What’s that got to do with the price of bread?

The Snapshot

- Bread prices tend to increase in a relatively stable manner in both the US and Australia.

- Wheat prices are driven by supply issues, and tend to be more volatile.

- There is a relationship between bread and wheat pricing.

- During times of large increases in wheat pricing, bread pricing goes up.

- It is relatively rare to see falls in bread pricing.

- Bread prices are sticky, in that they don’t change downward when the input price drops.

The Detail

One of the questions we get asked about a lot is the relationship between food and commodity pricing. In October last year, Matt had a look at the relationship between cattle pricing and retail meat (read here).

So I thought the yeast we could do is look at the price of bread vs the cost of wheat. So, bready or not, here it comes.

Whilst we are lucky to have access to a fantastic assortment of foodstuffs, large populations subsist solely on bread. Wheat is the main ingredient in bread pricing. Let’s stop loafing around and get into the data.

How did we look at it?

In this analysis, I have collated a bunch of datasets from various government departments, along with some pricing data.

To create a comparison of the data points, I have created an index of Australian and US bread and wheat pricing from 1990 to the present.

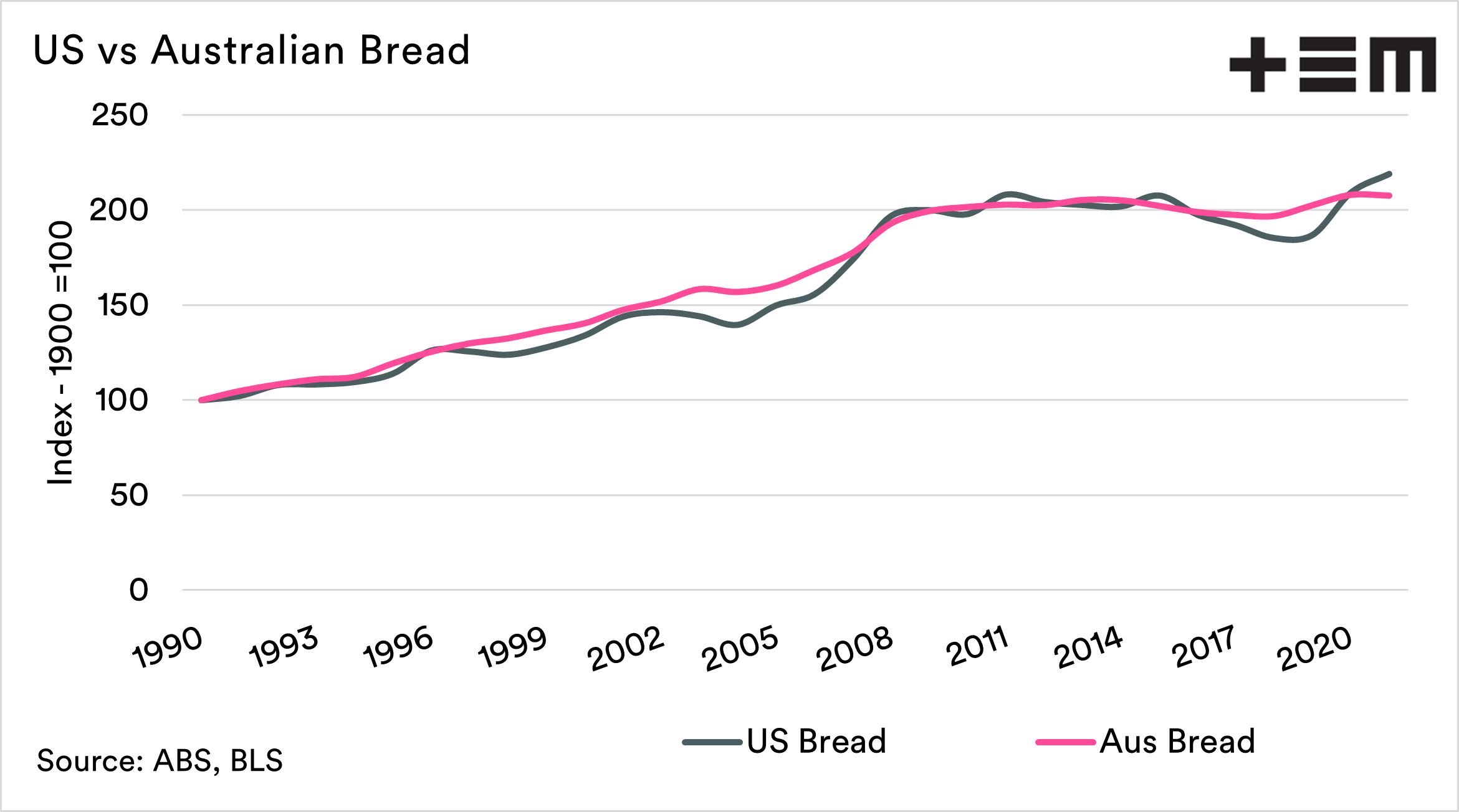

The chart below shows the index of bread pricing in Australia and the United States. As we can see, they both have a very similar trend. The correlation between the two is 0.99. One is a perfect correlation, and 0 is no correlation (the correlation of returns is 0.65). The return is a measure of the change in annual price.

The closeness of the relationship is interesting. The chart below, with on average around 2 to 3% increase in the cost of bread.

Bread is a retail product sold direct to consumers, and there is a tendency for retailers not to introduce sharp revisions to the price of staples.

