There canola be one!

The Snapshot

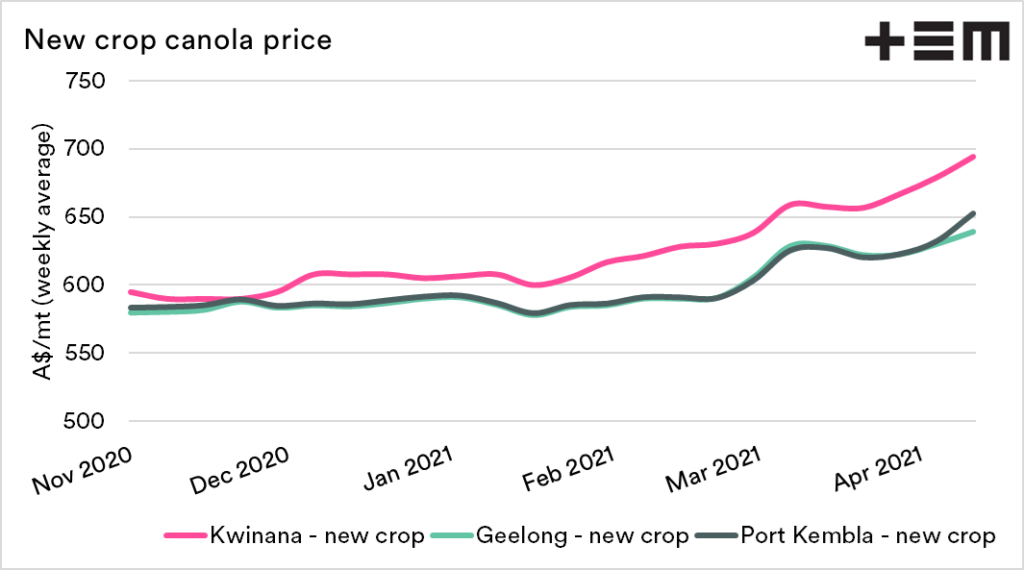

- Physical pricing for canola in Australia for new crop is rallying.

- Old crop canola is at heavy discounts to futures (see here).

- New crop is a story of east vs west. West coast new crop basis is close to the norm, but the east coast is at a more considerable discount.

- Pricing physical canola at this time of year is fraught with risk (and anxiety).

- European and Canadian canola is under some potential stress at the moment, and the next few months could be exciting.

The Detail

Last week I wrote a piece about our canola price versus the pricing of futures contracts overseas. The overseas futures contracts (MATIF & ICE) are the primary hedging method for canola (or rapeseed).

Read last weeks article ‘Canola: Is our price good?’

This particular article looked into the old season pricing as a comparison to the futures level, as we have a number of contacts who are in the process of trading old crop canola at the moment. The result was that we are trading at a massive discount to both French and Canadian futures pricing.

As we approach the cusp of seeding and the conditions are in place for good canola acreages this year, what about pricing for the coming harvest?

New crop pricing has increased dramatically from <A$600 at harvest to hitting A$700+ in Kwinana, and A$650+. This is attractive based on historical physical pricing levels. What about in comparison to futures levels?

