Fert Update: Conflict impact, record imports and local pricing

New Updates

Episode 3 has been reporting on Australian fertiliser markets for a long time, and in this update, we are changing the format slightly, to become our weekly updates. Our format will cover the main points impacting the fertilizer market, along with updates on local pricing and imports.

Our fair value model for pricing, which has recently been revised and improved after the you all filled in our fertilizer census, which you can continue to fill in here

Market Drivers

Severe Urea Production Halts in Egypt and Iran

A complete halt in Egypt’s urea production driven by a cut-off in natural gas supply following Israel’s emergency shutdown had removed a significant export source from the market. Simultaneously, Iranian gas infrastructure has suffered heavy damage from Israeli strikes, likely curtailing urea and ammonia output further. Together, these events have tightened the global nitrogen supply balance and increased supply chain risks.

Indian Urea Tender and Global Price Benchmarks

India’s major urea tender has become a central reference point for market sentiment, attracting 23 participants but with final volumes and pricing still unclear. Reports suggest that some international sellers are making highly aggressive offers, but most are holding out for higher levels, citing tighter summer supply and elevated costs. The tender result will significantly impact global urea prices and establish benchmarks for the coming months.

Ongoing Supply Constraints and Disruptions Elsewhere

Beyond the Middle East, Russian supply is under pressure following the drone strike and shutdown at Eurochem’s Novomoskovsk plant, which has removed both urea and ammonium nitrate from the market. Usual seasonal maintenance turnarounds in Russia and the Middle East are further reducing export availability. Chinese exports, meanwhile, remain restricted by quotas and official price floors.

Sluggish Demand and Regional Market Nuances

Despite global supply tightness, spot demand in several regions, including Asia, remains muted, with little immediate buying interest outside India and Australia (the latter may see a demand uptick after rainfall). In Brazil, urea prices are softening due to weak demand, contrasting with the firm tone in other markets. Meanwhile, in the US, values are easing as the application season draws to a close, highlighting significant regional divergence in both pricing and sentiment.

