Tight wheat supplies, but still price falls.

The Snapshot

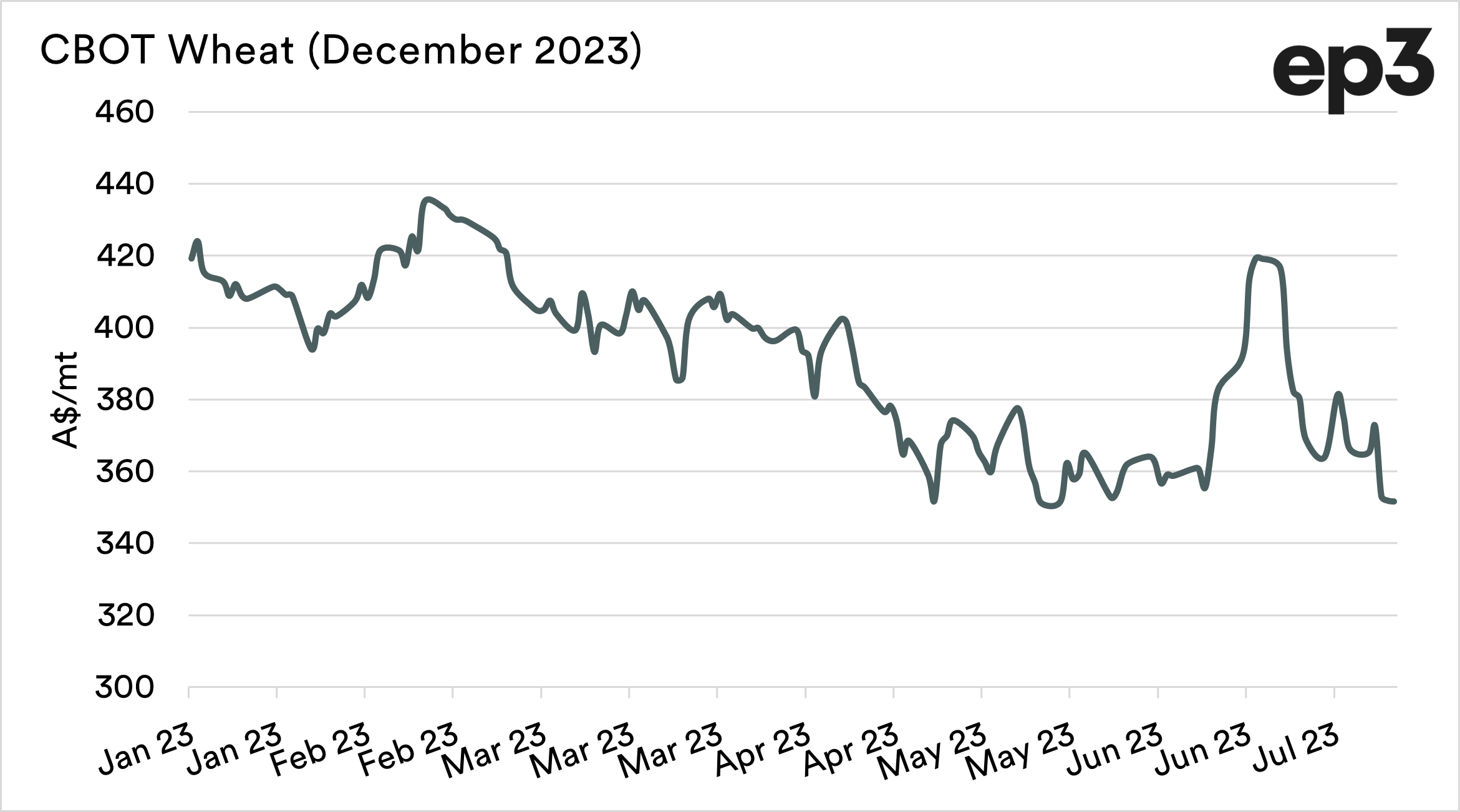

- This year’s wheat market fell overnight to the lowest level for the December Chicago wheat contract.

