Australian urea update and census findings

The Snapshot

- Urea pricing in Australia has dropped slightly in April, but significantly down from February.

- The fertiliser landed model is around the A$670 mark.

- Urea affordability is still in an acceptable range, especially for Canola

- Demand is low at the moment globally for urea

- The initial findings of our fertiliser census are interesting

- Prices quoted to farmers usually are trading at around the landed price plus 18%.

The Detail

EP3 has been at the forefront of ag market transparency in Australia. We were the first to publish a model showing the price of urea landed in Australia.

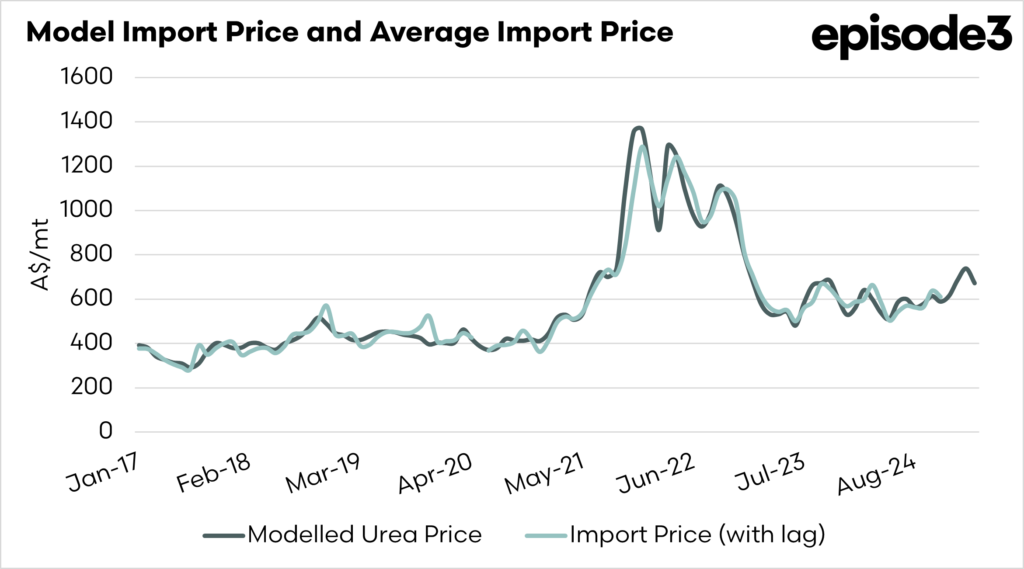

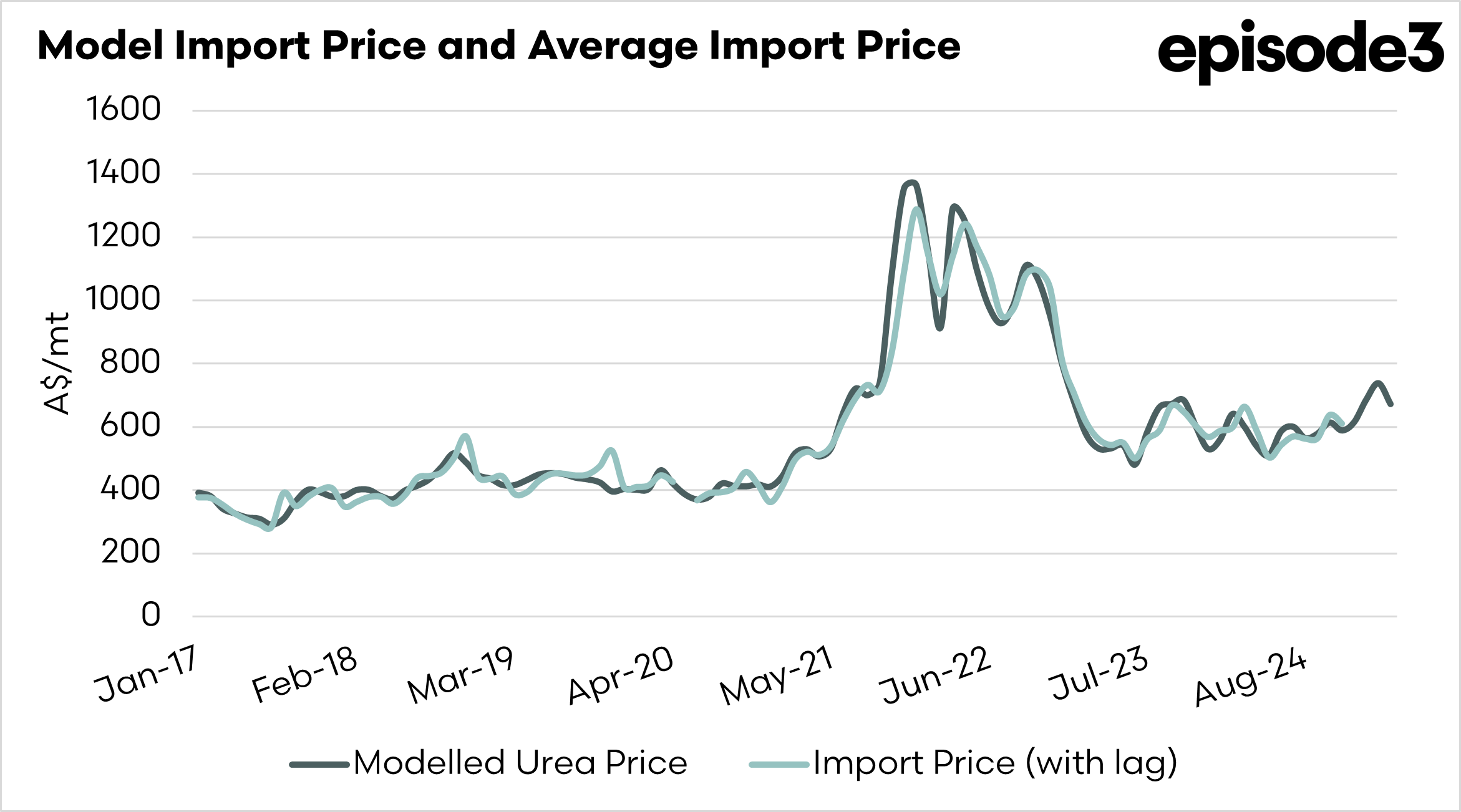

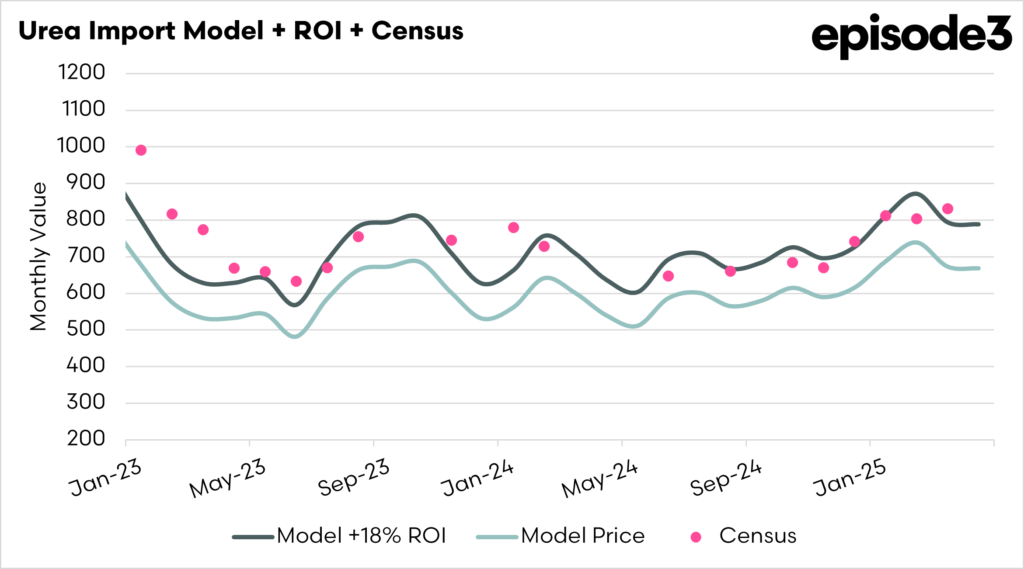

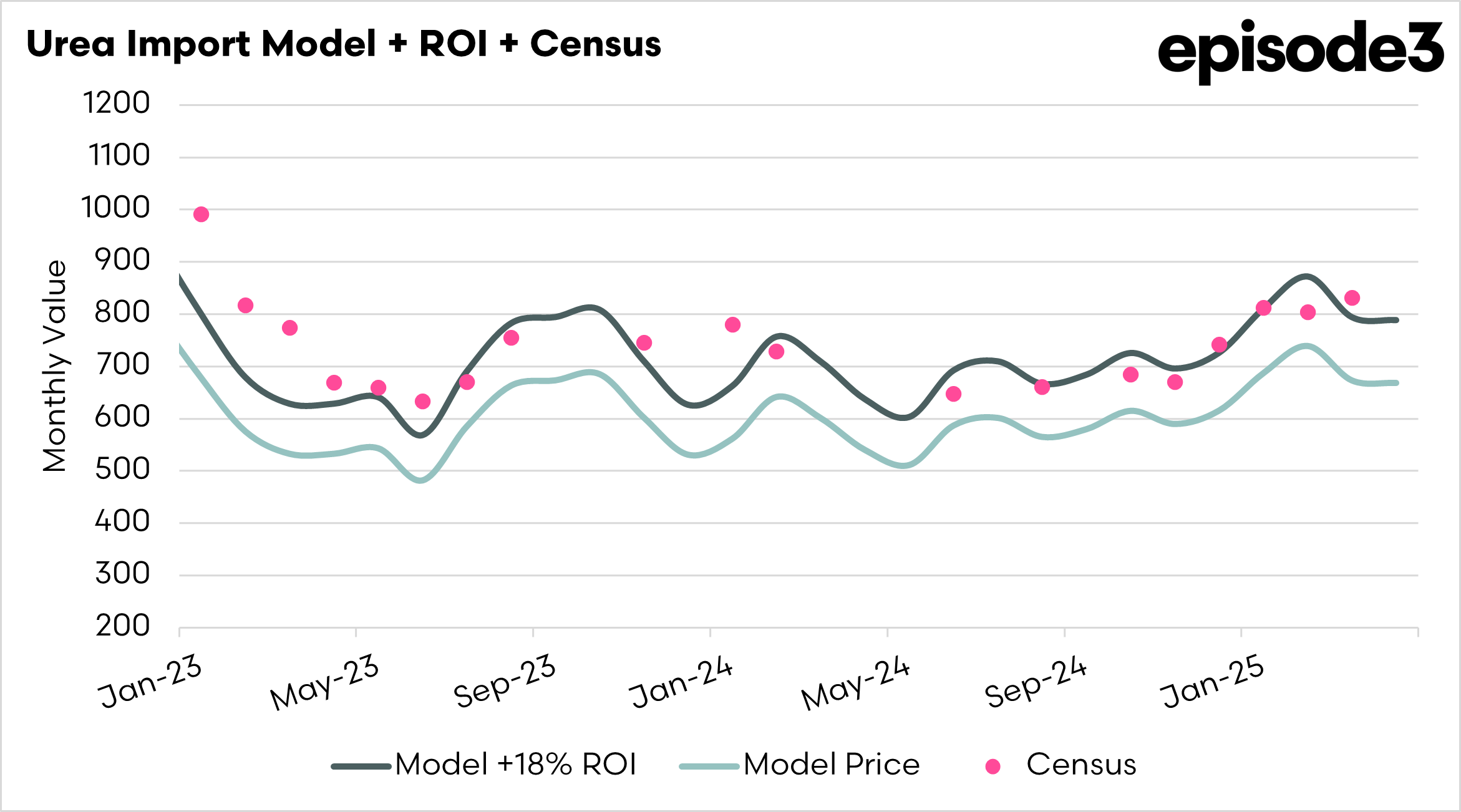

This model is shown below against the average price of urea imported to Australia. This chart vindicates that the model is highly accurate for our initial requirements, which were to provide a trend on the actual price of urea in Australia.

The fertiliser model currently shows a landed price of around A$660-690 for April, which is significantly lower than recent highs during February.

Demand for urea globally seems low at the moment, with only Australia as the major buyer at the moment, whilst the market awaits further Indian purchases.

