China back as an exporter, and urea prices falling.

The Snapshot

- Our model remains the only publicly available pricing point for Australian landed urea.

- Our model continues to be accurate.

- Pricing of urea has softened in May.

- China has been out of the export market, but is likely to return this summer.

- Ridley have purchased IPL

- Fertiglobal have purchased Wengfu Australia.

The Detail

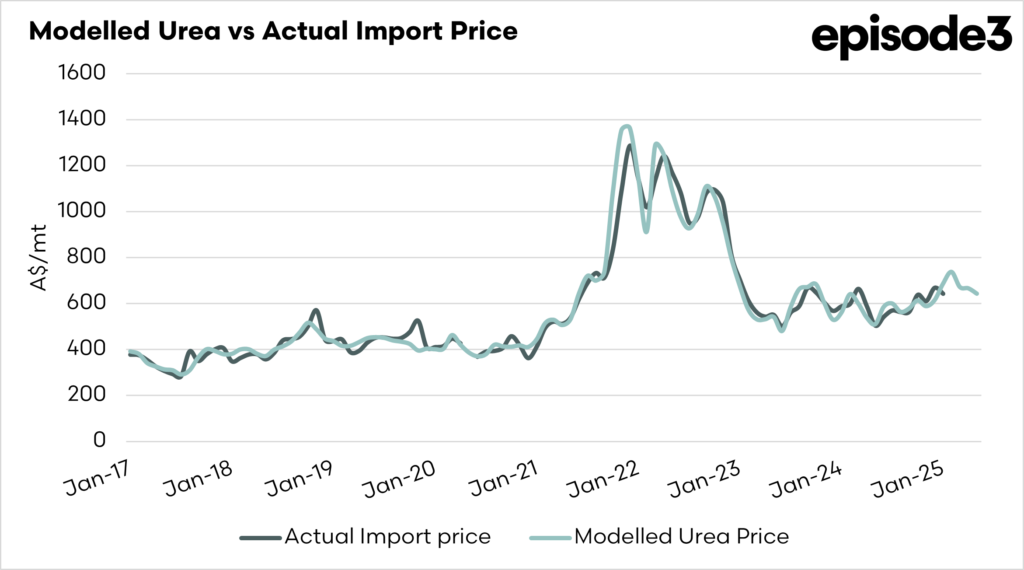

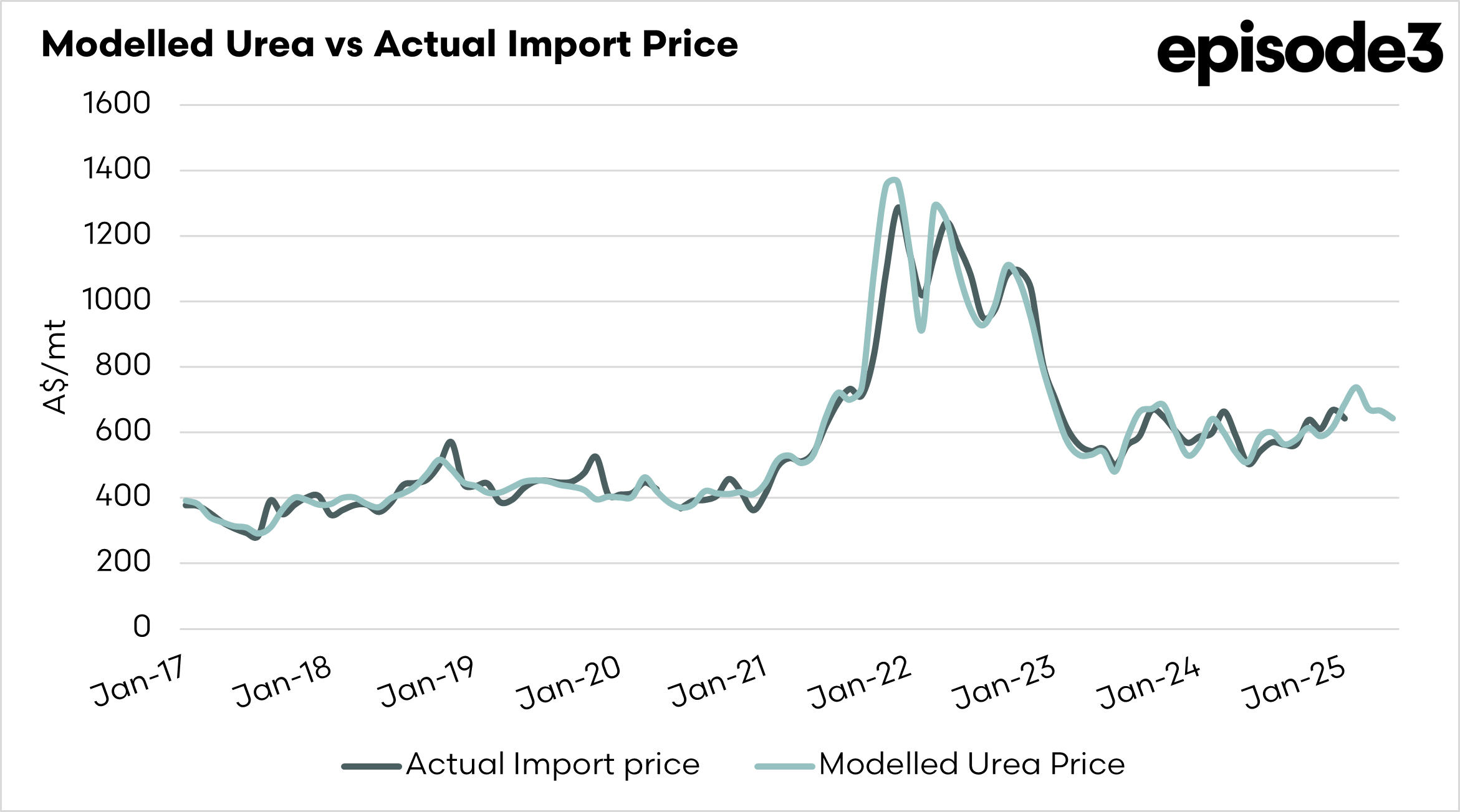

As there is no publicly available price for urea in Australia, Episode 3, for the past four years, has been producing a landed Australia model.

This model provides insight into the cost of purchasing urea and shipping it to Australia for unloading.

We compare this to the average import price quoted by ABS/Comtrade, and as shown in the chart below, our model exhibits a strong relationship and displays an extremely strong correlation.

The landed price for May is currently approximately A$20 below the average for April, at around A$640-50. This remains higher than the pre-spike level.