- Global stocks for wheat are tightening.

- The available stocks for the major exporters of wheat are the lowest since 2012.

- When we take into account demand, the stocks-to-use ratio of the main exporters is joint with 2007, the lowest since the turn of the century.

- Despite tightening global wheat supplies, the market fell.

- The USDA is expecting a record corn crop, despite having experienced poor growing season weather.

The Detail

The monthly World Agricultural Supply and Demand estimates were released this week. I don’t normally cover this off because it’s covered everywhere else.

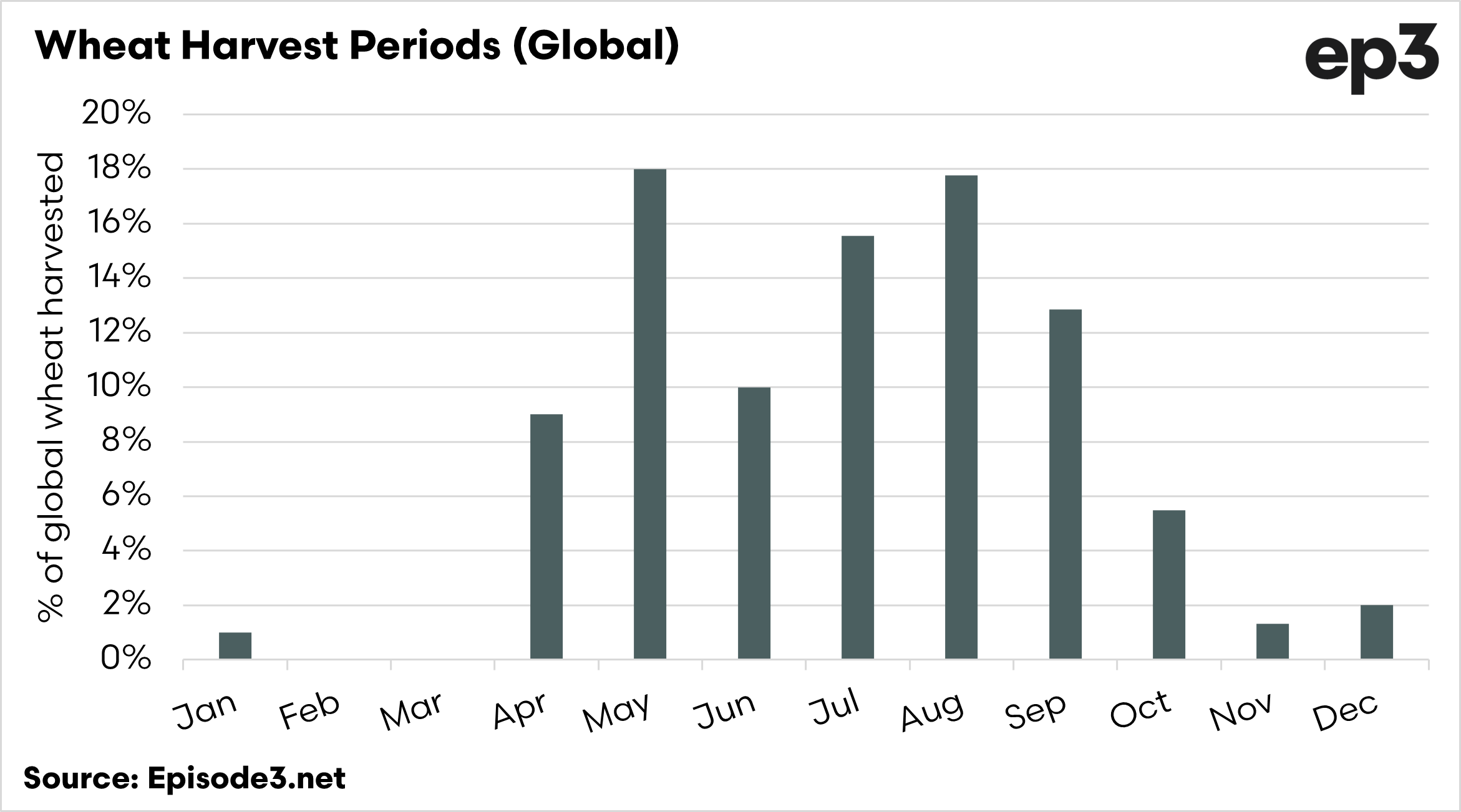

This time of year is when the global crop is largely produced. The chart below shows that the bulk of wheat production is centred around the middle of the year. So after this point, the crop is largely set. So that’s why it’s probably worthwhile looking at it today.

The wheat data from the USDA was largely bullish (+higher pricing), let’s look at some of the factors why I say that.

We are one of the major exporters of wheat into the global market, this is by virtue of our large production versus a small domestic population.

The volume from the exporters is what is basically available to the nations holding a deficit of stocks.

