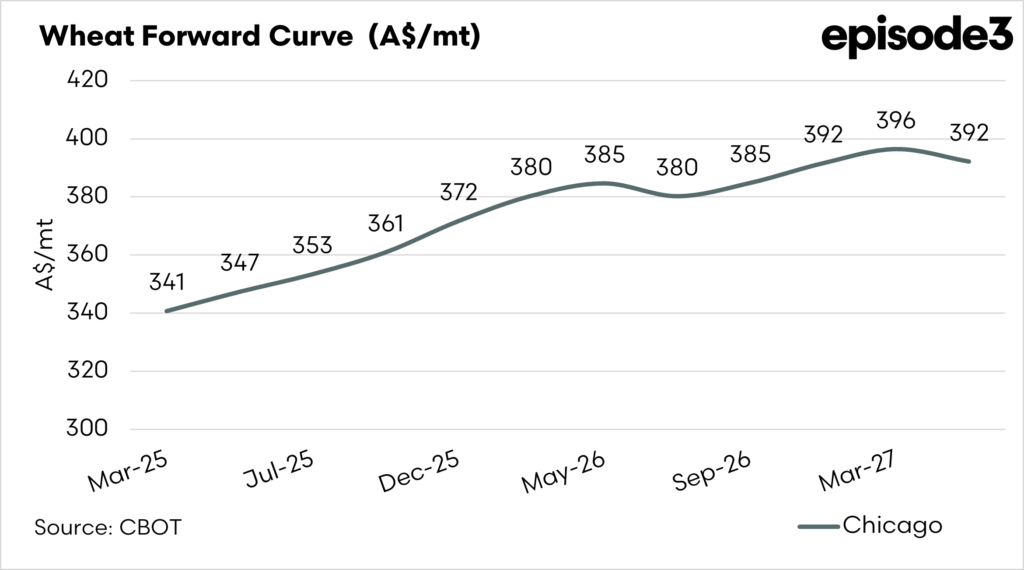

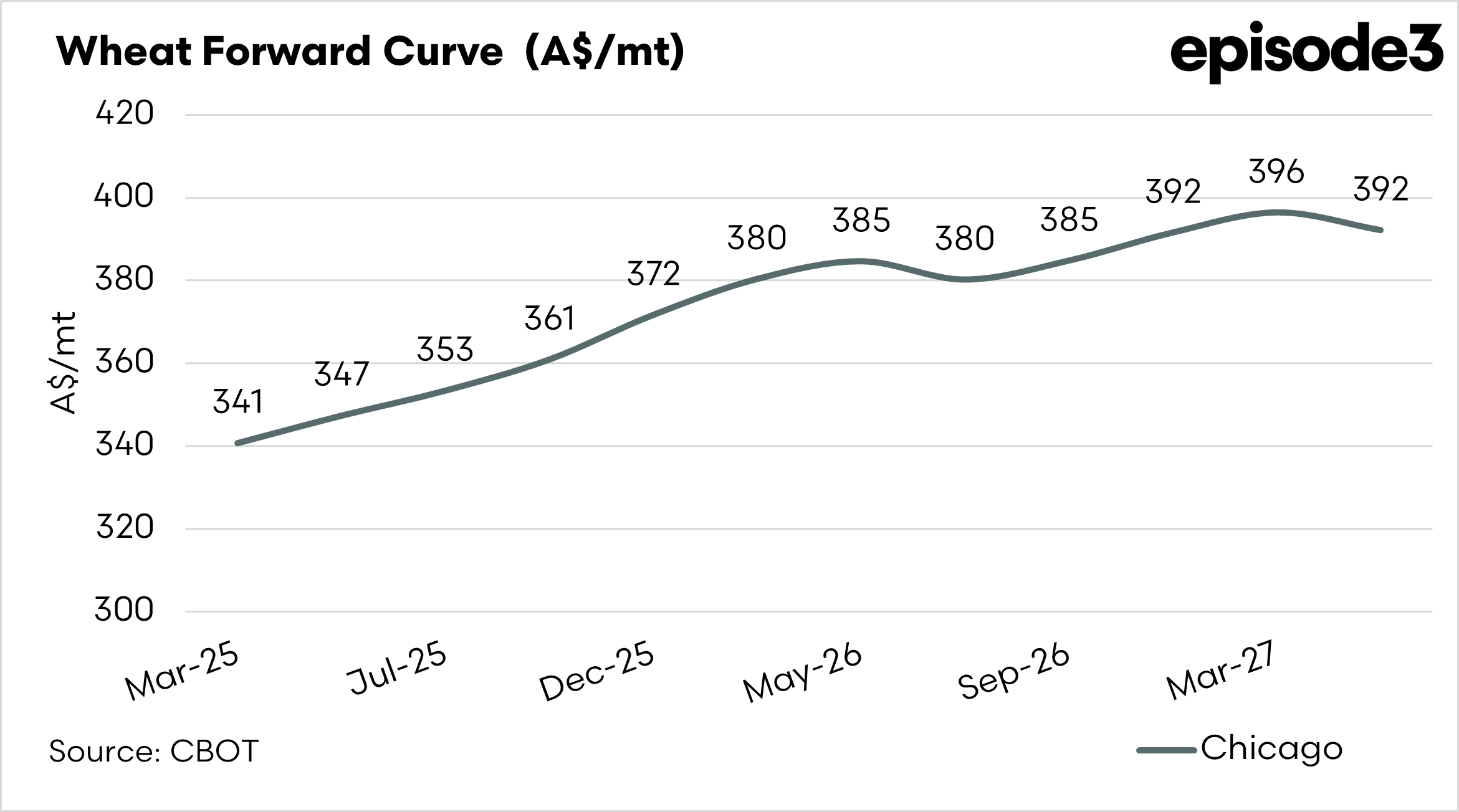

- The forward curve shows commodity prices, like wheat, for future delivery dates, helping predict market price movements over time.

- An upward-sloping forward curve indicates contango (future prices higher than current prices), while a downward slope shows backwardation (future prices lower than current).

- Wheat futures (CBOT) are currently in contango, with spot prices at A$341 and December contracts at A$372.

