The grain must flow.

The Snapshot

- The large crop has resulted in large discounts versus the rest of the world.

- The Australian export program in 2022 has been very strong.

- Traders who can access the export market are able to achieve very strong margins.

- Polls have been a bad word in Australian markets for a long time.

- In 2022, they hold a place when the pool manager is able to achieve margins which can be passed to members.

- It’s important not to discount any marketing method. Whether that be cash, pools, futures, options or others. Each season is different.

The Detail

Over the past two years, the big crops have caused a major logistical challenge. Whilst the big crops are welcome, they have come at probably the worst time in terms of logistics. During a pandemic which has meant reduced access to staff and arduous waits for parts required for maintenance.

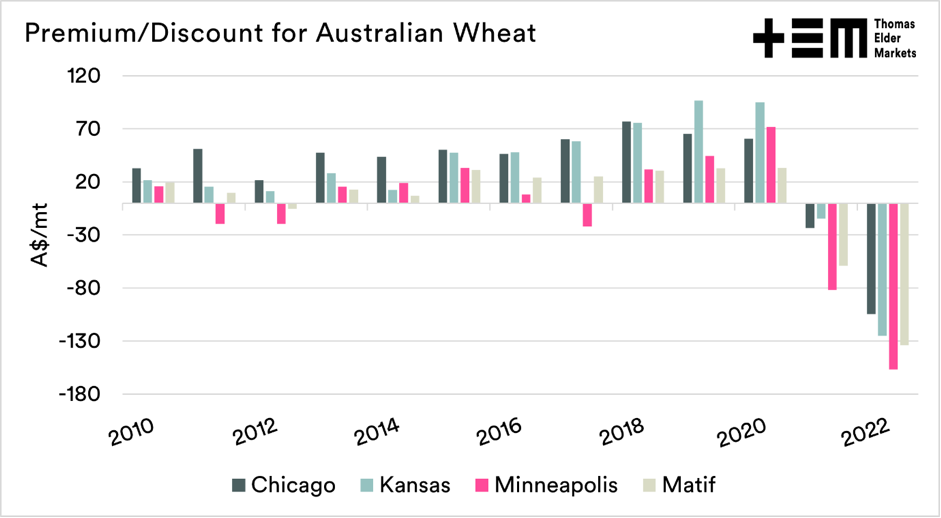

The result of a large crop has been reduced basis, with our pricing levels dropping to a massive discount versus overseas futures.

If the trade can’t get grain out of the country, they can’t get access to premiums overseas. Let’s see how the export program has been going.

