You’re oil I need.

The Snapshot

- Diesel prices remain extremely high, increasing the cost burden on farmers.

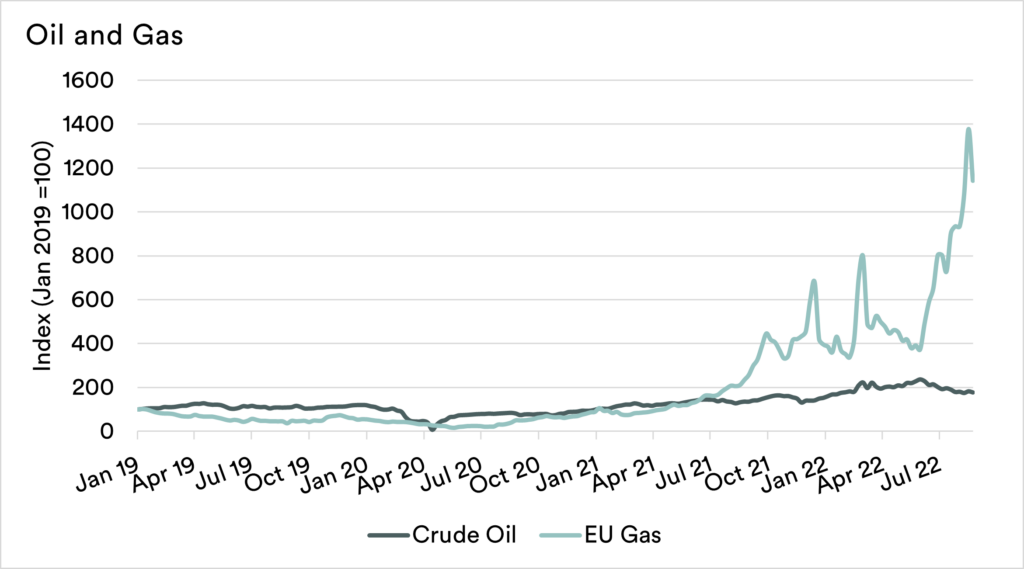

- Natural gas prices have increased due to activities by Putin. This will increase the cost of fertilizer.

- Crude oil has come under pressure due to recessionary fears and the associated drop in fuel demand.