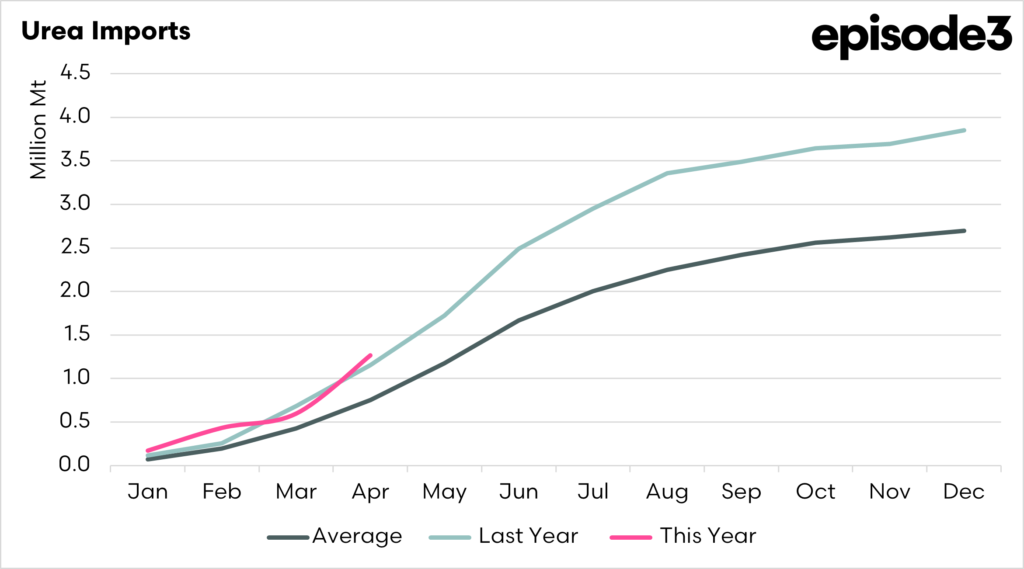

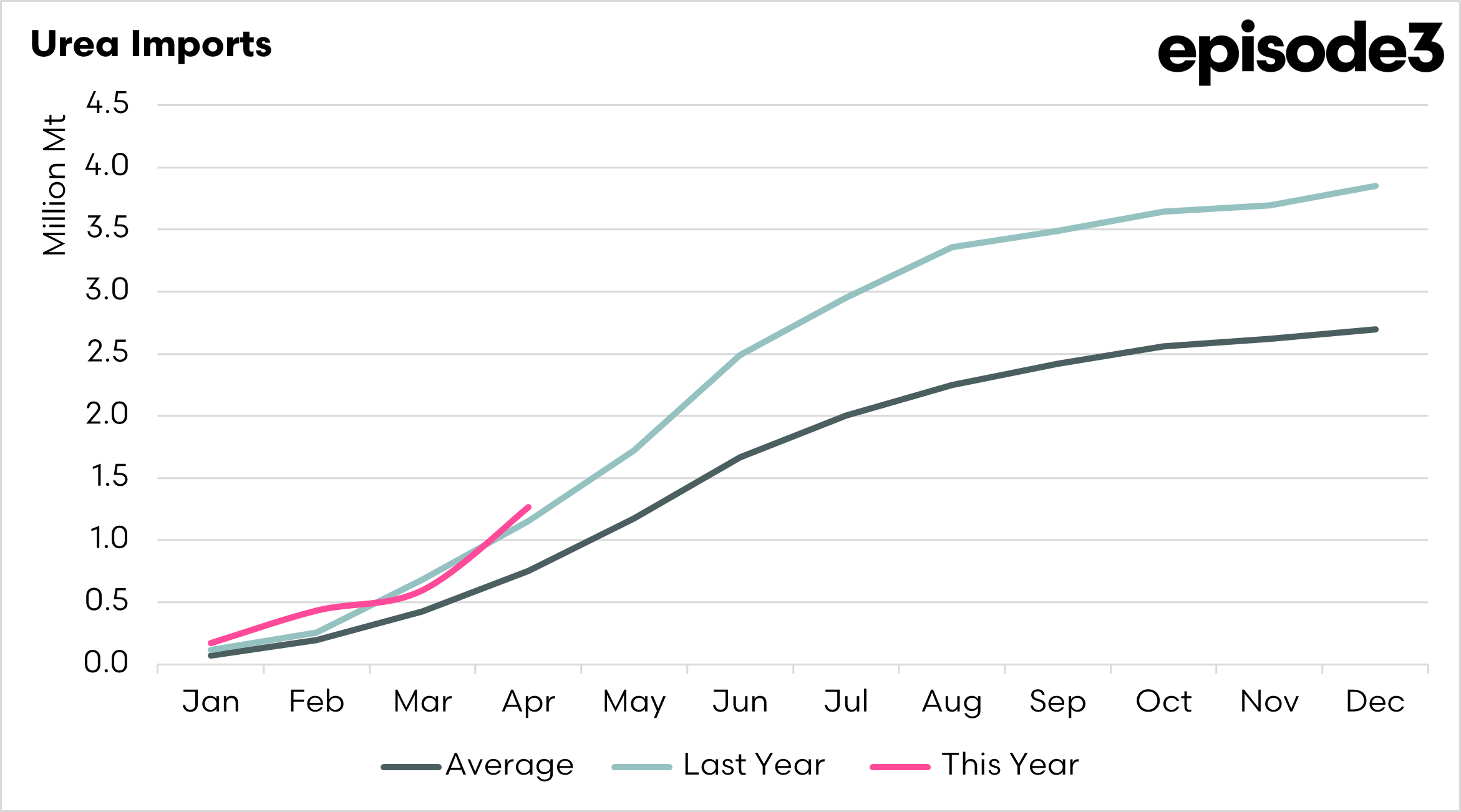

Imports

Every year, we seem to hear that urea is going to be in short supply, and that you need to get in quickly to ensure you have access to it. This fear isn’t that strong this year.

