Market Morsel: A record half year of urea imports

Market Morsel

At EP3, we look at a lot of data. As it gives us an insight into what is happening within markets and industries.

One of the most contentious issues in agriculture is fertilizer. We write about it a lot because we understand the importance of it. This year, many farmers have been complaining about not getting access to the urea they require; in fact, many farmers have complained enough that the ACCC have become involved and made a comment about unfair contract terms (see here).

We had provisional data on imports of Urea for June, which I briefly spoke about on a fertilizer webinar with GPSA, which you can watch here. At that point, it was looking like imports for the first half of the year were set to break record, and now that we have official confirmation using government data, I felt it was time to publish an article.

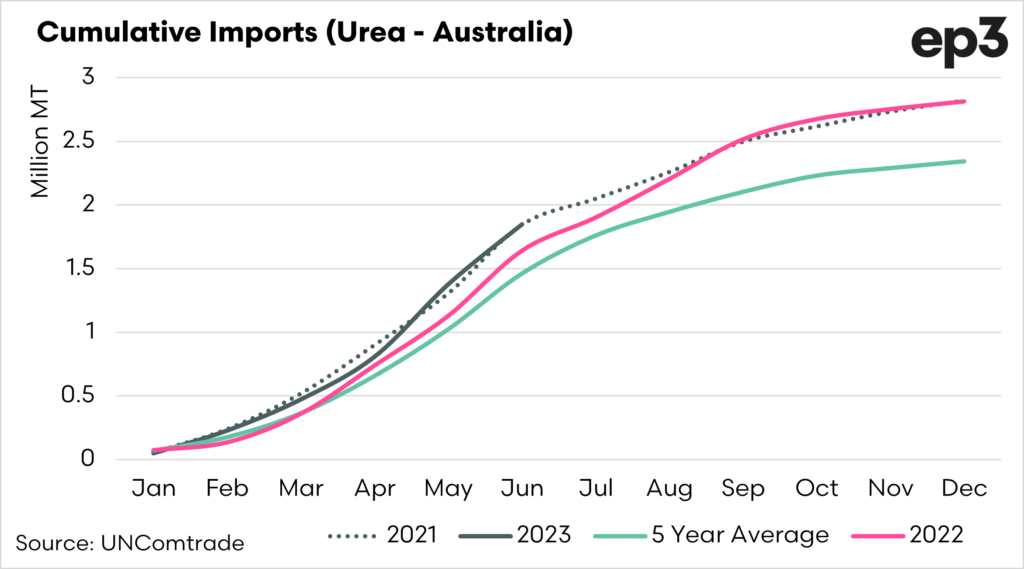

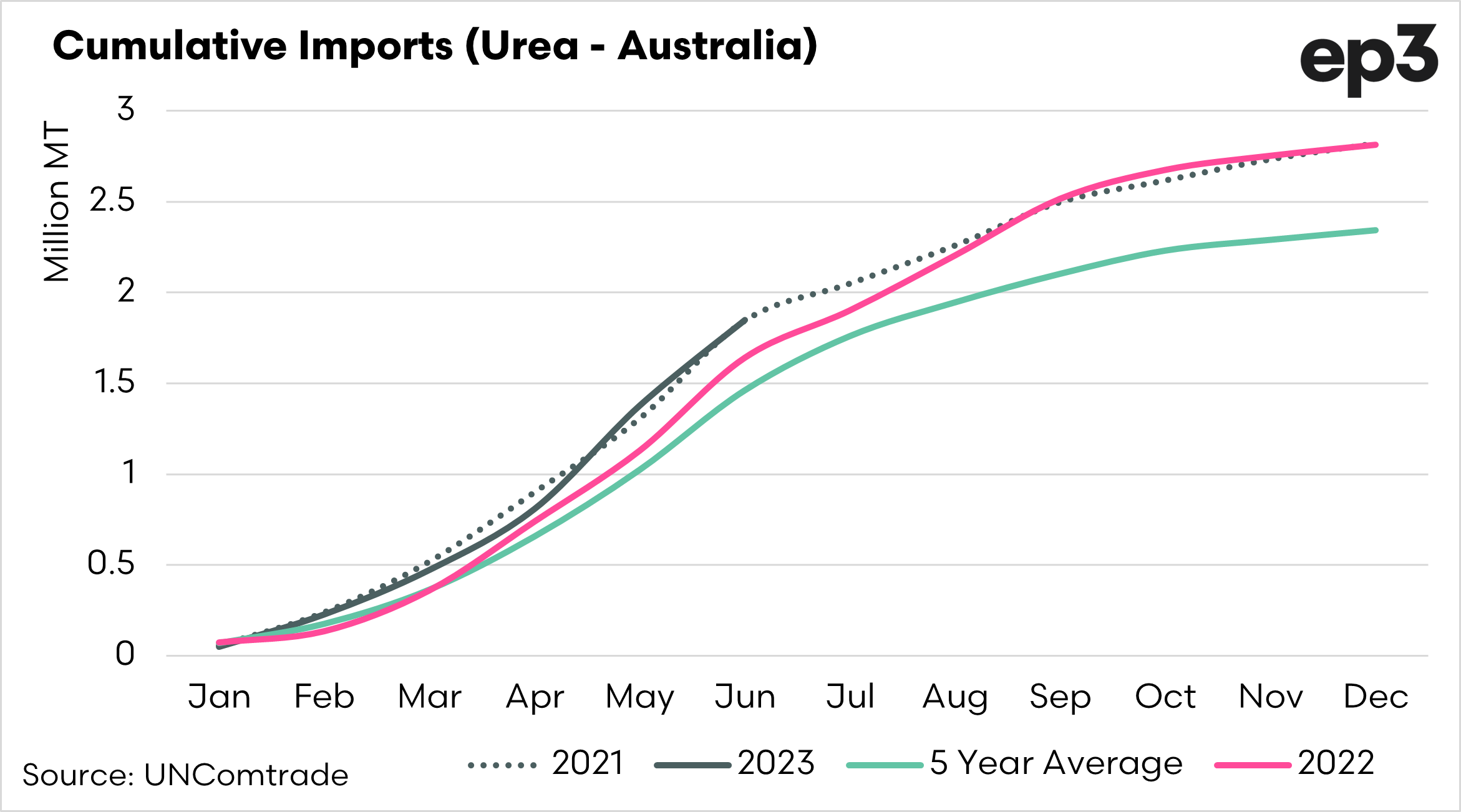

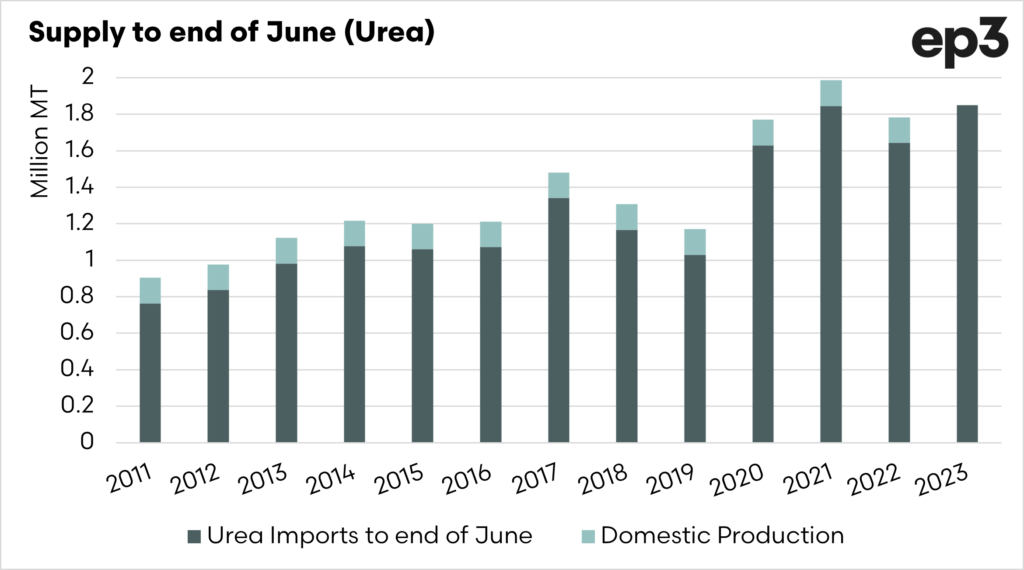

The first chart below shows the cumulative imports of urea, and import levels for 2023 up until the end of June are at 1.85mmt, which is just slightly above the 2021 import volumes.

