Wake up to WASDE

February WASDE Report

The monthly World Agricultural Supply and Demand Estimates (WASDE) report was released overnight. At this time of the year, it is largely tinkering around the edges ahead of the new season. In this update, I will briefly go through the pertinent points.

- Wheat stocks reduced to lowest level since 2016

- Wheat stocks to use ratio of leading exporters matching 2007 levels.

- Reductions in corn and bean production in South America, but may see further revisions.

- India forecast to produce record rapeseed crop.

Wheat

There was a minimal reaction in the wheat market to the WASDE report overnight, with wheat closing A$1 up at A$401.

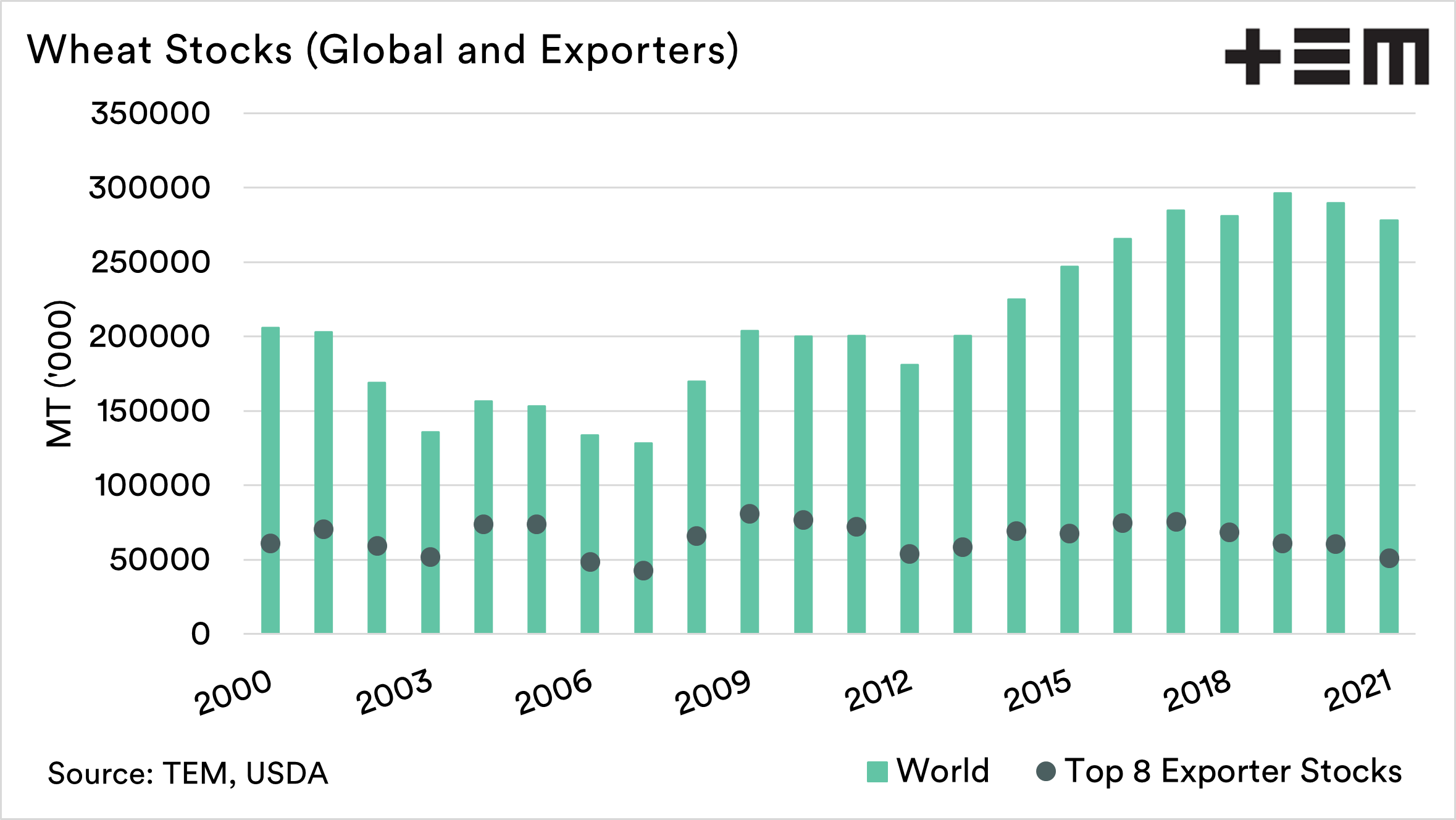

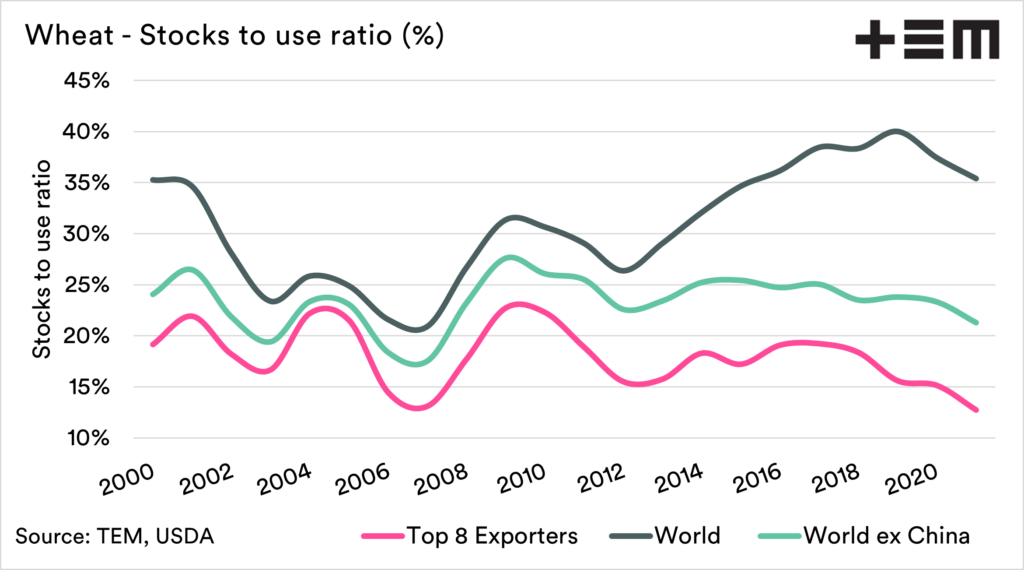

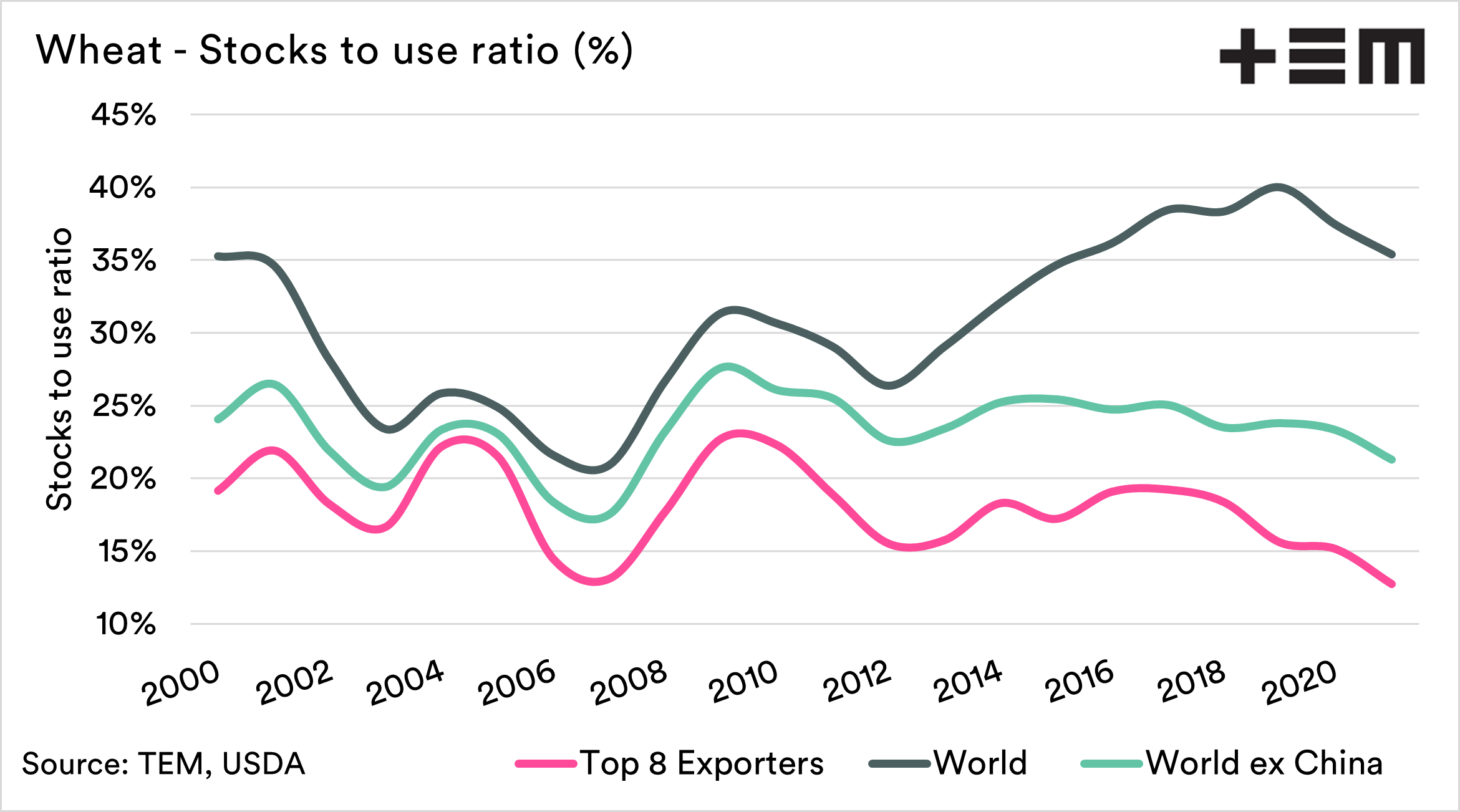

Global ending stocks were reduced to 278mmt, the lowest since 2016. More importantly, end stocks within the leading exporters are the lowest since 2012 and nudging the lowest since 2007.