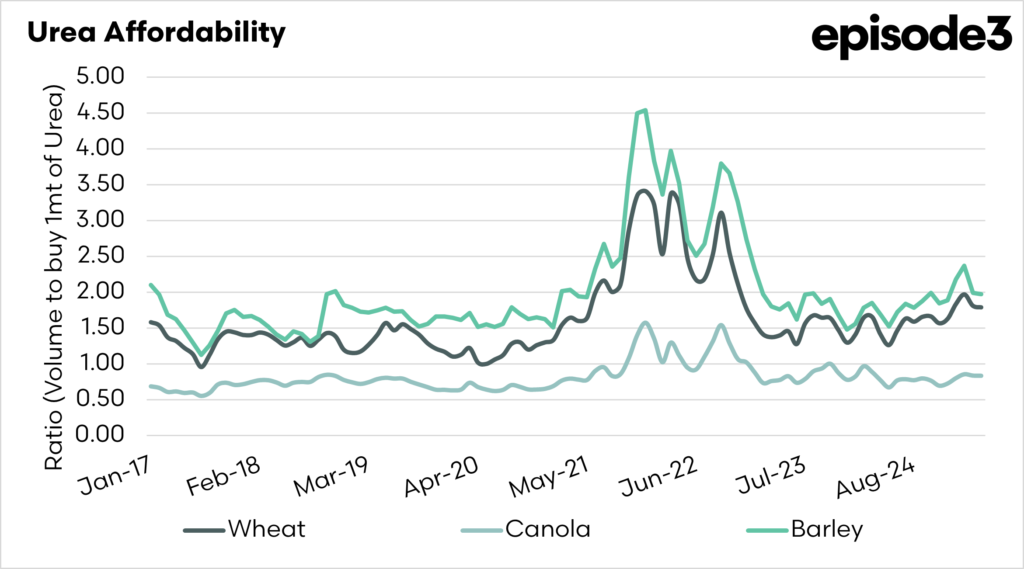

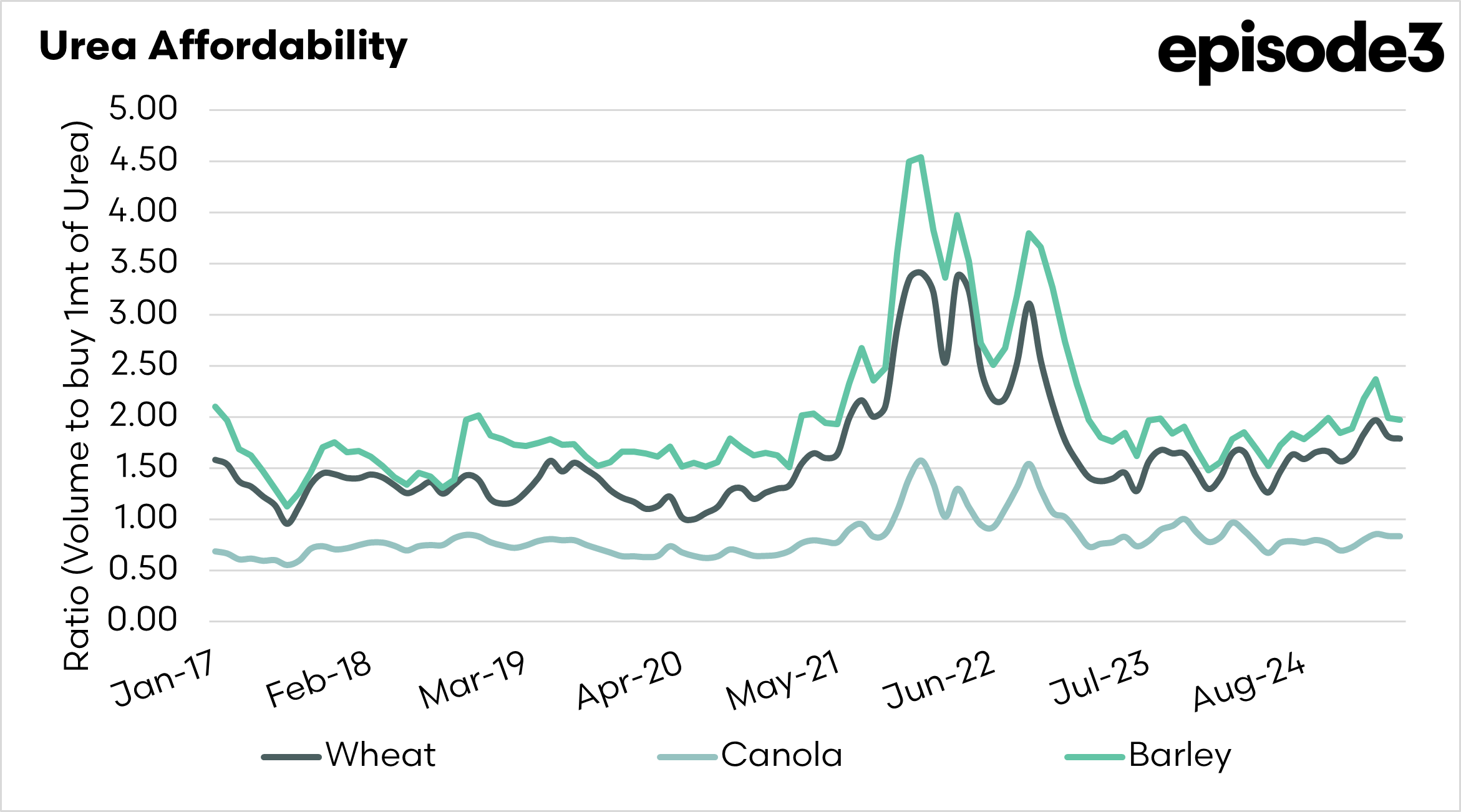

The affordability indexes we produce for urea measure how many tonnes of grain you would need to sell to buy a tonne of urea. During April, the affordability index was largely unchanged but significantly improved since February. This is really the key measure.