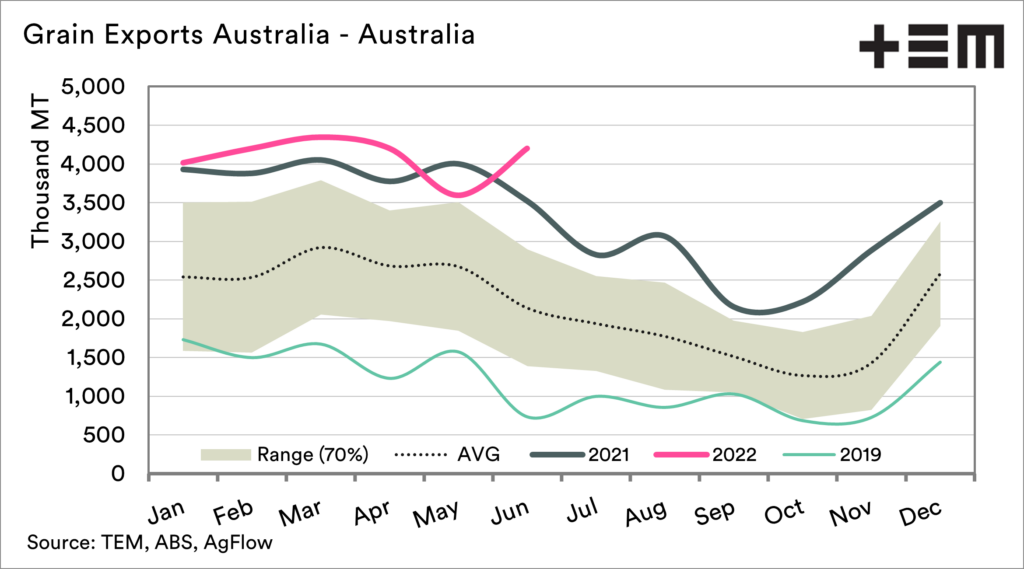

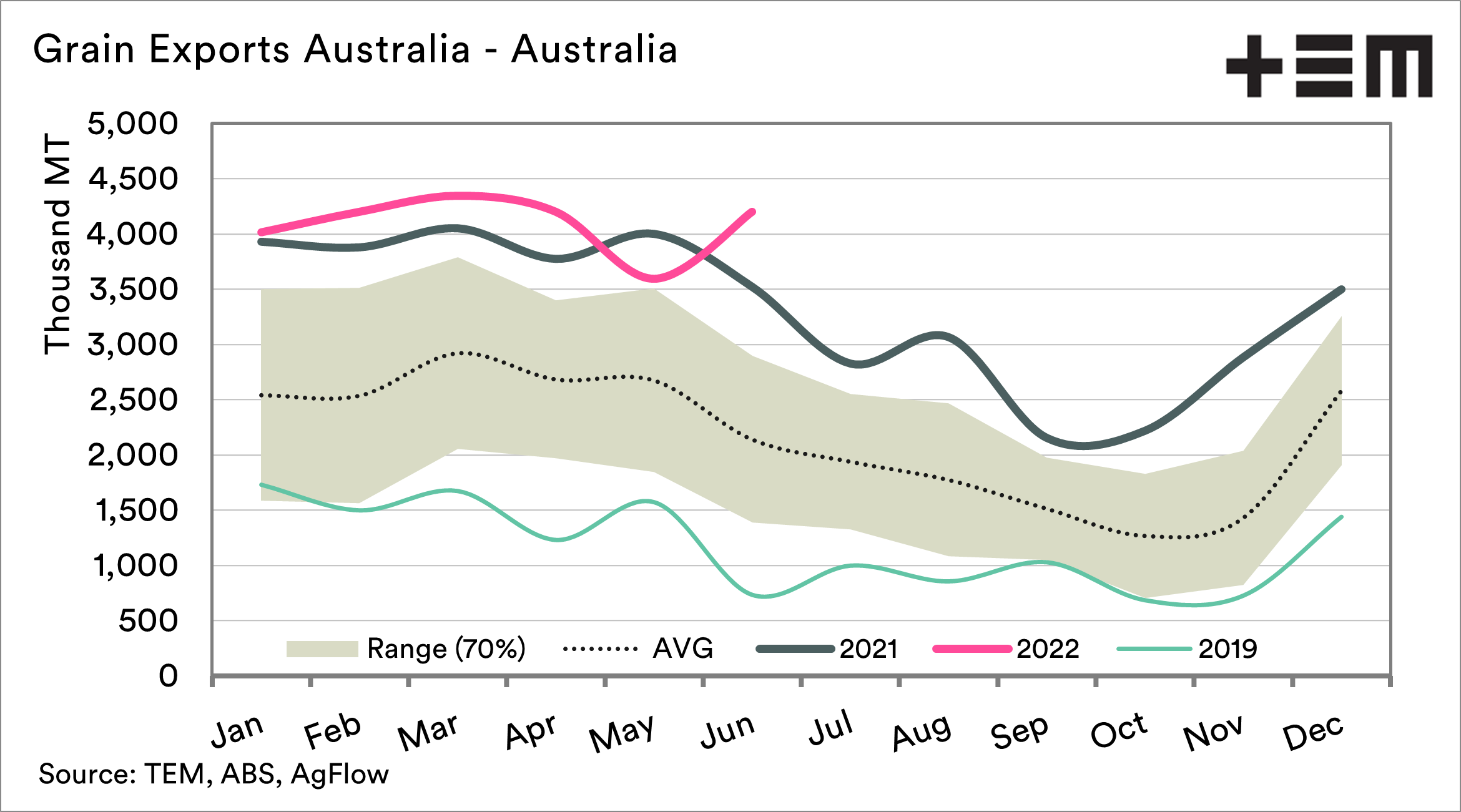

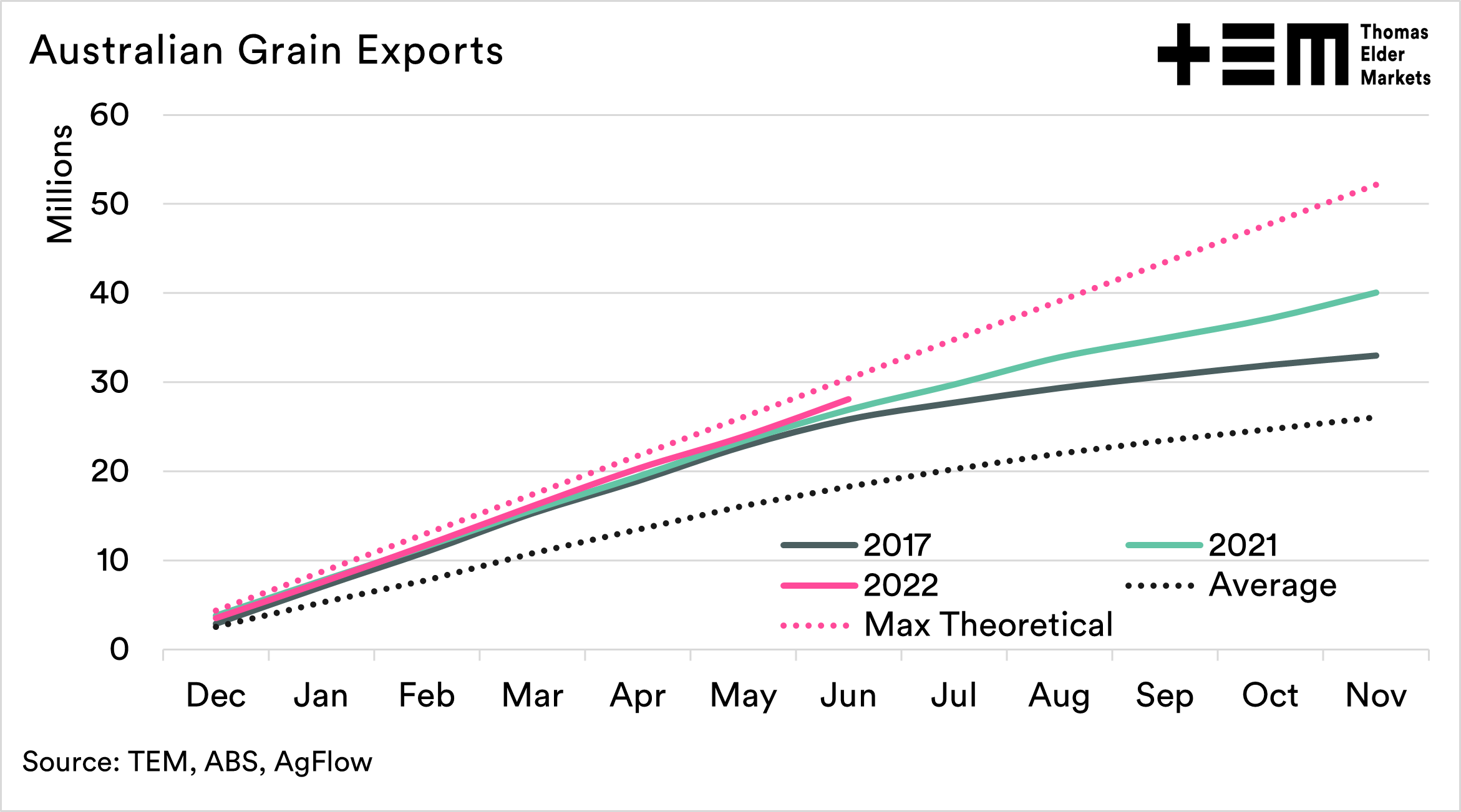

The chart below shows the total volume of grain exported each month, and includes barley, wheat, sorghum and canola. The chart has the seasonality, along with the monthly values for the past two years, and the 2019 drought year for comparison.

The export data from ABS is quite delayed compared to equivalent data in our competing nations, and is only up to date as of June.

This year has seen some major records broken around the country as our export pathways go into overdrive.