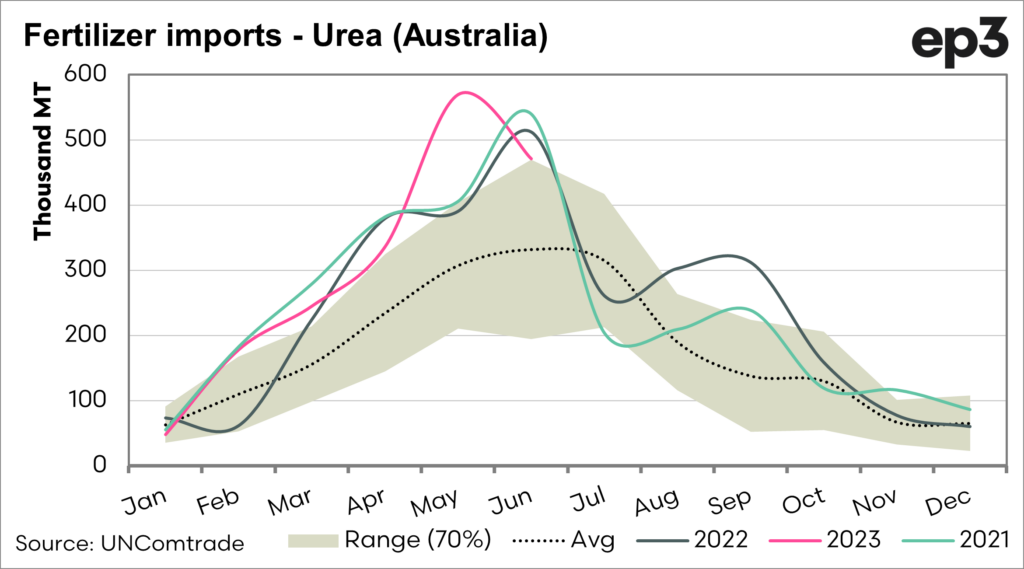

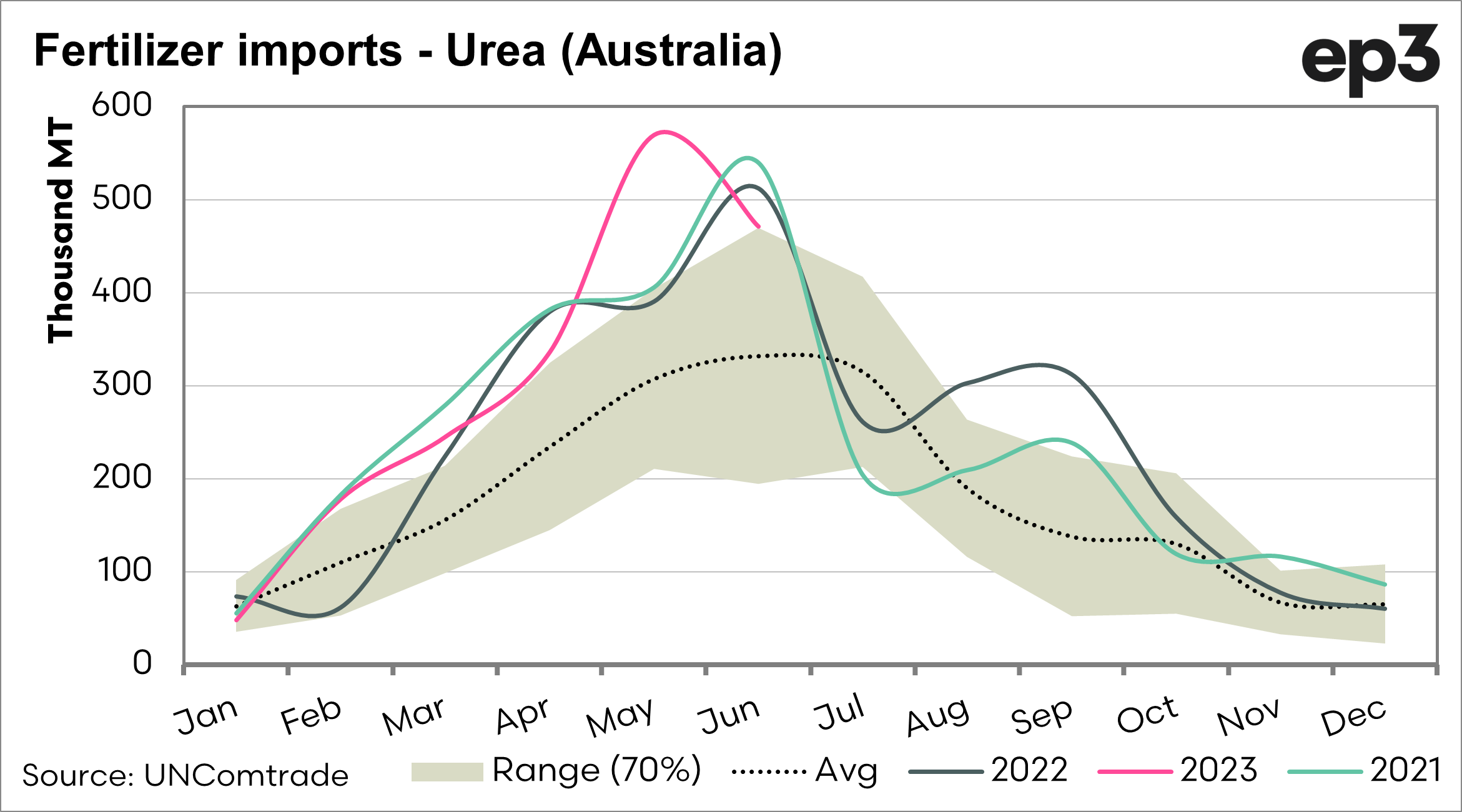

The second chart shows the seasonality. Typically June is the month of highest imports; this year, May was the record month, and imports, although lower month on month, were still historically high. We would expect imports from July onwards to follow the seasonal trend.