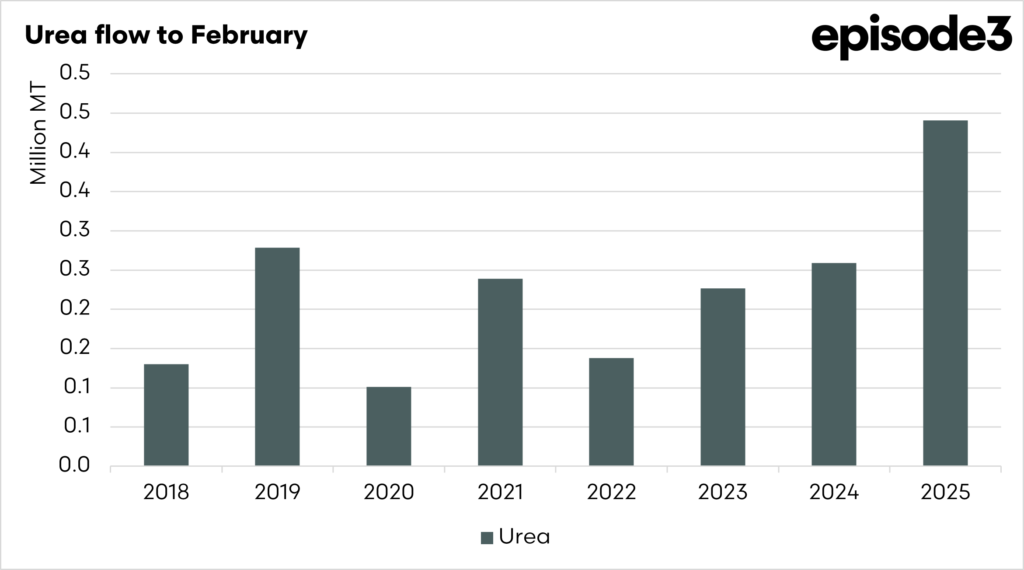

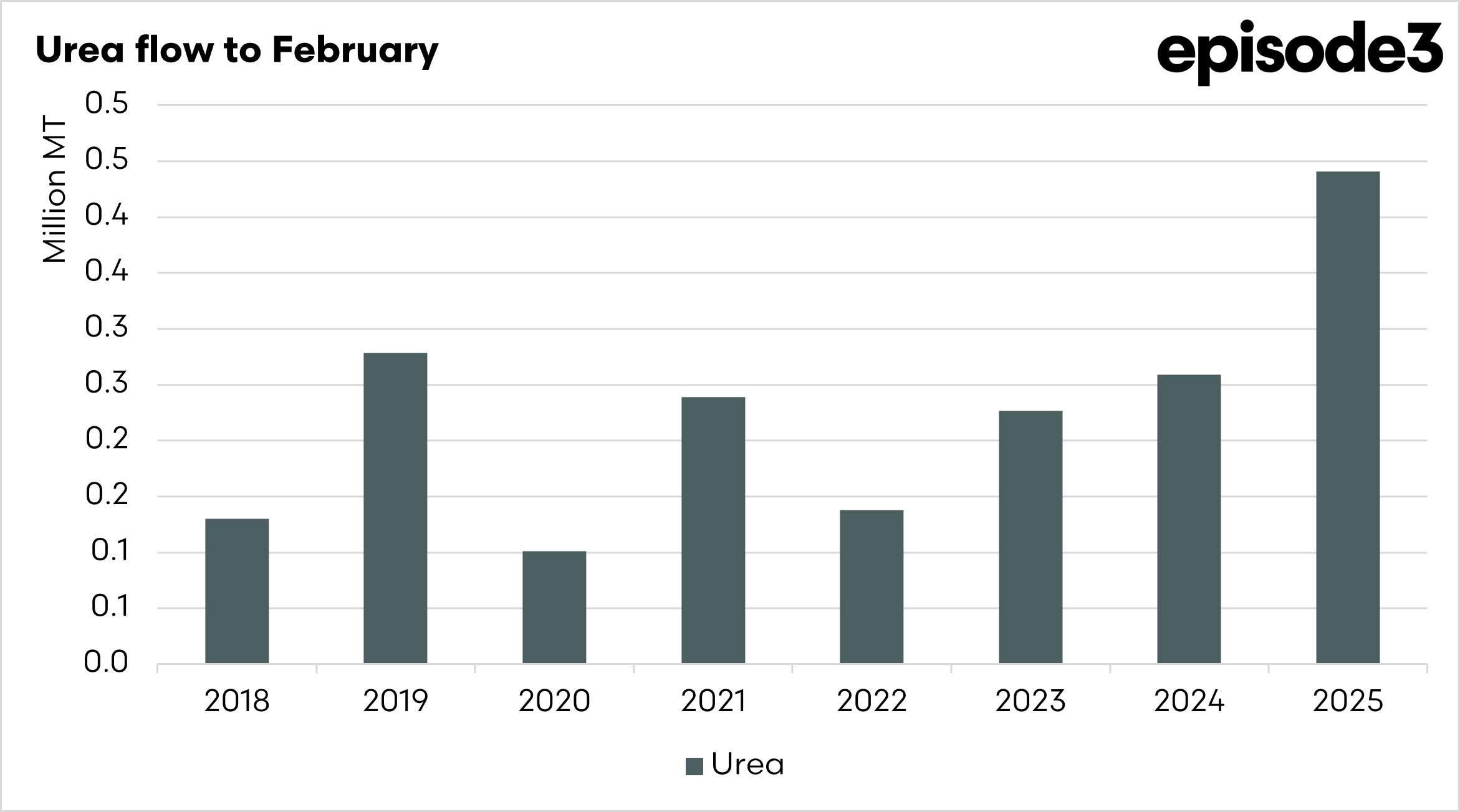

The imports of Urea in Australia have always been a contentious issue, with many years seeing a reported shortage of urea in the press. We regularly report on urea imports, especially during the period of peak import.

Last year was a record year of imports, with 3.8mmt of urea imported, and despite this record volume, we heard rumours of shortages.

This year to the end of February, Australia has imported 440kmt of urea which is significantly higher than Australia has previously imported during the first two months of the year.

We will be keeping an eye on things to see whether shortages occur this year or not.

You will have noticed that EP3 ran a census (see here) in which hundreds of our readers completed the form and told us how much they were being quoted for fertiliser.

We have used this to start to refine our models and continue to provide high levels of transparency into the Australian fertiliser market.

I am including an interesting finding. Anecdotally, fertiliser representatives told me that they wanted to gain about 18% return on purchasing fertiliser.

Whilst we like to use data rather than anecdotes, I thought I would plot this on our chart, along with the census price quoted to farmers.

This is shown in the chart below, with the pink dots being the average price farmers were quoted versus the model price, and the model + 18%.

Whilst I would still like more data, over the coming years to continue to refine, it does show that generally the quoted price that farmers are receiving is close to our model, plus 18%.

I’d like to thank everyone who completed the census. It has been valuable, and the more details we receive, the more we can offer the industry.

We have always mentioned that our model is just the price landed in Australia, and should be used for the trend, not the actual price that farmers will pay.

Do I think 18% is acceptable? Yes, I do. This 18% is to cover the following (plus more):

- Inspection costs

- Insurance costs

- Staffing costs

- Marketing costs

- Finance costs

- Storage costs

- Margin – we all need to make a crust

Through our model, and our analysis, we can start to pick out if the price becomes excessive.

Subsribe

Remember to subscribe to Episode3 by clicking here