In the period since 2007, demand has increased. This has led to the stocks to use ratio matching the same levels as 2007. There could be fireworks if there are significant production issues in the northern hemisphere this year.

Australia was maintained at 34mmt.

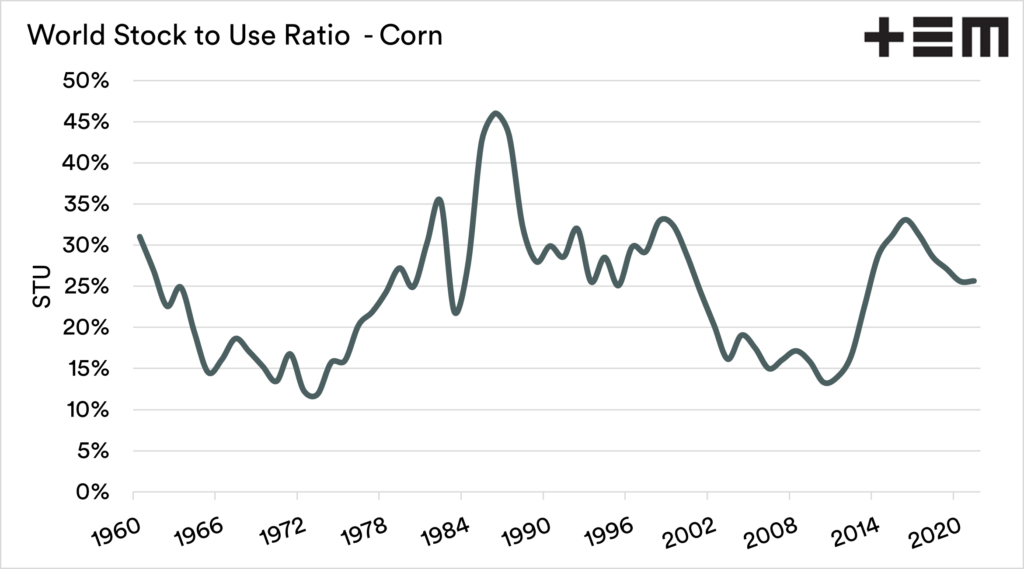

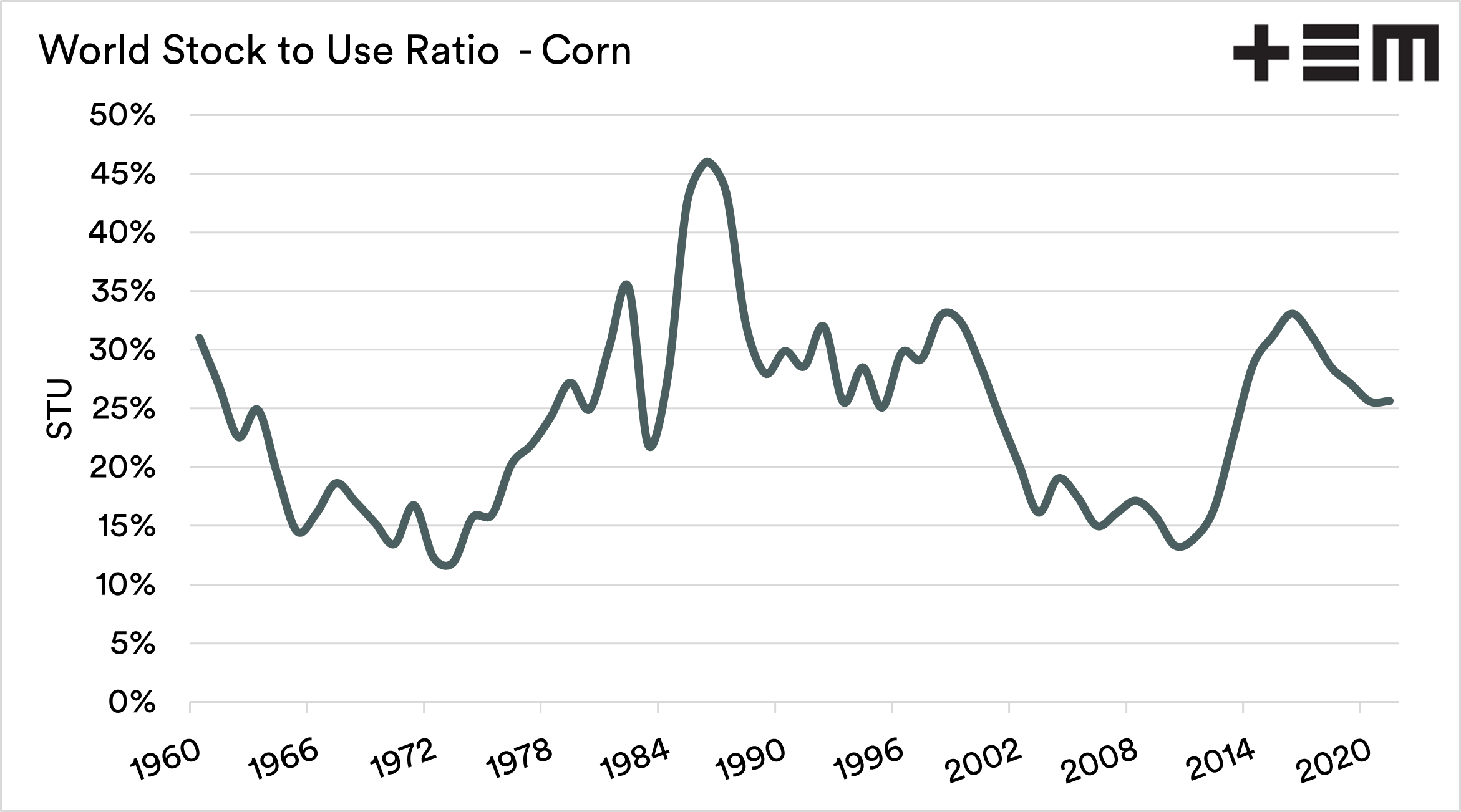

Corn

Corn had a bit more of an interesting night, with spot corn futures up A$8/mt. This time of year focuses largely on South American crops.

Revisions were quite muted, with ending stocks down under 1mmt to 302.2mmt. The trade was expecting larger downward revisions to Brazilian and Argentinan corn. The reality is that Argentinas production was kept the same at 54mmt, and Brazil dropped 1mmt.

Many are expecting further revisions to these two nations in later months.

On the demand side, China is still a major importer of corn at 26mmt projected.