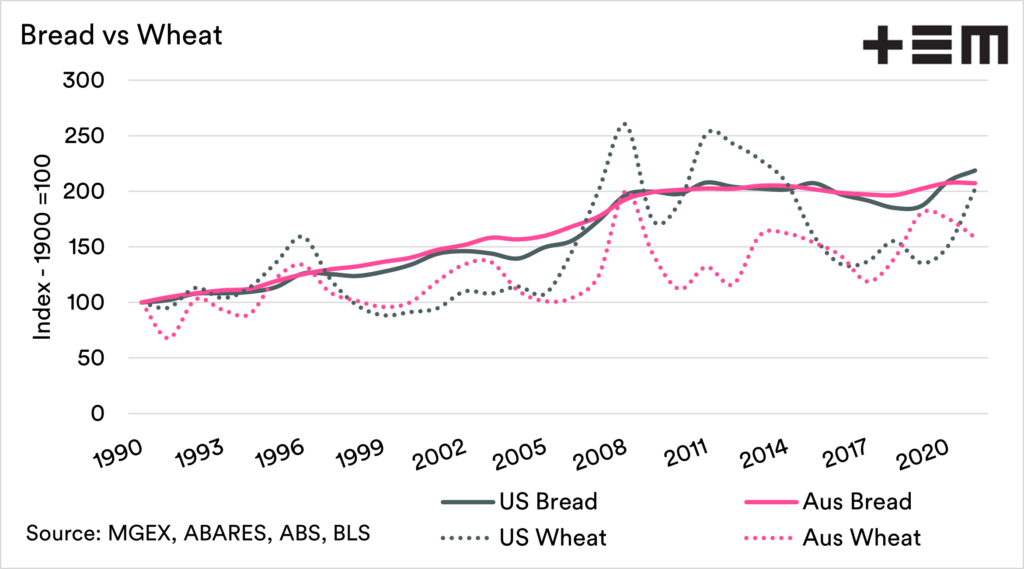

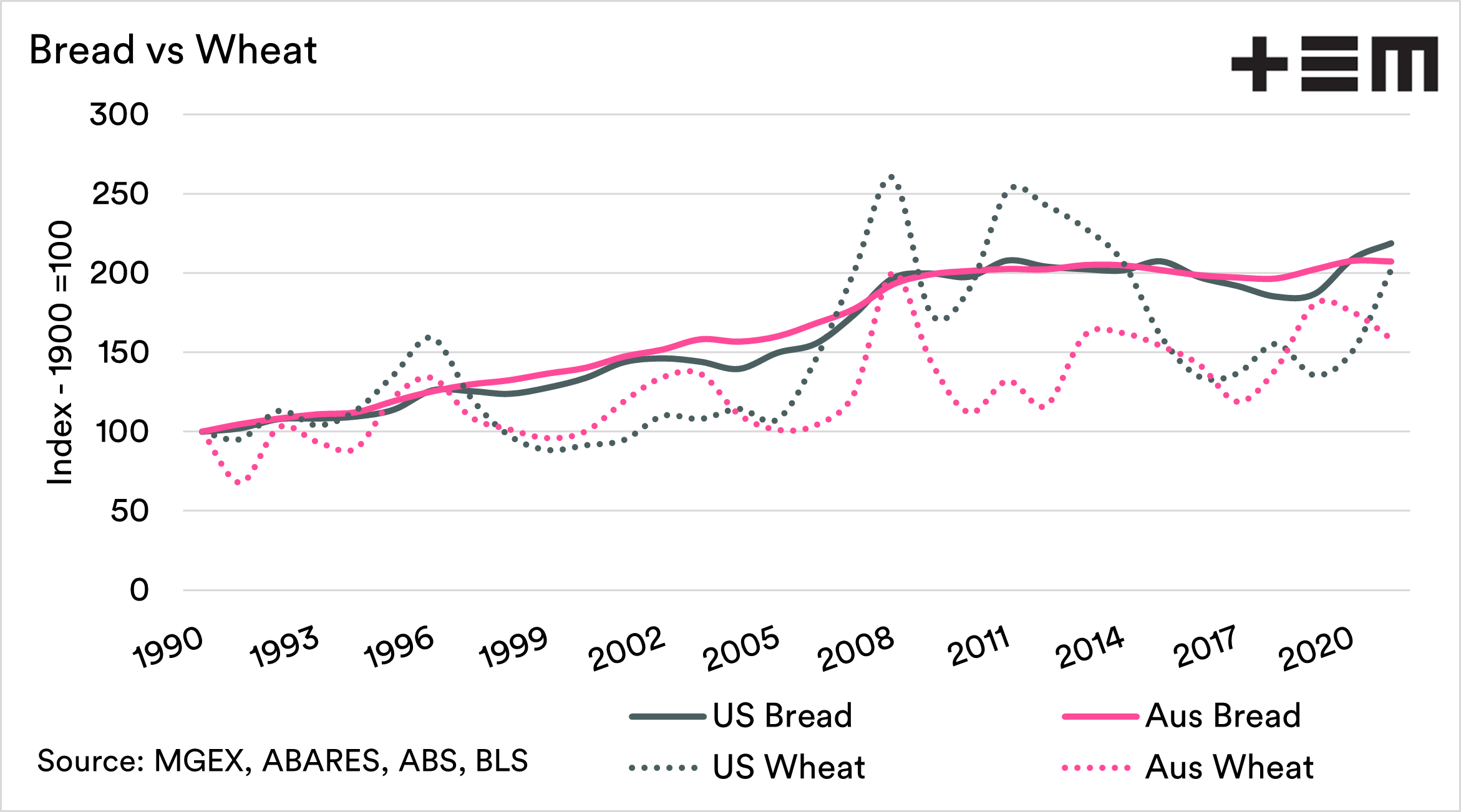

The chart below shows the same bread price index, along with the index of wheat pricing in Australia and the USA.

The movement in wheat pricing is far more volatile. This is due to the fact that wheat prices are generally driven by supply. If there are supply shocks (i.e. drought) then we see prices drive higher. If supply is ample, then we see pricing fall.

Bread doesn’t seem to be as impacted by swings as much.

