Market Morsel: Freight under full steam

Market Morsel

As an export nation, freight is a key component of our trade flows. It has a big impact on our competitiveness and, in effect, the return to the industry.

This year has seen massive uplifts in freight pricing levels, I wrote in June about the why (see here), and the freight market has continued to increase.

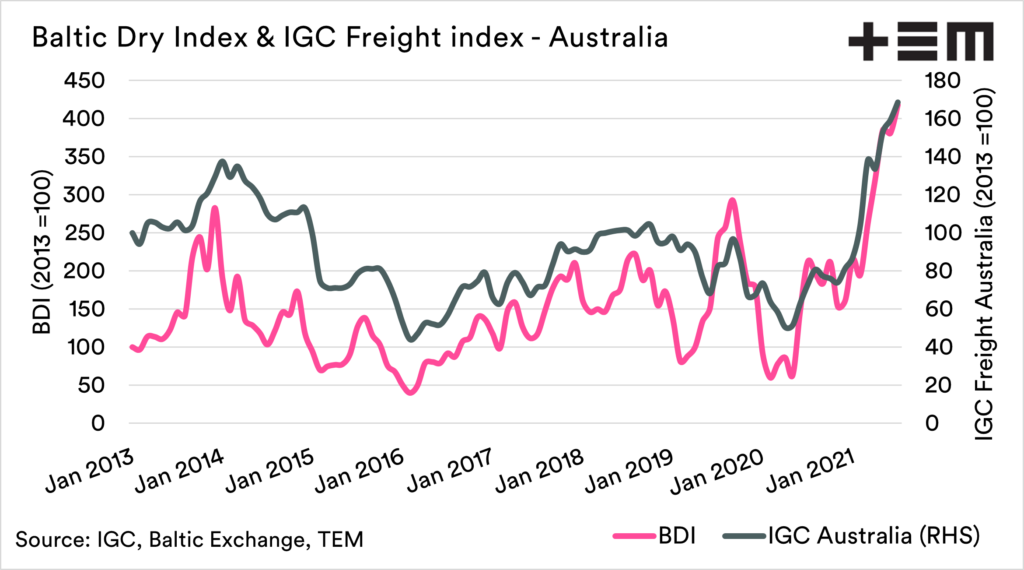

