Market Morsel: Fertilizer remains high.

Market Morsel

Although we haven’t even finished this harvest, time is ticking down, and we will soon be looking to buy our fertilizer for next year’s crop. What is happening?

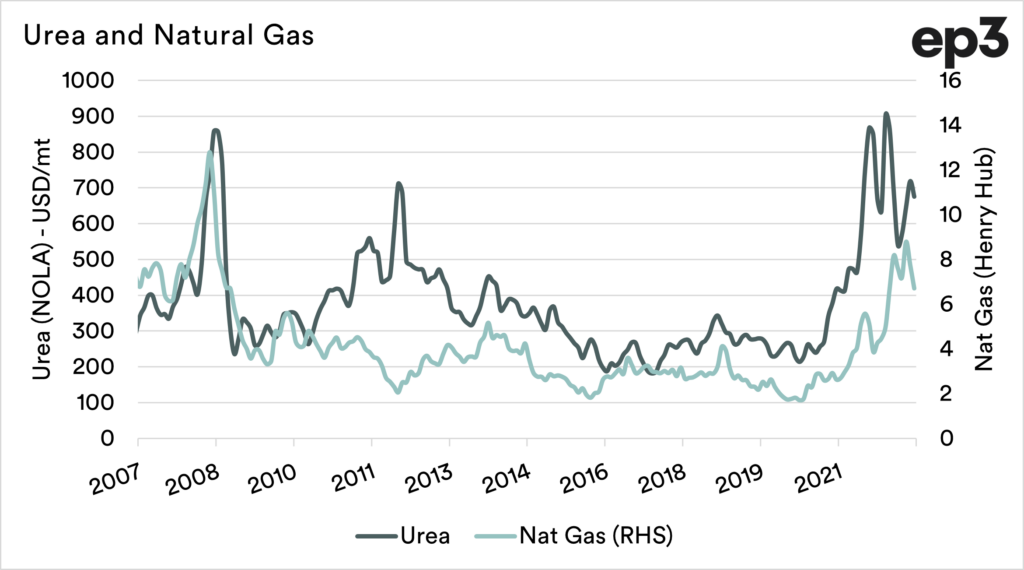

The big driver is the gas market. As you will know from our many articles on the topic, gas prices have increased massively due to the ongoing conflict in Ukraine. This is causing a lot of instability and will continue to place a lot of uncertainty in the marketplace. In the first chart below, we can see US gas and urea prices, and the relationship between them.