Volatility vs stability

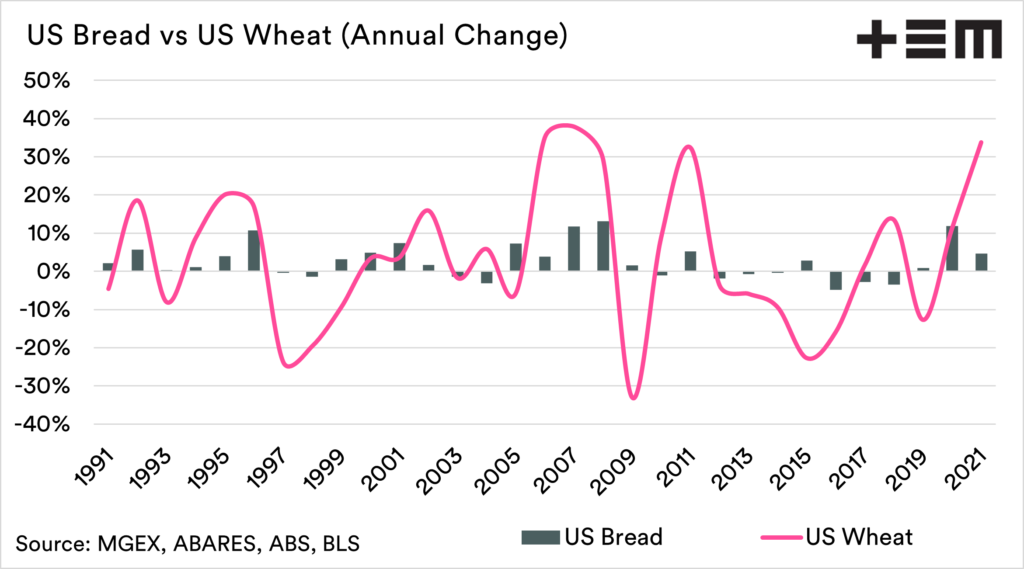

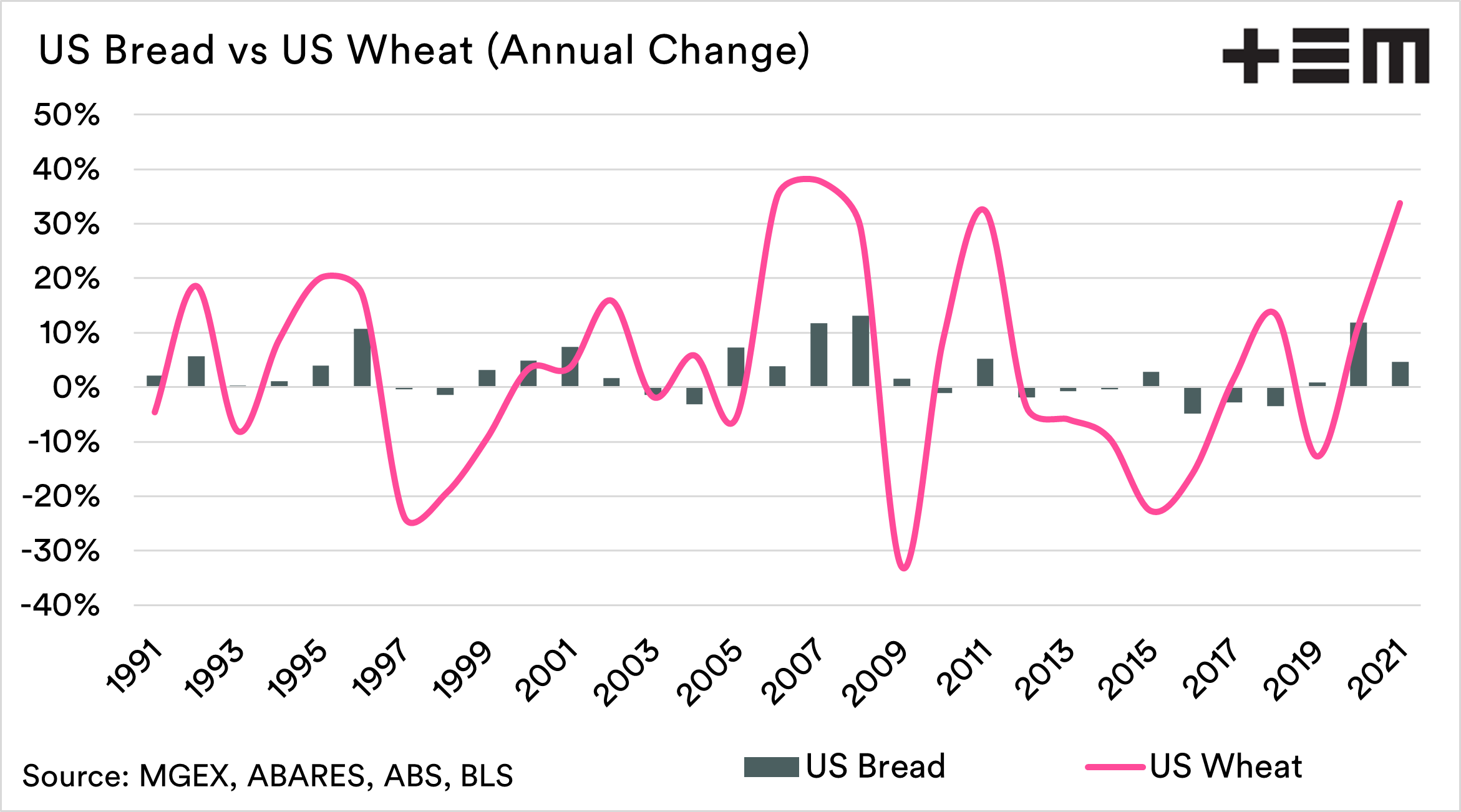

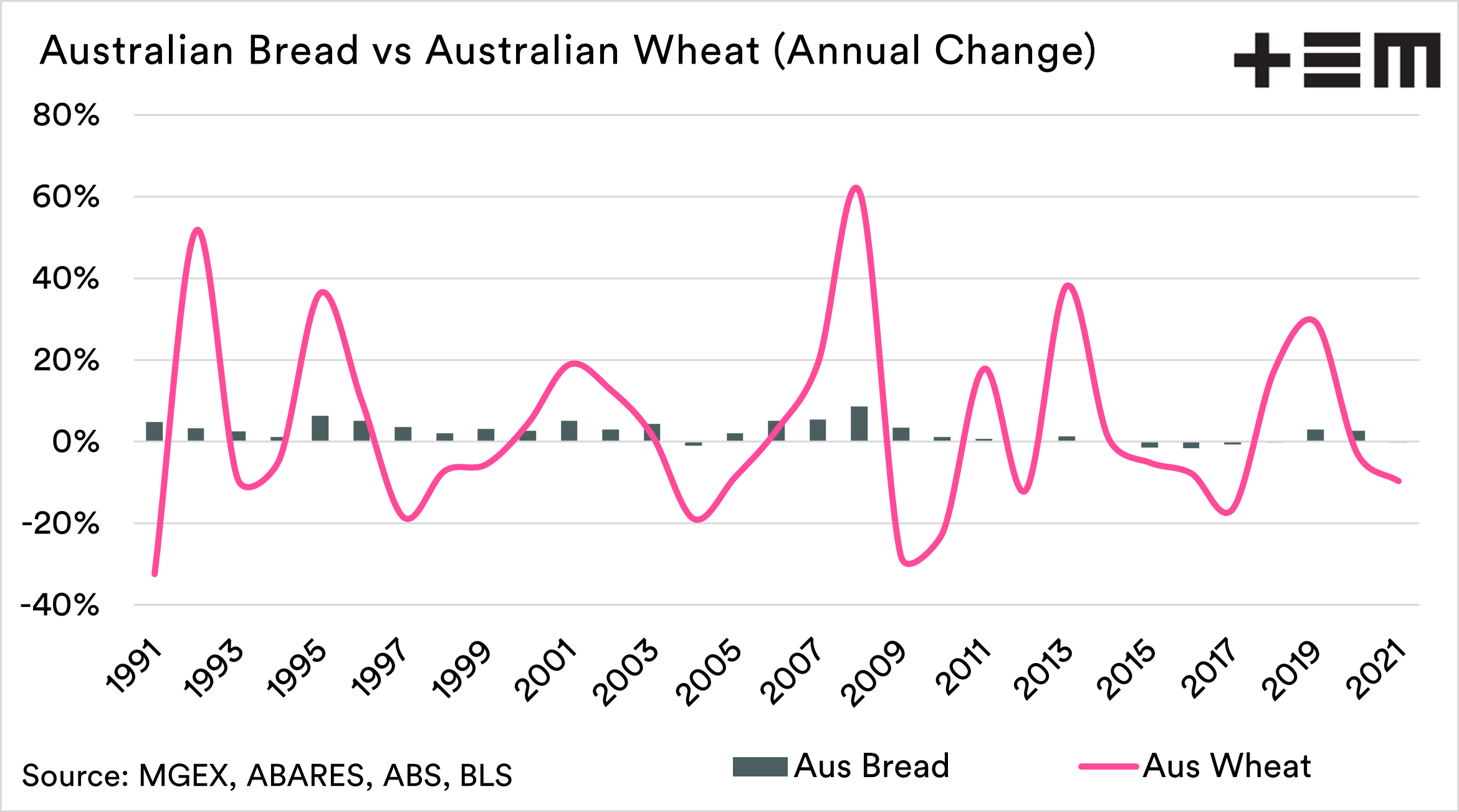

The charts below show the annual change in the price of wheat and bread for both the USA and Australia separately.

The relationship between bread and wheat pricing in America is slightly stronger than in Australia. In general, the most significant increases in bread pricing occur during times of higher annual increases in wheat pricing.

The correlation between US bread and wheat is 0.75 (0.52 returns) and between Australian bread and wheat is 0.72 (returns 0.45).

It is important to note that price falls in bread are not as common when the wheat price falls. This is especially so in Australia.

In a 31 year period, Australian bread prices had fallen in four years versus nine times in the USA. Just like sticky dough, the bread price is sticky.

Price stickiness is an economic term where prices have an aversion to downward change, when there are changes to the cost of the inputs.

Is it all a bit crumbly?

The price of bread and the price of wheat does have a relationship. However, the reality is that with bread being a retail product, many other factors drive the price, from marketing to logistics.

Bread prices do tend to rise when wheat prices rise. They do, however, tend to maintain their pricing levels when the wheat price falls back.

If you liked reading this article and you haven’t already done so, make sure to sign up for the free Episode3 email update here. You will get notified when there are new analysis pieces available and you won’t be bothered for any other reason, we promise. If you like our offering please remember to share it with your network too – the more the merrier.