Wheat is in short supply, but prices are falling?

The Snapshot

- Wheat stocks to use is low, especially when we examine the top 8 exporters.

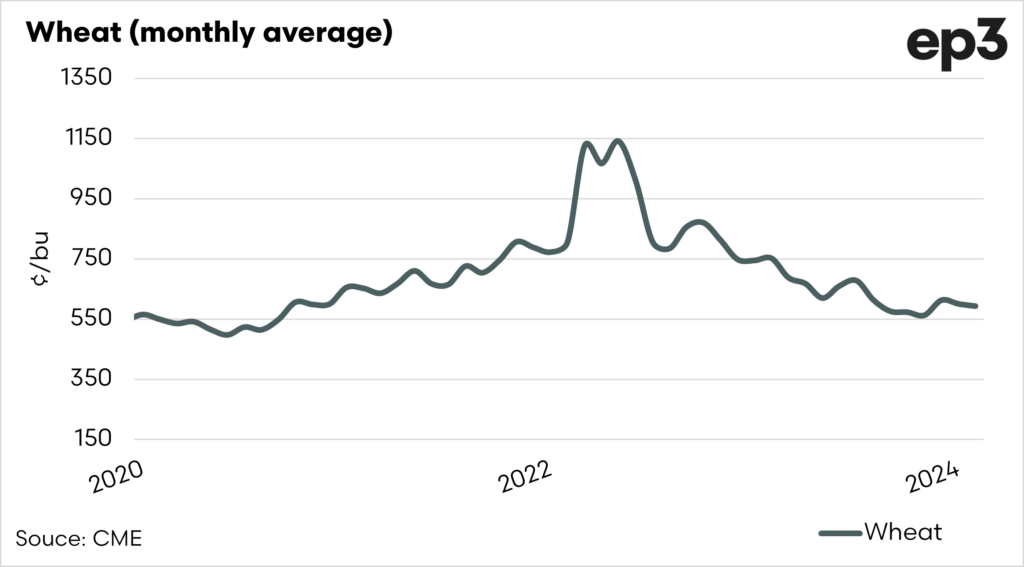

