Why did canola exceed A$1000/mt?

The Snapshot

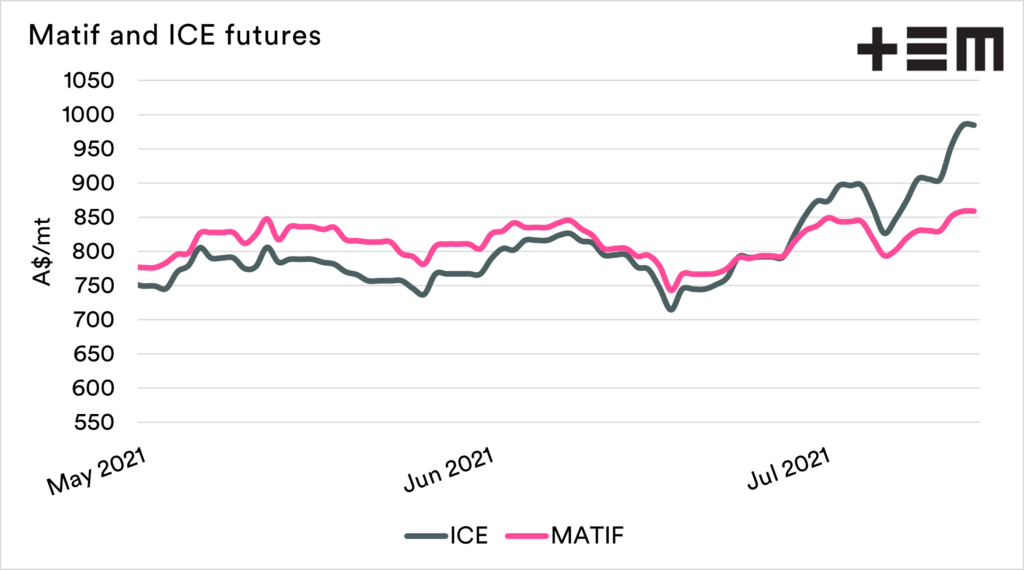

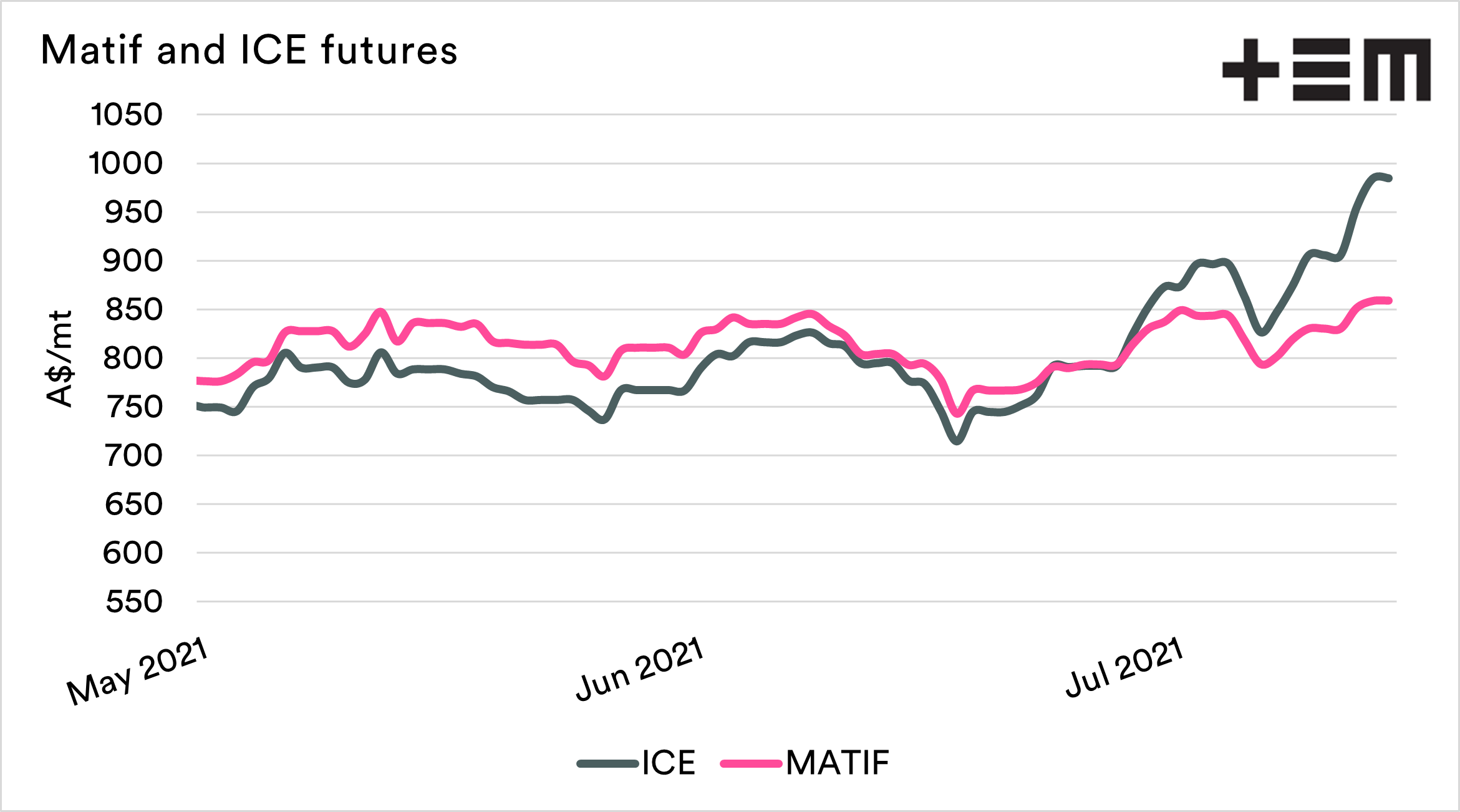

- ICE canola futures went higher than Richard Branson yesterday. They reached A$1017/mt.

- The main production area of Canada is in a sore state, suffering through dryness and heat.

- Canada supplies >60% of the world’s trade of canola.

- Our premium to Canada has fallen to extremely low levels.

- This is a result of the market paying a drought premium in Canada.

- Whilst we can’t expect to get paid the same levels as Canada, we can expect a flow-on effect from their poor crop.

The Detail

Canola is heading into the stratosphere at the moment. I keep a close eye on overseas futures, and yesterday afternoon, when I checked ICE futures, I had to triple check what I was looking at – I didn’t believe it.

The ICE Canadian canola futures hit A$1017/mt for the coming harvest. It has since lost some value dropping back to A$984/mt (still very high!).

A phenomenal level. Let’s look into why this is happening.