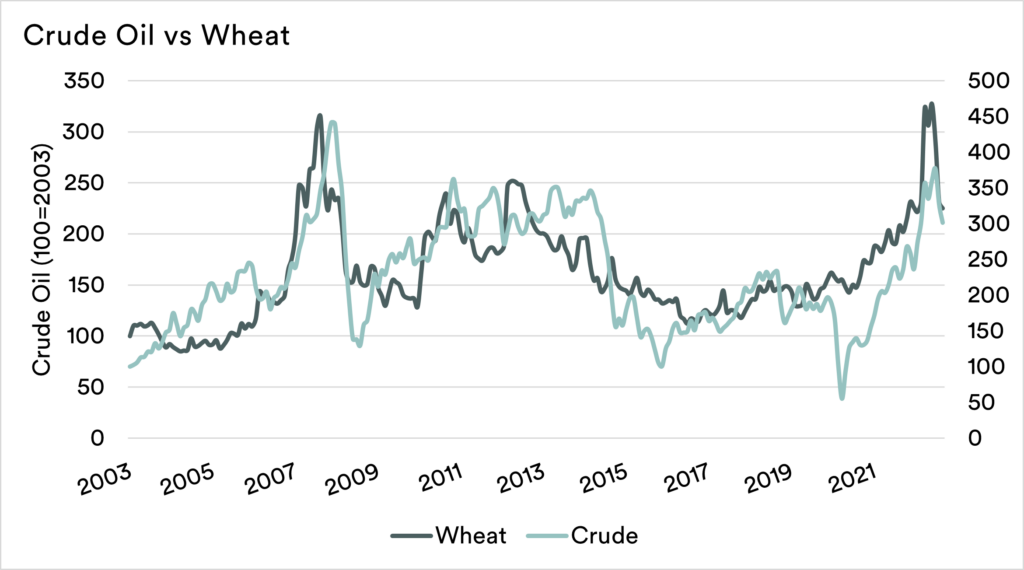

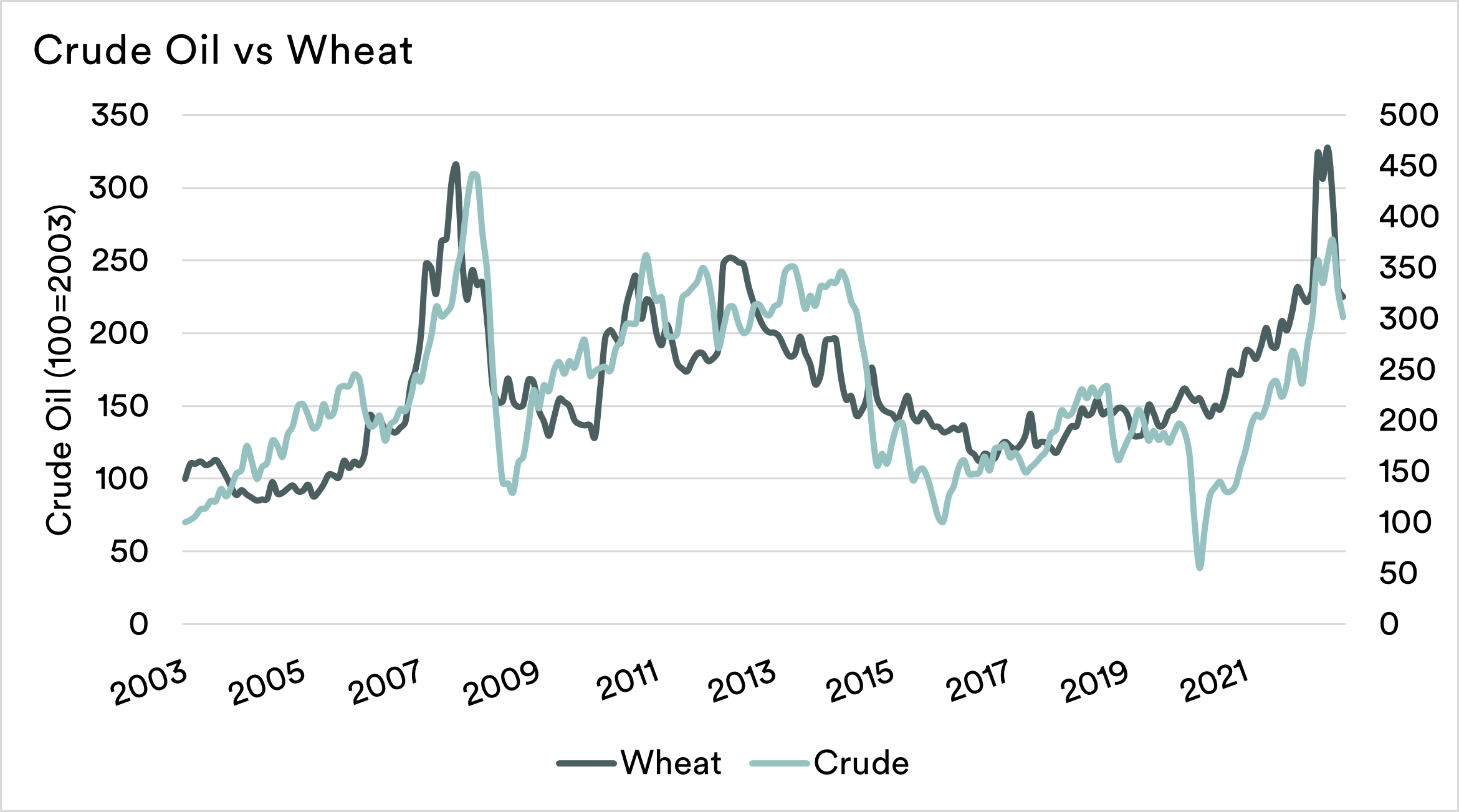

- Crude oil and grains trend together.