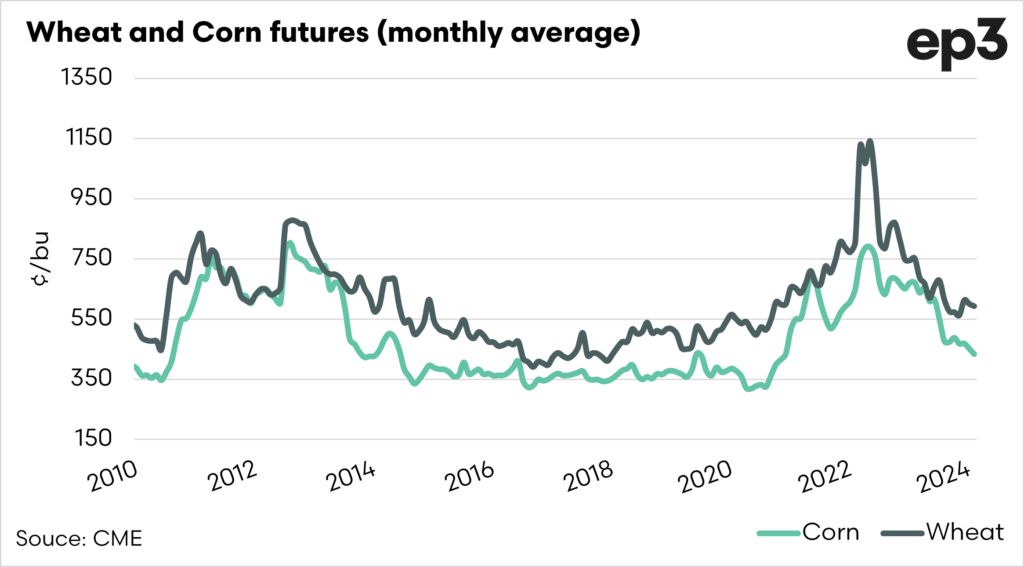

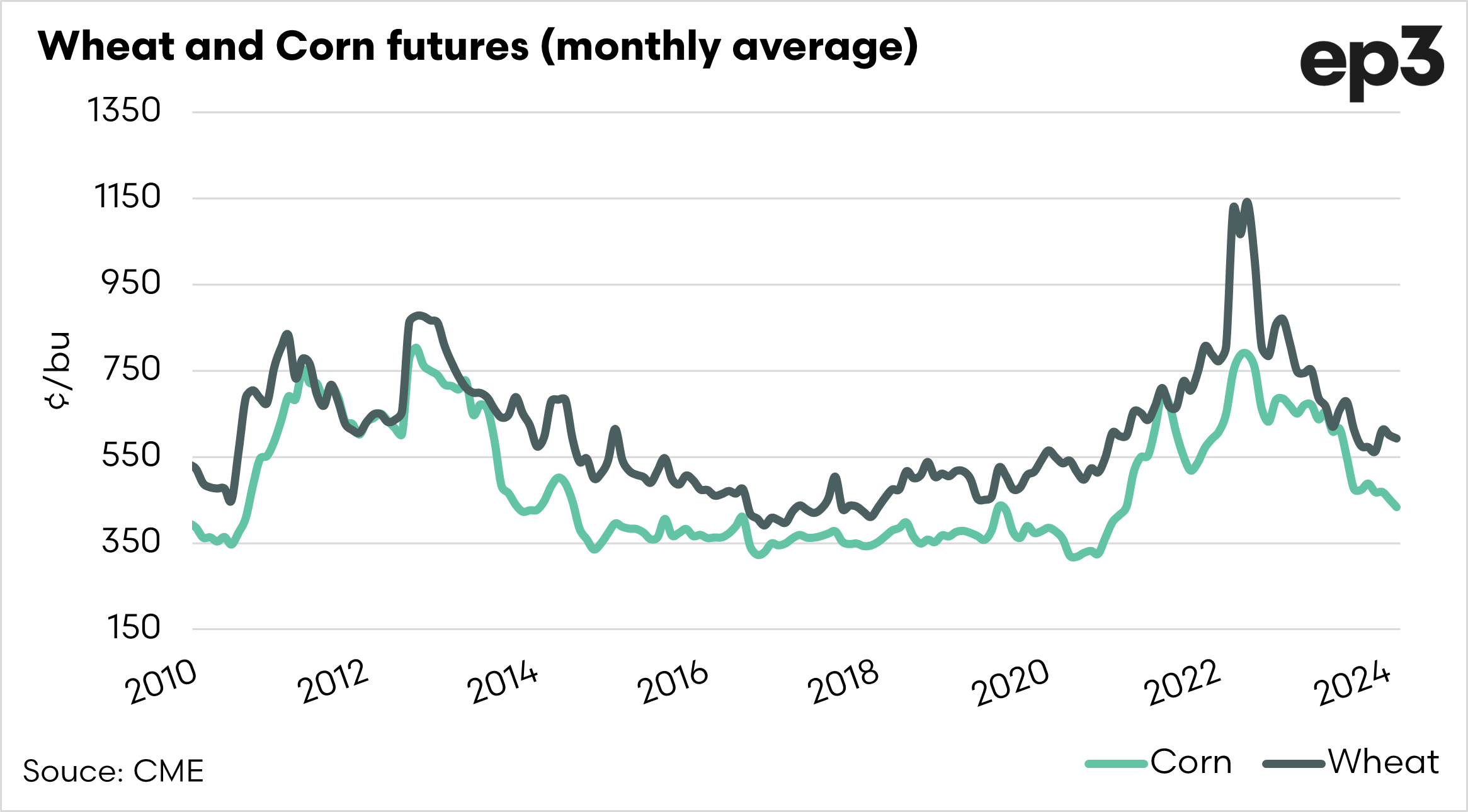

- Wheat prices have been falling in recent times.

- Corn is reasonably well supplied.

- The corn market drives the wider grain market.

