WASDE: Oilseeds

WASDE: Oilseeds

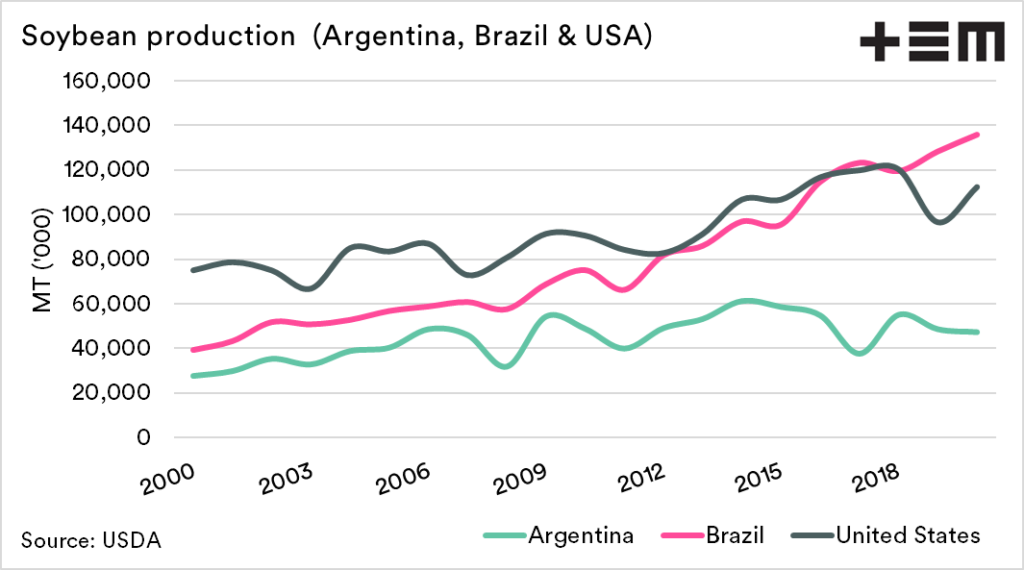

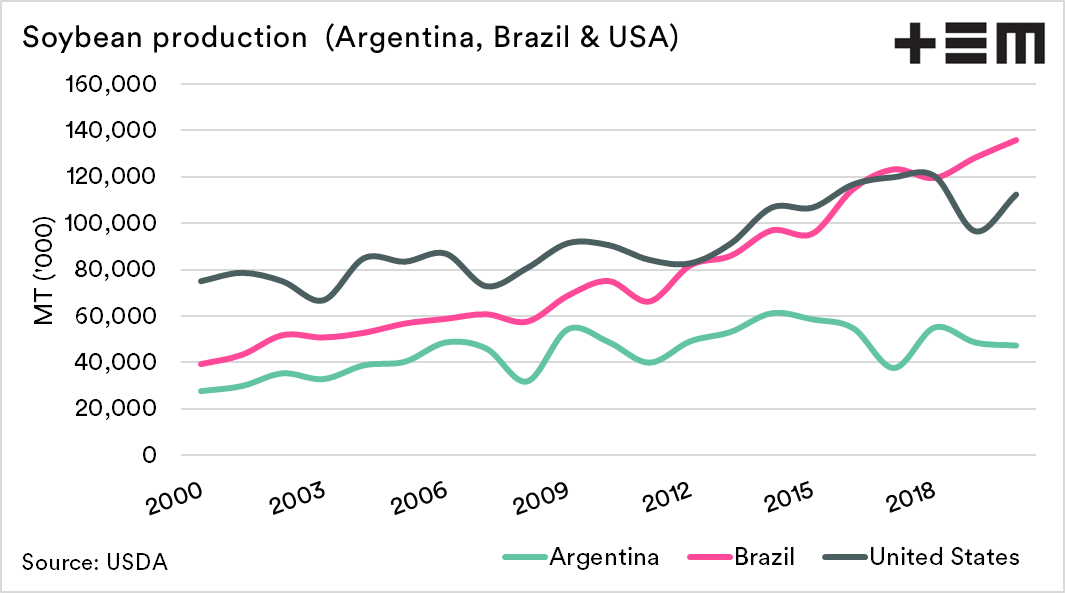

The WASDE report for oilseeds was bearish for April. Whilst the report was bearish month on month, the overall picture for oilseeds is for a relatively tight environment. The major moves were an increase in Brazilian soybean production and a decrease in consumption in China.