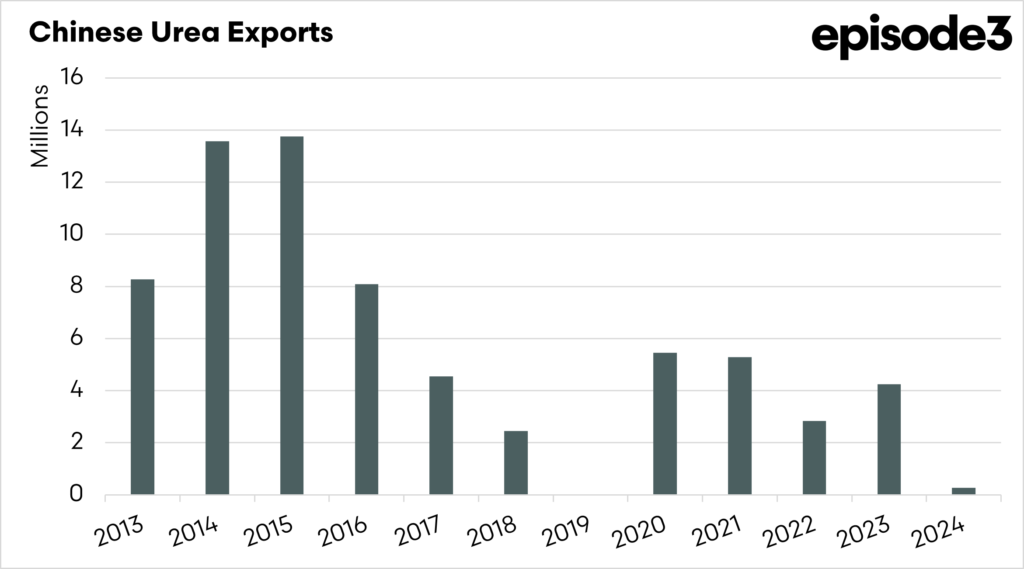

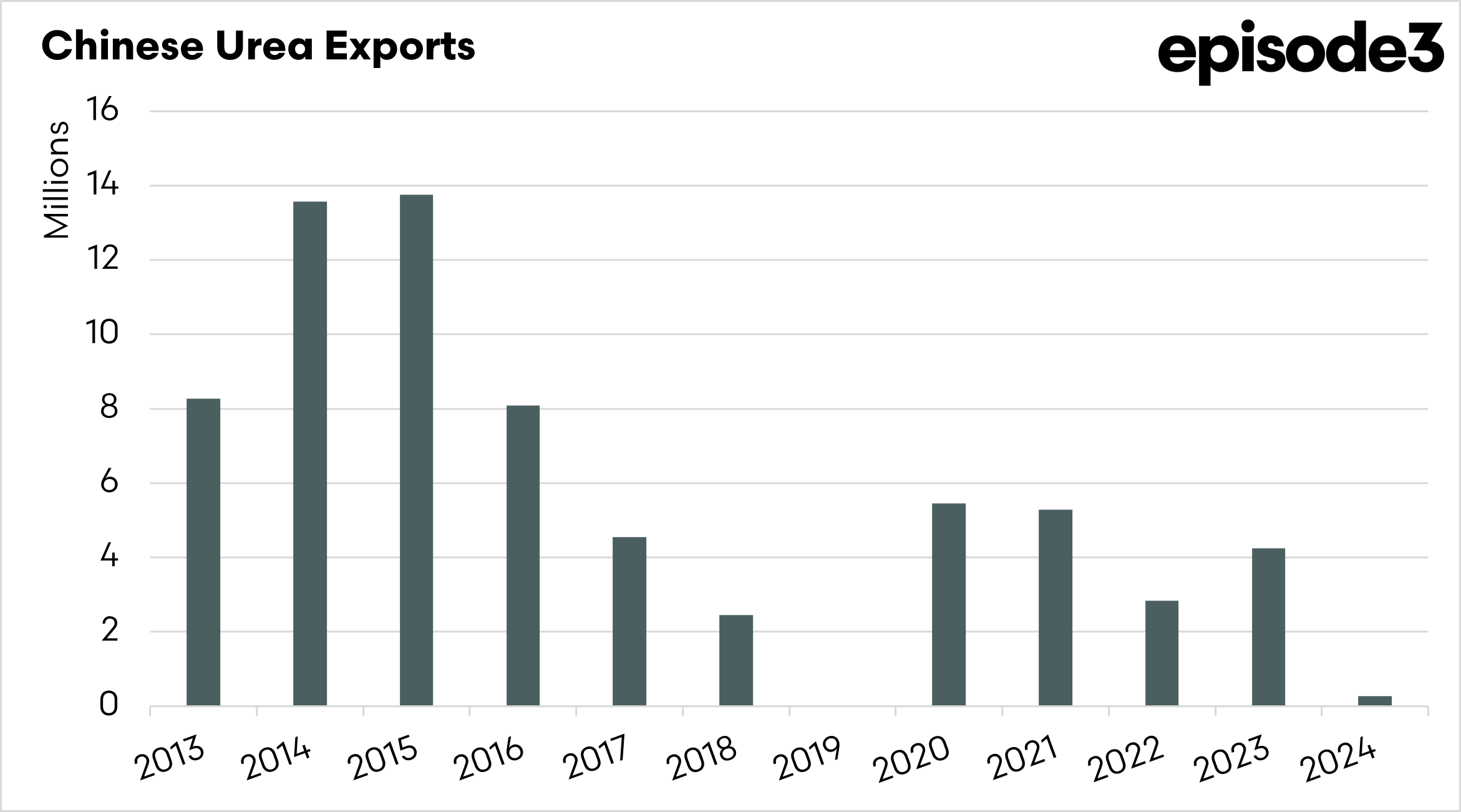

We expect that urea prices will come under pressure in the coming months as China is expected to allow urea exports in the northern hemisphere summer. China has been inconsistent in its approach in recent years, but the market was already soft, and this additional volume has the potential to push pricing lower internationally. Whether that gets reflected here is another question.