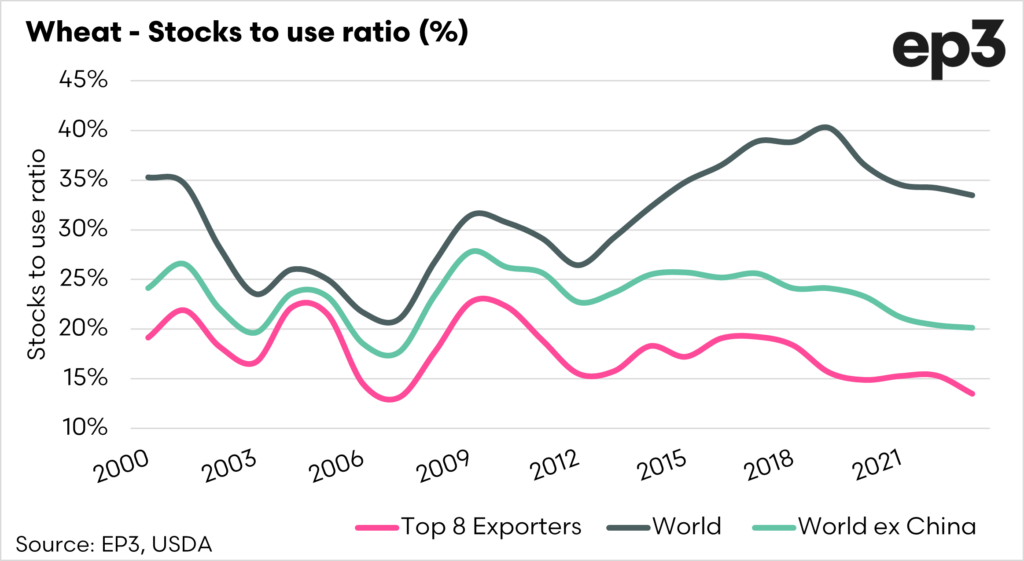

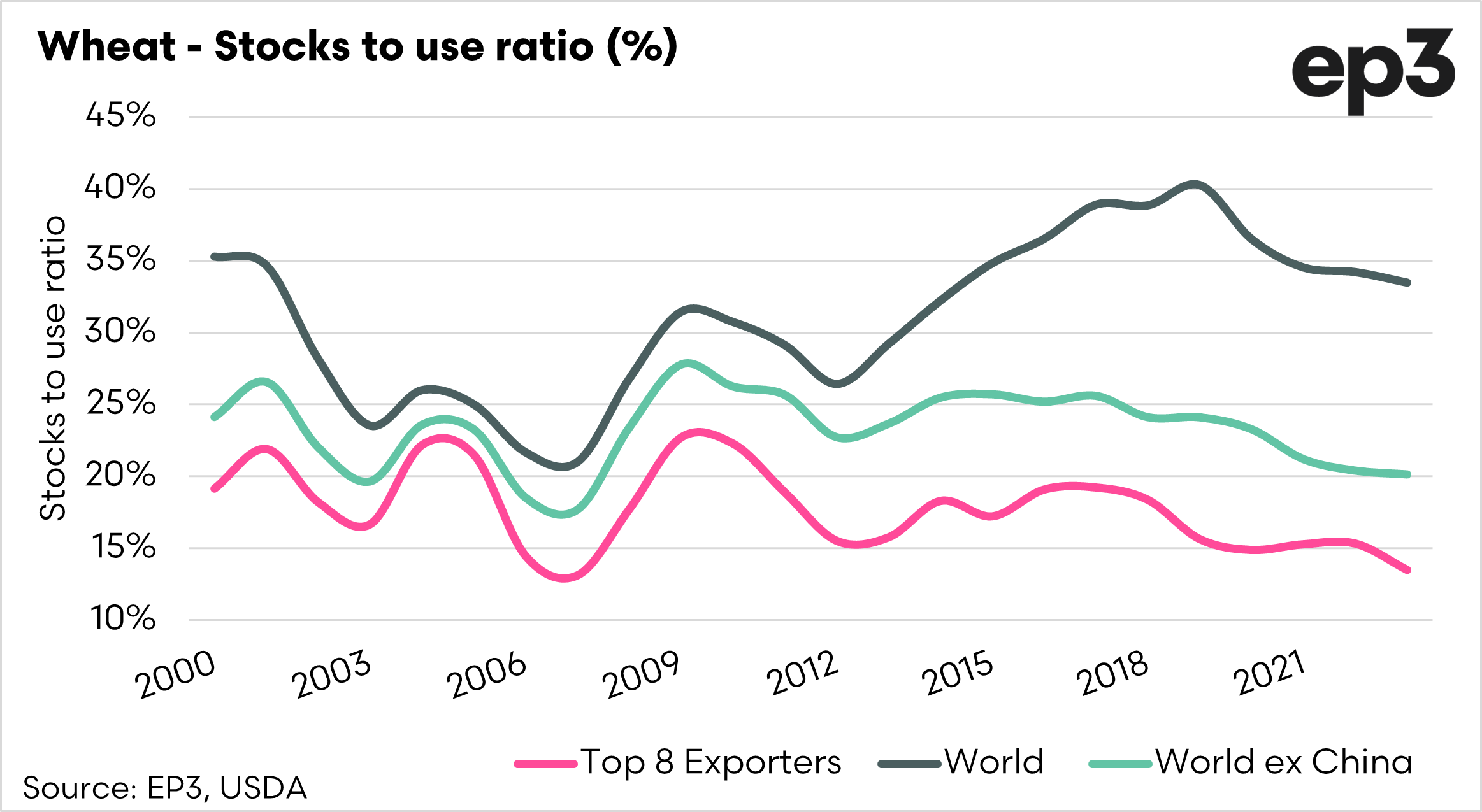

The chart below shows the wheat stocks around the world, with a dot representing the world’s top 8 exporters.

Globally stocks are high, but the stocks held by the major exporters are at the lowest level since 2012.

The stocks-to-use ratio is an important tool, as globally stocks could be high – but that doesn’t take into account demand.

The chart below shows the stocks-to-use for the world (with and without China) and the top 8 exporters.

The stocks-to-use ratio for the exporters is at the joint lowest level since the turn of the century. This points to a situation where things can get really tight quite quickly.

So despite the tightening situation for wheat, the market has fallen further. In A$ terms, the Chicago wheat futures contract for December is at the lowest level for the year.

Why is it down when wheat is tight?

We always have to remember that wheat doesn’t trade in isolation. It operates alongside corn. Despite the poor weather this season the USDA is projecting record large corn and soybean crops in the USA.

This has put a bearish tone on the market.