The Detail

Commodities don’t generally operate in isolation. We discuss this a lot on EP3 and our separate hobby podcast AgWatchers.

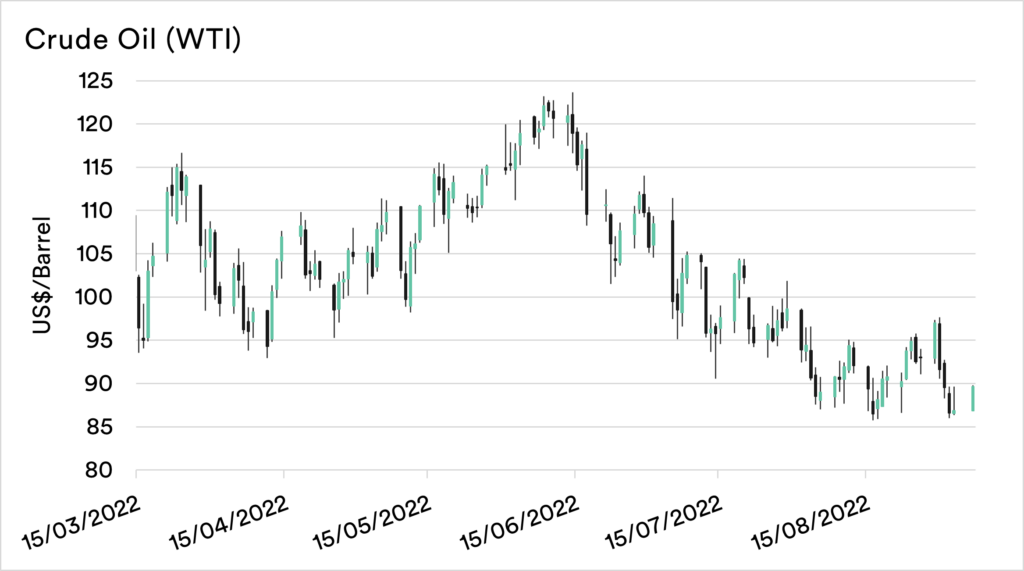

One of the major commodities of note is crude oil. It is a driver, quite literally, of the global economy. In recent weeks, I have highlighted the risk coming from increasing gas prices in Europe on our fertilizer price (here & here). However, the crude oil market has been moving in the opposite direction.

Fears of a global recession and reducing demand for fuel have seen prices of crude fall from recent highs. Governments around the world have been attempting to reduce inflation. One way is by increasing interest rates, curtailing consumer demand.

This has led to many consumers reducing their demand, which is seen through reducing petrol demand in some of the world’s largest users.

What does this mean for grain growers in Australia?

