WASDE: Give us our daily bread

The Snapshot

- A number of major wheat importers are looking to shore up food security.

- They are doing this by increasing imports and/or incentivising domestic production.

- The end stocks held in the worlds top 10 importers have increased in recent years.

- The stocks to use ratio for the top 10 importers is set to rise this year based on increased end stocks.

The Detail

Every month the US Department of Agriculture (USDA) release their monthly World agricultural supply and demand estimates report (WASDE). This report is a comprehensive examination of Agri commodities from both a supply and demand point of view.

The big focus tends to be on the supply side of the data, as generally supply is what drives the markets. I thought it was a worthwhile exercise to take a little time to examine the main customers of wheat around the world.

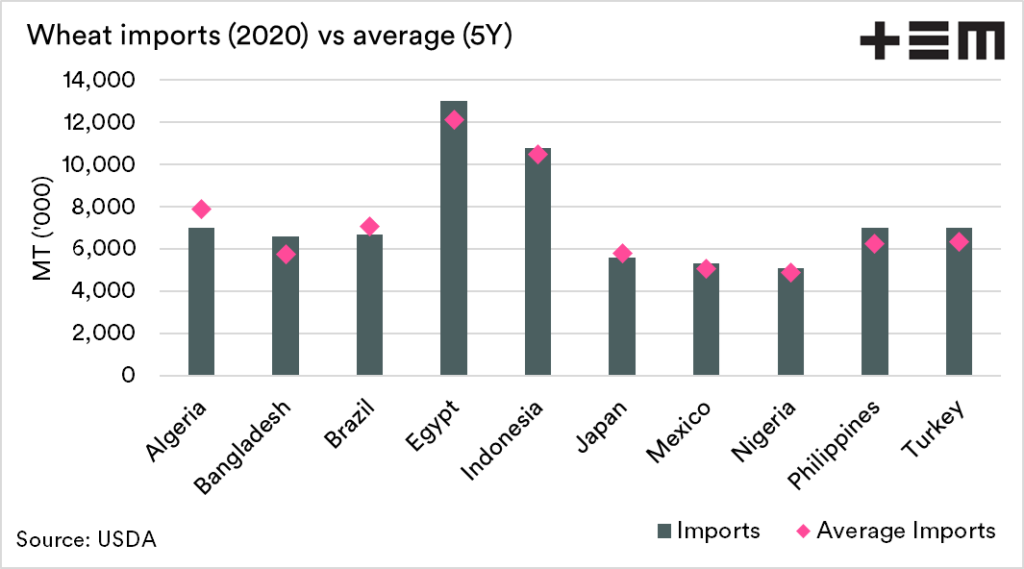

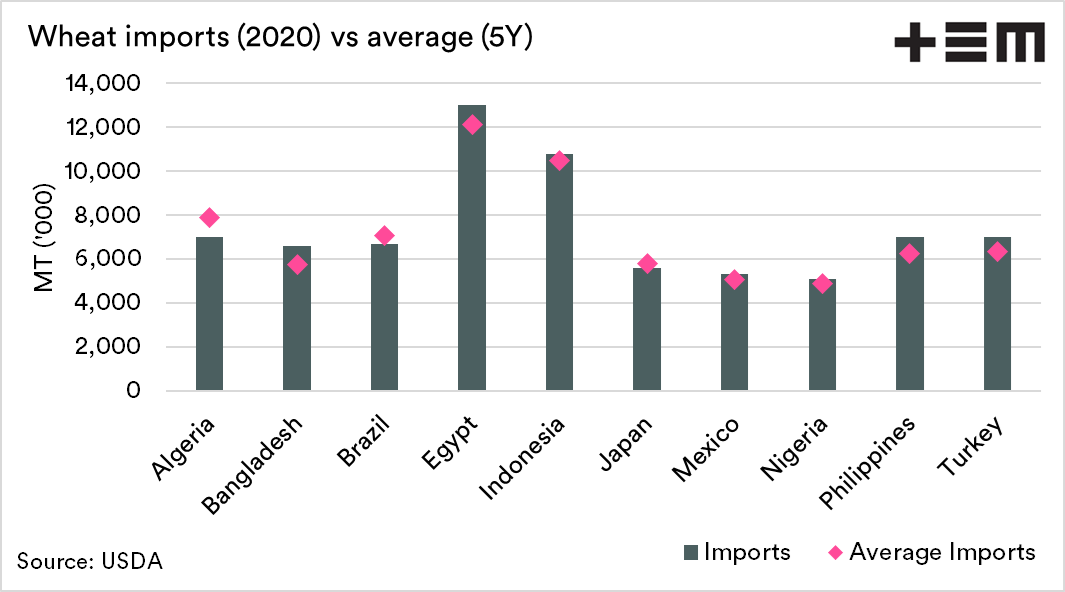

The top 10 wheat importers can change around dependent upon the season. For the purpose of this examination, I have selected the following; Algeria, Bangladesh, Brazil, Egypt, Indonesia, Japan, Mexico, Nigeria, Philippines & Turkey.

These nations were selected based on their imports over the past decade.

