You will always do better holding your grain post-harvest*

The Snapshot

- I am often told that you will do better if you hold grain post-harvest to the middle of the year.

- Markets don’t always follow a predictable flow.

- You have to cover the cost of carry in any price increase to ensure you are not going backwards.

- It is important to ensure you accurately consider carry; interest, storage costs and lost opportunity.

- In most years, prices, when carry is accounted for, did not increase.

- It is important to note this is a rudimentary analysis, and different farmers will have different circumstances.

- Never assume the market will always do the same thing.

- Always have a view on why the market will move.

The Detail

Anyone that says there is one solution to marketing that works every year is talking mince. Grain markets change; they adapt to the new information available.

So what about the theory that holding onto grain post-harvest always pays well?

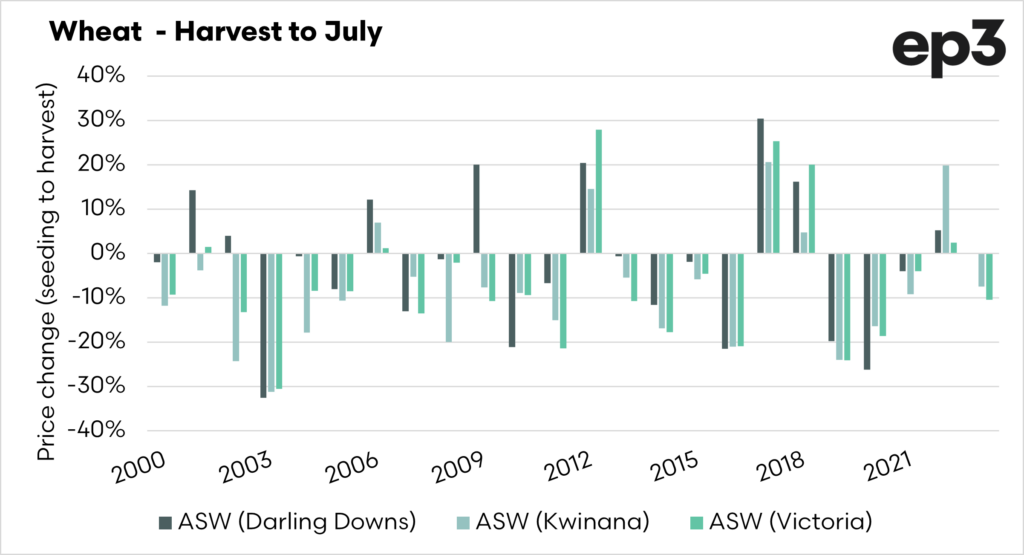

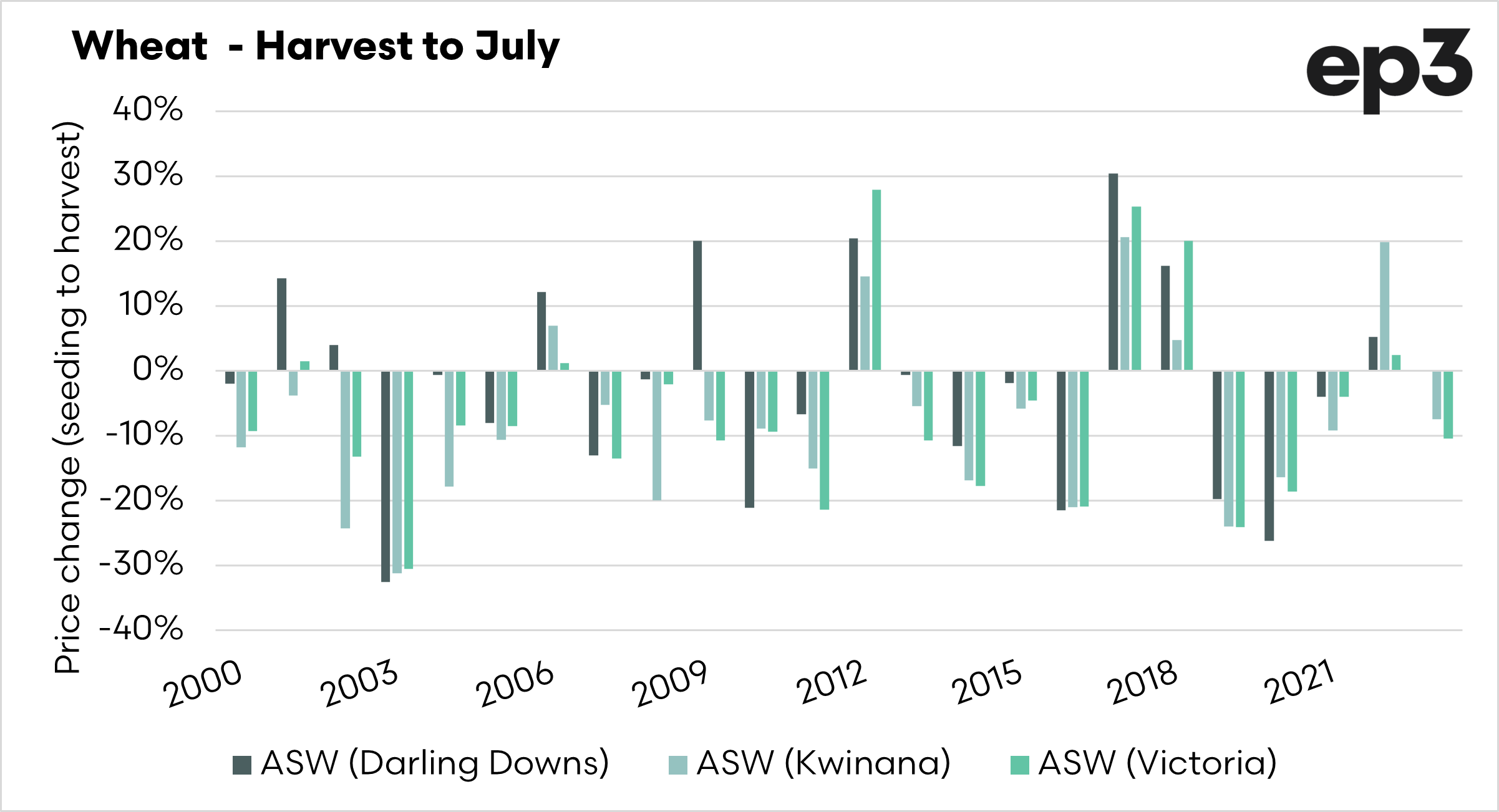

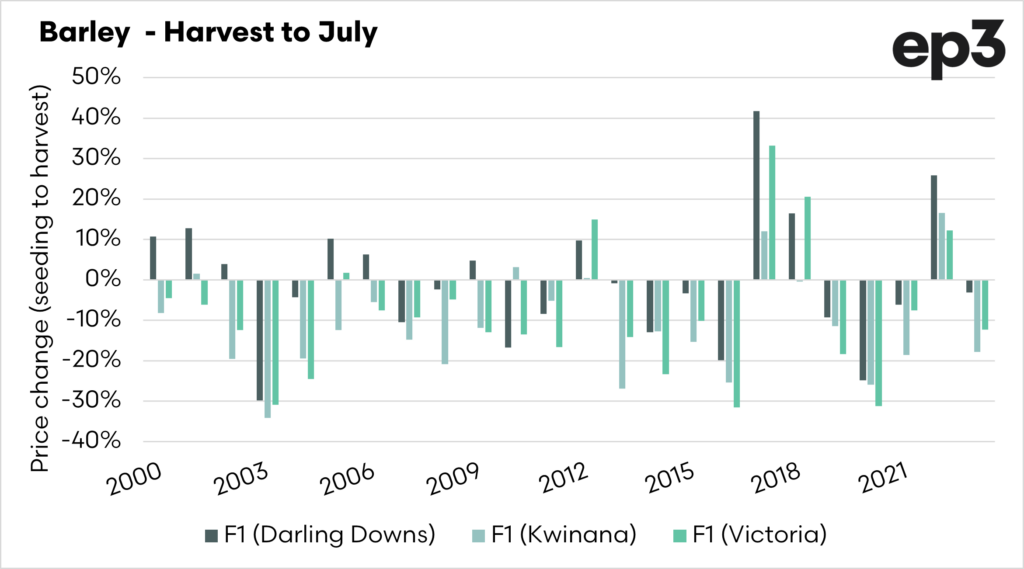

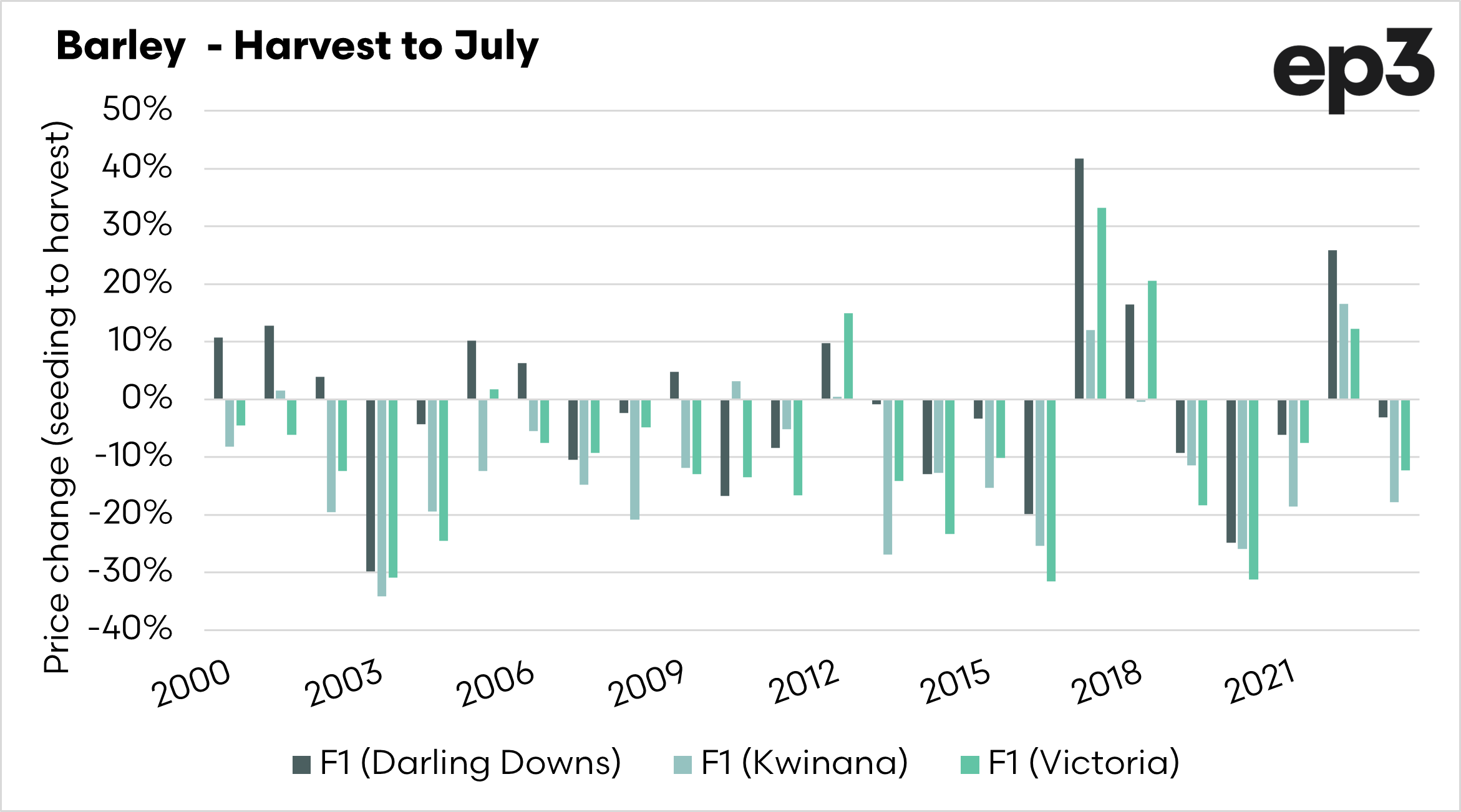

This analysis is just a simple look at the change in price between the end of harvest (January).

I have taken into account a carry cost (A$4.50/per month). Many people would say this is too much, but it is to cover storage costs, interest and lost opportunity. So I think that A$4.50 is a reasonable cost.