The Weather

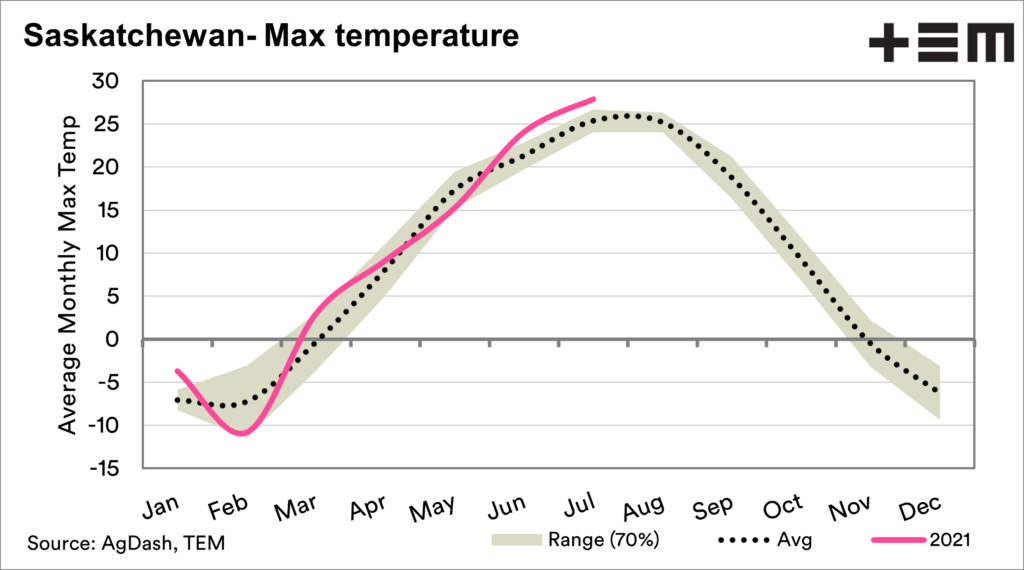

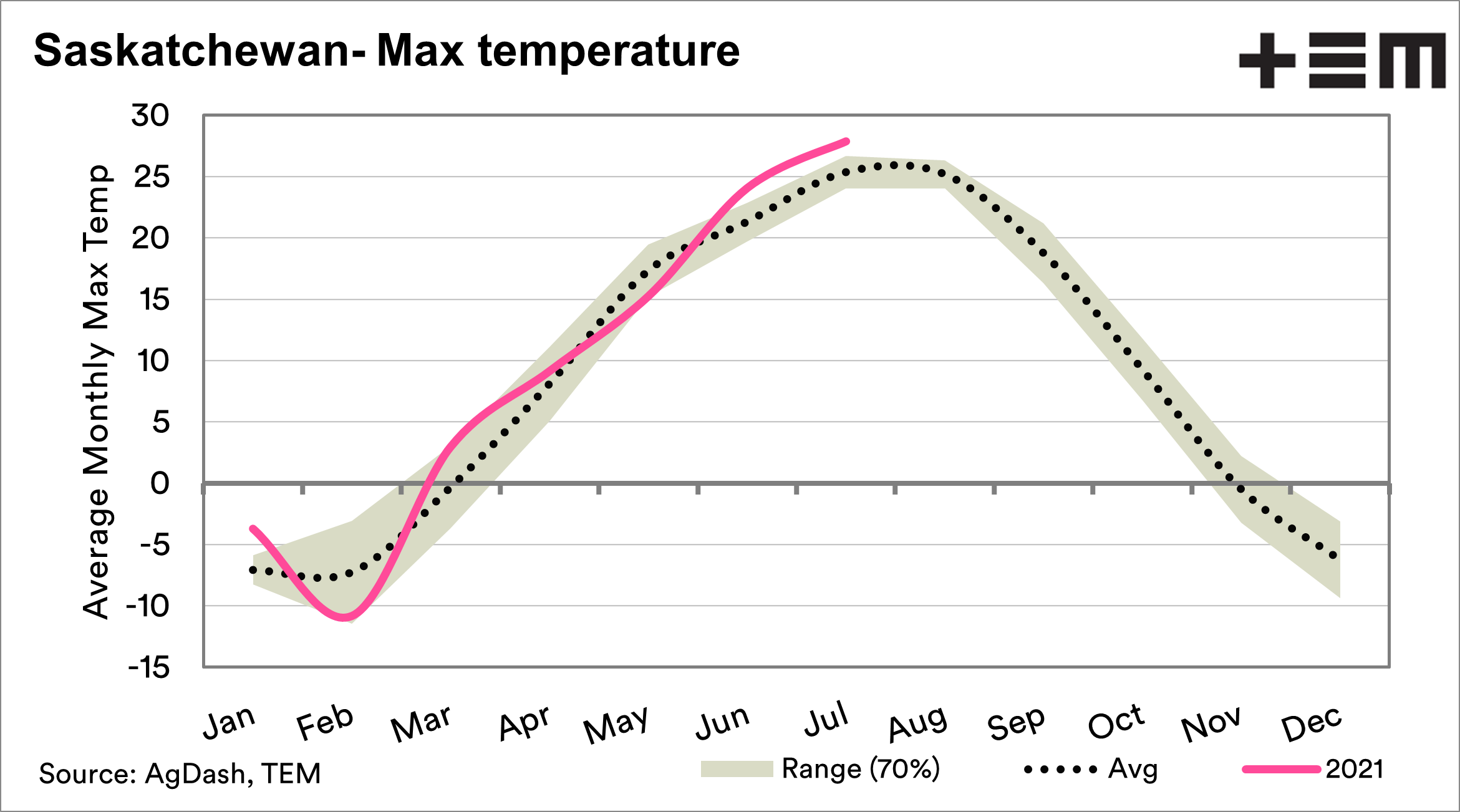

The majority (>50%) of Canadian canola is produced in Saskatchewan, so we will focus on this region for this report.

This season has been abysmal in Saskatchewan. During June and July, the average maximum temperature has been higher than typically expected. In 2021, June has been 24°C versus an average of 21°C. July has been equally bad at 27.88°C, versus 25.3°C.

