Fertiliser Price Update – Urea

Market Morsel

Market operate at their best when there is transparency of pricing. Our commodities trade in a global market, and having transparency means we can get a good indication of how our terms of trade are in comparison to the rest of the world. This goes for everything from grain to meat. This is why we produce lots of articles comparing our pricing to elsewhere – to make sure that we are not getting screwed over.

This also applies to inputs, which is why we have been regularly publishing a pricing model for Australian landed urea for the past four years. We had recognised the need for greater public input price transparency and provided this to the industry free of charge.

We will be asking for your help to improve this process; more on that in a different article.

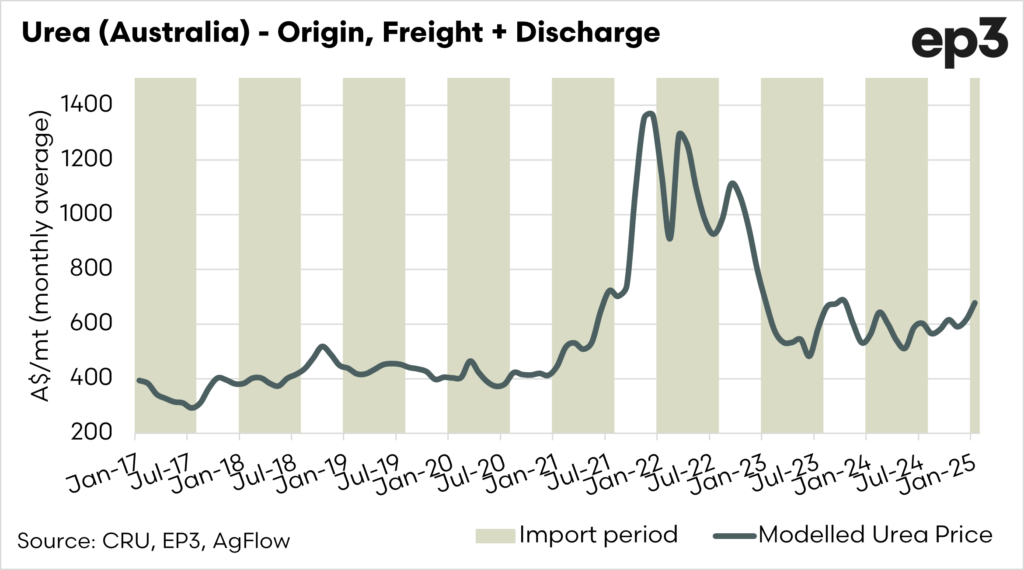

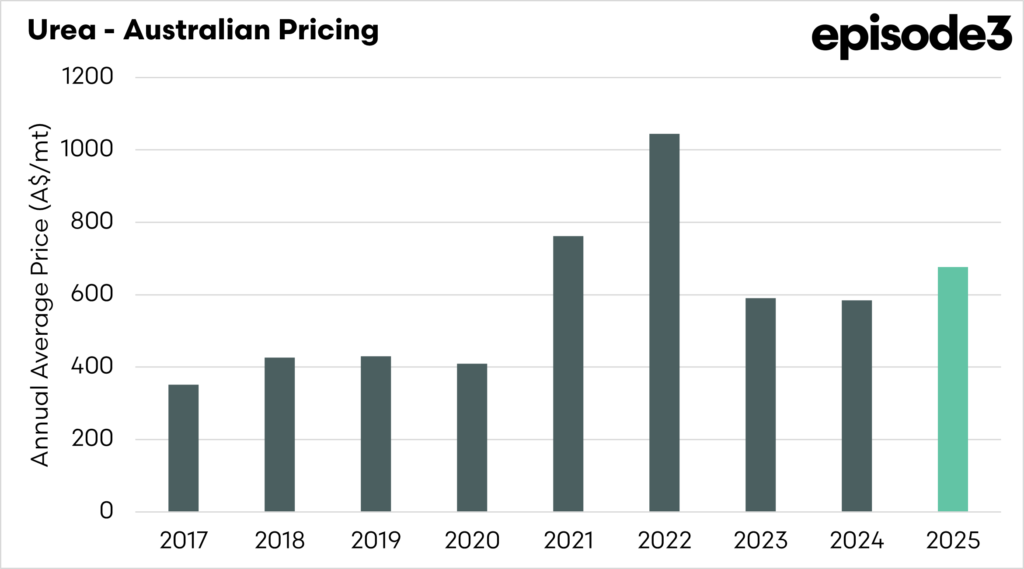

So, let’s take a look at it. The chart below shows our model, which basically explains the cost of buying urea in the Middle East (our biggest source) along with freight, foreign exchange, and unloading in Australia.

Urea has traded around the A$600 mark for most of the year, but we have seen a substantial increase in recent weeks. In December, the average value was A$600-620. It has now increased to A$680.

This is partly due to a decrease in the Australian dollar, making it more expensive to buy US dollar-denominated commodities.

There have also been some major tenders in process, with India looking to purchase 1.5mmt; this, along with additional demand coming onto the market from Australia, has helped increase the price.