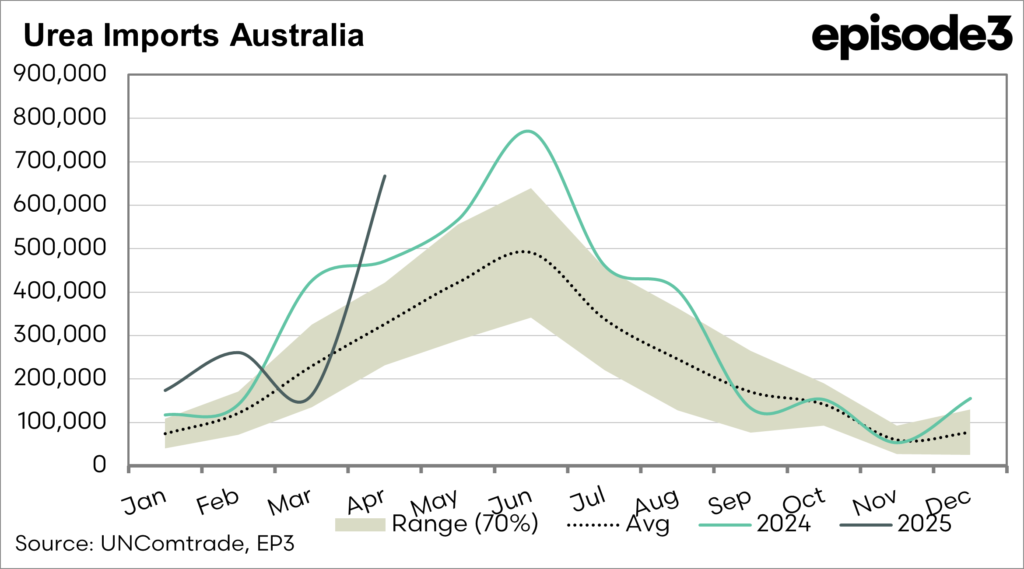

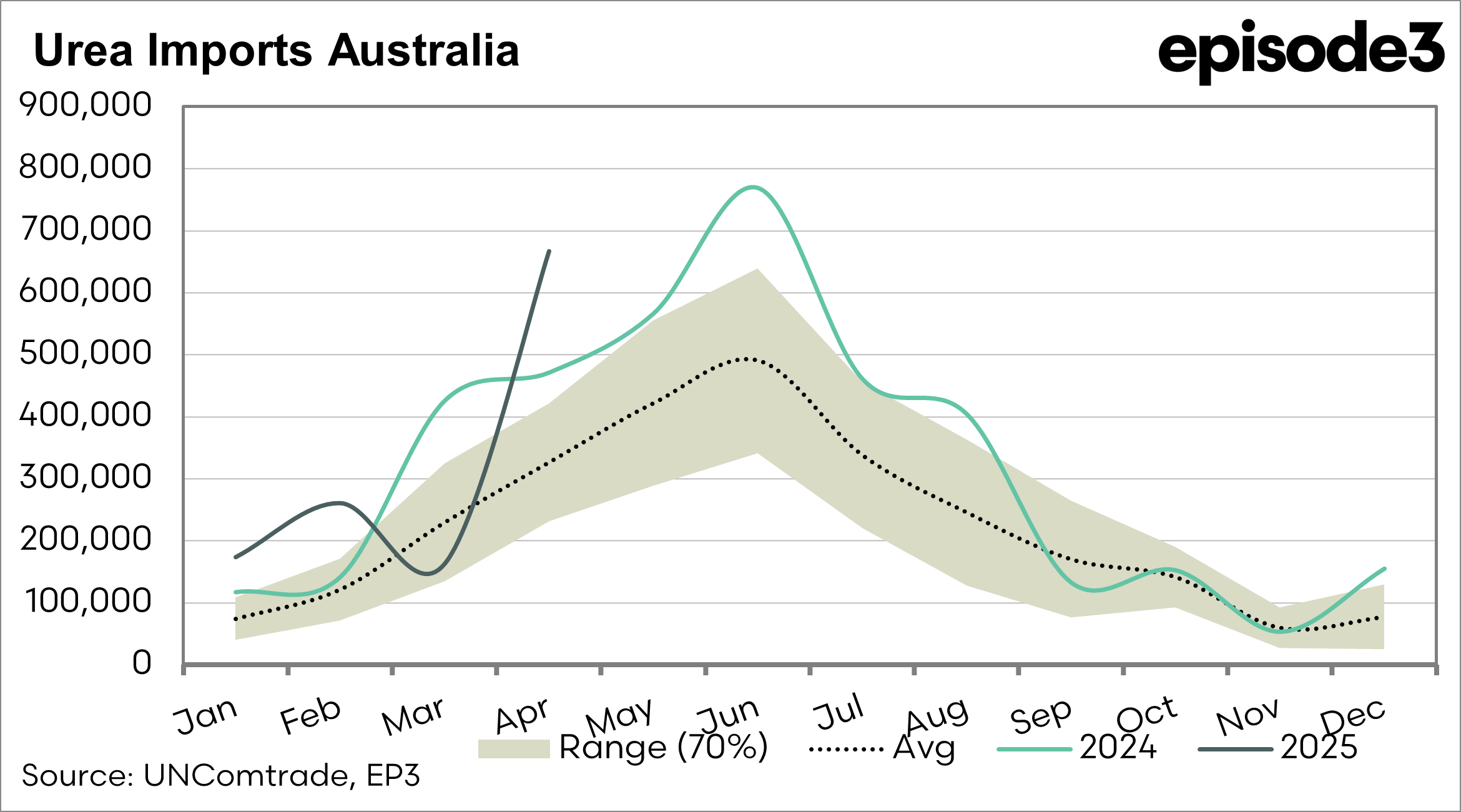

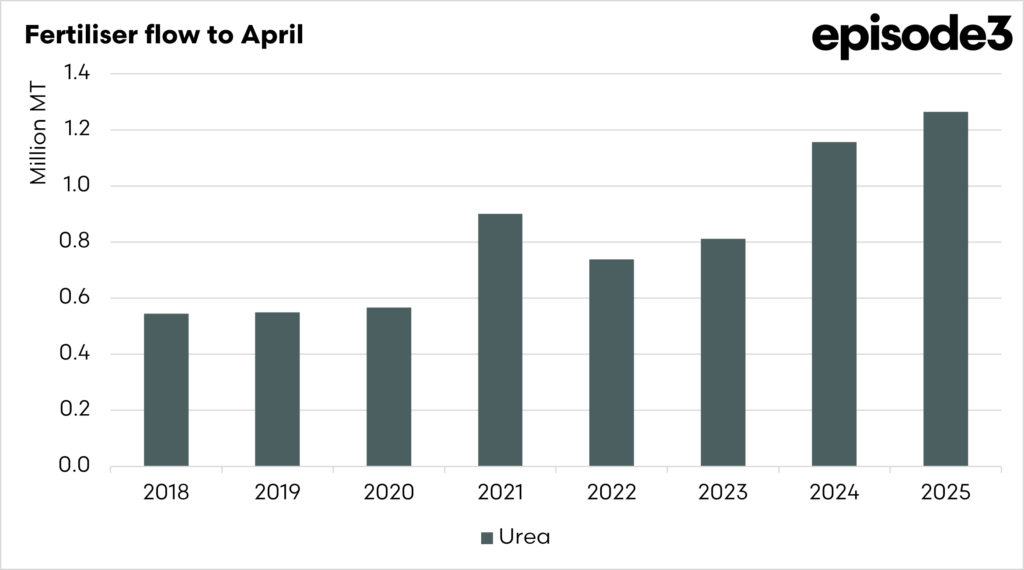

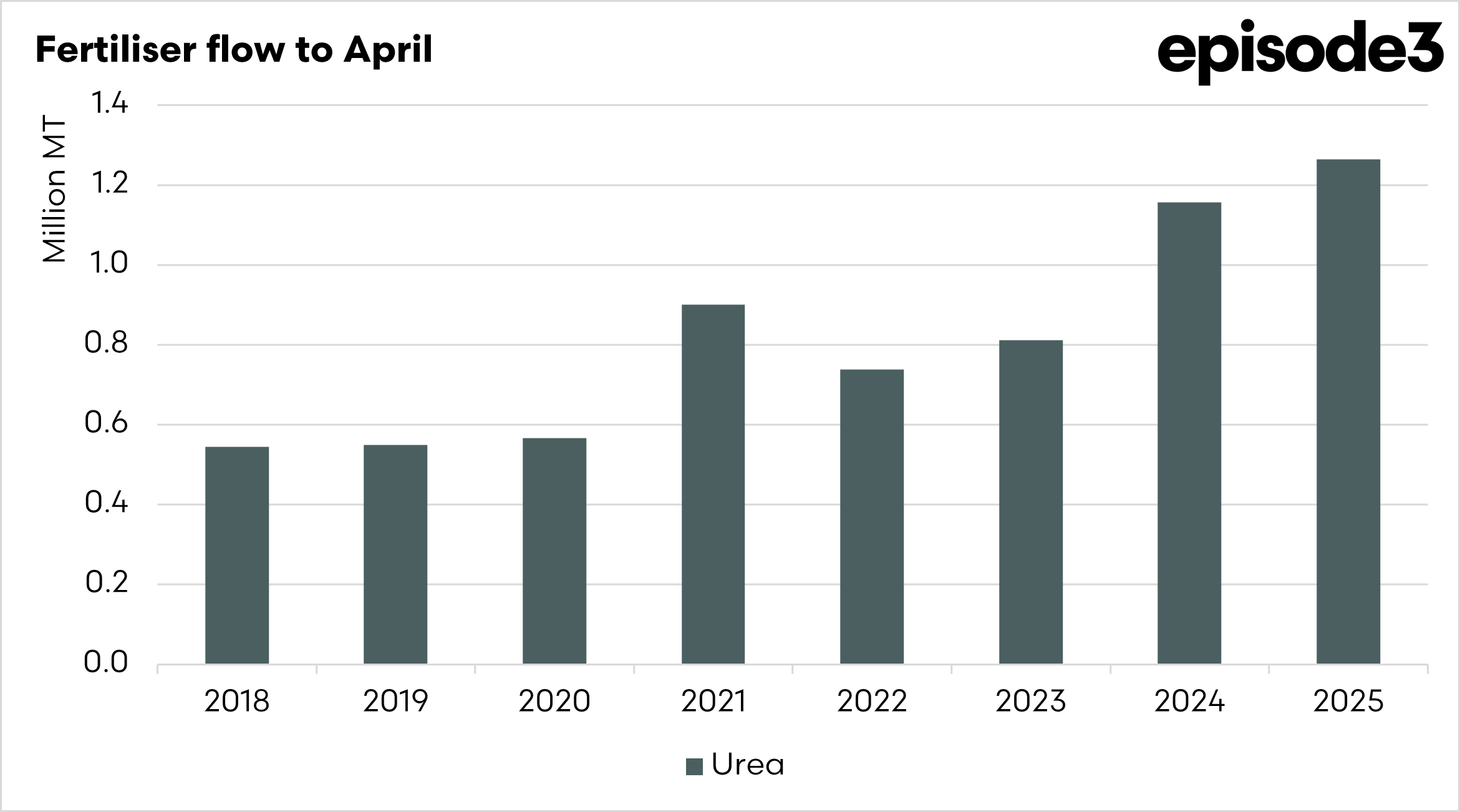

So far in 2025, Australia has imported 1.26mmt of urea. This is a record volume of imports for the first four months of the year. There is likely to be reduced demand in Victoria and South Australia, as farmers await follow-up rains and keep a close eye on costs.

Typically June is the largest import month; it will be interesting to see if import numbers continue to follow seasonal trends. According to our sources they likely will, leaving ample supplies for the Australian market.

If you are hearing of shortages, then let us know.