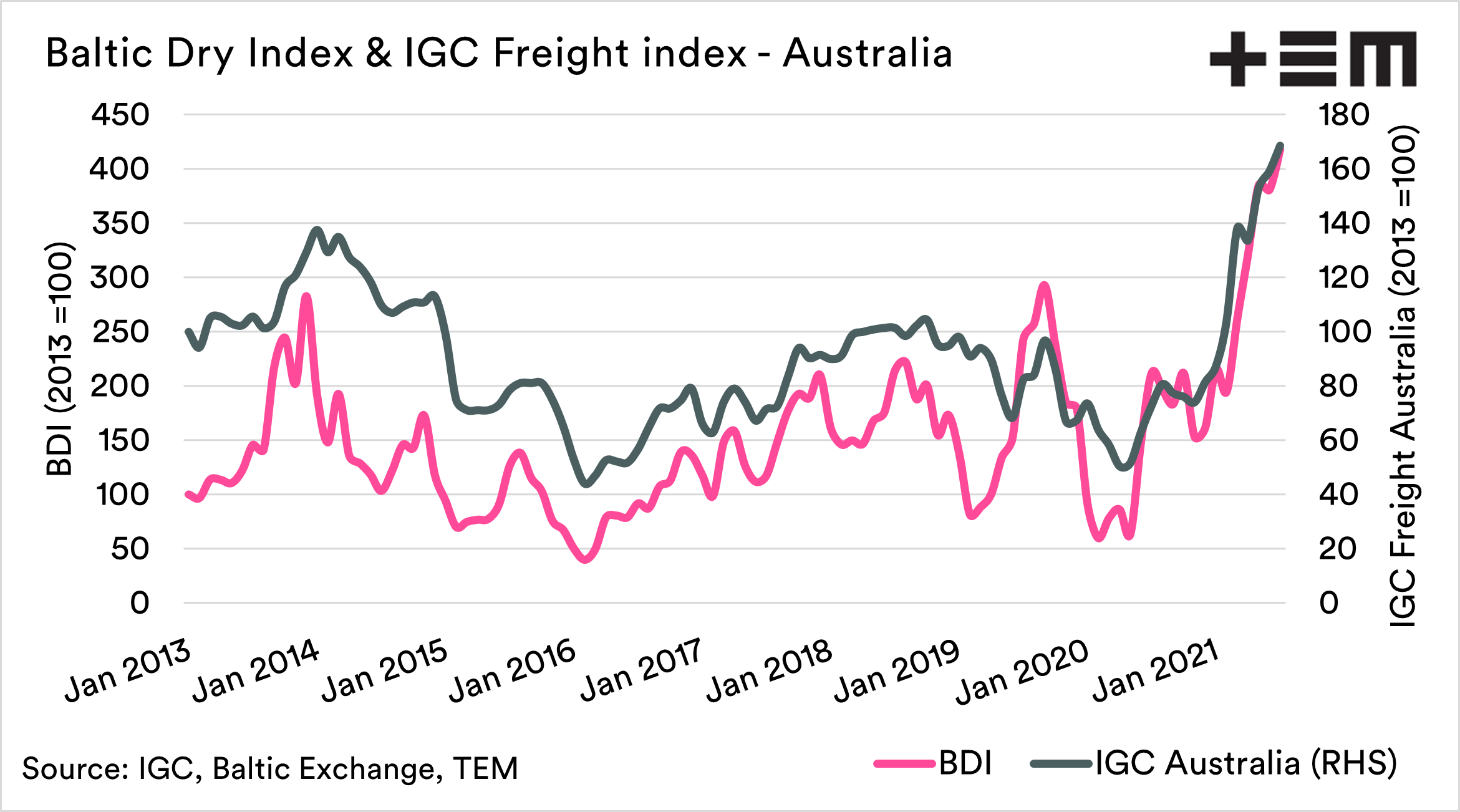

The first chart below shows the Baltic Dry Index, which is both an indicator of bulk freight and is considered an economic indicator (see here). Included is the International Grain Councils freight index for vessels ex Australia.

The freight rates are at their highest levels since 2013. Huge levels, but still not up to the same levels as the boom before the GFC bust.