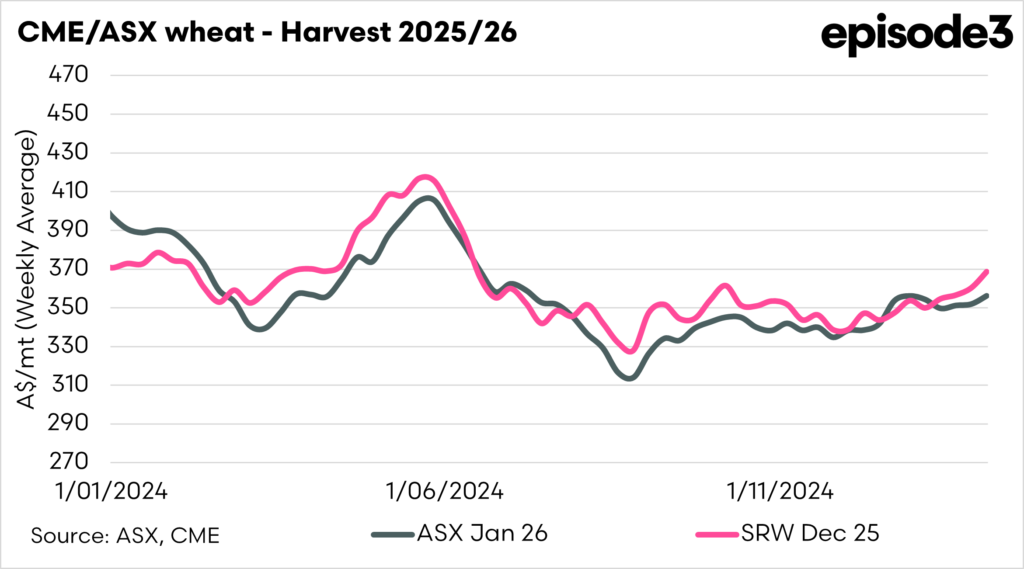

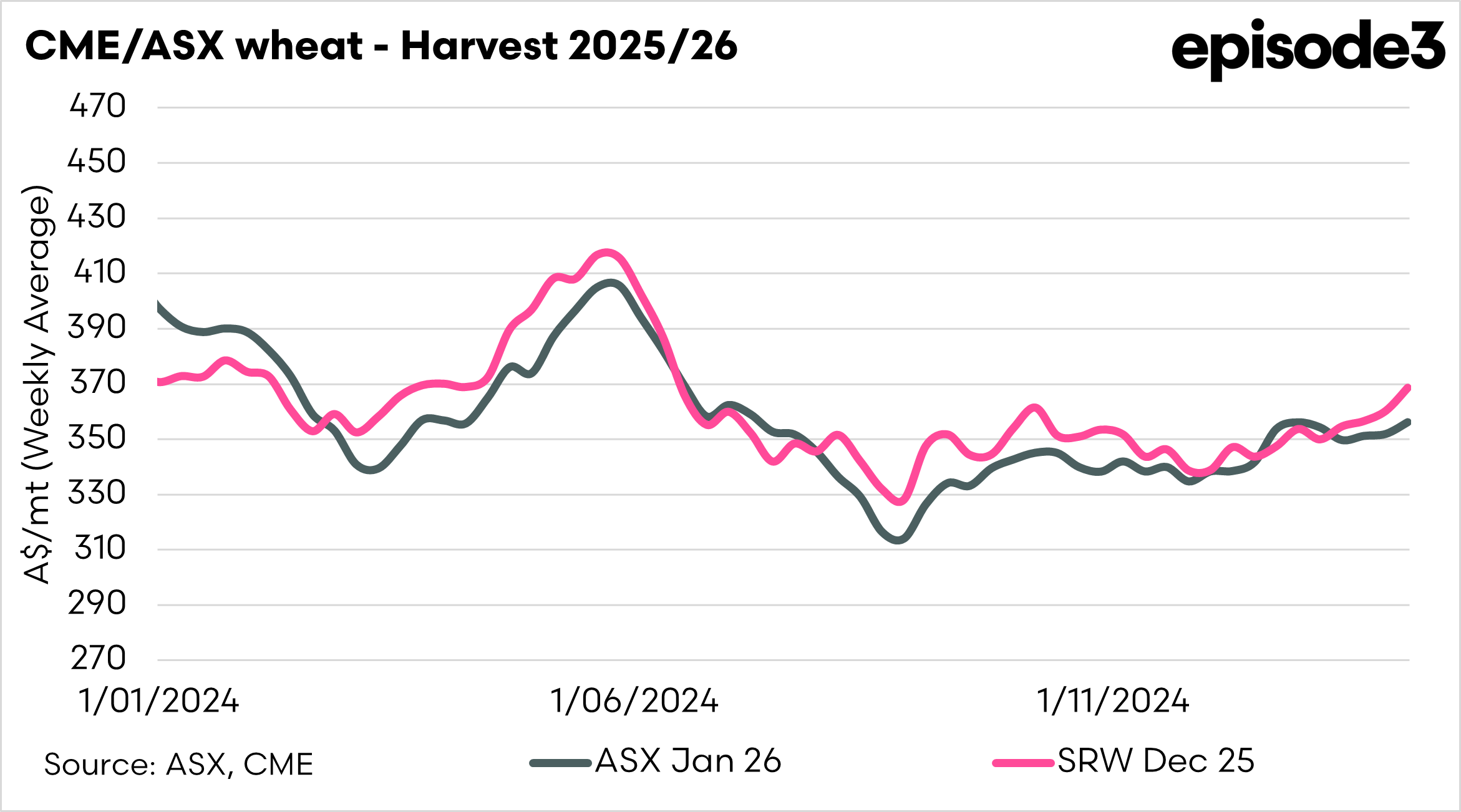

- When using futures to manage price risk, consider the basis—the difference between Australian prices and futures markets, which can shift from premium to discount depending on harvest size.

- ASX wheat is trading at a discount, which reduces basis risk but may not be attractive if Australia has a smaller harvest later in the year.

The Detail

Time goes past quickly, and it won’t be long until we will be looking at selling next year’s crop. So it’s a good time to get a head start and see what is on offer.

Let’s first look at the forward curve for the wheat futures market.

The forward curve is a graphical representation that shows the prices of a commodity, like wheat, for delivery at different points in the future. Each point on the curve represents the price of a futures contract for a specific delivery date. By looking at the shape of the curve, you can see how the market expects prices to move over time.

If the curve slopes upward, it means future prices are higher than current prices, indicating contango. If it slopes downward, future prices are lower than current prices, showing backwardation. The forward curve helps farmers, traders, and buyers make decisions about when to sell or purchase wheat, based on how prices are expected to change.

Presently, wheat futures (CBOT) are in contango. Futures prices will be at a significant premium to the spot market. The spot market is A$341, and the December contract is A$372.

If you are using futures as a way of managing your price risk, you need to take into account the basis. This is the premium or discount of Australian values to the futures market. Historically, Australian values have been at a premium to futures, but when we have a big year this can move to a discount.

So, if we use futures at A$372, we need to think about whether the basis will be positive or negative. However, A$372 isn’t a bad starting point.

We could look towards the Australian futures market. By using Australian futures (most likely ASX), you are reducing the impact of basis risk, as the market is closer to our physical price.

However, ASX wheat is currently trading at a discount, which means you will be locking in that discount.

We don’t yet know whether Australia will have a big or small year, and locking in a discounted basis at this time of the year may not be that attractive.

At this point, however, overall prices on offer either through local or international futures markets give a decent starting point. Whatever you do, don’t leave all your eggs in one basket.