The Grain Bullets

5 main drivers of the grain market

Middle East Tensions Spark Wheat Rally and Short-Covering

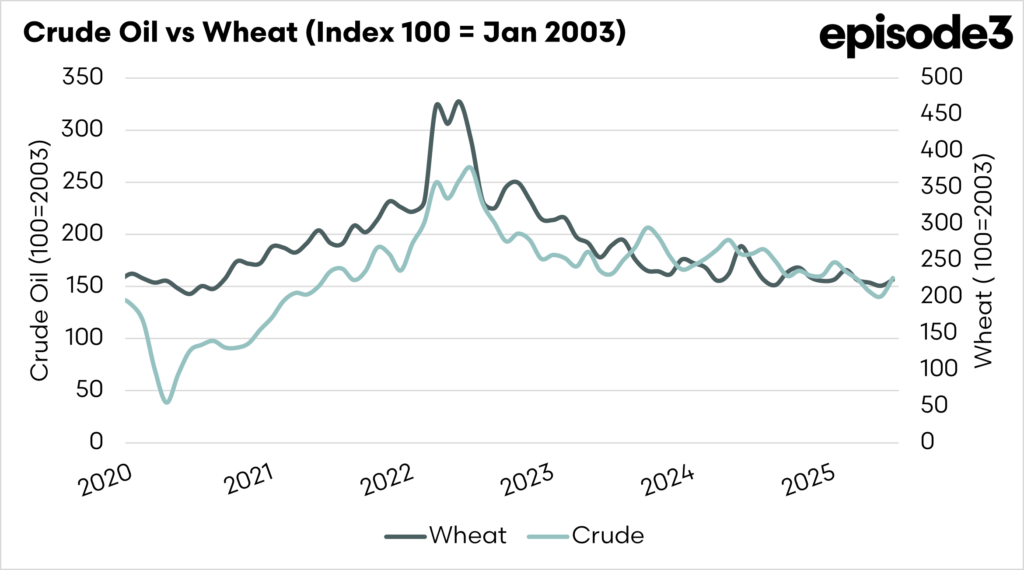