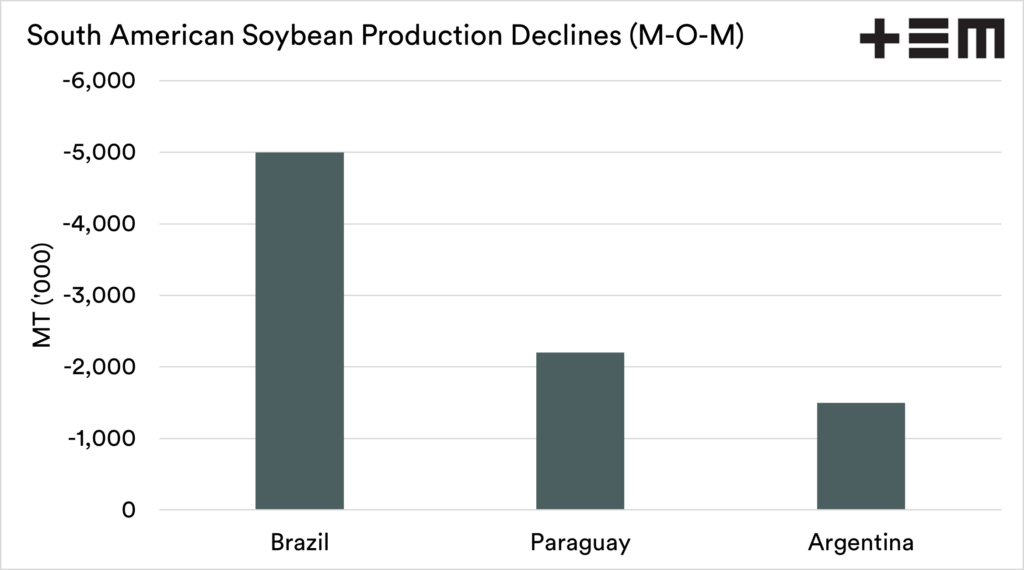

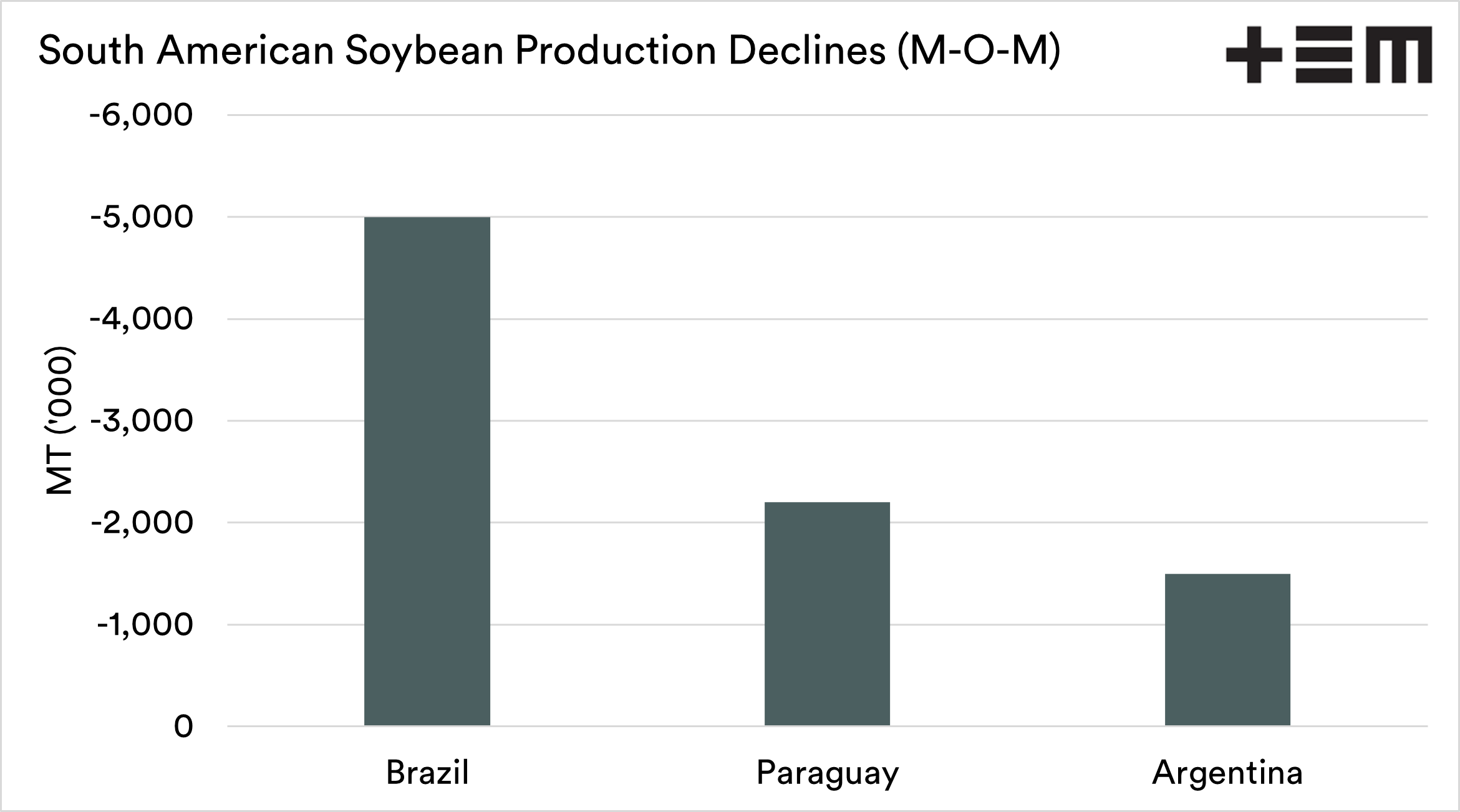

Soybeans/oilseeds

Soybeans have been on a rip in recent weeks on the back of dry South American weather. These concerns in recent weeks were reflected in the WASDE update.

Brazil, Paraguay and Argentina had a combined production drop of 8.7mmt between January and now. However, the USDA balanced the books somewhat with Chinese imports and crush were reduced by 3mmt.

