The wheat market is trading a war

The Snapshot

- Russia and Ukraine are potentially on the brink of war.

- The market is currently trading this war risk.

- If conflict erupts then the market will fly higher.

- Russia and Ukraine contribute a huge volume to world markets of wheat, barley and canola.

- At present, major scale conflict may be avoided.

- If conflict fizzles out then the market will come under pressure.

The Detail

The only real big item in the grain news at the moment is the situation on the Ukrainian/Russian border. At present, there are reports of over 100k troops on the border, and many worry that conflict is on the horizon.

The market has reacted with wheat prices rising sharply in the past week. Markets love uncertainty, and geopolitical issues always provide oodles of uncertainty. The chart below shows the extent of the recent movements on Chicago wheat futures. Why all the palaver?

Why should we care about it?

The former soviet nations have massively grown in importance for the global grain trade during the past two decade. Russia as an example, has moved from a net importer to the worlds largest wheat exporter.

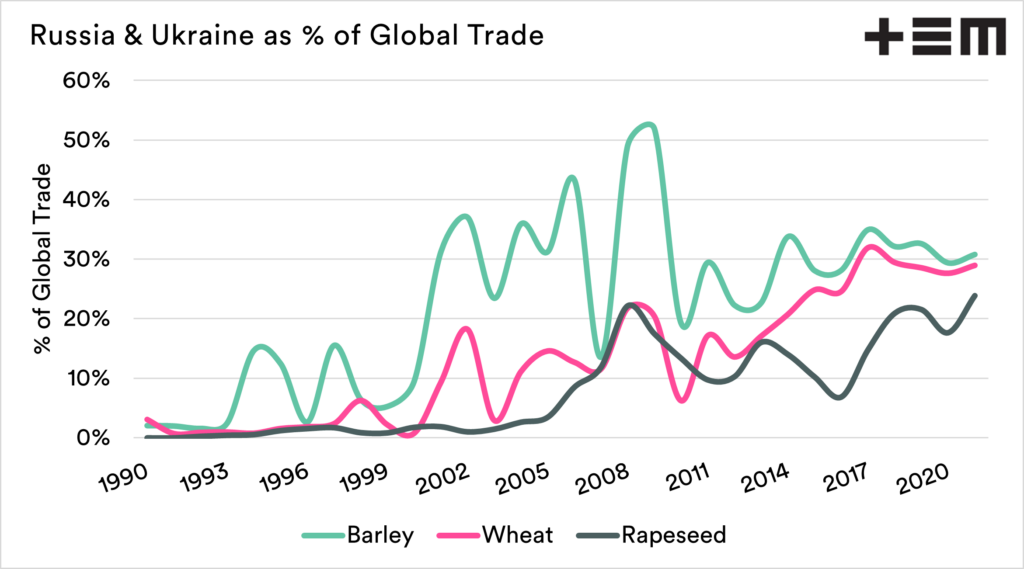

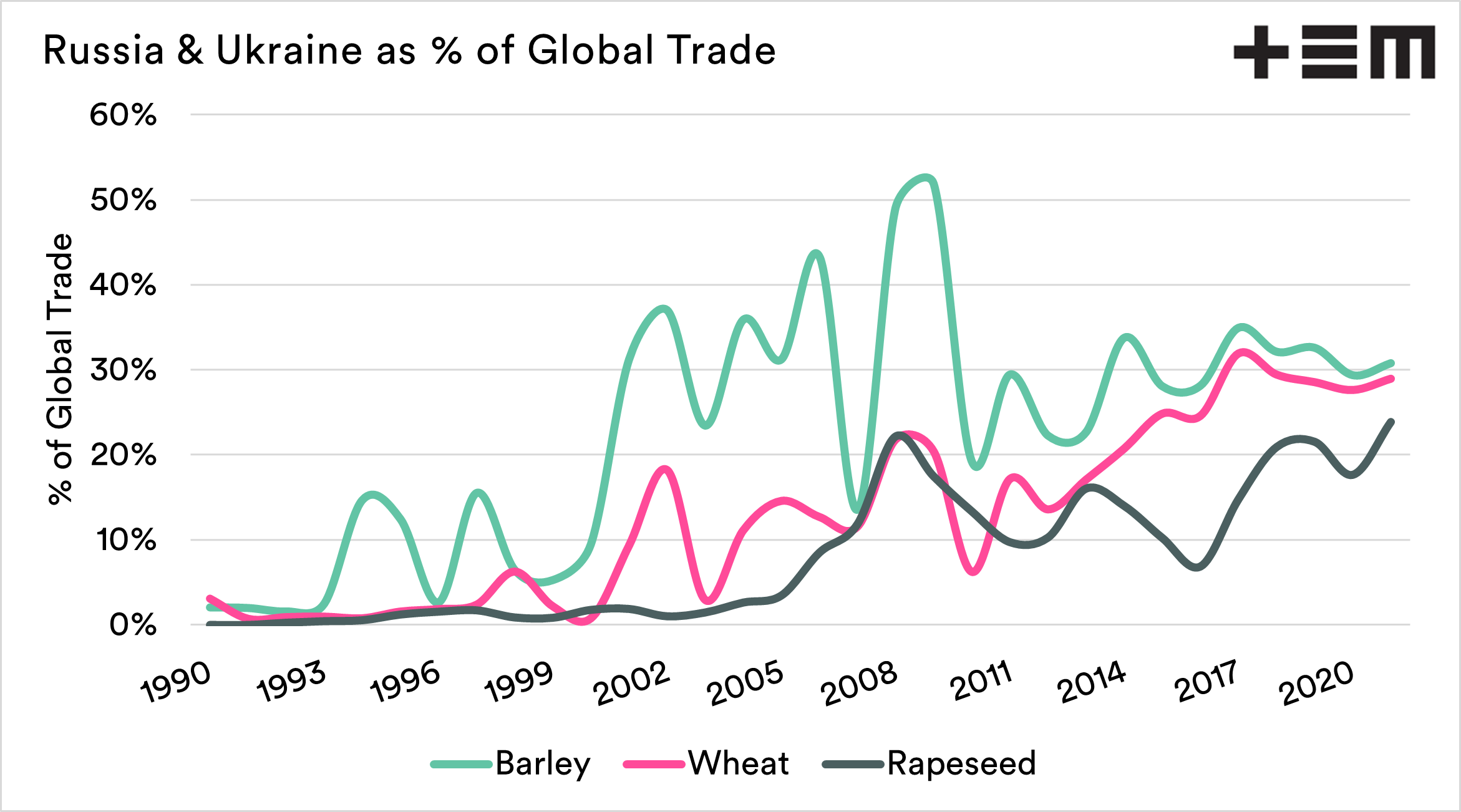

The chart below shows three of the main commodities which Russia/Ukraine exports which we as a nation have an interest in – Barley, wheat and canola.

This region has grown to be of the utmost importance to ensuring the world is supplied. If they don’t supply, then the world will have to turn elsewhere – Australia will be in the firing line (excuse the pun).

Lower available supplies = higher prices.