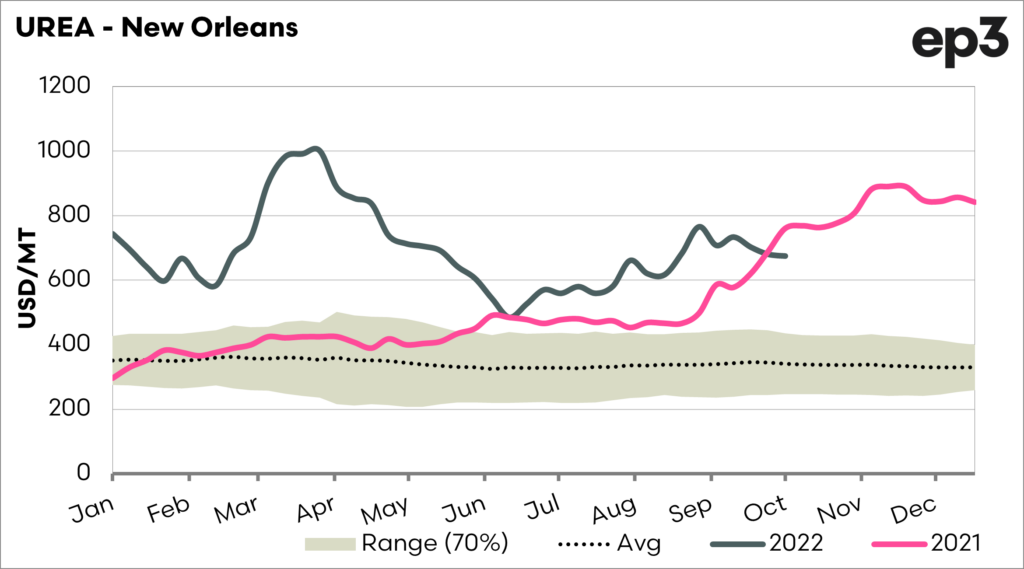

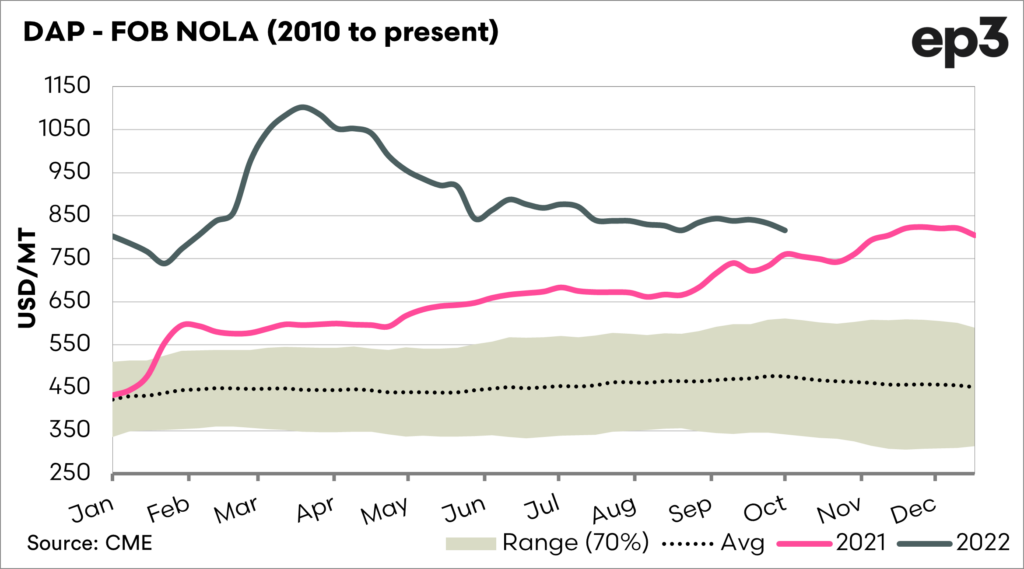

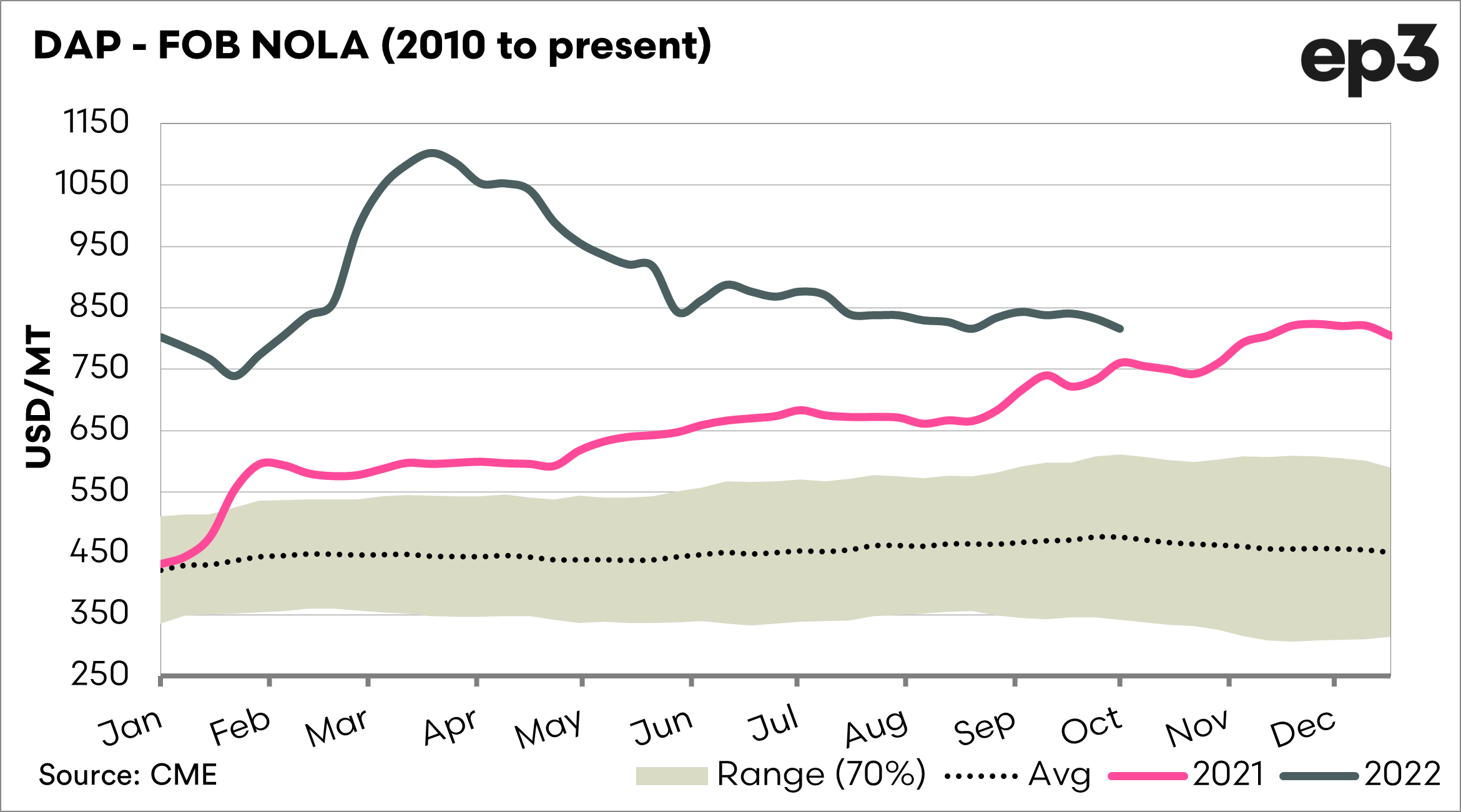

The second two charts show the seasonality of Urea and Dap, both at New Orleans. We can see that both are well above the expected range (or standard deviation). The pricing levels are however both off of their peaks from the early part of the year.

We do expect that fertilizer pricing will remain at elevated levels for quite some time. We are getting to the stage where there is starting to become more demand rationing as the expense of inputs starts to bite. This could have longer-term impacts on yields.

These charts represent the US gulf’s pricing and are somewhat of a benchmark that can be used for viewing the market trend.

There is, however, a lack of available pricing data on Australian pricing, which you can potentially assist in improving transparency (more on that later).