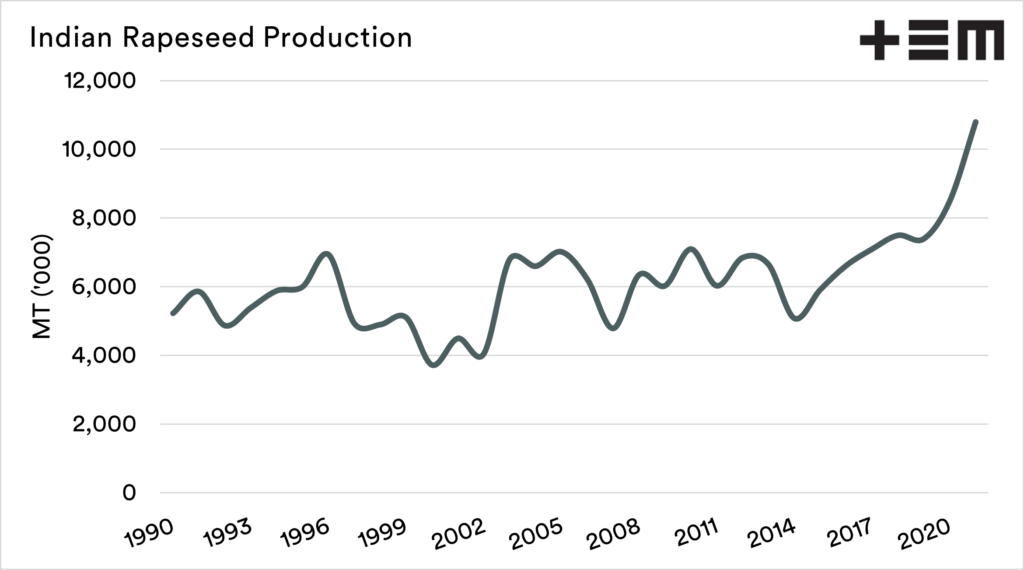

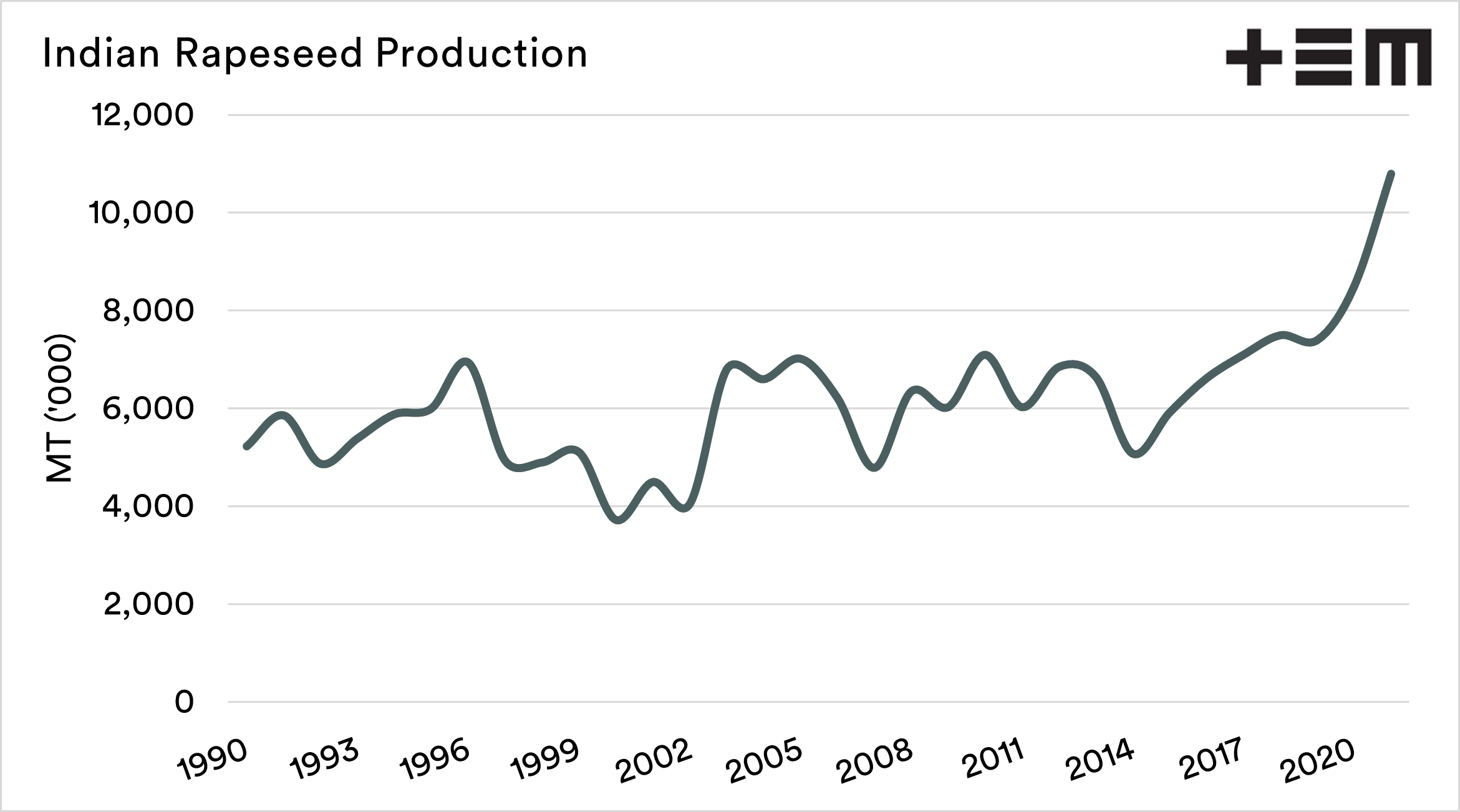

Of interesting note is that Indian canola (rapeseed) production was increased by 1.3mmt to 10.5mmt. This is a forecast of record production, with the average production from 2010 to 2020 at 6.8mmt.

A Side Note

There is a huge amount of data in the monthly WASDE, and I always like to delve in and see if I can find a morsel of interest.