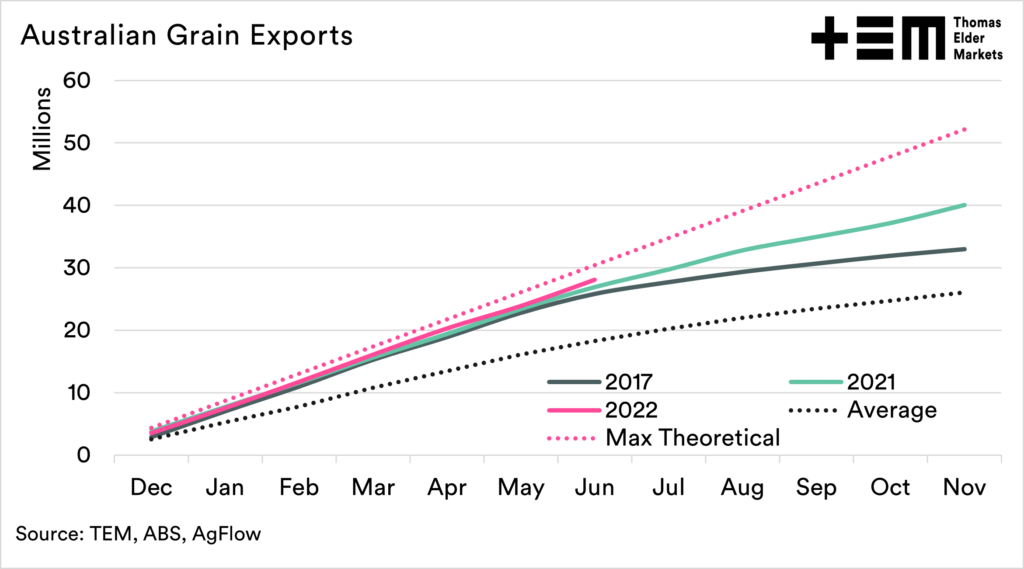

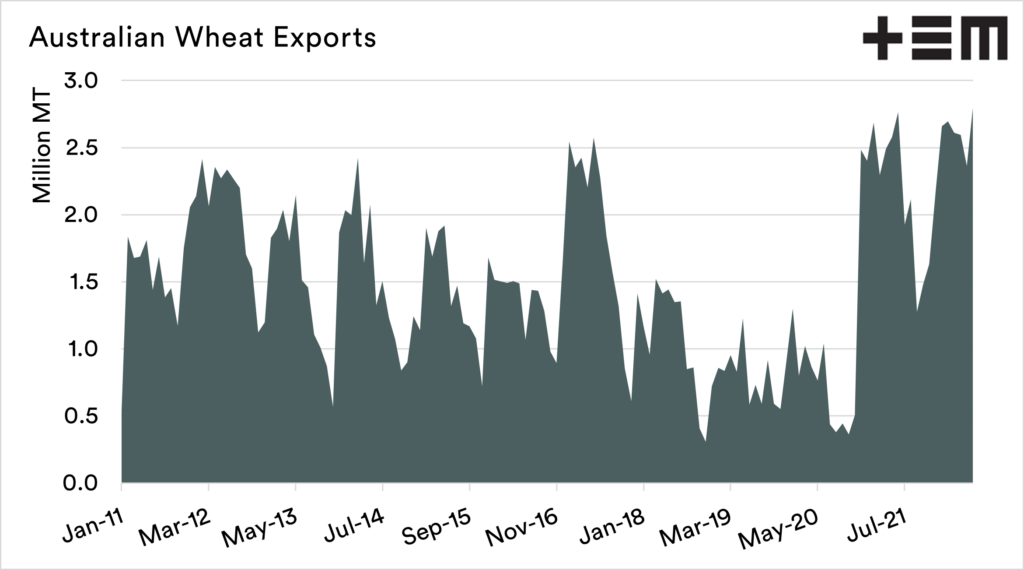

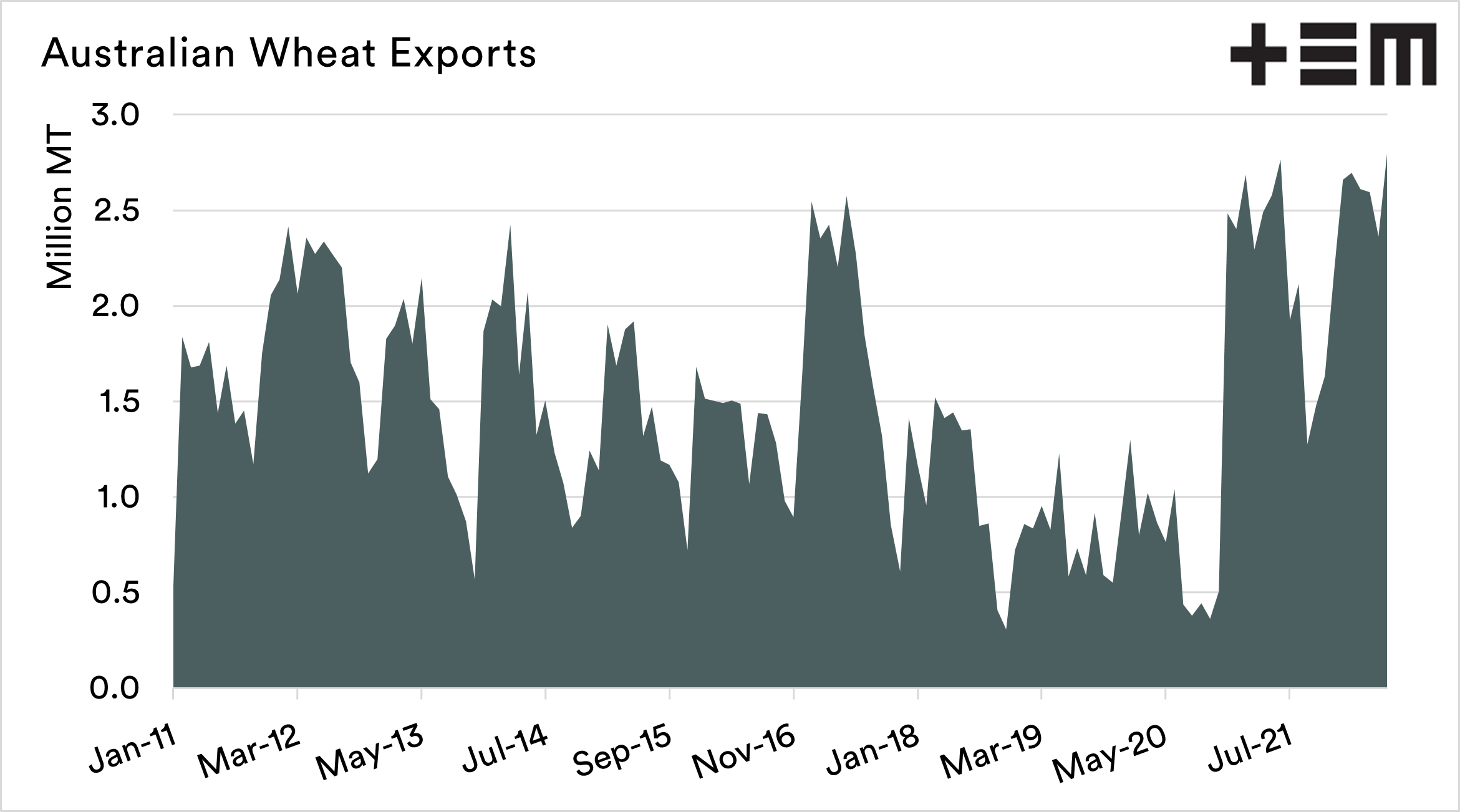

The chart below shows the cumulative exports of grain from Australia, along with the largest years of the past decade. The pace has been quick so far this year, beating last year by a small margin.

I have included a ‘theoretical’ export pace. This is purely theoretical, and the volume of grain Australia could export if the supply chain worked each month at its record pace.

Clearly, that is not possible, as the supply chain cannot work at that constant pace. As the export program continues, the low-hanging fruit is plucked, and the program tapers off.

Generally, we are focused on getting the grain out ahead of the northern hemisphere harvest. This year we are likely to see a record export program, and next year will also be large.

There are huge (elevation) margins to be made if you can get grain loaded onto a vessel. It is almost a perfect time for those able to export grain if they have capacity. A huge crop, with low prices compared to overseas, along with very large overseas pricing levels.

Pools were a bad word for a long time. This year we are seeing pools come back in vogue, especially those with access to elevation. Still, it is important not to discount any method of marketing grain, as different years provide distinct opportunities.

A year like 2022 is where a pool can come into its own. If managed correctly and large elevation margins can be realised, this is passed on to the pool members.

It will be interesting to see what the market environment is like in late 2022 as we start onto the new crop. I have already spoken about how we could be in for an extended period of low basis, as crop conditions look strong (see here)