The chart below shows the volume of exports that China was contributing in the early and middle of the last decade, and how low they have been in recent times.

China has cut back on how much urea fertiliser it sends overseas because it wants to make sure its own farmers have enough, especially when prices are high. China has been trying to keep local prices stable so that farmers at home aren’t hit with big cost increases. To achieve this, the government has tightened export regulations by introducing additional paperwork, inspections, and even restrictions. This effort aims to prevent excessive fertiliser exports and maintain sufficient stock during the key planting seasons.

Another reason for the cut in exports is that making urea is expensive, especially when global energy prices like coal and gas go up. Since urea production depends on these fuels, the cost of making it has risen, and China didn’t want those high costs passed on to its farmers. By keeping more urea at home, China also has more control over its food supply and farming sector. As one of the world’s largest fertiliser producers, when China exports less, it affects global prices and availability for everyone else.

China coming back into the market should add large volumes of additional supply, softening prices. That being said, it is worth remembering that China can change its policies at the drop of a hat.

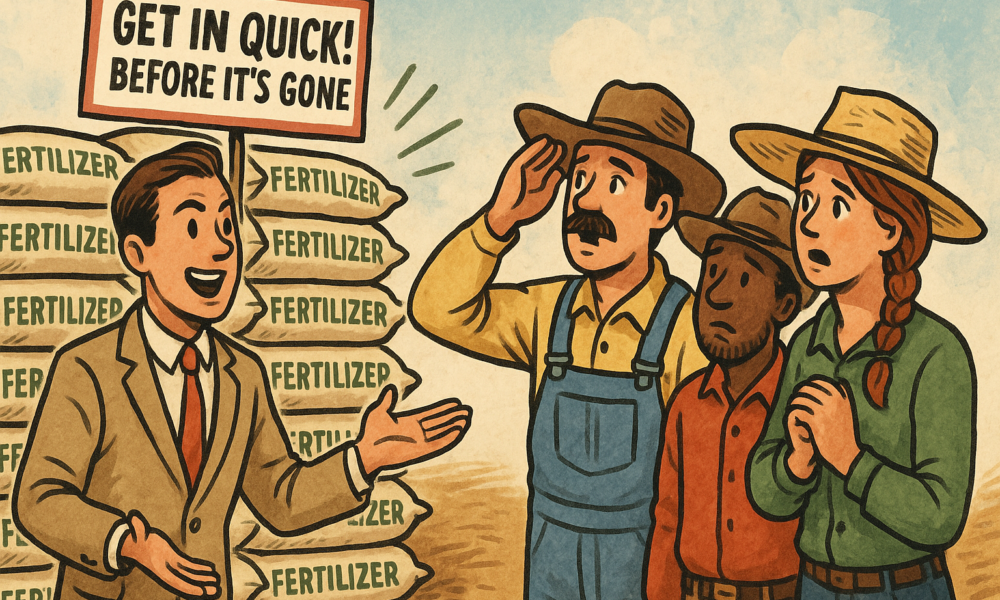

At an Australian level, the critical part is that we get the imports that we need to grow the crop. It seems that most years, we get told that supply is going to be tight. “Get in now, before it is gone” is what we usually hear. This year, we haven’t heard much of that dialogue from the fertiliser salesforce.