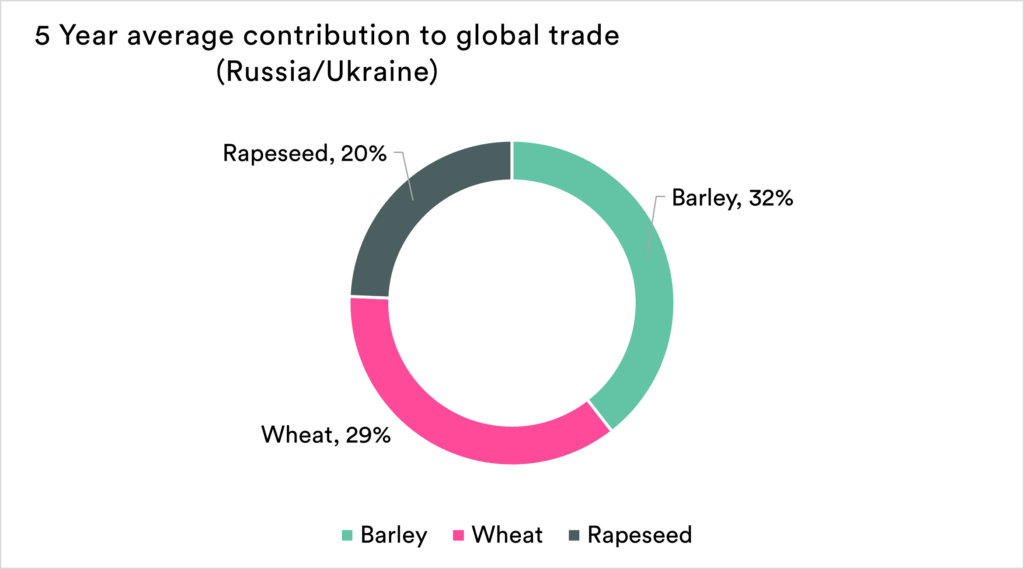

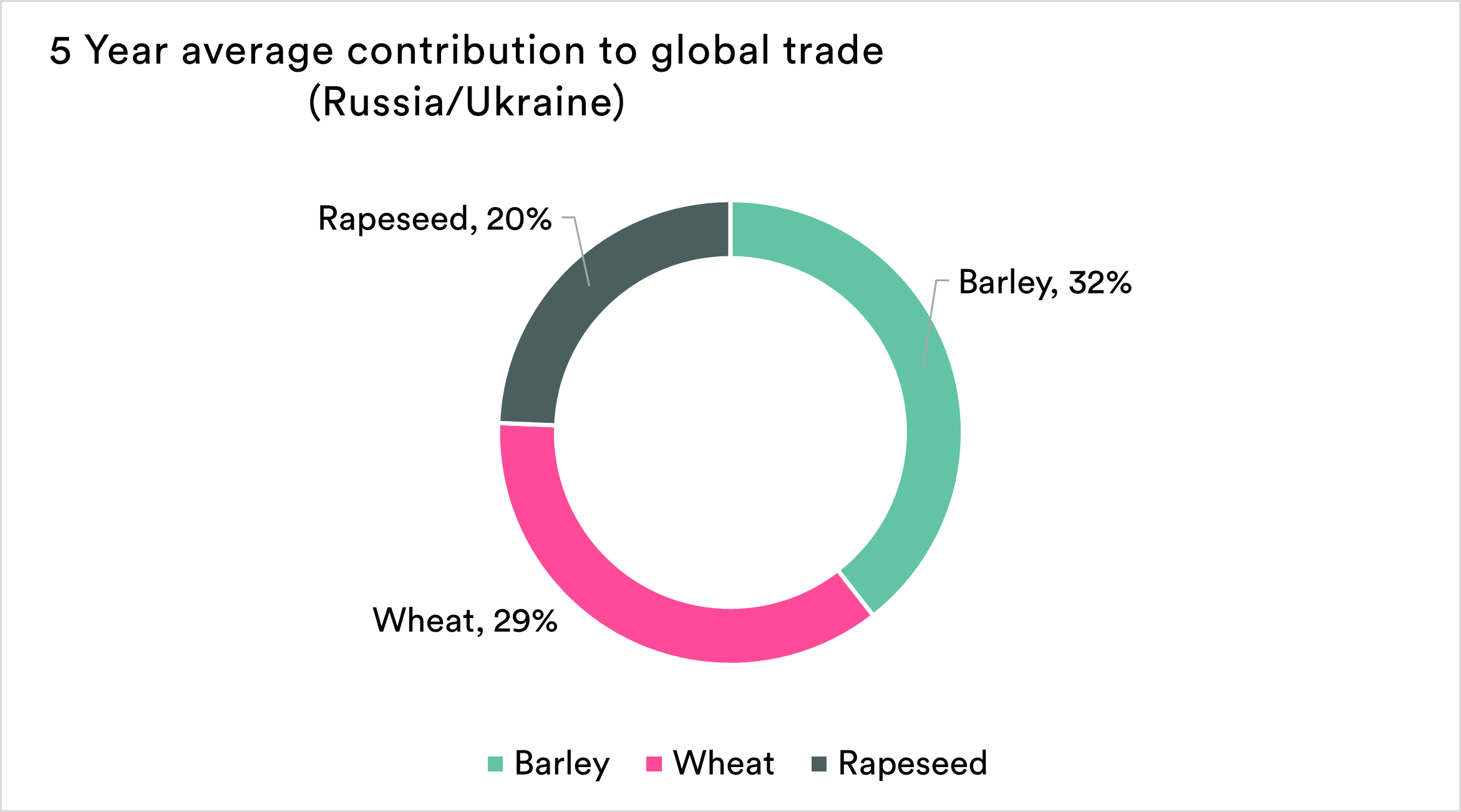

The yearly exports are valuable for showing the growth, but this chart below shows the average over the past five years.

It’s considerable.

Will they attack?

At the moment, it is all conjecture; they may or may not attack.

I personally don’t think an attack will happen. It will not be in Russia’s best interest to attack Ukraine. The end result will be thousands of Russian (& Ukrainian deaths). Our contributor from Russia, Andrey Sizov made the following comments:

“Currently, we feel that this rally could be overdone. In our view not much changed between Russia and the west during the recent weeks.

Both parties, and Russian first of all, continue to make big statements while discussing some kind of a new big Russia-West deal. Friday’s meeting between top Russian and US officials in Geneva didn’t lead to any breakthrough but also wasn’t a disappointment. Russia expects to receive an official written statement from the US next week addressing Russian concerns. Biden and Putin could talk shortly directly.

There is a chance that kind of new deal could be indeed achieved which will help many parties to report this as a big victory. Putin (“we stopped NATO”), Zelensky (“we stopped Russian aggression”), Biden, and perhaps the EU (“we stopped a war in Ukraine”). If this optimistic scenario turns true, wheat is likely to be under pressure again.”

I have to say, that I agree with the comments from Andrey, a hot war is unlikely. If Russia wants to attack, then I think actions like recent hacks are more likely.

At least I hope so – as I will be flying over the area in a few hours.

If the hot war doesn’t eventuate the risk premiums currently priced into the market will begin to fade away, similar to what occurred when previous sabre rattling didn’t lead to a sustained attack – see our earlier analysis.