The Detail

In my view, the basics of supply and demand economics are low supply equals high price, high supply equals low price. It’s pretty simple.

At the moment, wheat around the world is in relatively low supply, but at the same time prices are falling. What’s going on?

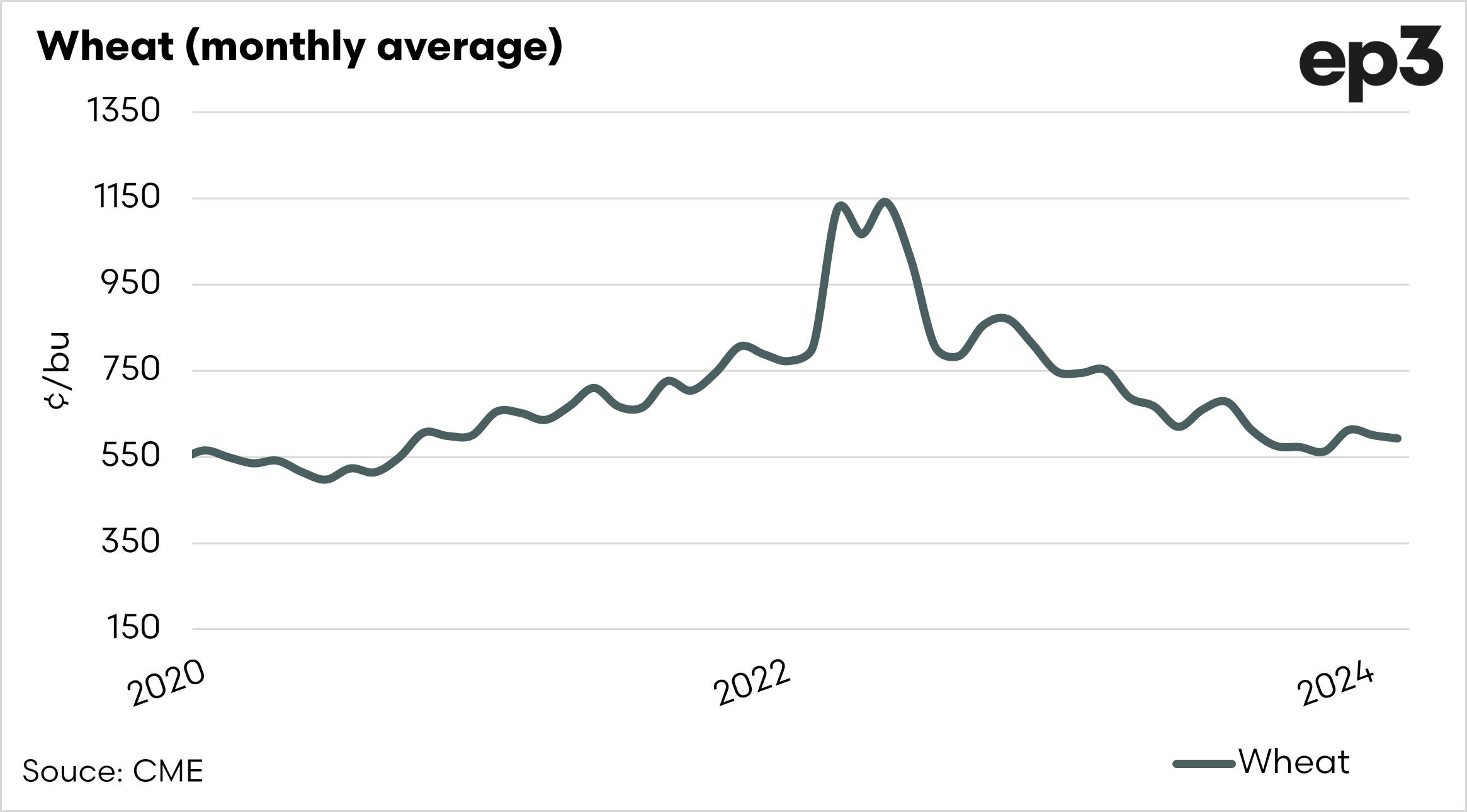

Wheat is in short supply around the world. One of the best quick measures of supply and demand is examining the stocks-to-use ratio.

