Market Morsel: Fertile market – a urea update.

Market Morsel

It has been a while since we provided a quick update on the urea market. So, this article will outline the import program and the current ‘fair’ value price.

So let’s first look at imports. In Australia, all of our urea is now imported, which is a risk if there are any major supply chain disruptions. In recent years there have been claims of major shortages in Australia, which is why it is important for EP3 to maintain our import datasets.

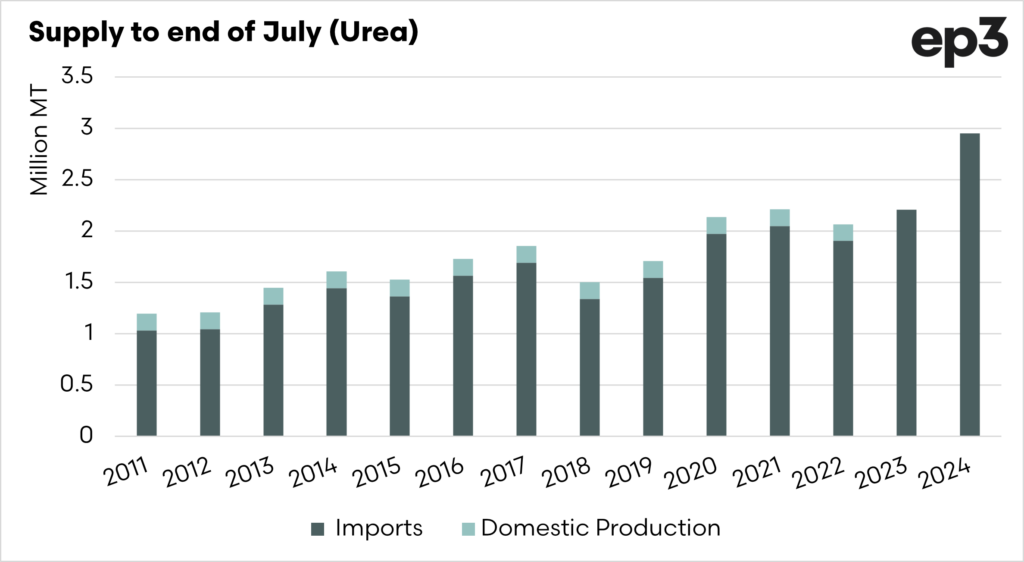

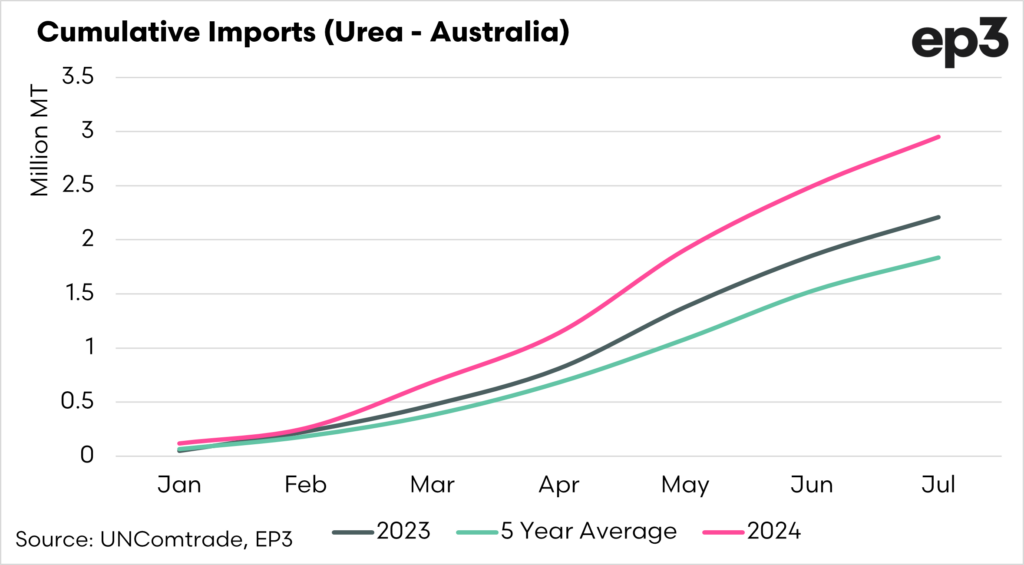

The currently most available data is available until the end of July. The first chart below shows the total volume of imports and a theoretical production figure for what was previously domestically produced. The second chart shows the cumulative imports to the end of July.

We can see that the total ‘supply’ is significantly higher for the first seven months compared to any other time. The first seven months of the year have seen 2.9mmt imported, according to Comtrade data; this is not far off last year’s record full calendar year imports.