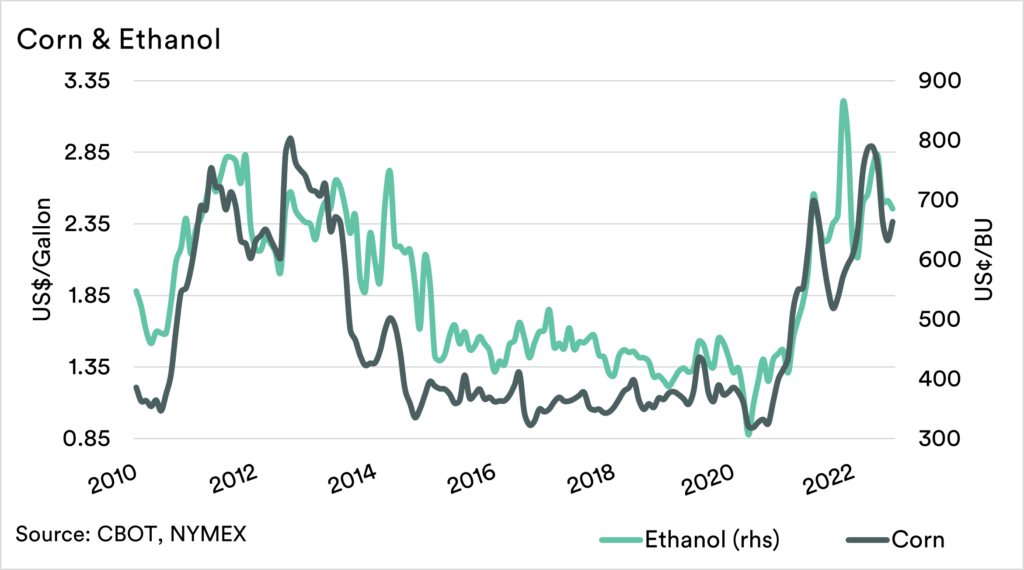

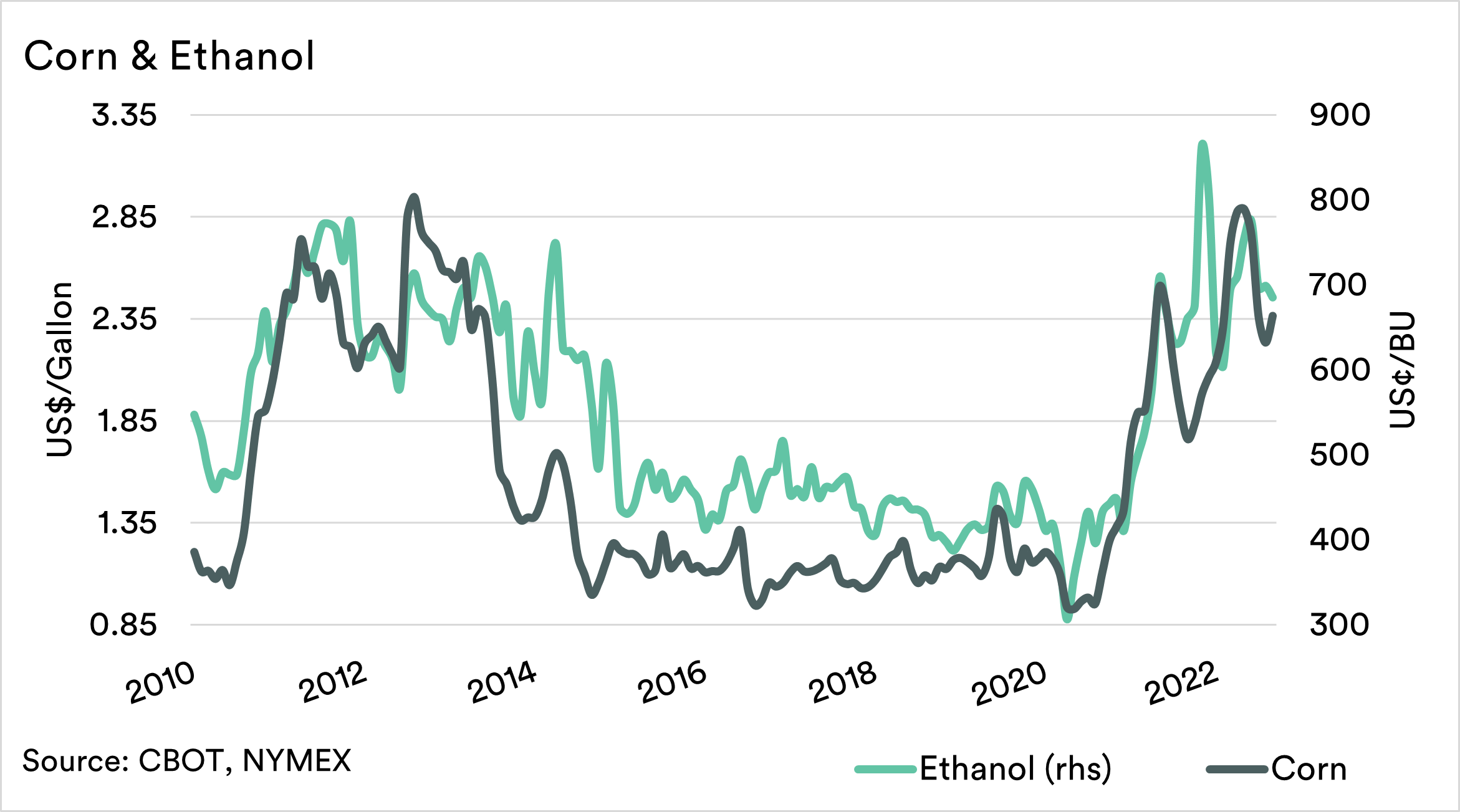

There is a close trend in the movement of crude oil and wheat. Over history, they have tended to ebb and flow in the same direction. This is in part due to our friend corn.