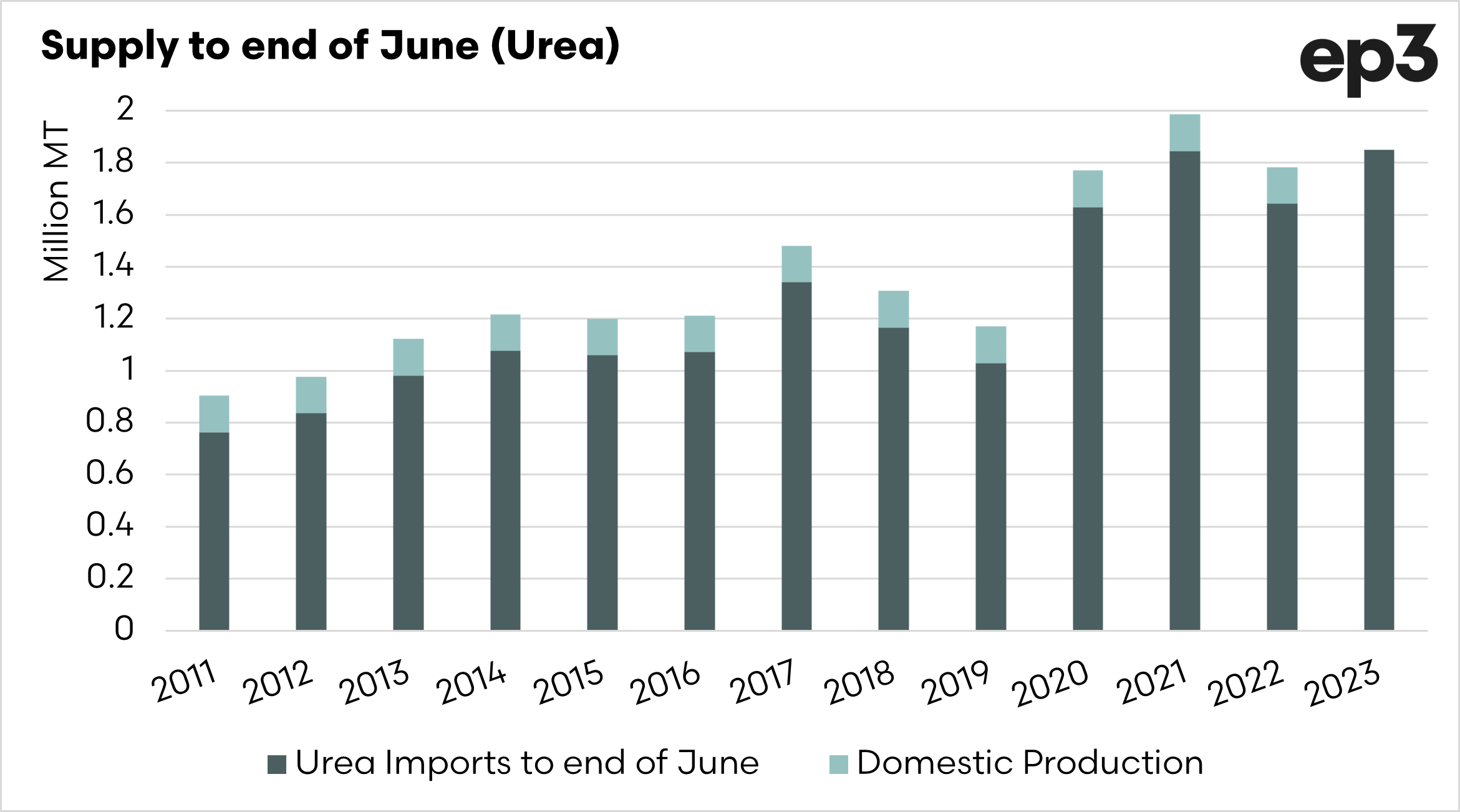

Imports are high, but we have also lost an important production source with the closure of the IPL Gibson Island facility. The third chart has a rudimentary analysis of the overall supply, which is expected domestic production along with imports. Remember, this is a rudimentary chart, but it does show that ‘supply’ has moved only marginally to 2nd highest on record for the first half of the year.

So in summary, the data shows that imports have been strong. Where is it, and why are farmers having difficulty accessing supply? There are many ideas floating around, which may or may not be contributing to the fractured supply chains.

- Nitrogen in soils needed higher levels of inclusion to make up for recent years, and caused demand to rise.

- Urea supplies are not in the right places, pointing towards potential poor supply chain planning.

- Stock swaps between importers are not being conducted, which means suppliers have to wait before vessels come in as opposed to swapping with other importers.