Wheat up A$15 on USDA smoking gun.

The Snapshot

- The WASDE report has seen major revisions downwards to global wheat production.

- Global wheat production was dropped 2%, or 15.5mmt.

- This is a big fall for an August report, the largest since 1995. The second largest was 2010, when Russia was downgraded.

- The Russian crop dropped 12.5mmt this month.

- Australian wheat was increased to 30mmt.

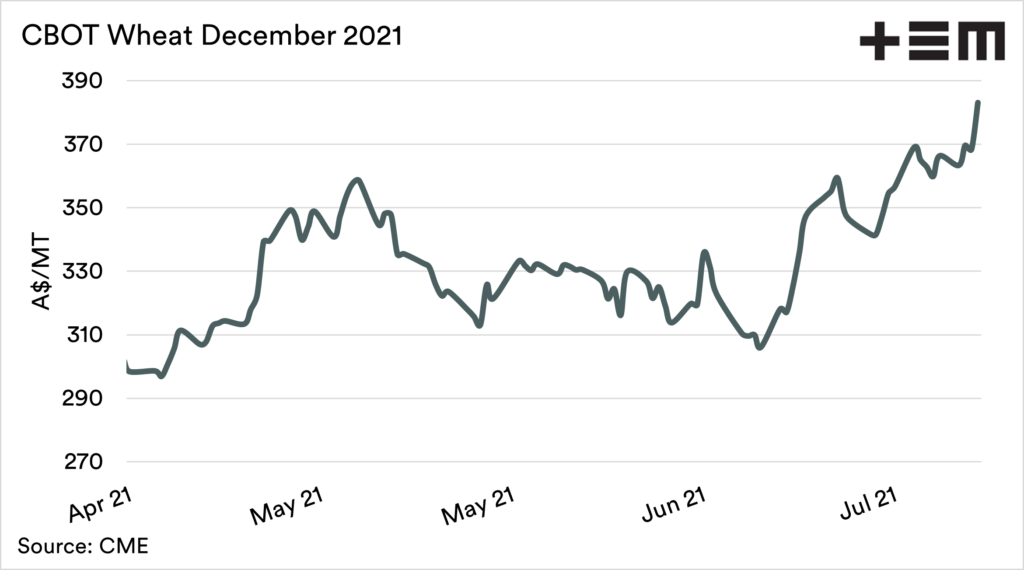

- The wheat price reacted strongly, putting on A$14.6 to hit A$383.

The Detail

You might have noticed that I don’t tend to talk too much about the WASDE report. This report comes out once per month and gives an outlook on global supply and demand. I don’t cover it every month because it’s boring. You have to work through the data to find something interesting. If it’s boring for me to write, then I’m going to take the view that it’s boring to read.

This month though, it’s worthwhile talking about it because there is some excitement. There have been some major downward revisions to wheat production, causing a nice little bonus to grain prices as we head into the weekend.