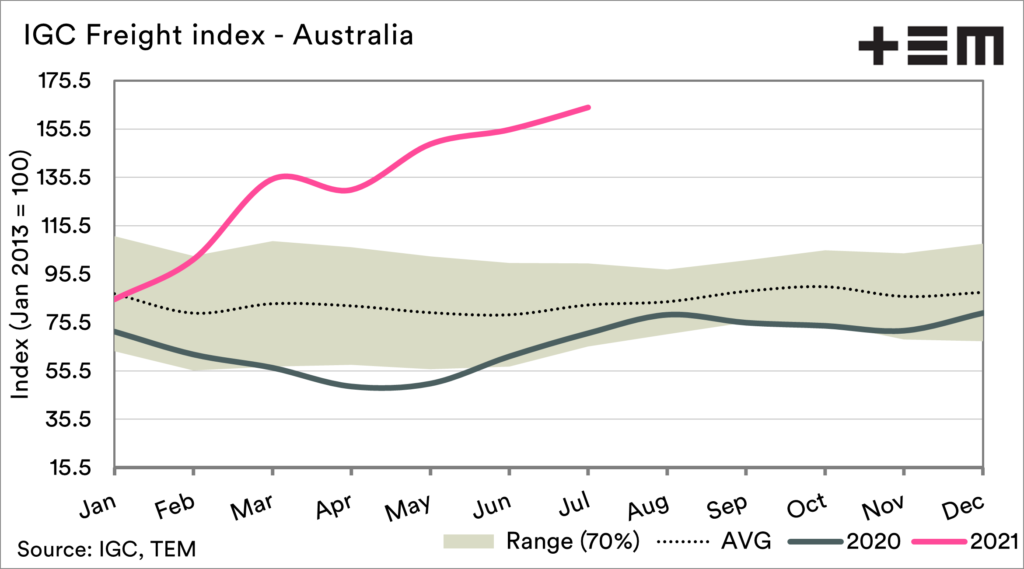

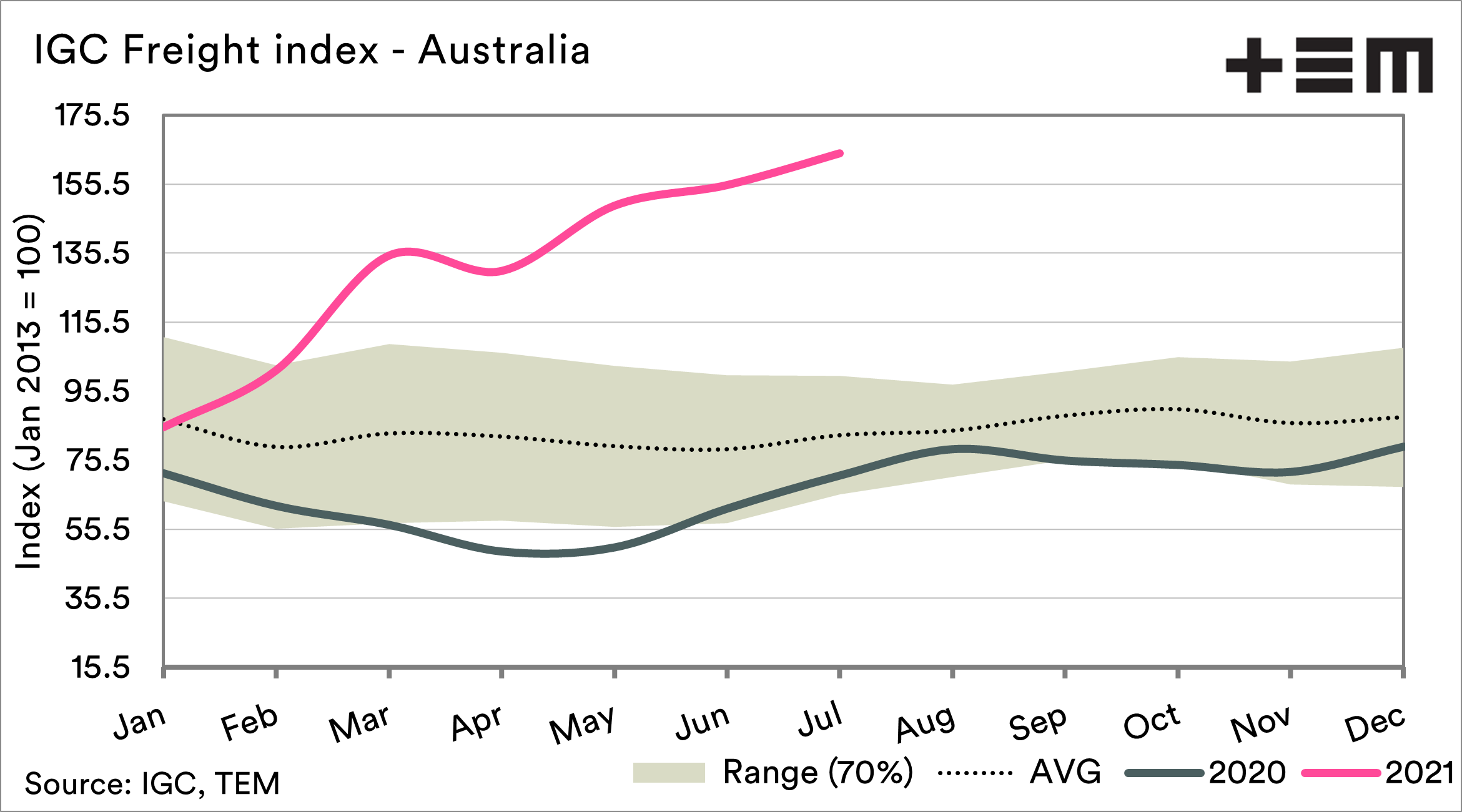

The second chart shows the seasonality of the IGC freight index and shows how far above the norm that freight has become.