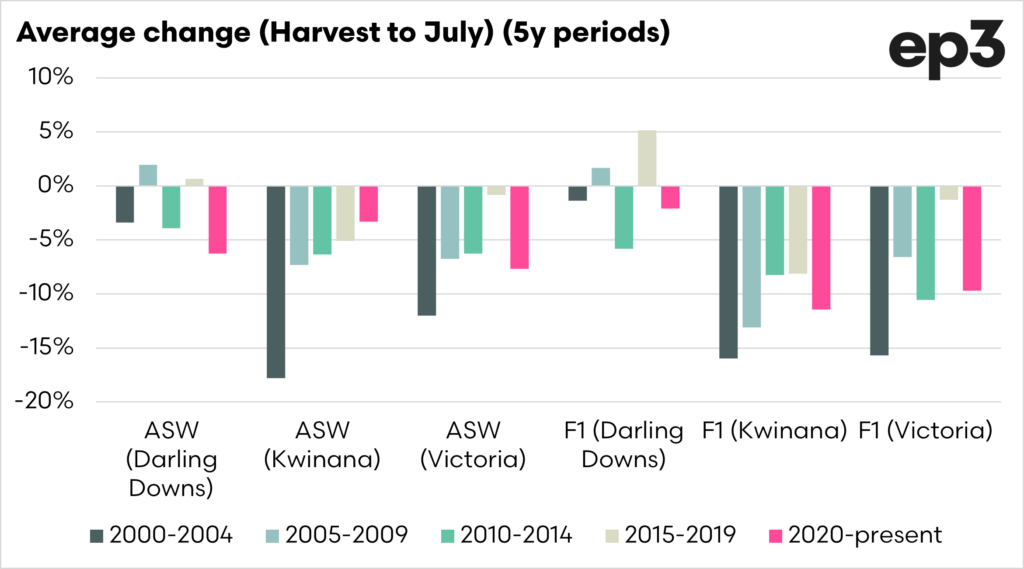

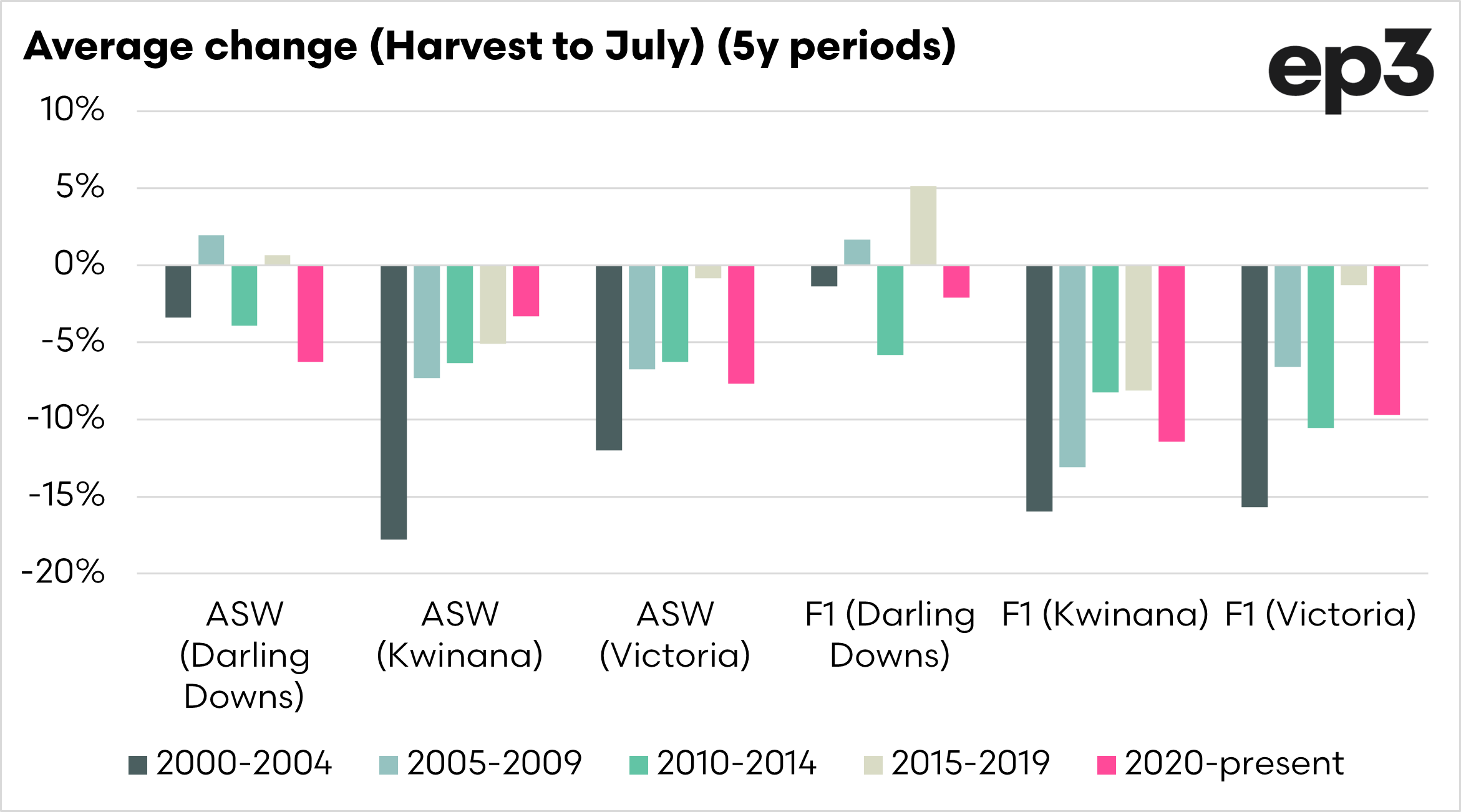

If we look at the charts above, the price change (incorporating the cost of carry) shows that it is better to sell at the end of harvest in most years.

The chart below shows the average for each five years since the turn of the century.

Typically, the experience has been that in holding onto grain post-harvest, the price increase doesn’t necessarily beat the cost of carrying the grain.

I want to point out that this is a rudimentary analysis, looks at averages of price change, and places an arbitrary A$4.50 per month carry.

Some may have cheaper (or more expensive) carry.

The lesson I really want to portray is that grain markets are never set and forgotten; no strategy works every year.

There are years when it will work to your advantage and years when it won’t. Some points to always consider:

- What is your cost of carry? If the price increases but doesn’t cover that, then you are going backwards.

- What is your market view or those of your advisors/analysts? Are we coming into a year of higher supply?

- Where else could you put the money that would be a better investment?

- Also talk to your account to see if there is any tax benefit from holding off until July.