Pricing

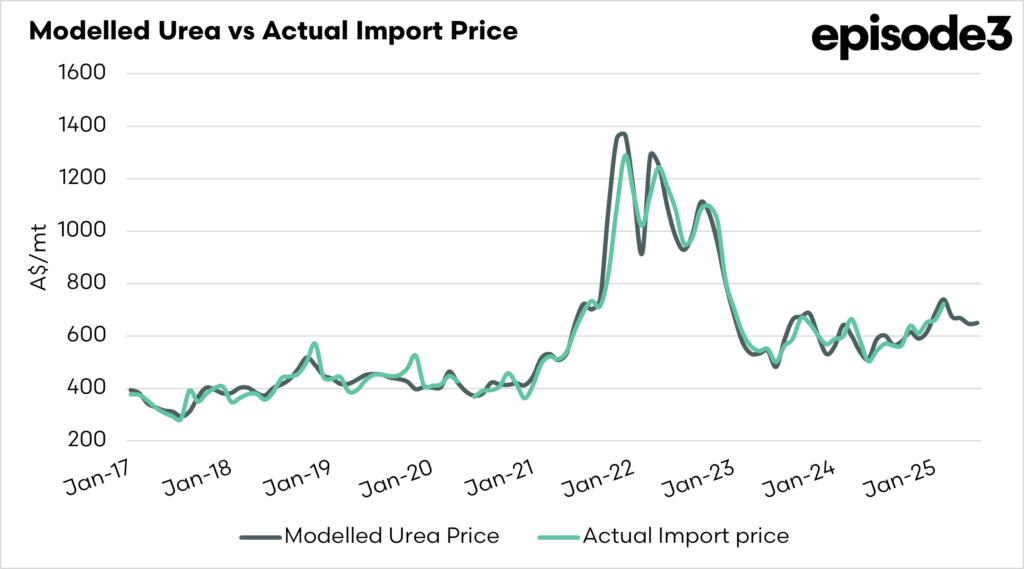

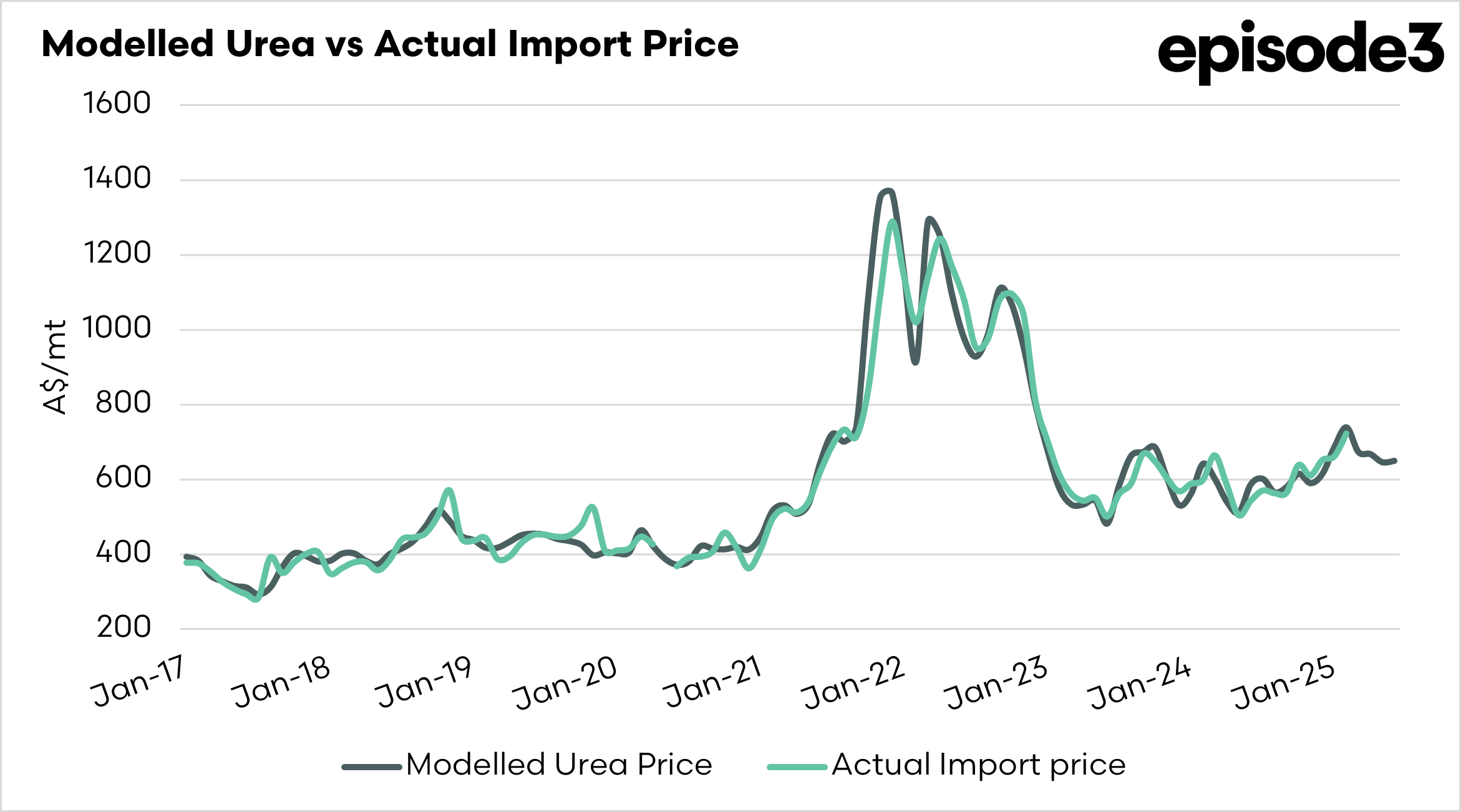

The fair value model, which we have been producing for years on a monthly basis, has now been updated to a weekly model. This model calculates the fair value cost of urea imports into the country.

The first chart displays the monthly average, along with the average actual import price, which serves as an indicator that the model continues to reflect the import price of urea into Australia accurately. Overall, in June, the price has largely been tracking at the same price as May, around A$650 (landed in Australia).