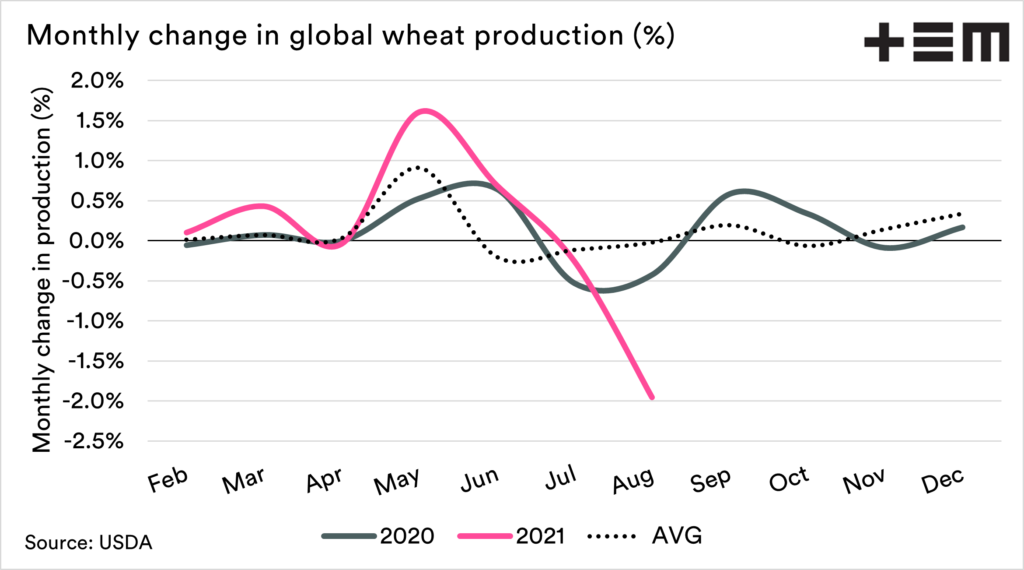

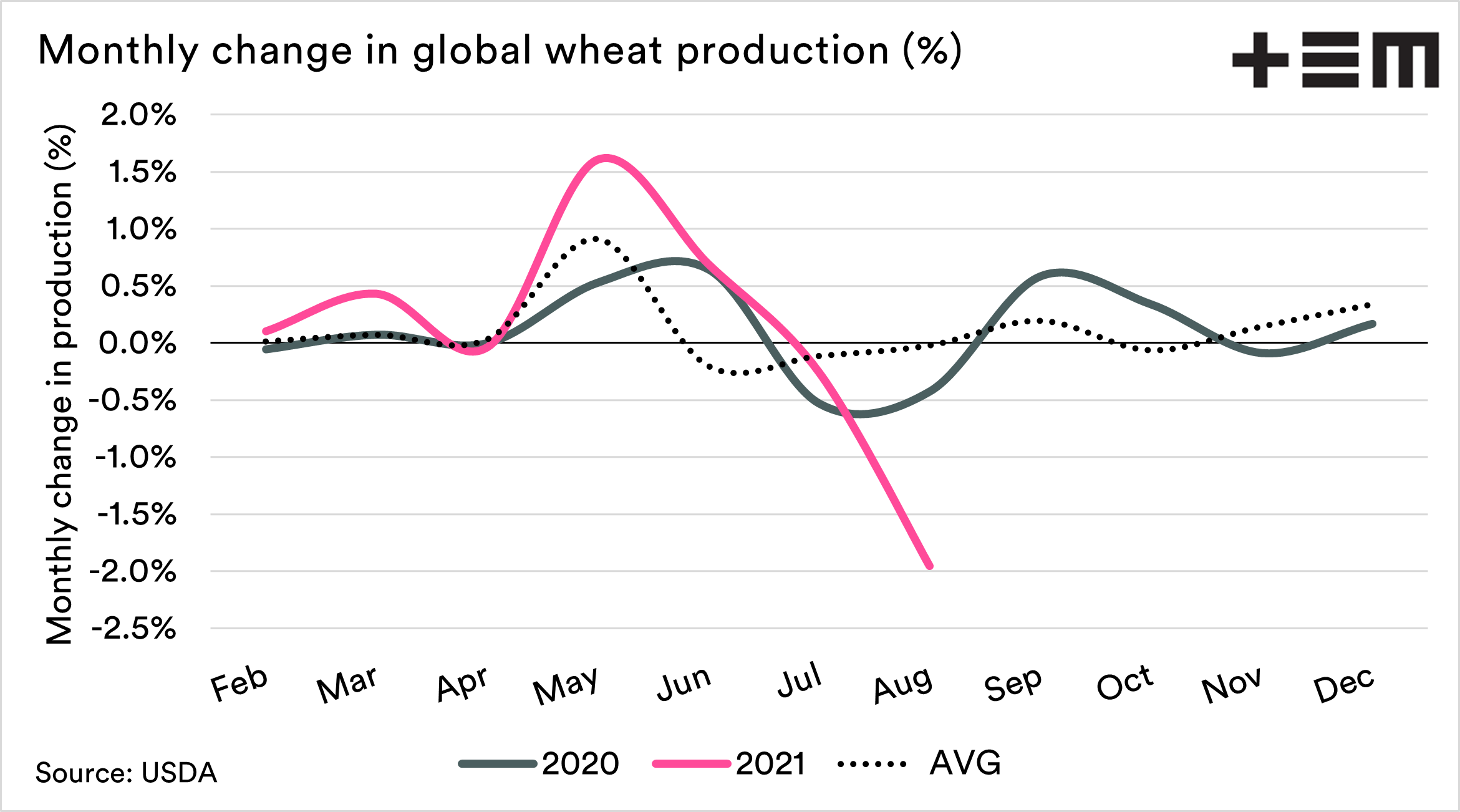

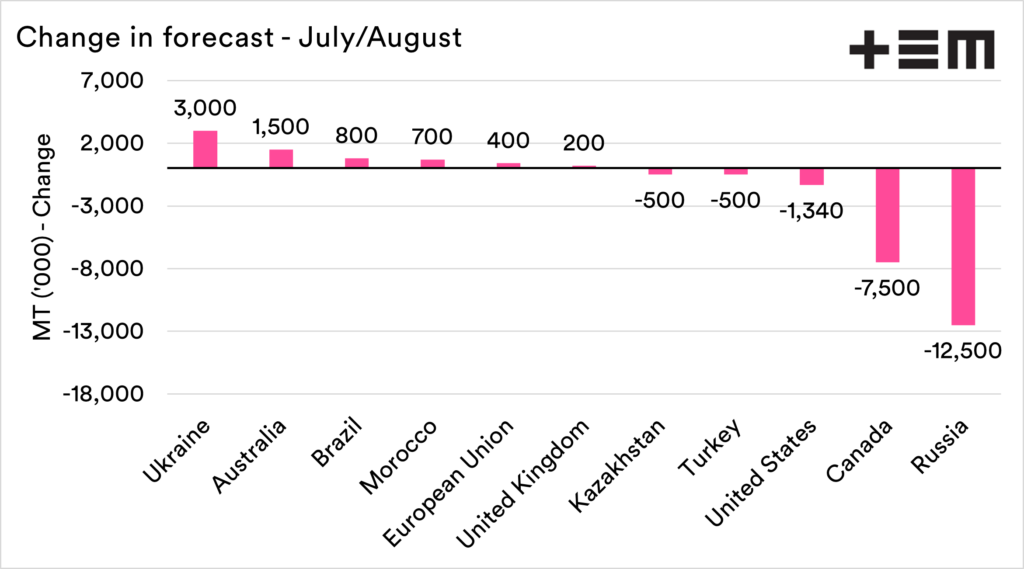

The chart above shows the monthly change in the forecast for global wheat production. The wheat production forecast fell by 2%, which, although it doesn’t sound like much, is a fall of 15.5mmt. To put this into perspective, this is slightly more than half the forecast that USDA has for Australia at 30mmt.