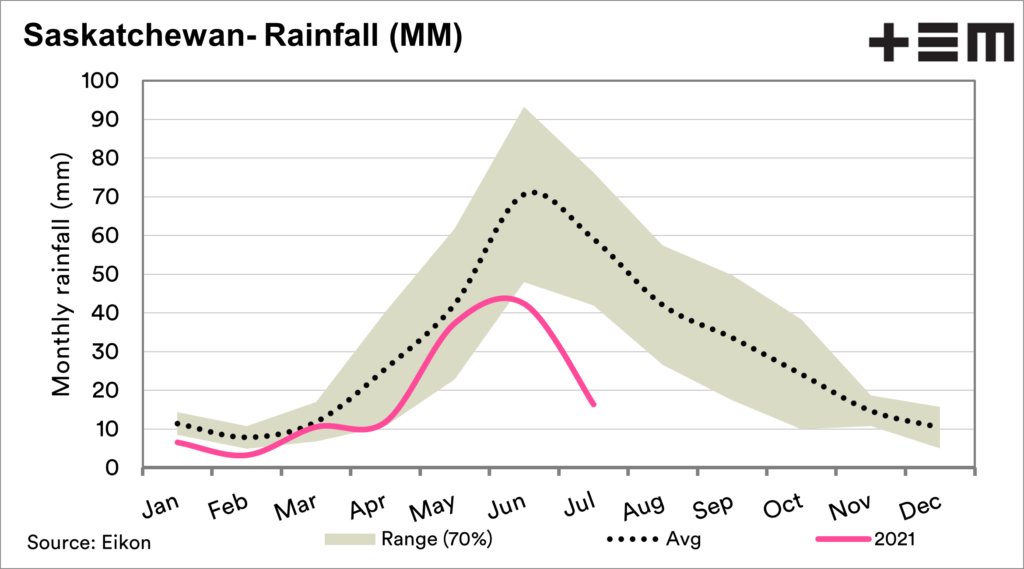

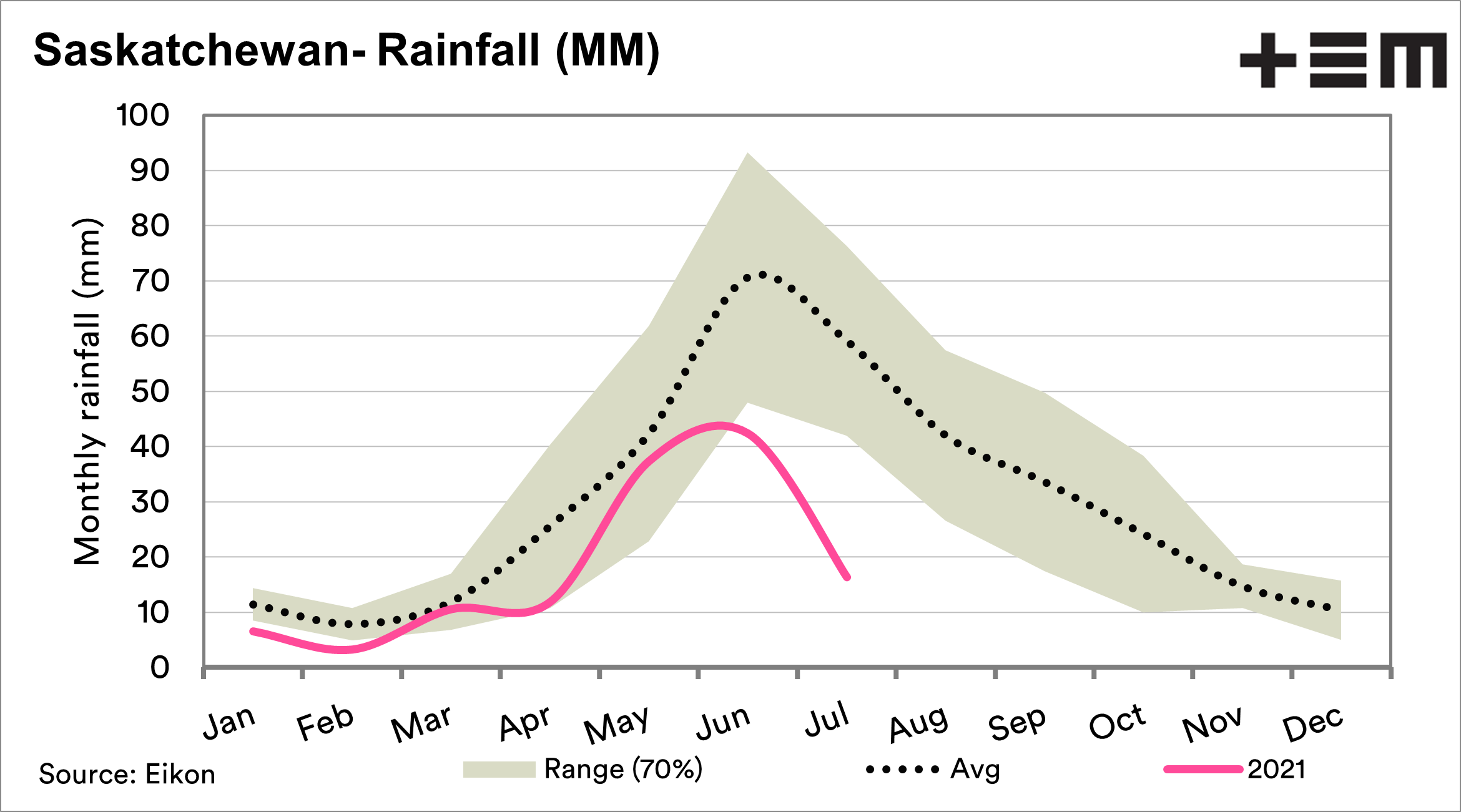

The rainfall has also been below average in recent months. During June 42mm fell, versus a long term average of 70mm. So far, during July 16mm has fallen, versus a long term average of 59mm.

So it’s dry and hot. I ain’t no agronomist, but I’m pretty sure that these conditions are not conducive to big yields.

So what’s the impact?