The stocks-to-use ratio is an important tool, as global stocks could be high – but stocks don’t take into account demand.

The stocks-to-use ratio is a metric that shows the amount of a commodity left in storage (stocks) relative to the amount consumed or used over a specific period. It is a crucial ratio for analysing commodity markets.

Low Ratio: A low stocks-to-use ratio indicates that there isn’t much of the commodity in storage compared to its usage, which can often lead to higher prices due to scarcity.

High Ratio: A high stocks-to-use ratio suggests that there is an abundance of the commodity in storage relative to its usage, which can lead to lower prices due to oversupply.

The chart below shows the stocks-to-use for the world (with and without China) and the top 8 exporters.

The stocks-to-use ratio for the global situation is lowest since 2013, but again we need to look at it without China. When China is excluded, then it is the lowest since 2007.

As we delve in further, an area I think is key to look at is the top exporters. These are the countries that provide a surplus of wheat that can be shipped to countries of deficit. It is these countries which really determine the global market. The stocks-to-use ratio for the top 8 exporters is currently joint lowest since at least the turn of the century.

This reducing ratio points towards a scenario of falling supplies and the potential for higher pricing.

But pricing is decreasing.

The grain market is driven by corn. That’s the reality. The world consumes over a billion tonnes of corn annually, used for everything from feed to fuel.