Many of the nations in this list have a very tight balance sheet, with limited local production requiring vast import programs. The current concerns of COVID-19 and moves to food security, leading to increased import programs.

In recent weeks Algeria has changed their tolerances to accept black sea wheat to diversify sources from traditionally importing from France. Egypt has also followed with increased imports and incentivising domestic production.

The chart below shows the USDA forecast for this years export program, along with the average imports over the past five years. We can see that a number of them have imports programs well above average. Whilst COVID-19 remains an issue, the concerns around a dry Russia may result in further increases in import programs.

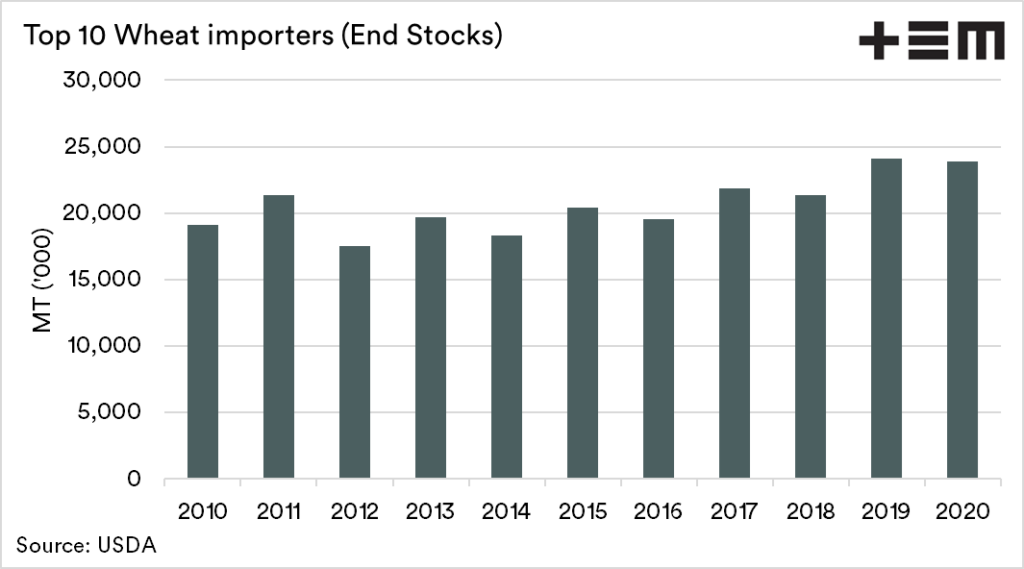

The increasing imports, by these nations, has been occurring during recent years, but is exacerbated by the pandemic risk. This has lead to end stocks in these importing nations to increase to high levels.

This will provide these nations with buffer stocks to get them through disruptions in the near term. It does potentially mean that their import demand in futures years, provided no issues arise may be reduced.