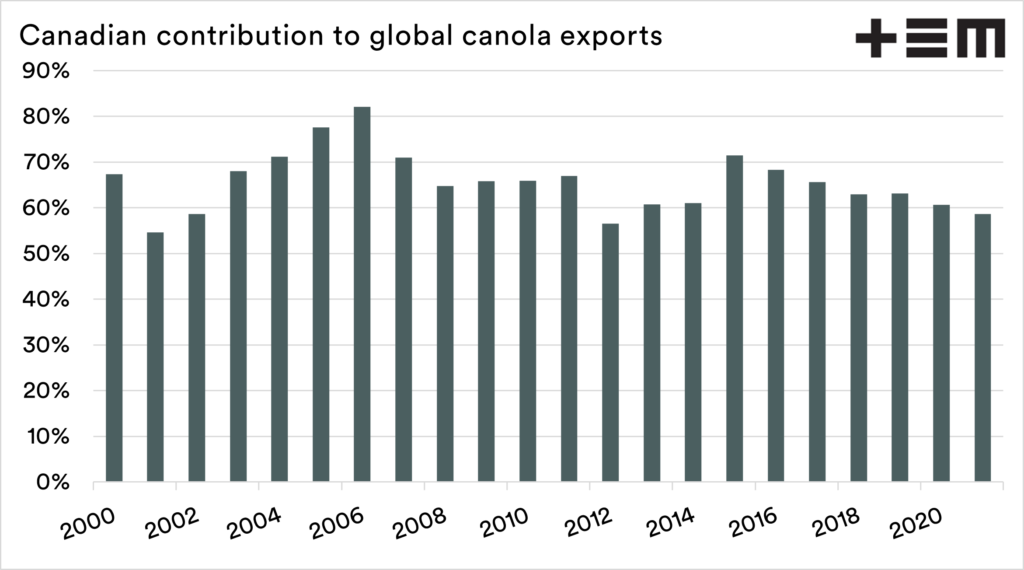

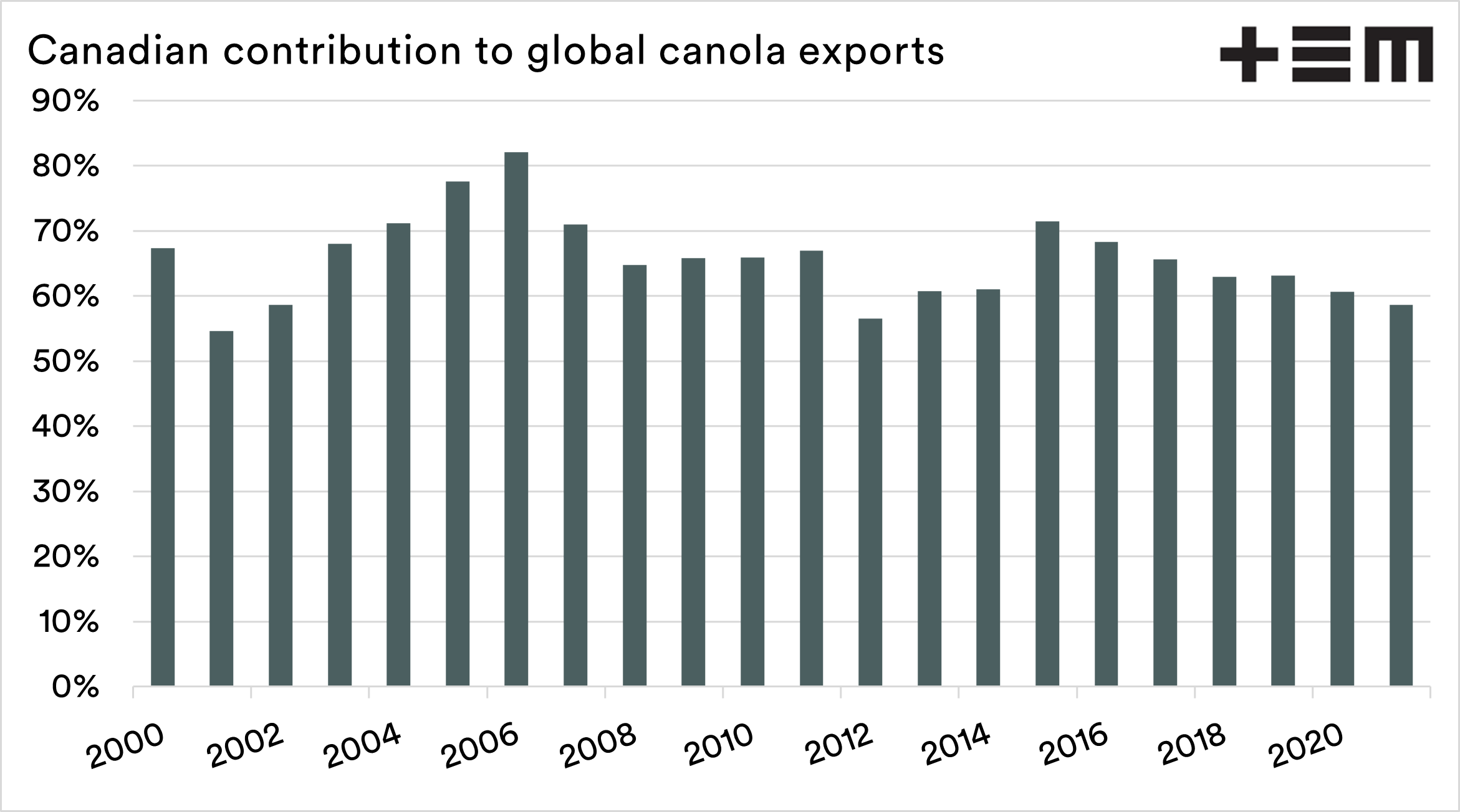

Canada is the worlds largest exporter of canola. On average, they have been responsible for 64% of global export trade in canola. A major issue in Canada will start to move demand to other nations; in fact, this year, I wouldn’t be surprised to see Australian exports to Canada if some of the forecasts ring true.

At present, the USDA are forecasting 20.2mmt, 1.2mmt higher than last year. Last year was a poor crop, and some of our contacts are talking about a 16.5mmt canola crop.

Whilst this is on the bottom range of expectations, it doesn’t leave much over for exports when Canada has had an average domestic consumption of 10.1mmt in recent times.

The end stocks in Canada as we start this season are low at 1.1mmt but will come out of new crop even lower.

So why hasn’t the price locally increased as much?

The ICE contract is a Canadian based contract, and therefore the local conditions are driving the price.