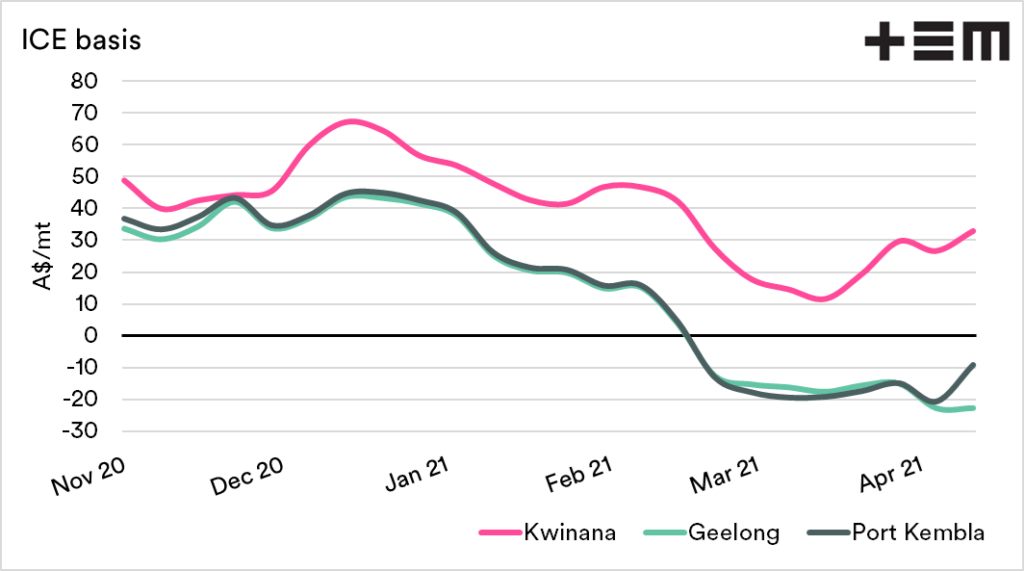

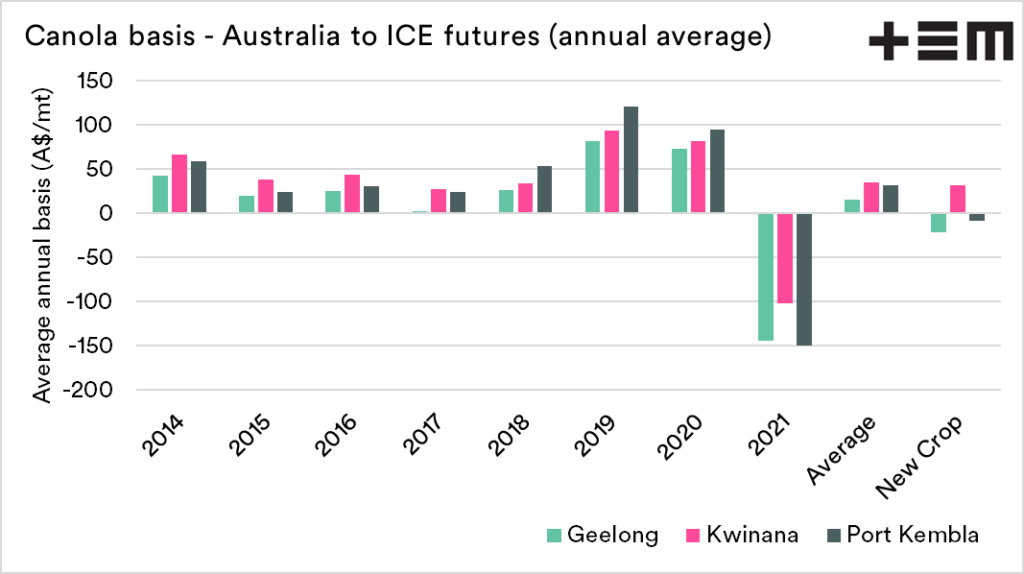

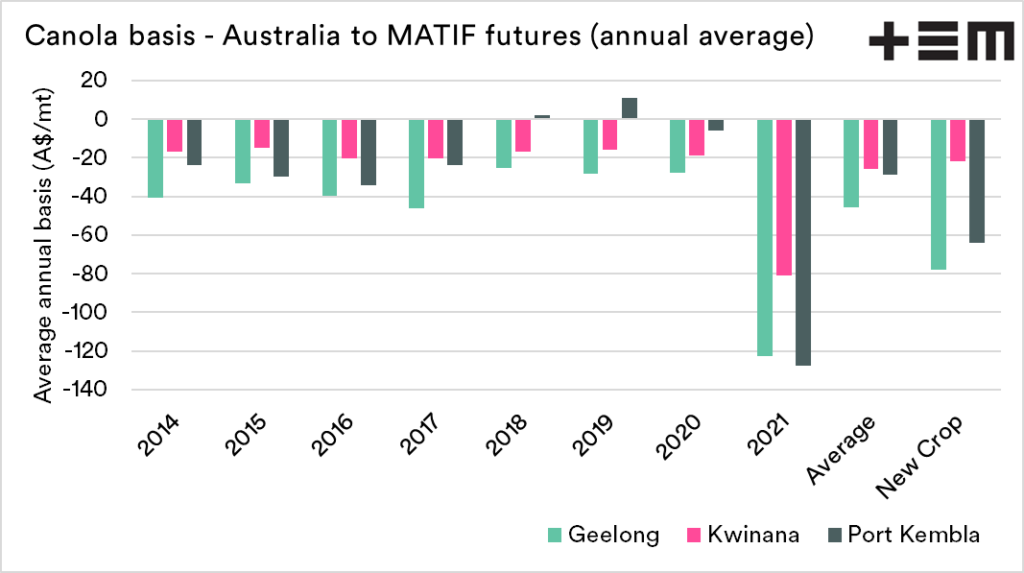

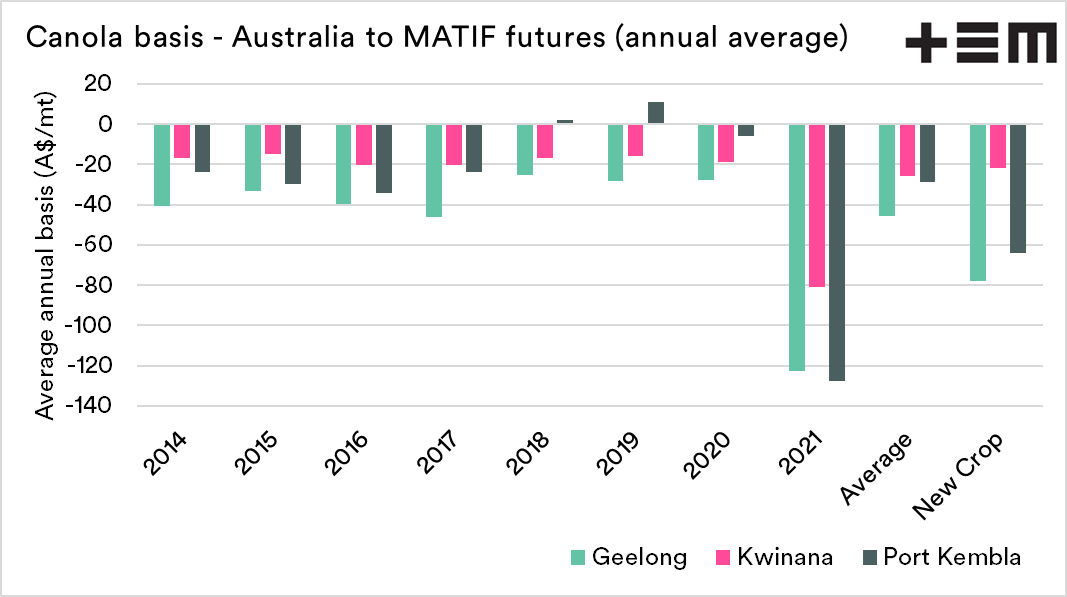

The second two charts below show the basis level between new crop physical pricing in Australia and the corresponding futures contract around the time of our harvest.

ICE:

Typically we trade at a premium to ICE futures, and generally, our canola competes with Canada as a large exporter. We are trading at a discount on the east coast and a premium on the west.

The basis for the new crop for Kwinana is at A$32, which is closer to the longer-term spot average of A$35. Geelong is at -A$22, and Port Kembla is at -A$9. This is against a long term average of A$16 and A$32, respectively.

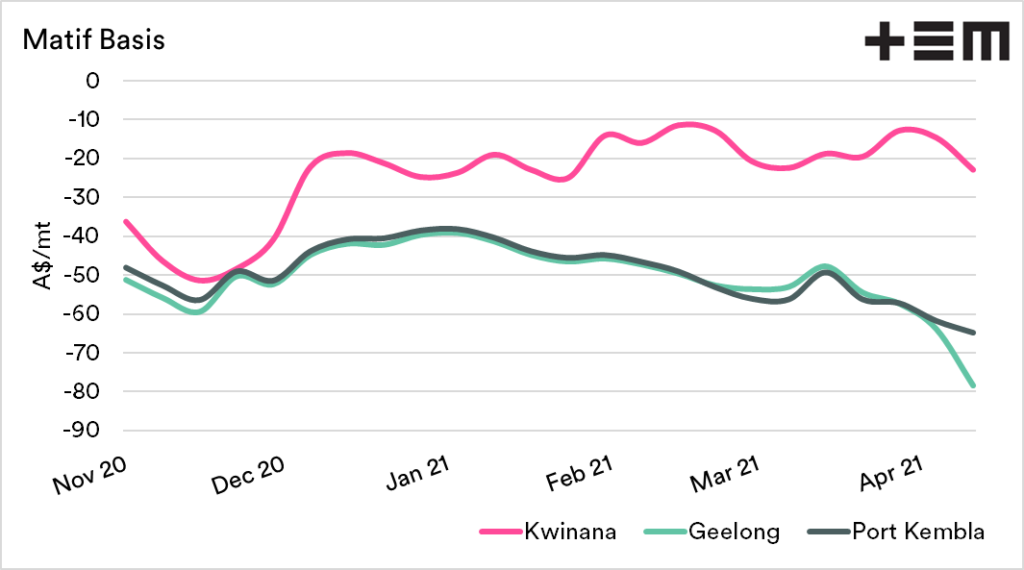

Matif:

Australian canola generally trades at a discount to Matif (French) rapeseed. Historically we have exported significant volumes of into Europe, especially during times of deficit there.

Kwinana currently trades at a discount of -A$22, versus a historical discount of -A$26. The east coast are trading at Geelong -A$78 and Port Kembla -A$64. This is against a long term discount of A$-45 and -A$29.

Is the price good?

Comparing against the average is fraught with danger, as we have had several years of drought. The annual average spot price, along with the average and new crop, is displayed in the charts below.

If we compare to history, then Kwinana is in quite a reasonable basis pricing range. The price on offer in Western Australia is quite reflective of typical basis in normal years.

On the east coast, the basis levels are substantially below where they would typically be.

Should we sell? Well, first and foremost, selling forward physical canola is always a significant risk due to its fragility. On the west coast, prices are fair; on the east coast, the basis level you’d be locking in is is below expectations.

As we move into the next couple of months, when things get exciting (see here), we could see some fireworks. At present large parts of Canada are working under poor conditions; the same can be said for Western Europe.