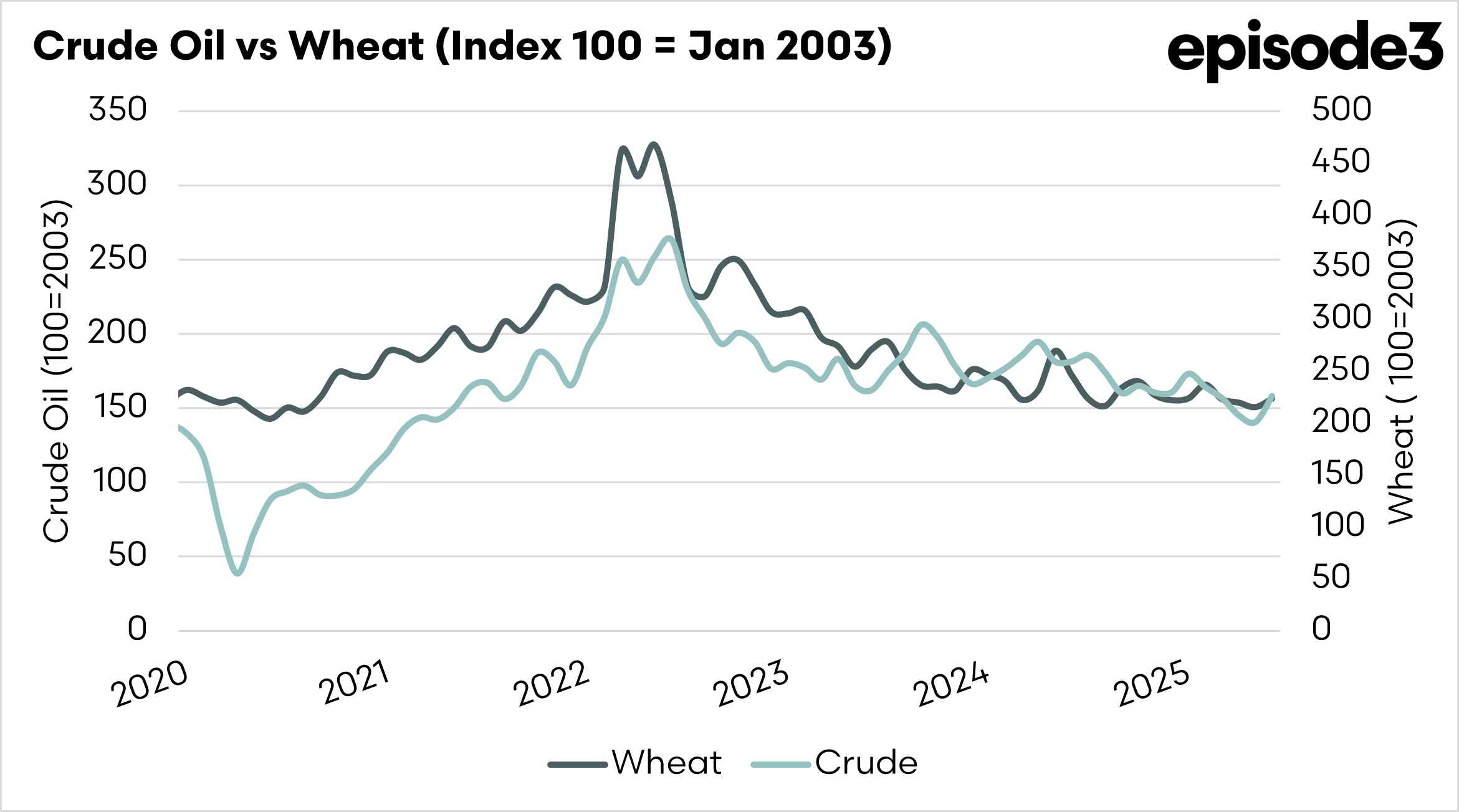

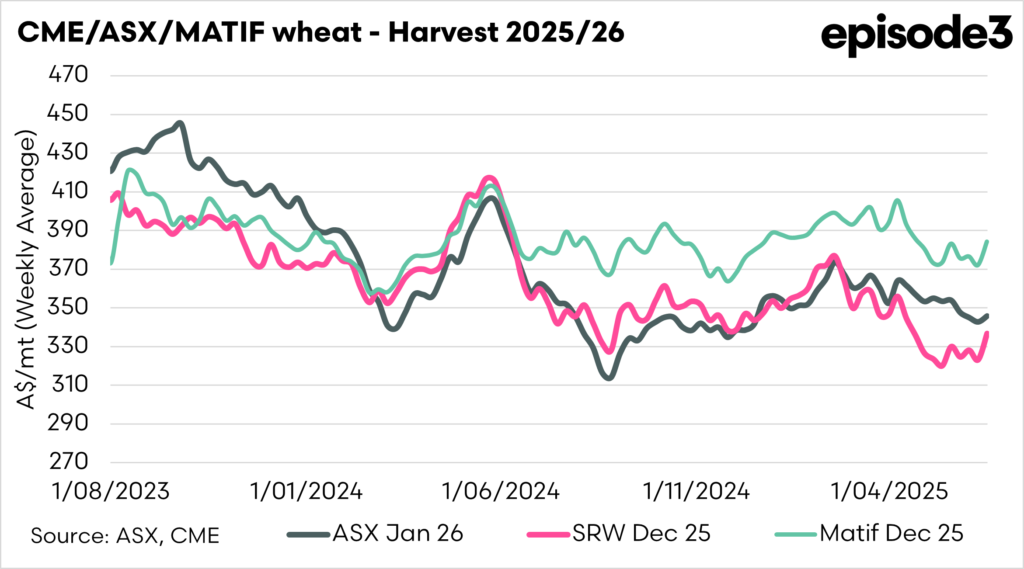

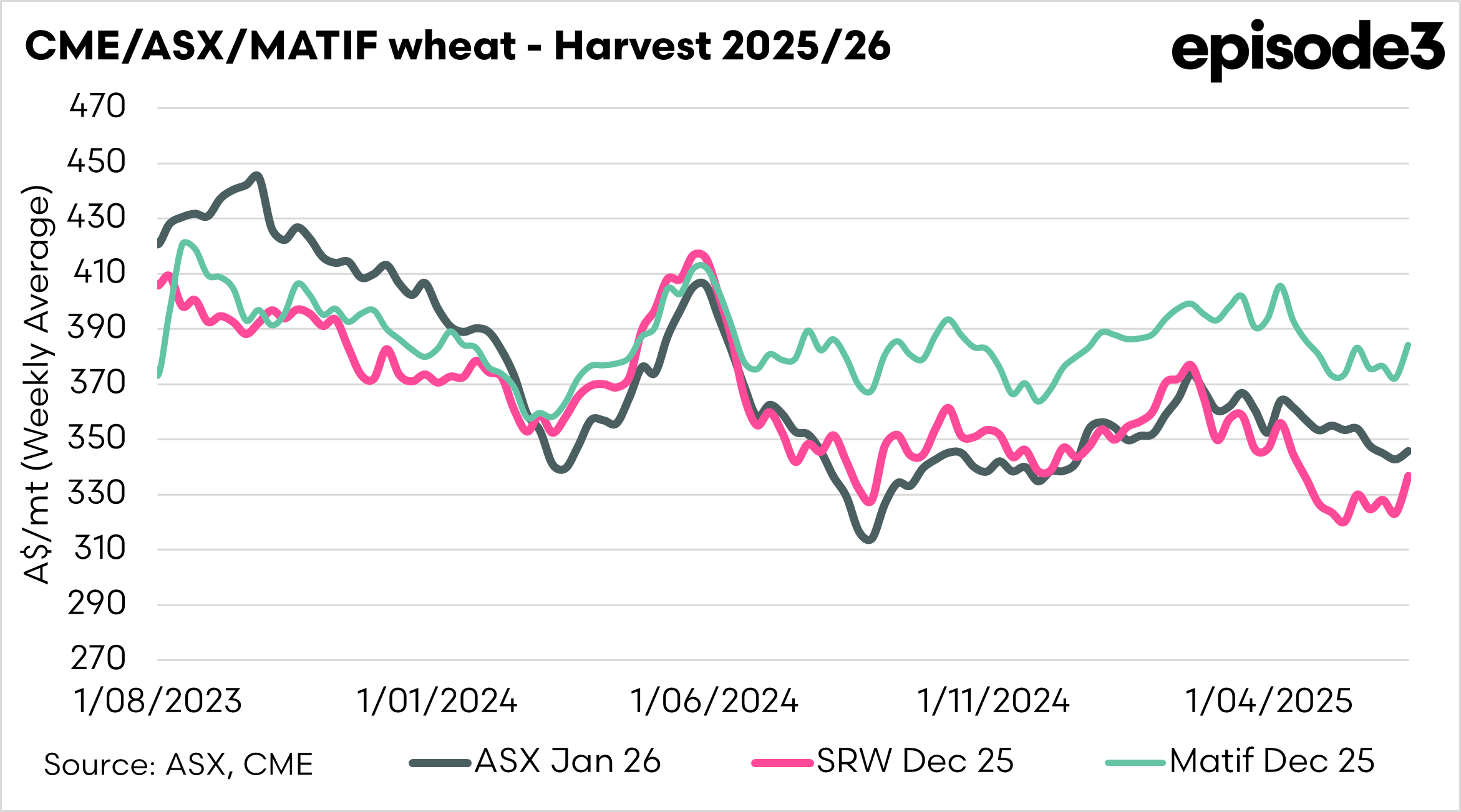

As mentioned in our updates from early last week, the ongoing Israel-Iran conflict has lifted oil prices and sparked volatility in global grain markets.