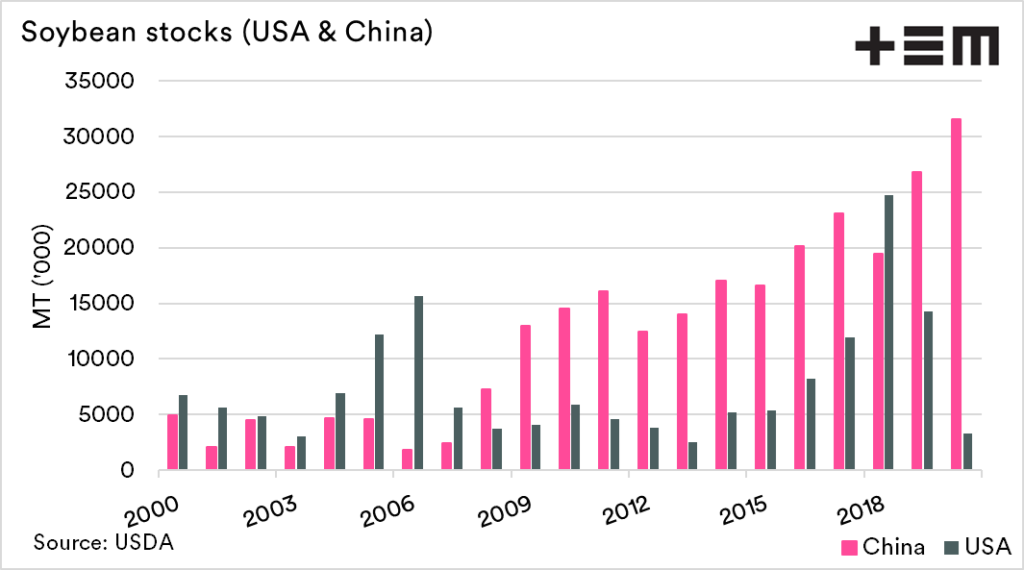

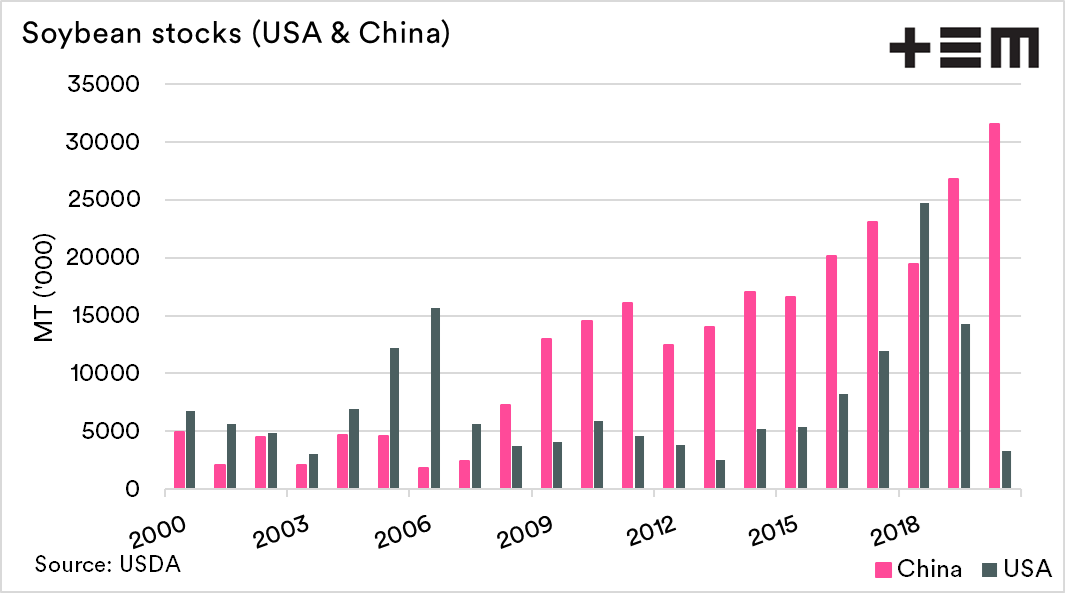

- US soybean end stocks are forecast at 3.25mmt. A large fall from recent (2018) records of 24.74mmt.

- Chinese ending stocks have risen to a record 31.6mmt.

- Brazilian soybean production is forecast at 136mmt, +2mmt on March forecasts and at record levels.