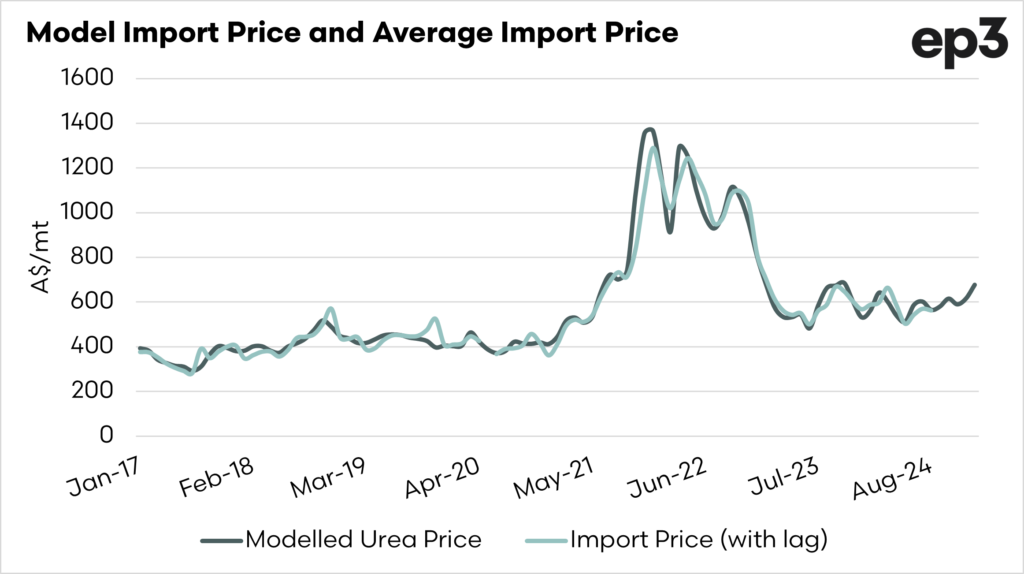

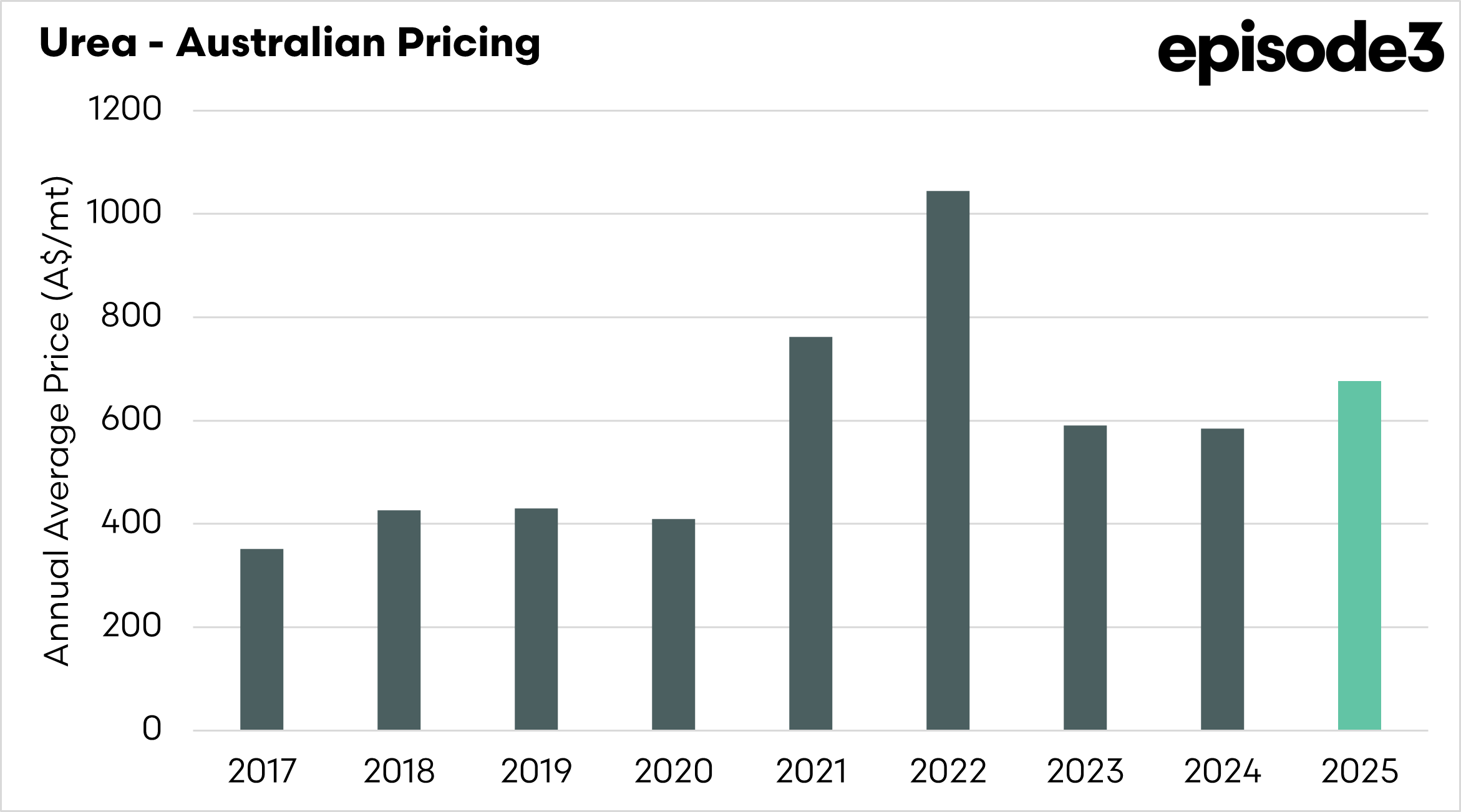

We test our model against the actual import values, as reported by the government. This gives us an indication of whether our numbers accurately represent the cost of bringing urea into the country.

This can be seen in the second chart below. This shows the modelled price against the actual import price. The import price is lagged by one month to take into account the freight timing.

It will never be 100% accurate due to factors such as forward contracts, but it does give a good indication. It is important to note that this pricing does not include margins and on-shore costs. It is not the price the farmer pays.

As we move into the year, prices are above last year; let’s hope things are correct.