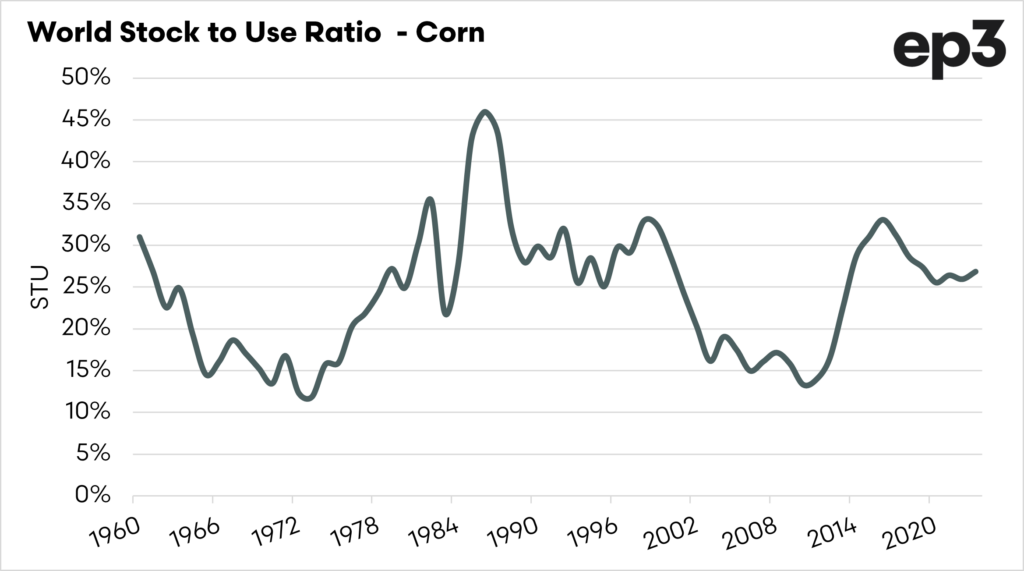

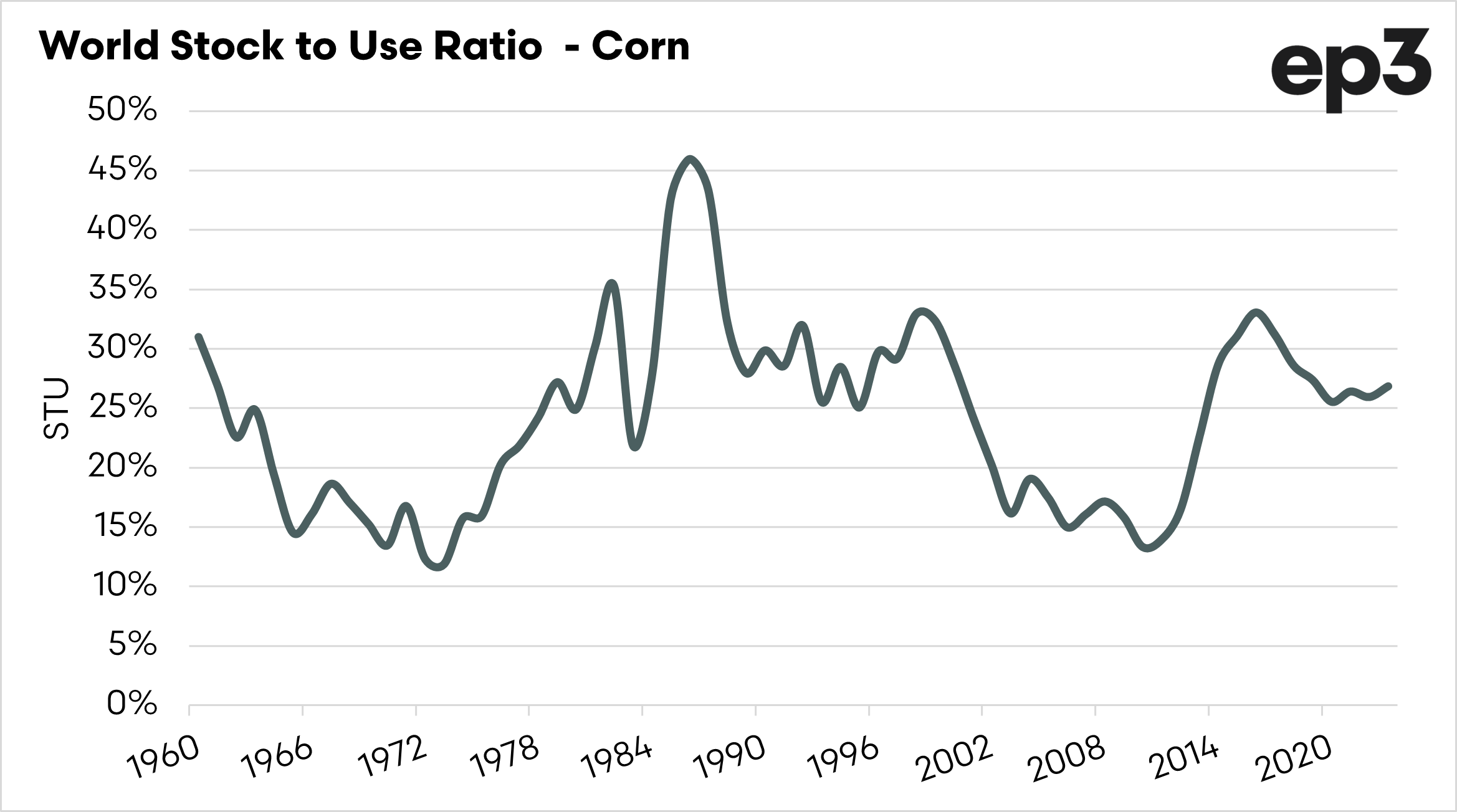

What happens with corn flows through to what will happen with wheat. The chart below displays the global stocks to use ratio for corn.

During the past five years the stocks to use has been quite flat, switching between 26 and 27%.

The average stocks-to-use ratio over time has been 24%, so its above average. This year is looking promising for corn production around the world compared to last year.

Some of the bullet points:

- US stocks are high

- Argentina’s outlook is favourable

- Chinese corn imports were record high.

We still have a few months before the northern hemisphere comes out of its winter slumber, so there isn’t a whole lot of new information coming out at present.

At the moment, in terms of the wheat market, I am most concerned about corn pricing pulling down wheat pricing, which is what we have seen recently.

Let’s hope there is a weather issue in some of the major corn-growing regions.