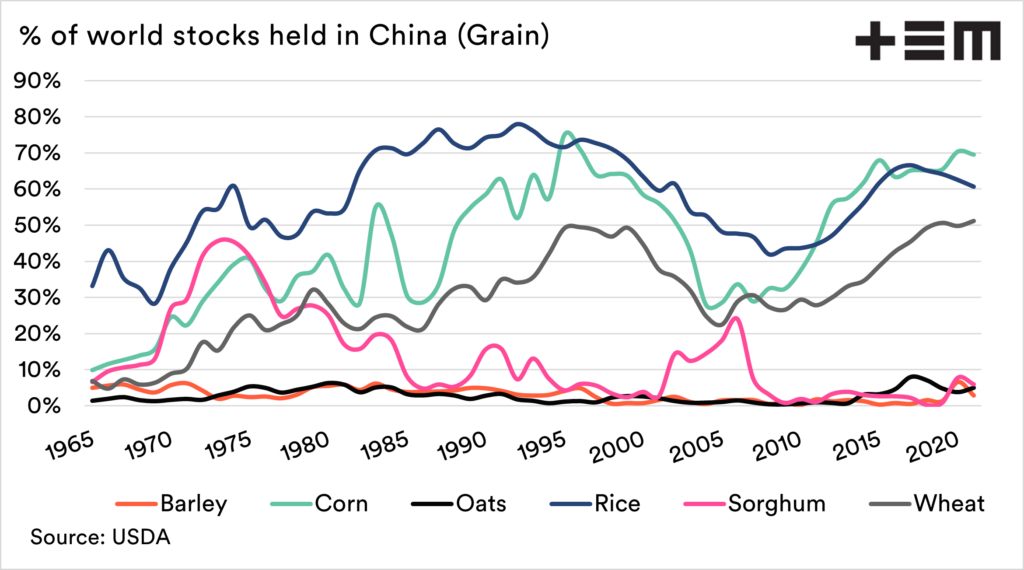

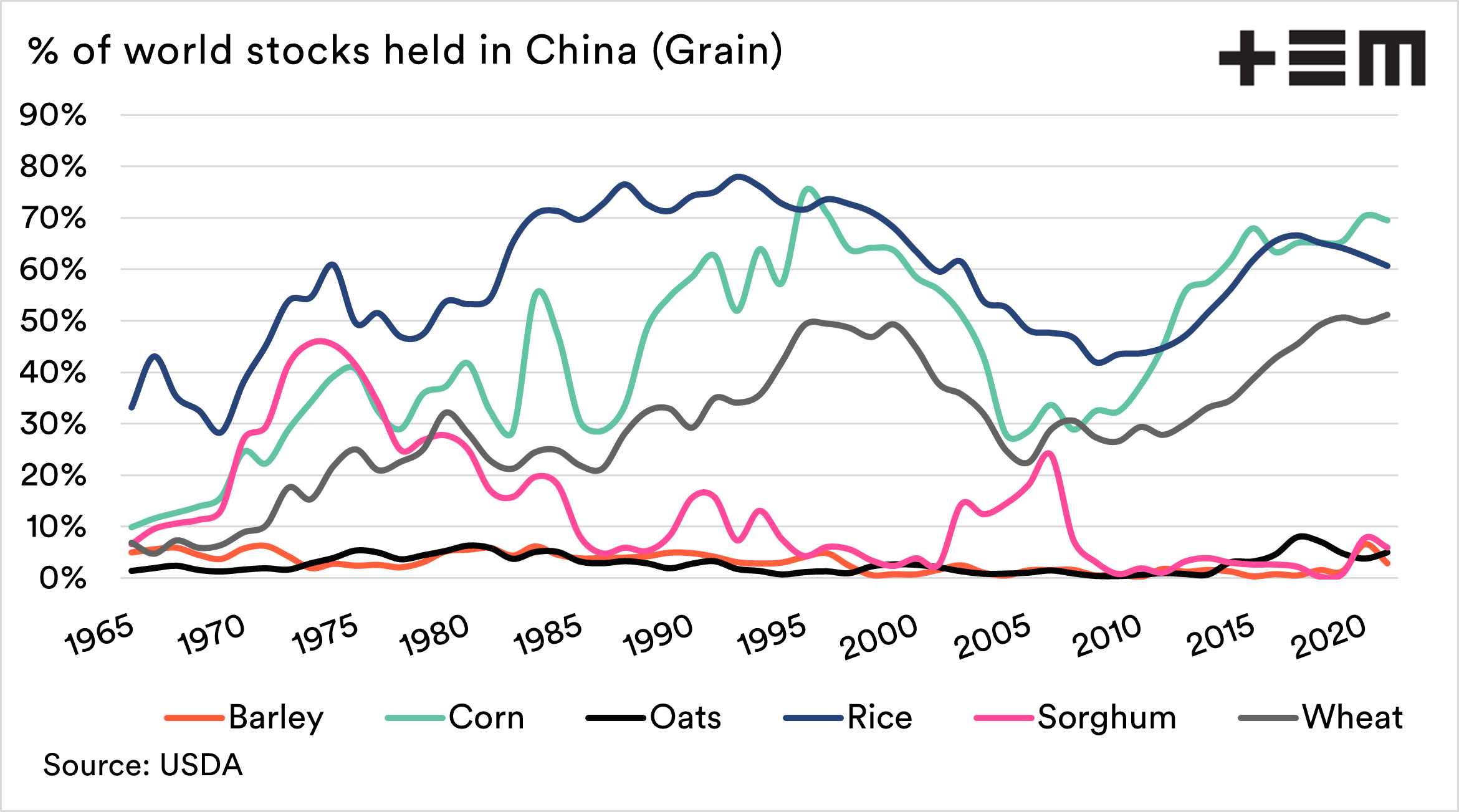

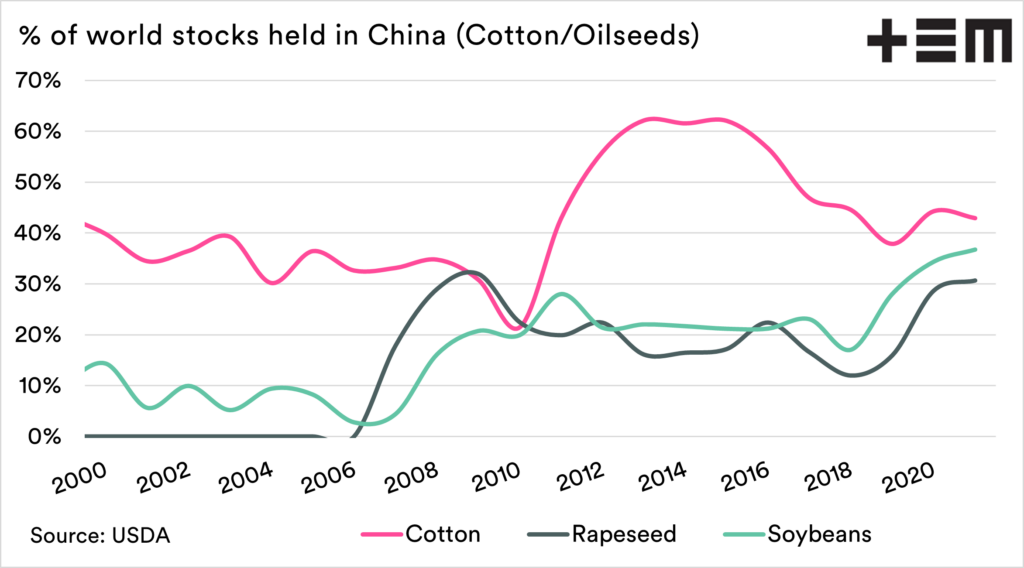

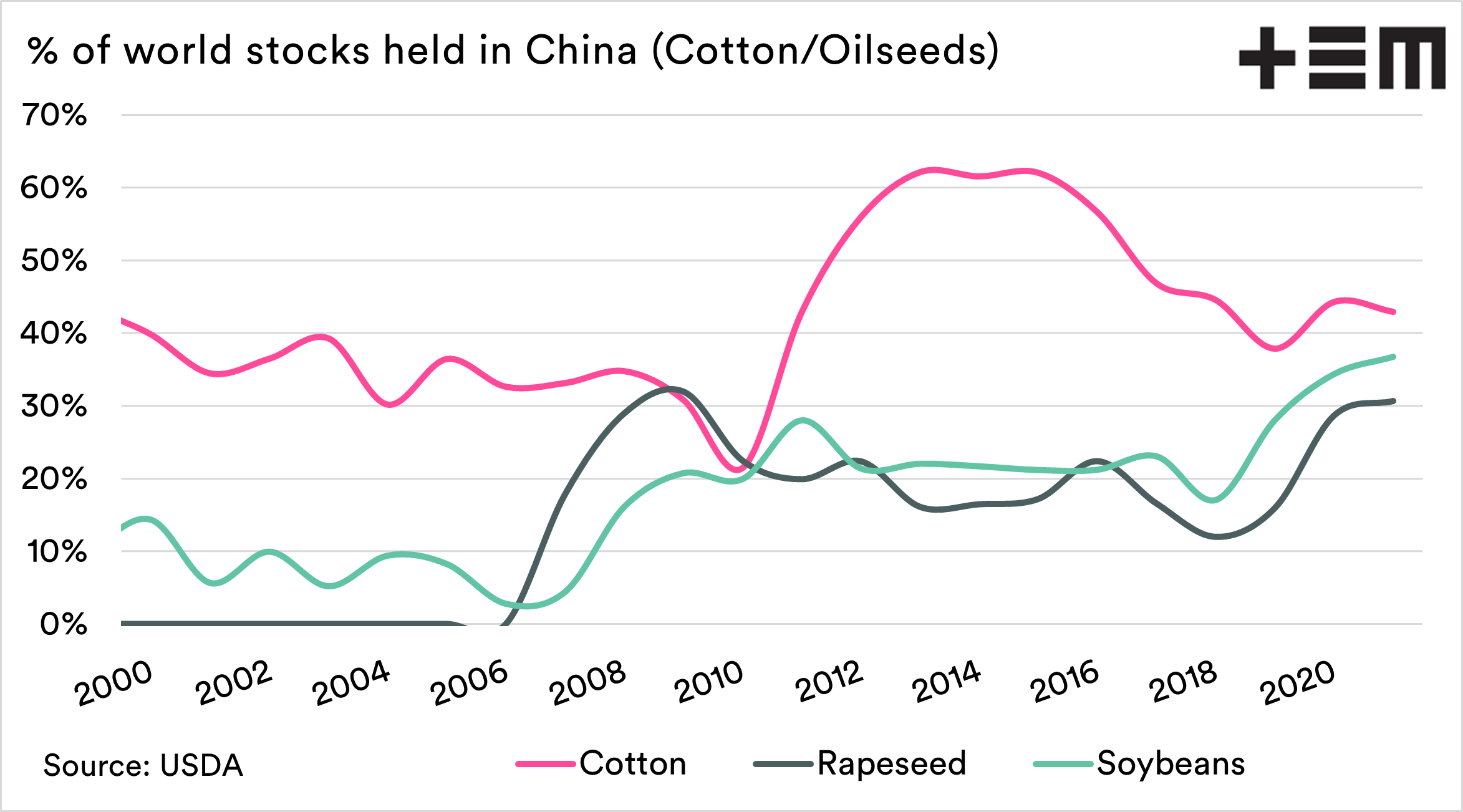

One of those is the volume of world stocks of various grains and oilseeds held within China. China, on paper, holds >50% of the worlds rice, wheat and corn.

These are huge stockpiles, and the likelihood of this meeting the international market is minuscule. This is why it is important to calculator supply and demand scenarios without including China.

If you liked reading this article and you haven’t already done so, make sure to sign up to the free Episode3 email update here. You will get notified when there are new analysis pieces available and you won’t be bothered for any other reason, we promise. If you like our offering please remember to share it with your network too – the more the merrier.