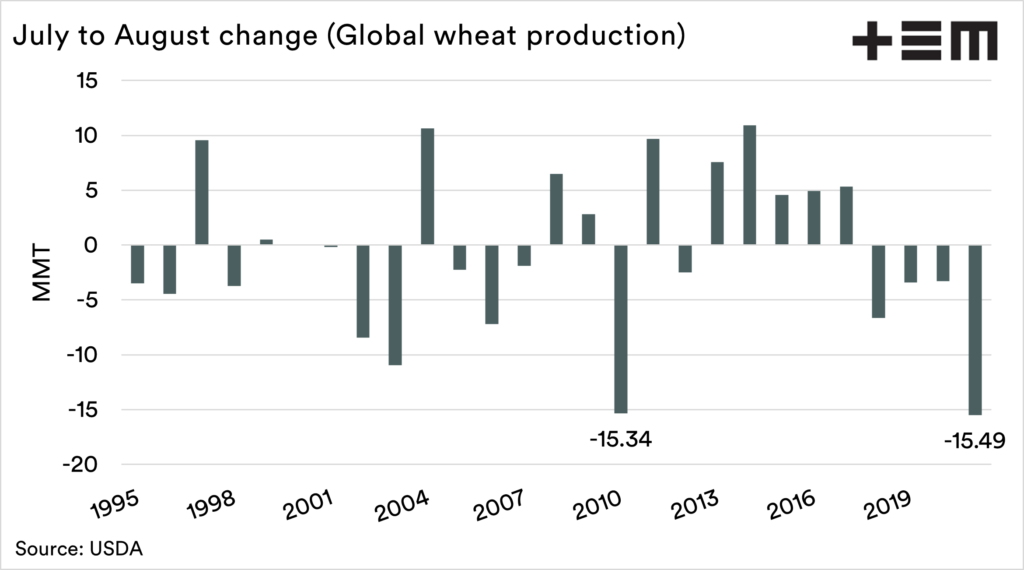

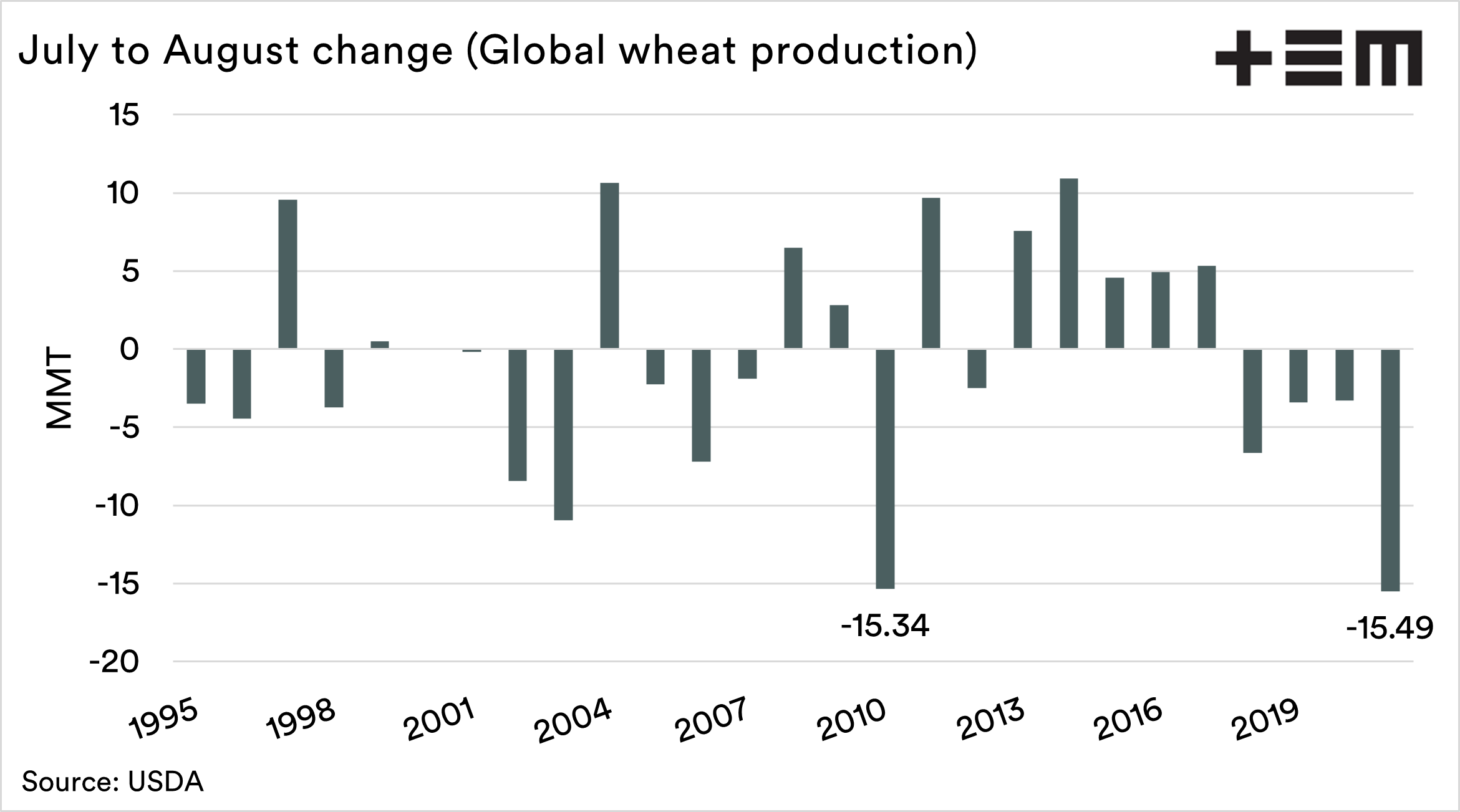

This is a big fall for August. In tonnage terms, it is the largest fall since 1995. This narrowly beats out 2010, and coincidently the month that I moved to Australia. In August 2010, a year where Western Australia suffered through drought, as did Russia.

Where are the major changes? There have been upward revisions to Australia and Ukraine, but these don’t outweigh the fall in Canada and Russia.

Russia has seen a very large fall of 12.5mmt and Canada down 7.5mmt. These revisions shouldn’t be much of a surprise as they have been covered in EP3 many times in recent months.

What is important is that Russia and Canada are both major export nations. Therefore a fall in these countries contributes a large impact.

The good thing at the moment is that the wheat market is now trading its own book. In the past year we were largely following the corn market. The result of the WASDE report revisions to wheat production have lead to a strong upward movement in wheat futures.

The December CBOT wheat futures have risen A$14.6/mt to A$383. This is a very attractive number. Whilst we still expect basis to remain negative for a while, this keeps the flat price up.

It’s a nice time to be a wheat farmer in Australia!

If you liked reading this article and you haven’t already done so, make sure to sign up to the free Episode3 email update here. You will get notified when there are new analysis pieces available and you won’t be bothered for any other reason, we promise. If you like our offering please remember to share it with your network too – the more the merrier.