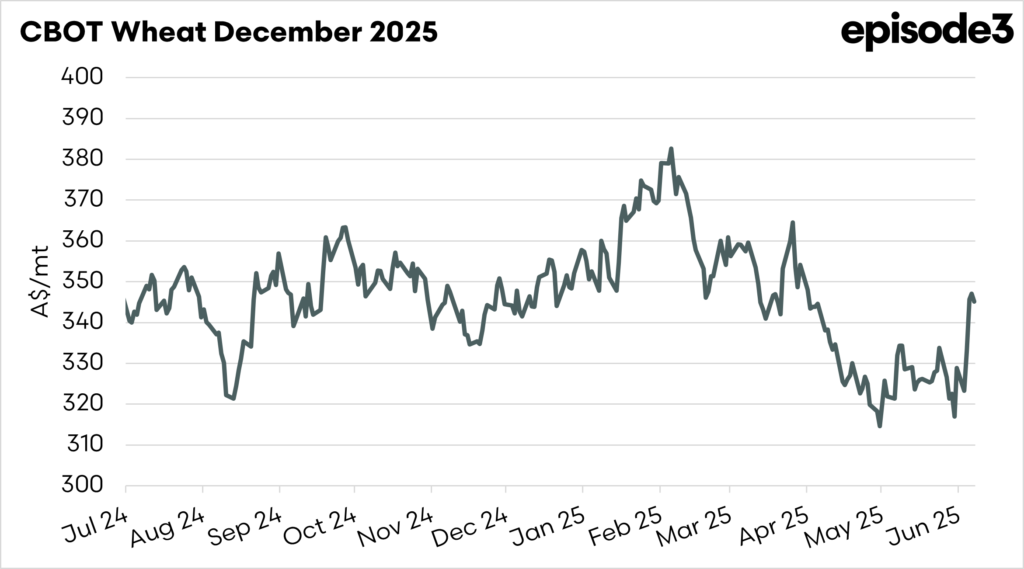

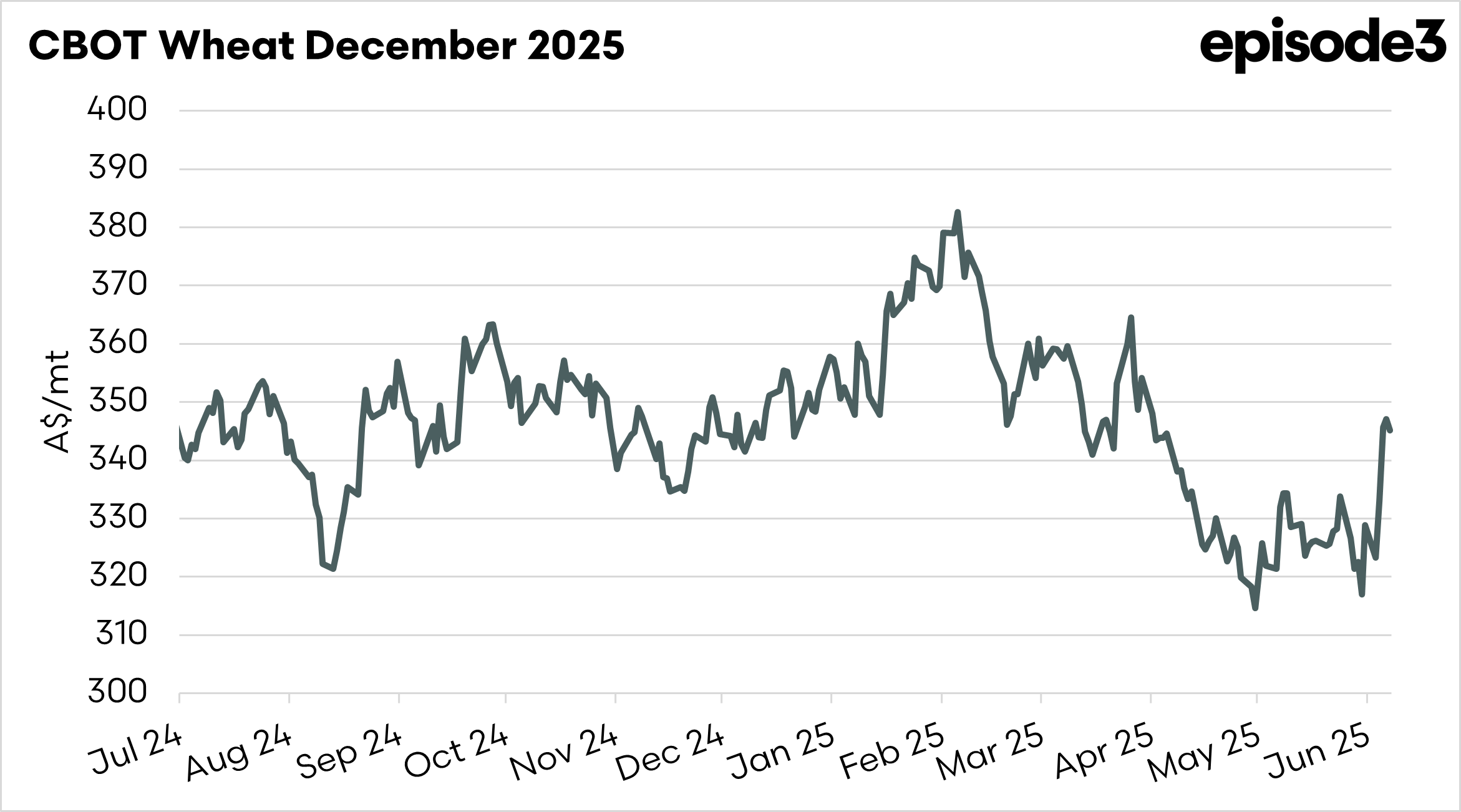

Funds rushed to cover large short positions in wheat, driving Chicago and European futures sharply higher midweek before easing as immediate conflict risks faded.

There was an expectation by many in the trade that cooler heads would prevail after Trump said he would make his decision in the next fortnight on whether to attack; he attacked on the weekend, which surprised many.

Weather Extremes Dominate Wheat Outlook

A heatwave hit France while Russia declared a drought emergency in Krasnodar, its central wheat-producing region. The U.S. Plains experienced heavy rainfall, which complicated crop conditions. USDA winter wheat ratings dipped to 52% good/excellent, and French crop ratings slipped to 68%.

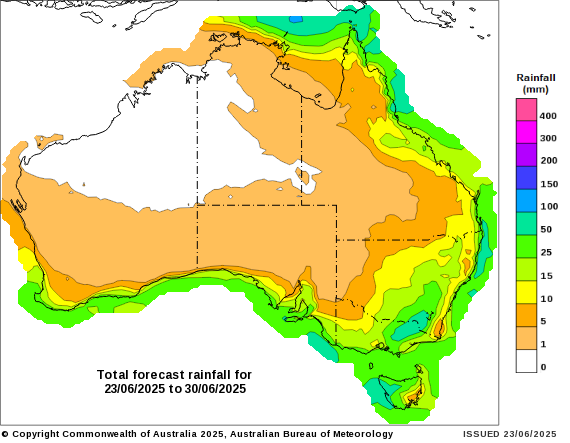

Locally, rain was reasonable in parts of Western Australia, whilst the east coast largely lost out. The 8-day BOM forecast shows a good rainfall forecast, but we will wait until farmers can hear it on the roof.

EU and Black Sea Harvest Prospects Evolve

Ukraine began its 2025 grain harvest in the south, but poor weather could reduce total output by 10%. Strategie Grains and Coceral raised EU wheat crop forecasts, with expectations of record crops in Spain and Romania, and French wheat areas rebounding 9% year-on-year.

Export Demand and Price Competitiveness

Late-season demand boosted French and European wheat prices to multi-week highs; however, French wheat remains approximately more expensive than Russian origin, thereby capping export competitiveness. New tenders from Algeria, Jordan, and Egypt drove market activity.

Oilseeds Mixed: Rapeseed Hits Highs, Soybeans Ease

Rapeseed futures surged above A$880/t, buoyed by higher oil prices, strong fund buying, and ongoing biofuel demand. However, soybeans slipped for the week after recent gains, as Midwest rains improved US crop outlook and profit-taking set in. Chinese imports of Brazilian soybeans continued to climb