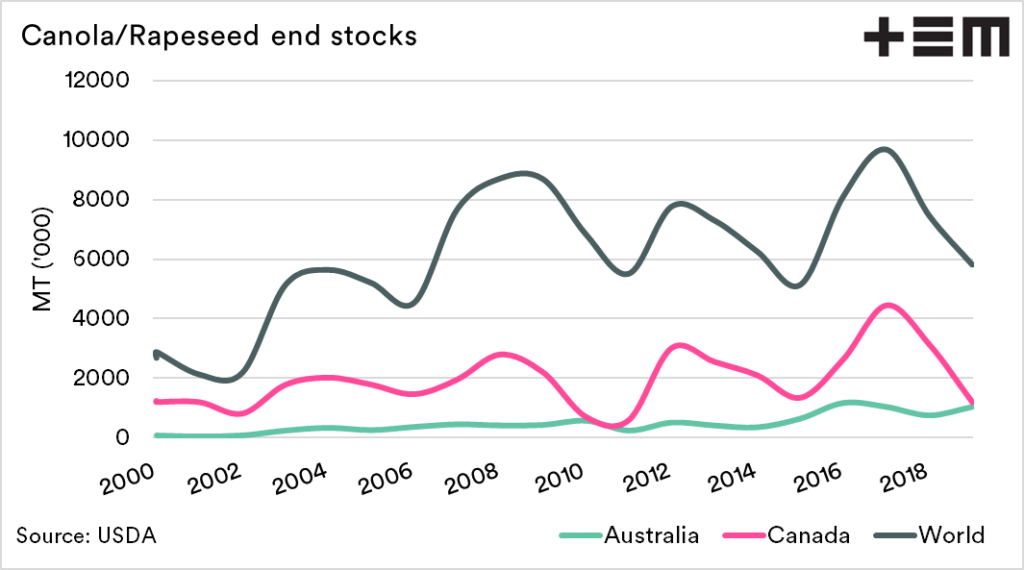

- Canola end stocks in Australia are forecast at 1mmt, the highest level since the post-2016 levels.

- Canadian canola end stocks have fallen from recent highs of 4.4mmt (2018) to 1.2mmt.

- There remain concerns about the European and Canadian rapeseed/canola crop state for the coming season.

The USA is a major producer of soybeans, and the last couple of years have been tumultuous. The trade war with China resulted in trade flows moving to Brazil and a corresponding increase in US stocks. The situation has changed with US stocks going from a record 24.74mmt in 2018 to 3.25mmt at the end of this season.

This places US soybean stocks at the lowest level since 2013. On the flip side, according to USDA figures, stockpiles in China have been increasing to hit a record level of 31.6mmt.

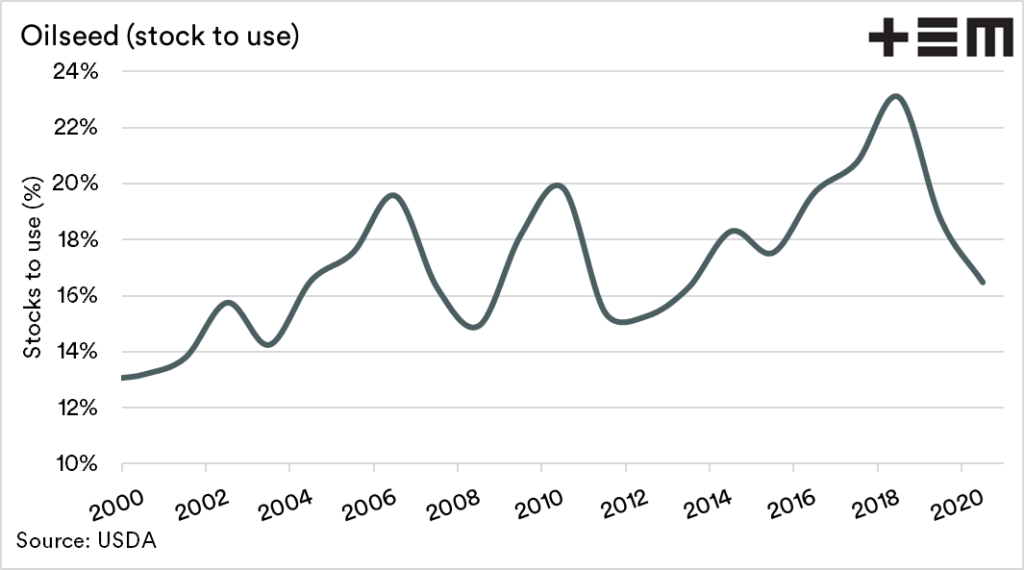

Our southern hemisphere cousins in Brazil have performed well after good crop conditions. The result is that Brazillian farmers will produce a bumper crop of 136mmt, a record. This has somewhat dampened the bullish tone to oilseeds; however, the oilseed stocks to use ratio remains at low levels compared to recent years.

Imports of Soybeans in China have been strong this season at 100mmt, a large jump from 82.5mmt in 2018. Consumption forecasts have dropped by 2mmt between March and April, which could indicate a less enthusiastic pig herd rebuild than Chinese government sources would indicate.

To read more on this, click on “Why I don’t trust Chinese data on the pig herd rebuild”

Australian end stocks of canola are set to be strong, with just over 1mmt at the end of the season. This is close to record levels experienced after the 2016 crop.

Interestingly, Canada’s end stocks have dropped to 1.2mmt, a far cry from recent levels of 4.4mmt and not far off our levels. This is despite Canada producing nearly 5x the Australian crop.

As we move forward into the new crop, France and Canada are both suffering from poor conditions that may impact their production this year. Last week I briefly discussed comparisons of canola pricing between Australia and overseas in “Canola: is our price good?“.