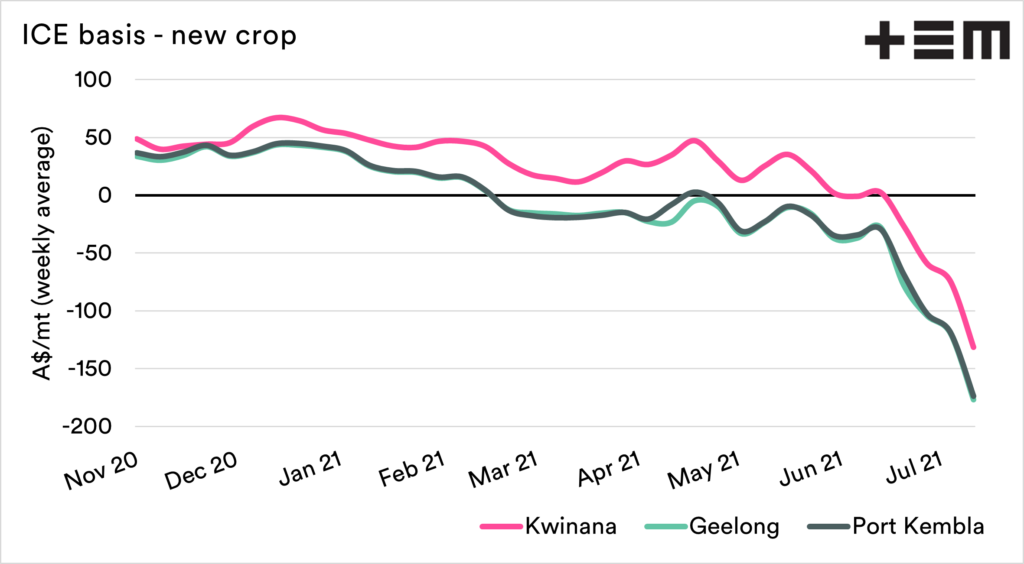

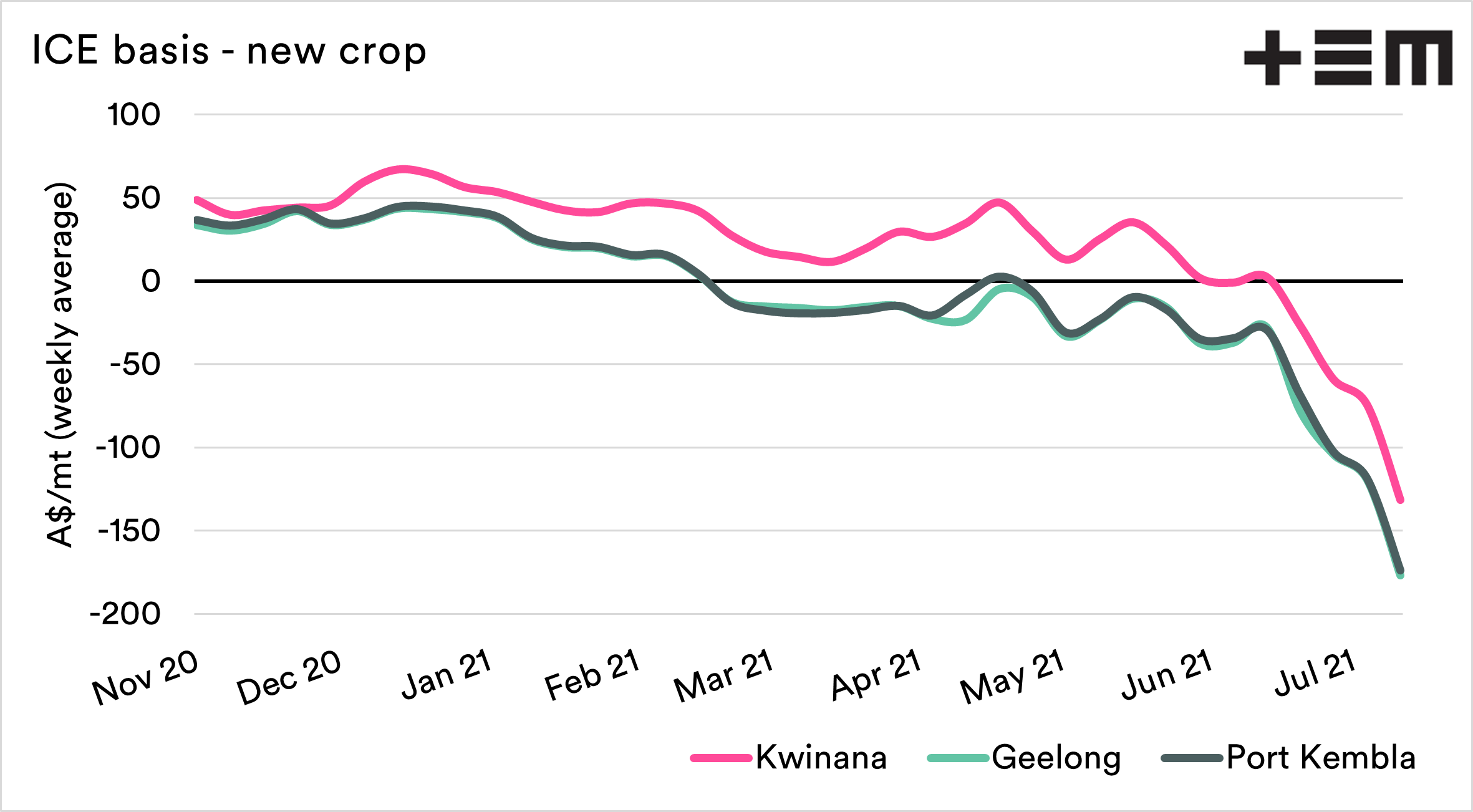

Our basis (premium/discount) over ICE futures is at extremely low levels. This is to be expected and is reflective of a Canadian drought premium. This is similar to the ASX during the recent drought; Australian pricing rose to a high level against the rest of the world.

A distinguished fellow in the grain industry made a good point “The ICE price is available if you move your farm to Canada and half your yields”.

However, there is a flow-on effect to our pricing levels. As mentioned earlier, 60% of the world’s canola exports are at risk at a time when Australia is expecting decent volumes.