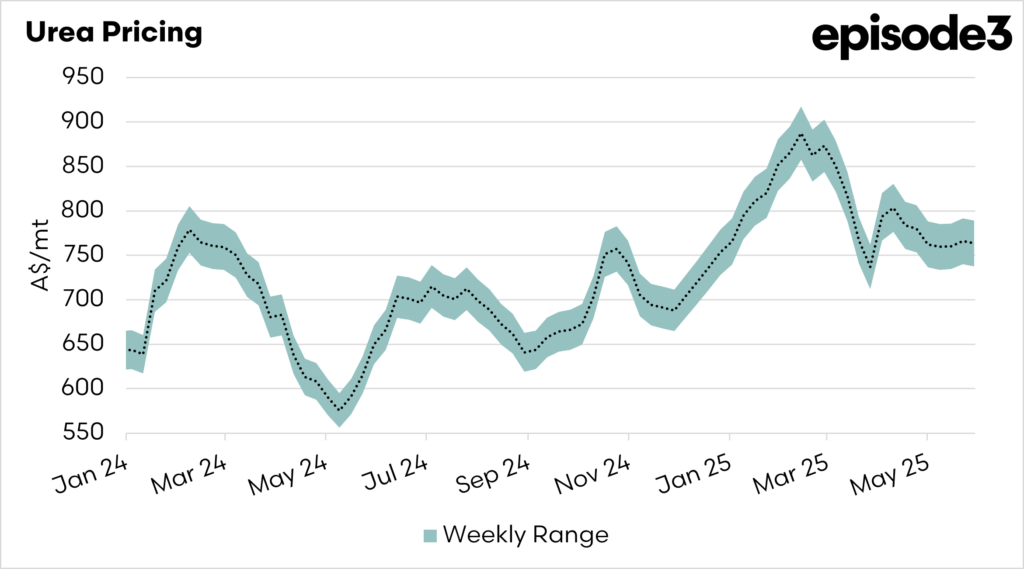

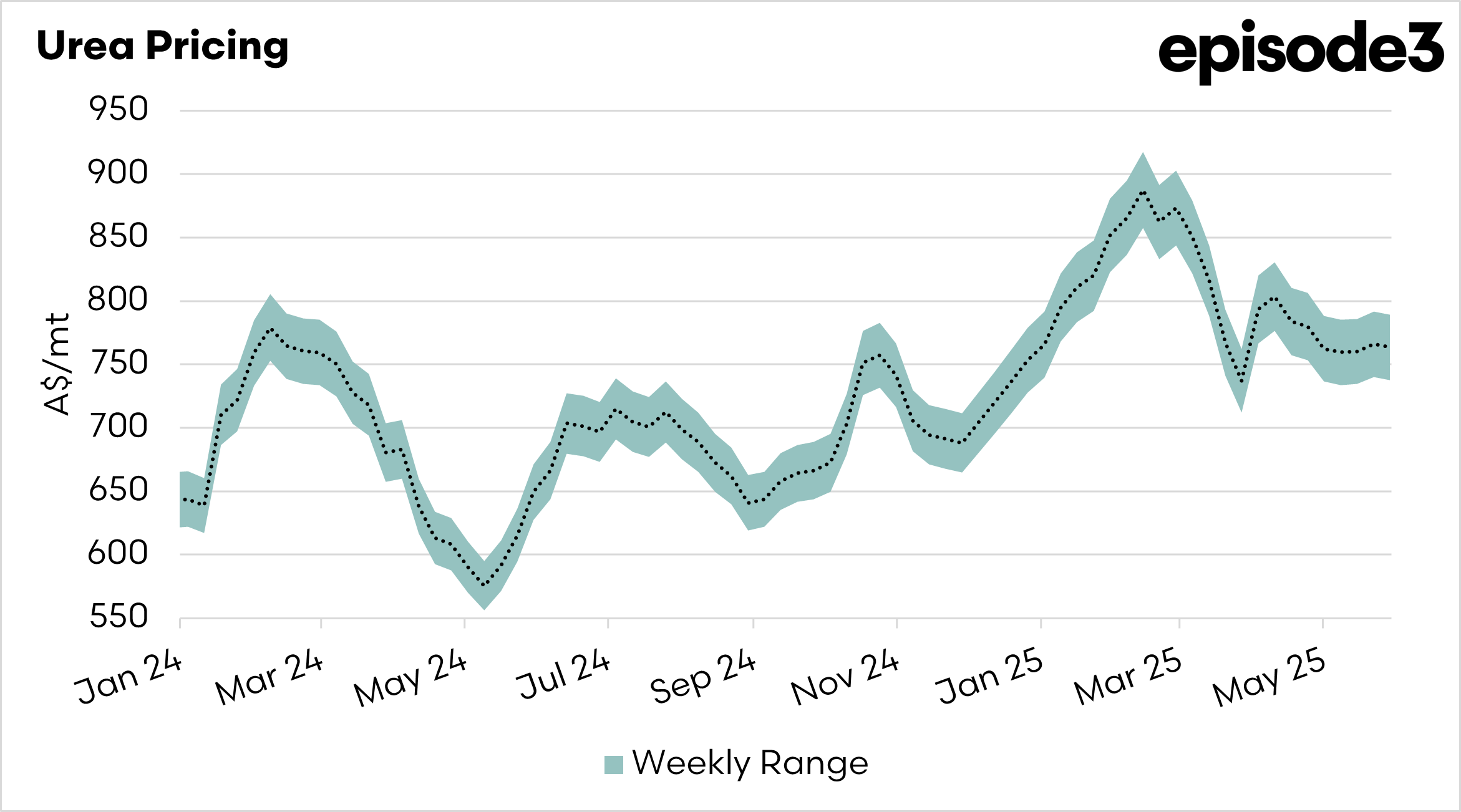

The second chart below shows our new weekly urea pricing model, which we will be producing (and continuing to improve). This gives an indicator of where the market should roughly be for urea, which the grower pays.

We place a range, as we perform an Australian average, but around A$750 is the expected price for urea landed in Australia, and on a truck to the grower.

If you want to help EP3 continue to provide this type of insights, help us out, to help you, by completing our census by clicking here