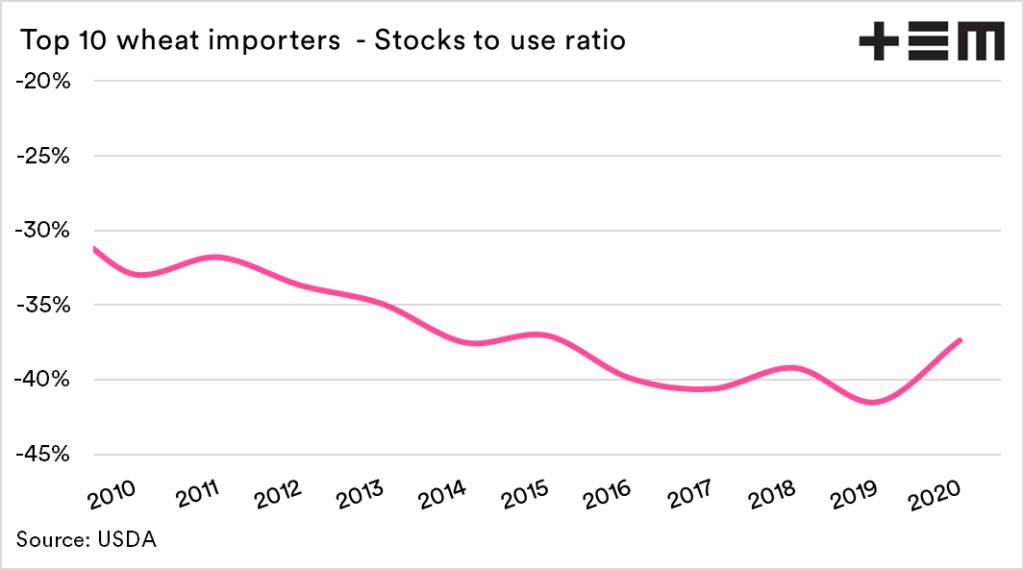

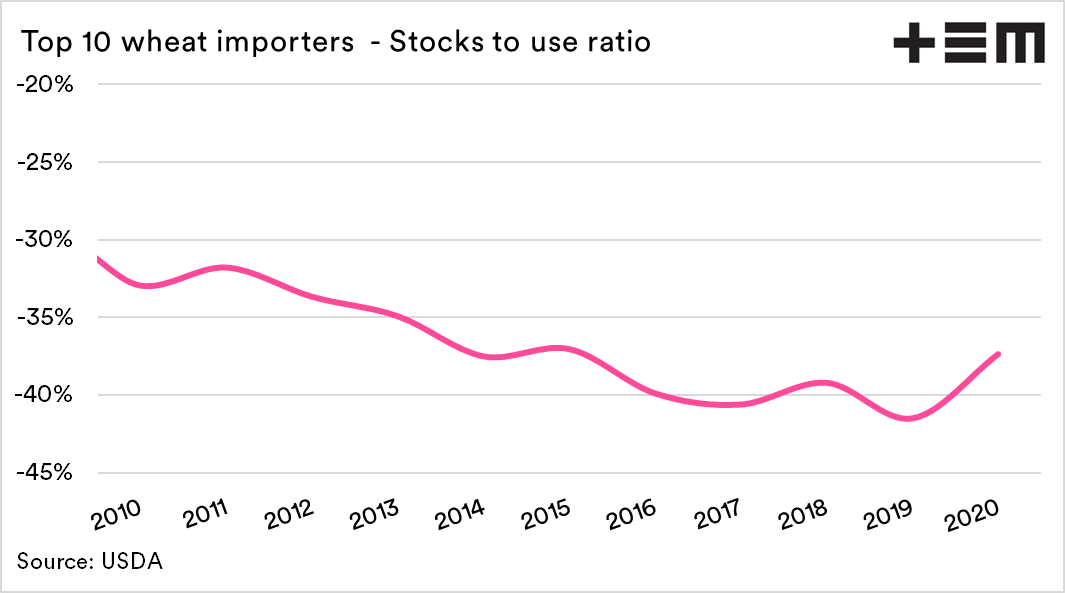

The stocks to use (STU) ratio is a crucial barometer which is used to provide an insight into the relationship between supply and demand.

I will cover the global STU in a further article on the supply side of things. The higher the STU, the higher the access to grains. In the chart below the STU for the top 10 import nations is shown.

Overall the STU of the major importers is negative. However, the STU ratio appears to be moving to a more positive ratio. The importer STU has moved to -37% from -42% last year, this would be the highest STU since 2015.

This increase in the importer STU is due in part to the larger end stocks held within these nations.