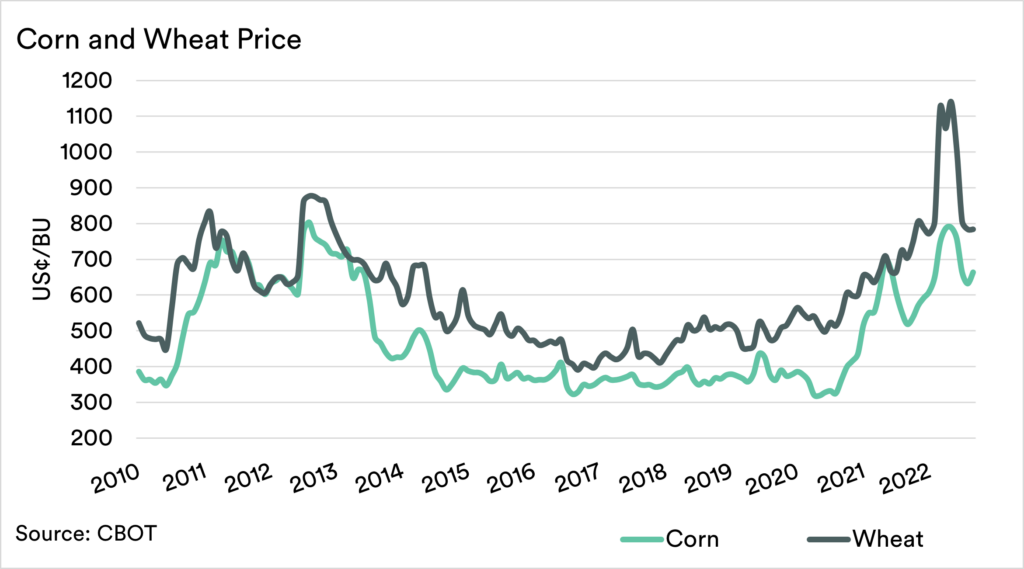

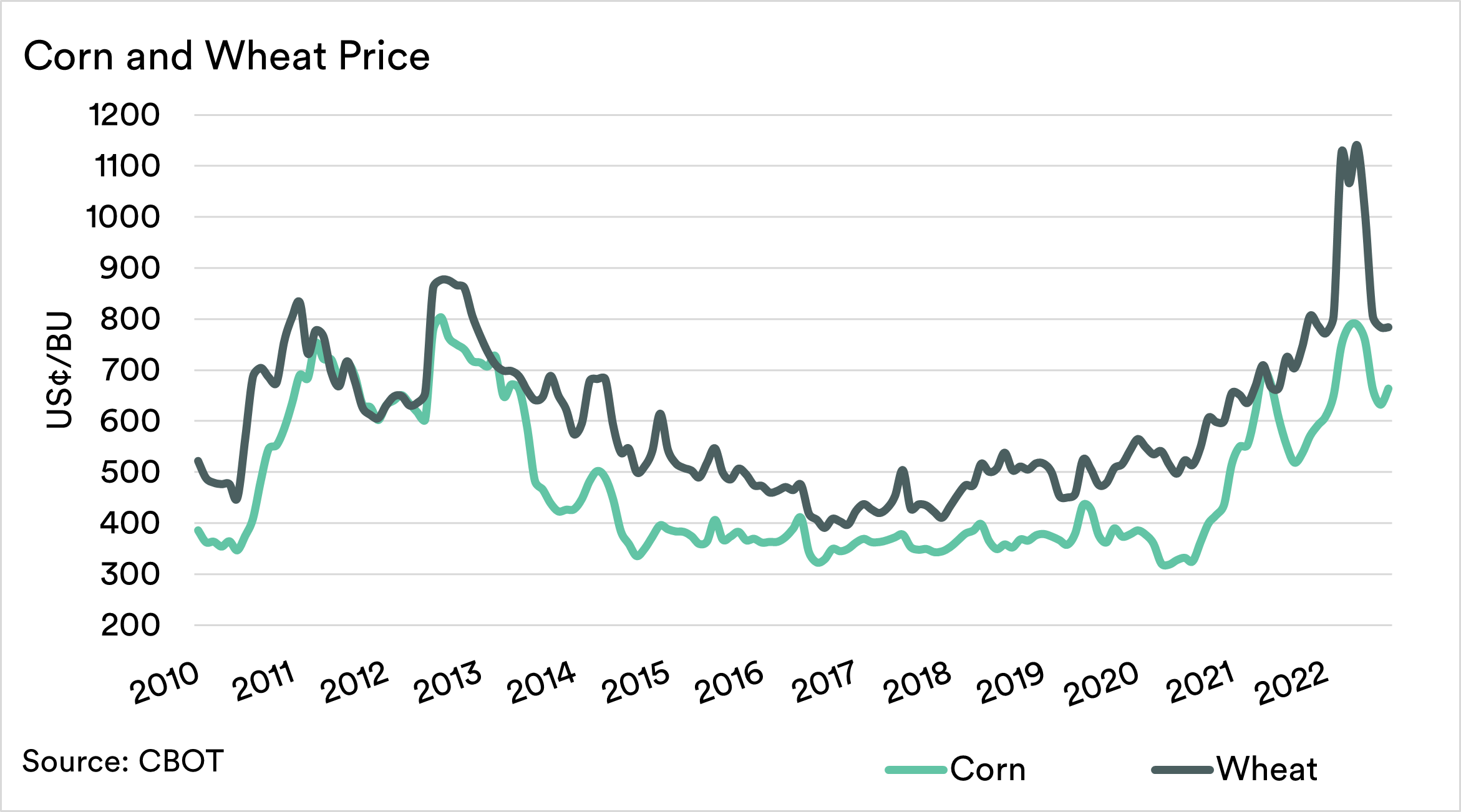

The association between wheat and corn is well documented, and we regularly look at this in our articles. Corn and wheat are interchangeable in many instances (feed).

Over time, movements in the price of these two grains tend to follow one another.

So let’s run it over

There is a linkage between crude oil prices and wheat through its association with corn/ethanol. So there are some potential positive messages from increasing crude oil. It may be that farmers are better off with more expensive fuel if it means higher prices for our grain.

OPEC has overnight agreed to curtail oil production, which has resulted in a 3% lift in crude oil values. Crude oil has fallen but has remained at high levels compared to recent years, albeit still well behind natural gas.

It’s a volatile time, but crude oil is a reasonable indicator for a proportion of the movement in grain prices.