What about the price?

In recent years, there has been an explosion in fertilizer prices as a result of supply chain constraints alongside booming energy pricing. That is currently a thing of the past, for now at least.

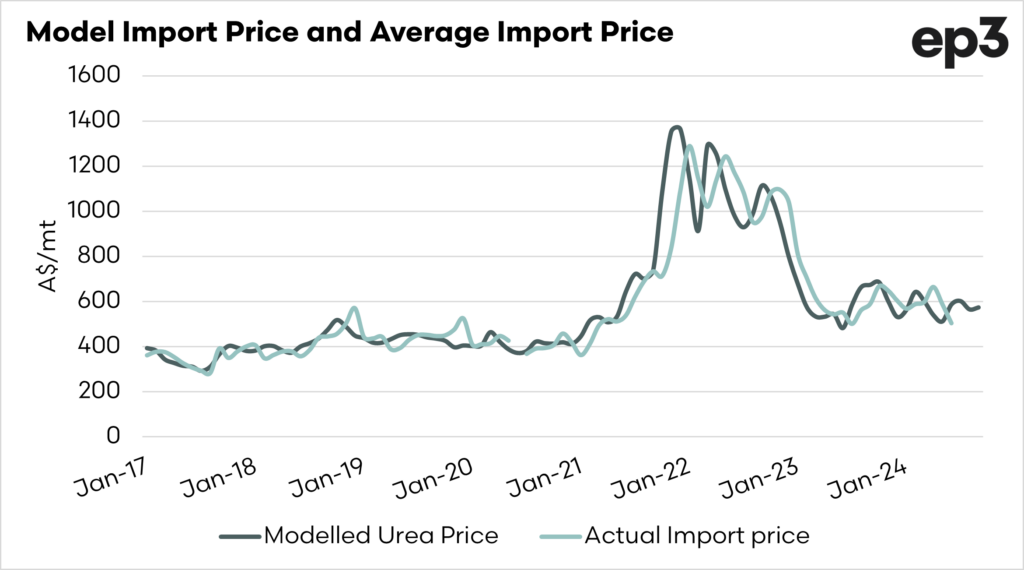

There is no transparent pricing of fertilizer in Australia. So at EP3, to add an element of transparency, we have created a modelled price for the the cost of getting urea to Australia.

The first chart below shows the modelled price alongside the actual import price quoted by Comtrade. We can see at the moment the urea price in Australia is approximately A$575-625. It is important to note that this is just the price of buying and importing into Australia (as an average). It does not take into account distribution costs or margins within Australia.

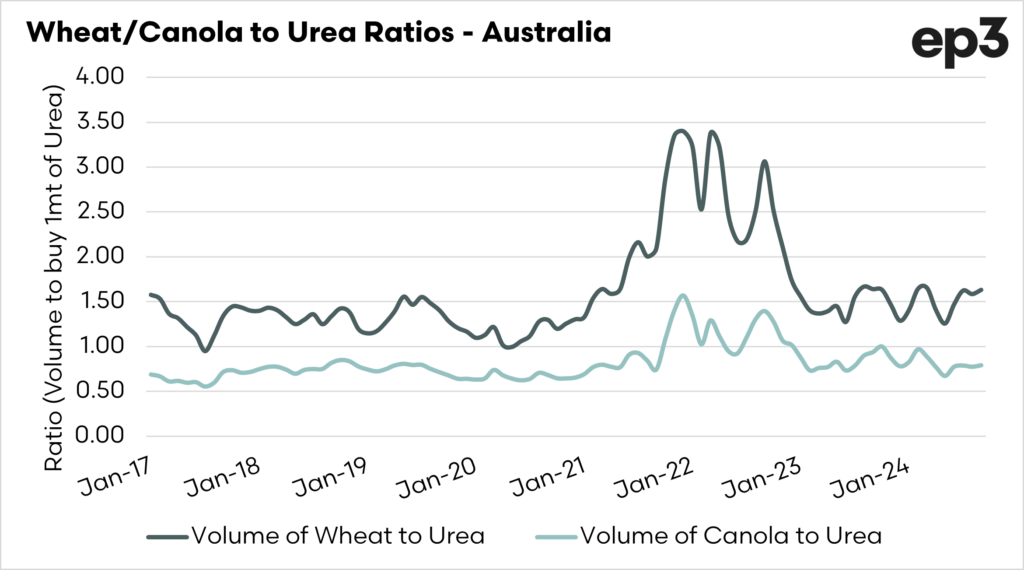

The second chart displays the affordability ratios. This is how much canola or wheat you must sell to buy a tonne of urea. We are back to roughly average levels for affordability.