What is basis in wheat?

The Snapshot

- The term basis confuses many. It is however, merely the difference (positive or negative) between the physical and futures price.

- The basis generally refers to CBOT and local, however, could be with any other futures exchange.

- The biggest driver of basis is the local supply of grains.

- If supplies are low, then basis rises. Conversely, a large crop tends to lead to lower basis levels.

The Detail

One of the most common questions which I am asked is ‘what is basis?’. It is a jargon word which confuses many. In reality, the term basis is quite simple.

The price offered by your local grain buyer is quoted as a flat price, this is the price for the physical delivery of grain, with all the components of pricing included. An example would be A$310/mt delivered Melbourne, and this price includes futures, fx and basis.

The term basis is exchangeable with difference. When someone is talking about basis, they are discussing the difference between two different prices, generally between physical and futures.

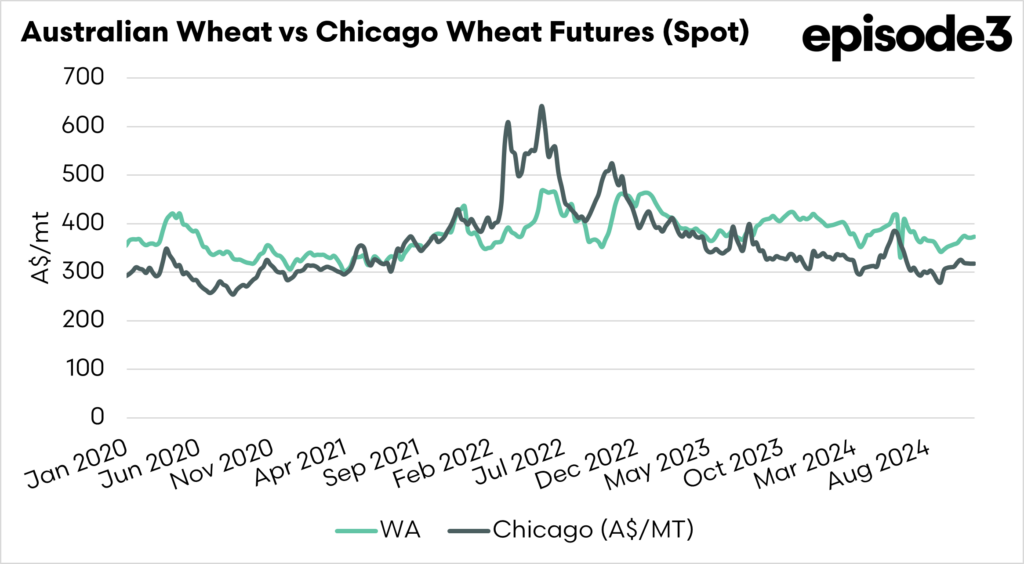

In general, in Australia, basis is a comparison of against CBOT soft red winter wheat (in A$/MT). Although whether CBOT is the relevant indicator is a discussion for another day.

The basis level can be either positive (premium) or negative (discount) to CBOT futures. Australian basis levels tend to be positive, with very minimal time at neutral or negative levels.

What drives basis?

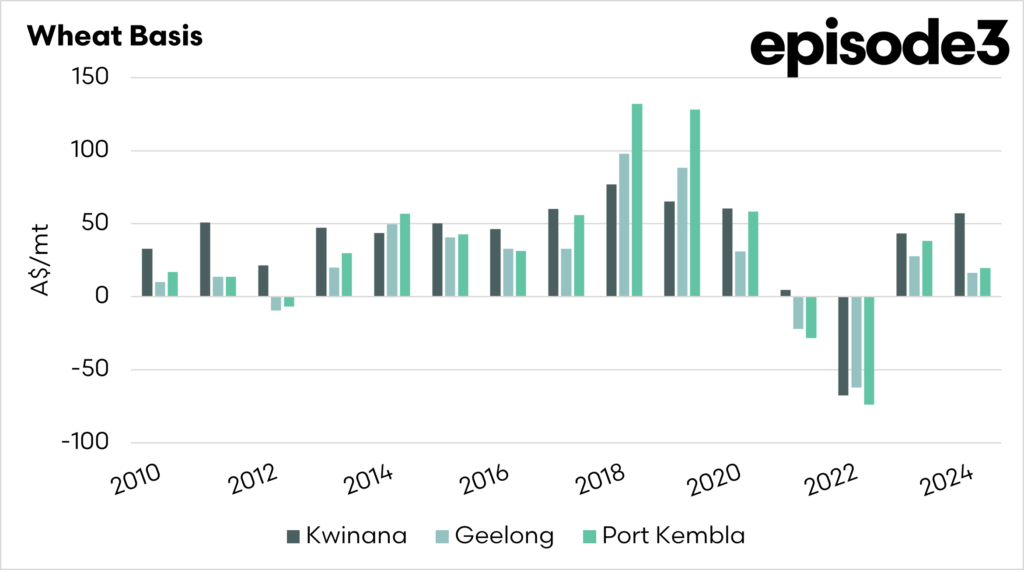

The primary driver of basis is the supply. The last couple of years have been quite interesting for Australian grain. We had droughts in 2018 and 2019, which caused a reduction in supply; the result was that the basis levels rose to extremely high levels. In the most drought-affected areas, the annual average basis level was A$100 over Chicago wheat.

Immediately after the drought, we had the huge production years, which resulted in prices falling to massive discounts to Chicago wheat. In 2022 as an example the annual average basis plumetted to a discount of over A$50 for most of the country.

The reason that basis is driven by supply in its basic terms is FOMO, or fear of missing out. When there is a drought domestic buyers (feed mills etc) will have to ensure that the grain does not leave the country. They have a largely inelastic demand, and they will pay to avoid the grain going onto a ship. Conversely, when supply is great, they do not fear that they will miss out, so they are not as enthusiastic buyers.

This is clearly a simplification but it largely holds up to historical precedence.

So what about now?

The basis levels around the country are back to what would be considered normal. We are not having a big year, and we are not having a small year.

When I think about basis, in most cases we dont want a huge basis level. A huge basis level generally will indicate that supplies are low. You may get a strong premium for your wheat versus the rest of the world, but the reality is that you will likely have less to sell. The inflated basis level tends not to cover the drop in production.