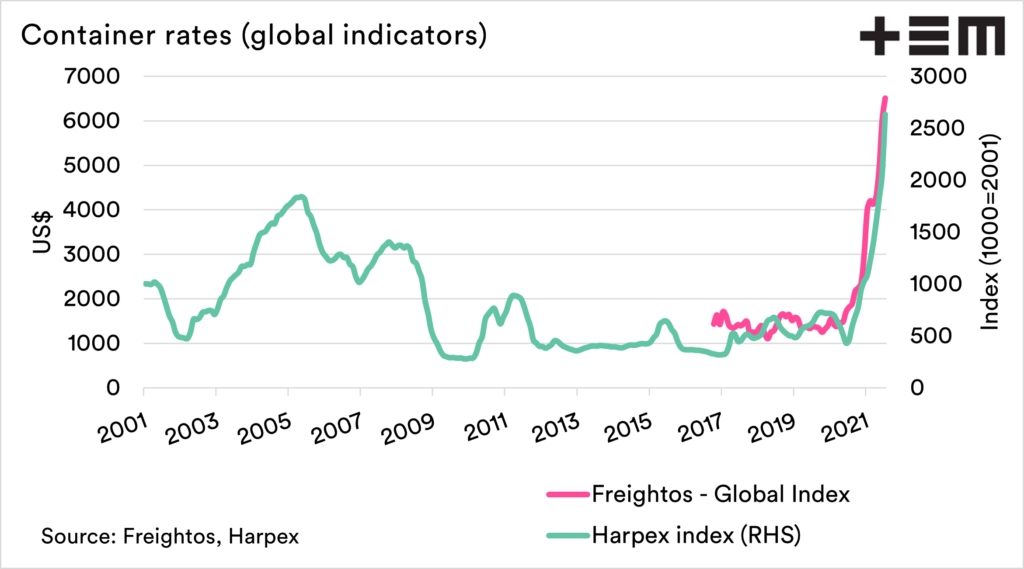

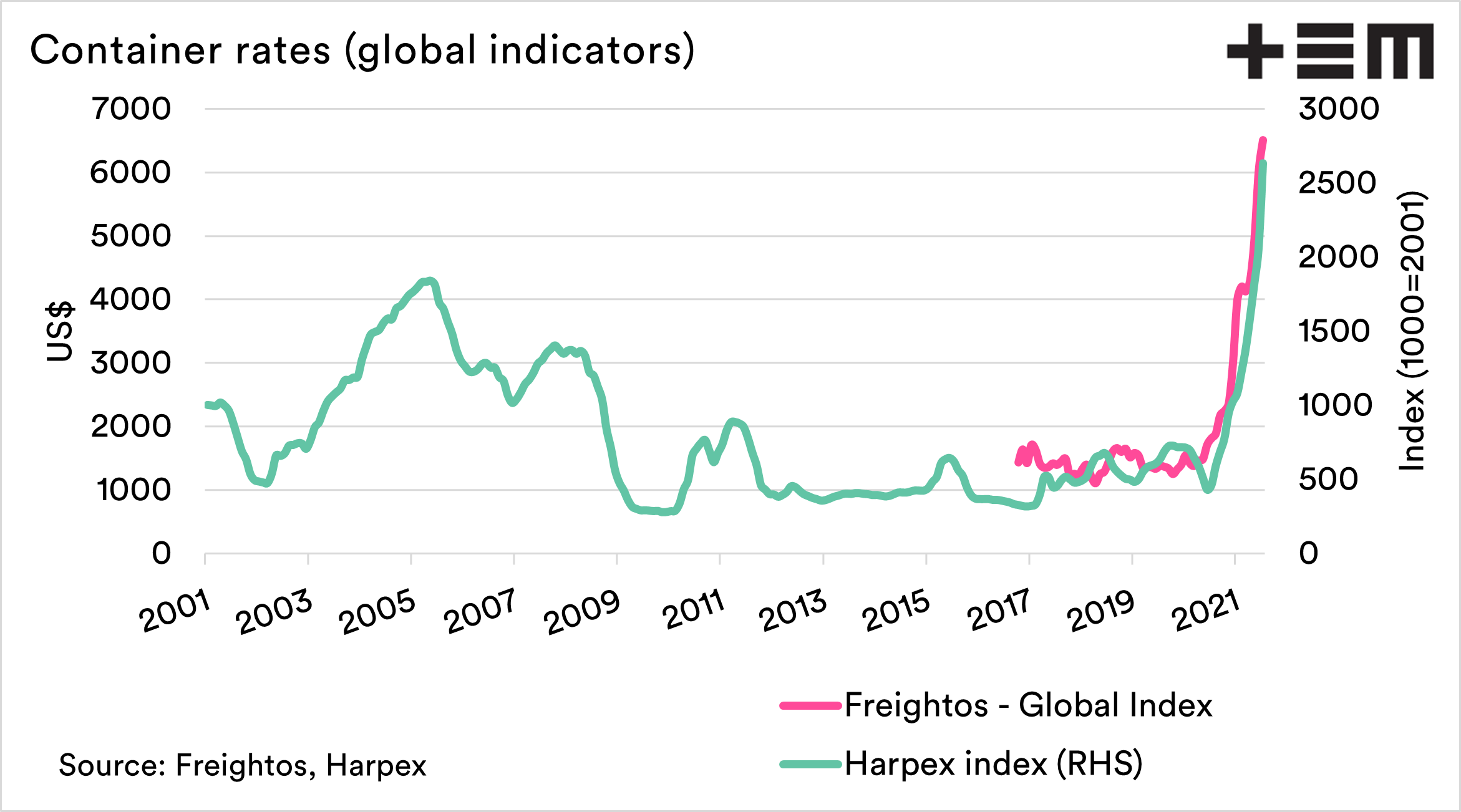

The third chart shows the cost of containers, and these continue to defy gravity. This is the global index, and as we can see, it hasn’t been higher. This has a big impact on many of our agricultural products, including meat, wool and grains (especially pulses).

If you can get a container to export in Australia, it is going to be expensive.

In bulk products such as grain, we have huge markets on our doorstep. This means that whilst freight has increased, that our lower travel times will give us a slight advantage over our competitors elsewhere.

So instance, the cost of shipping from the black sea will be considerably higher to Indonesia than from Australia.