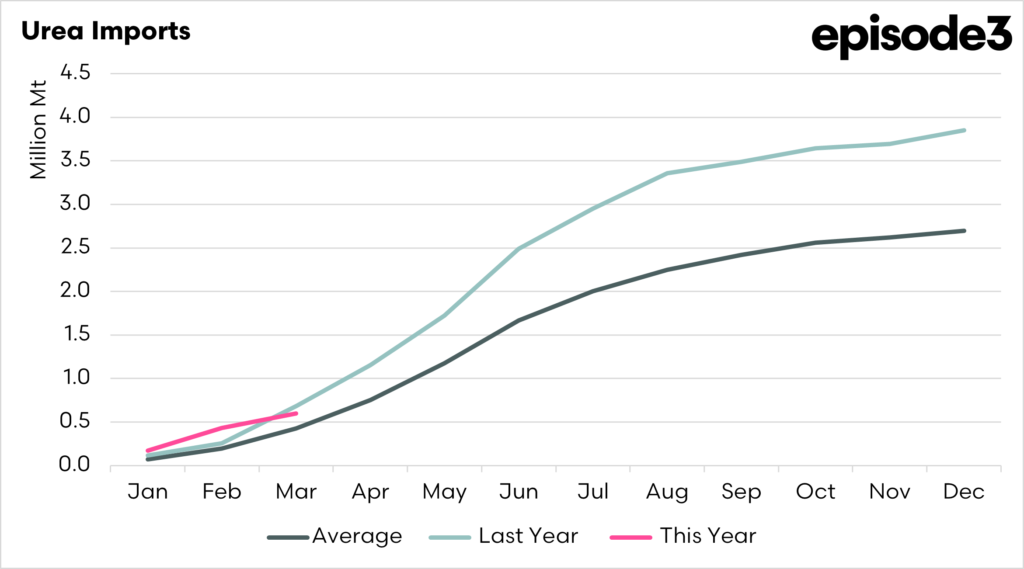

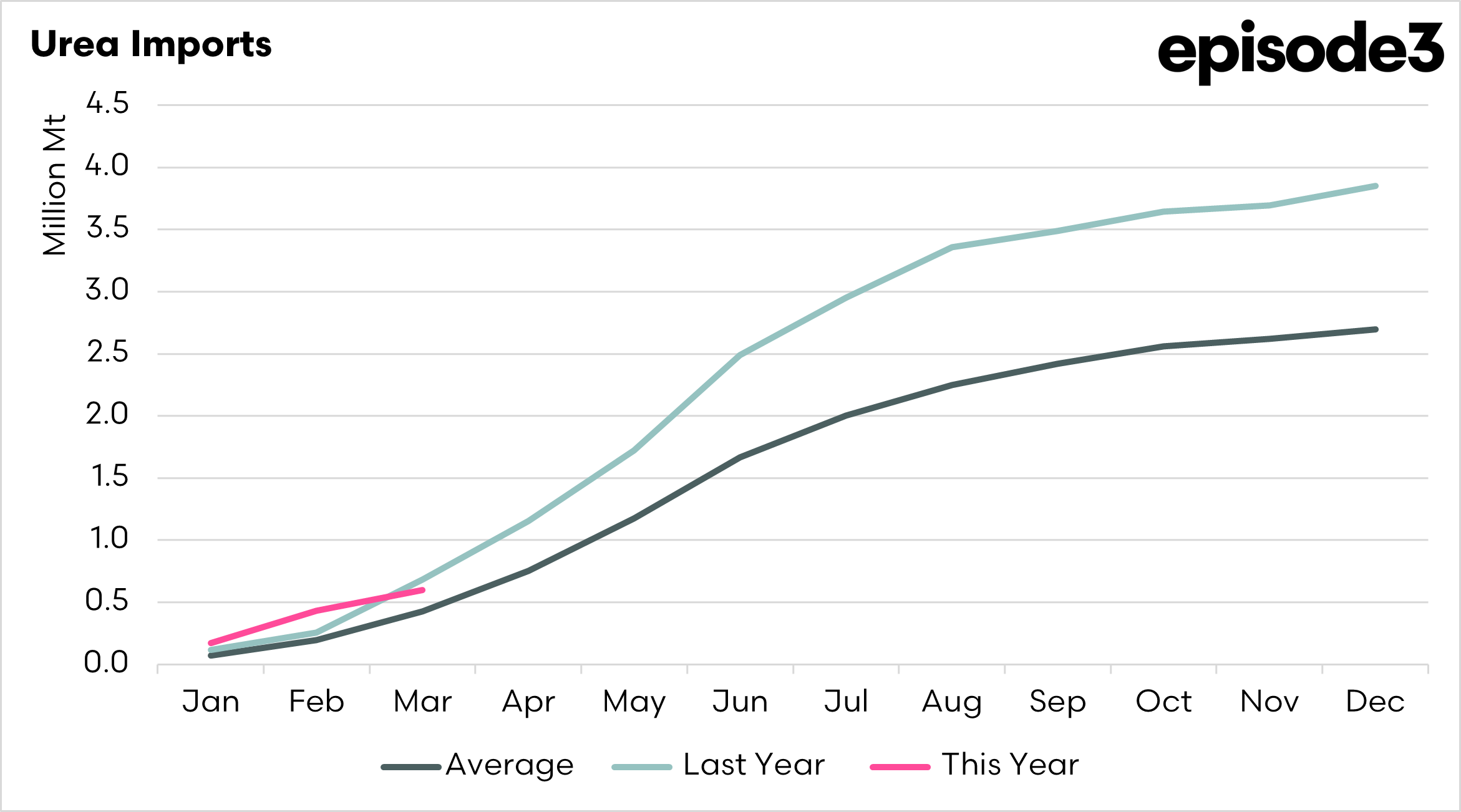

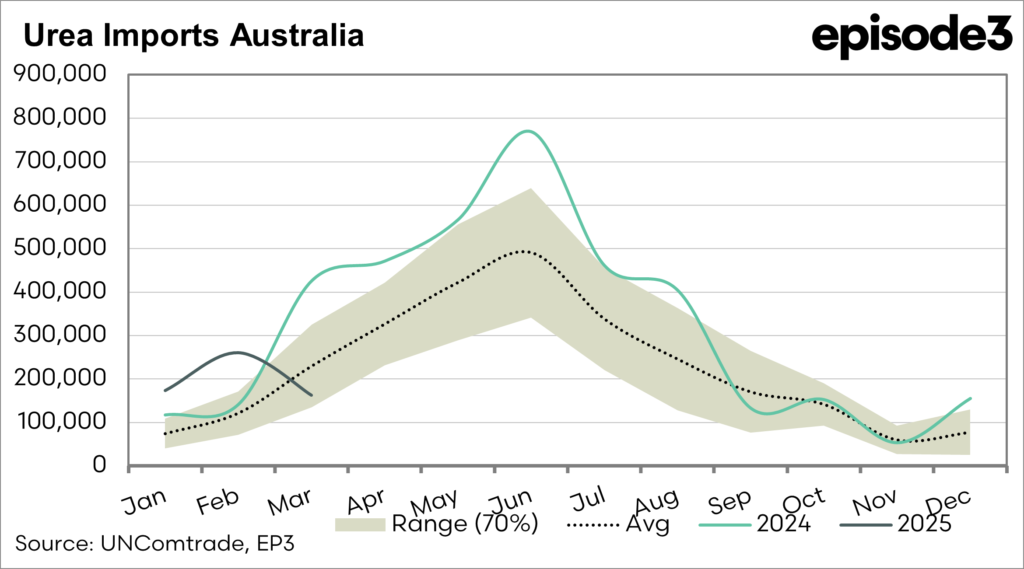

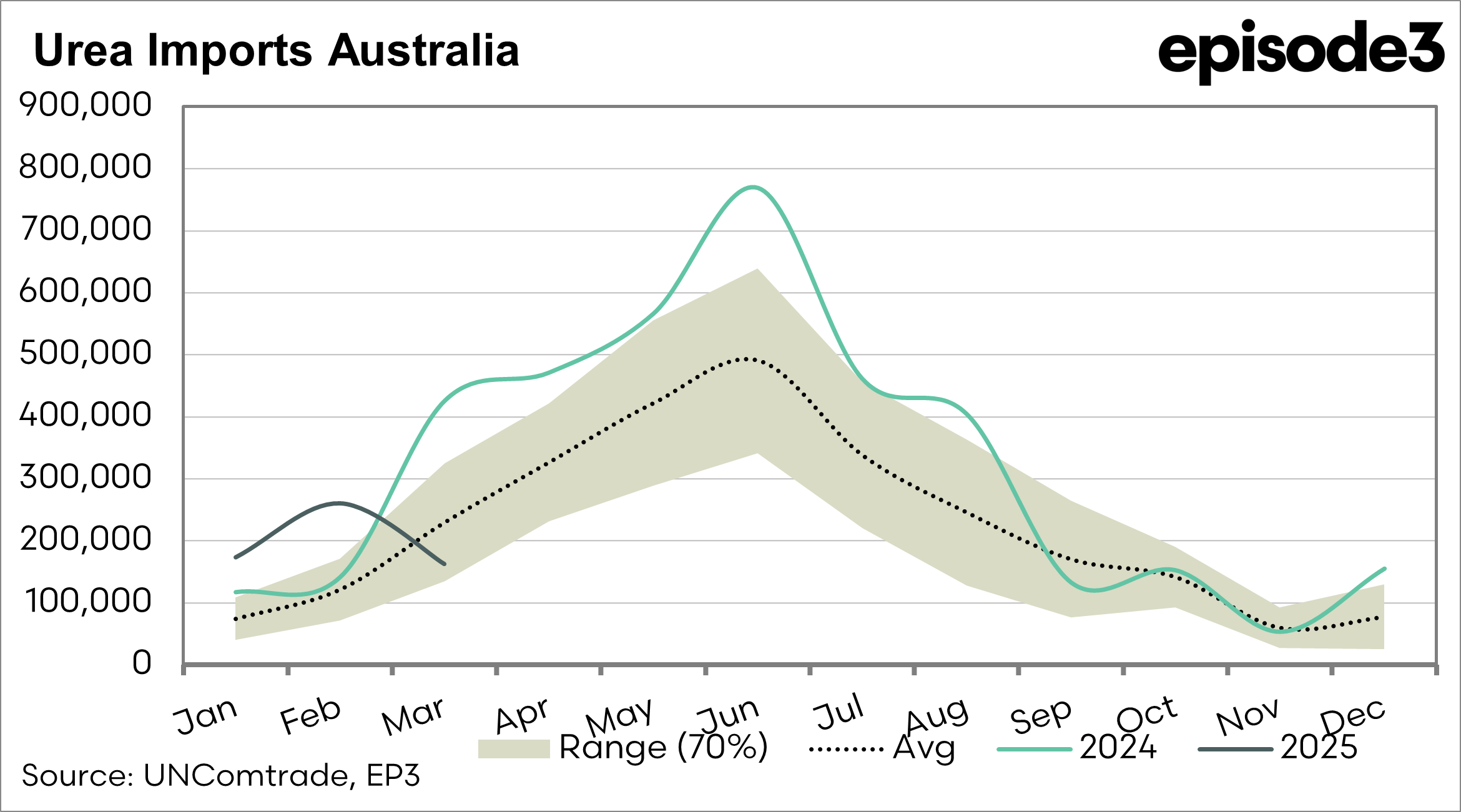

The imports so far this year, up to the end of March, the most recent data, show that volumes are below last year, but last year was a record year of imports. The fall on last year is still minimal overall, and is the second highest on record for the first three months of the year.

The peak import month tends to be June, so we will keep you apprised of import volumes throughout the year.

In local news, there has been some changes in suppliers.

- Ridley, largely an animal feed company, have purchased the Dyno Nobel fertiliser business (IPL) distribution business.

- This doesn’t include the supply contract for 2.2mmt of urea from the Perdaman facility.

- Does not include Phosphate Hill

- Fertiglobal have purchased the distribution assets of Wengfu Australia. Wengfu’s eight warehouses distribute around 750kmt of urea per year.