Market Morsel: Fuel firing up

Market Morsel

Whilst many grain farmers diesel expenditure at the moment might be filling the Landcruiser to tow the caravan to the beach, it’s time to start thinking about the coming seeding.

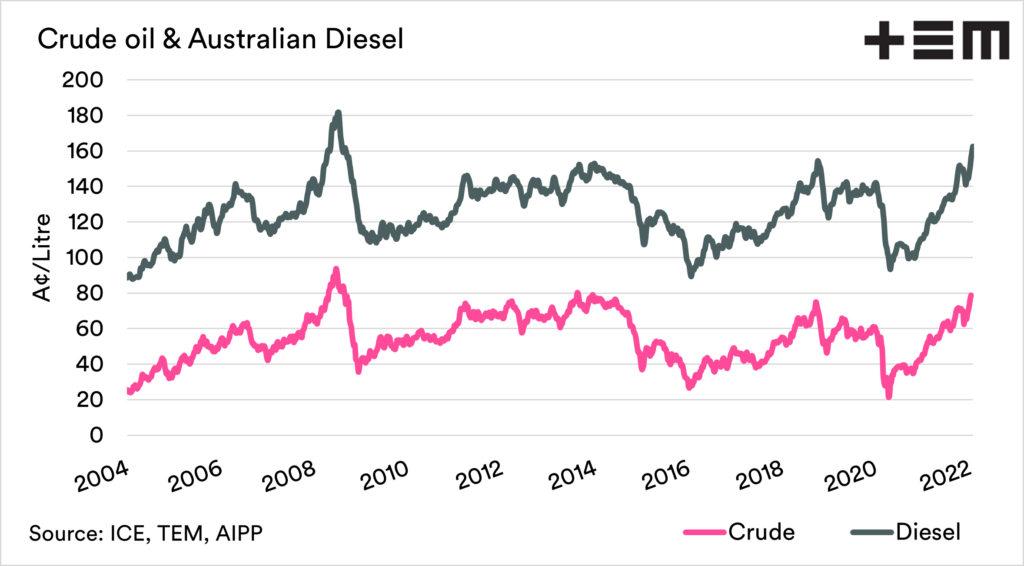

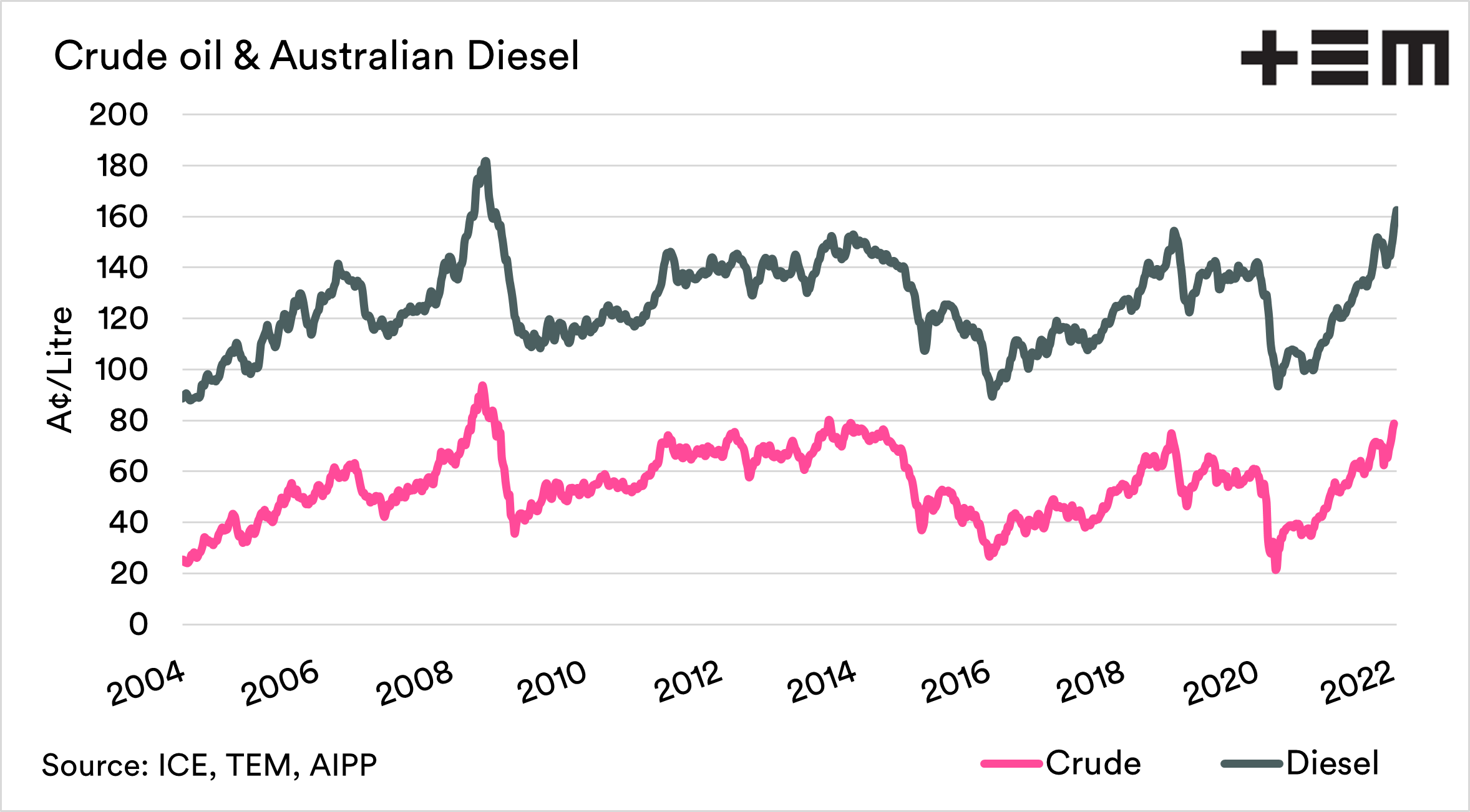

In October, I wrote about how this harvest was likely to have the 2nd most expensive harvest fuel (see here). I filled up last night and was a bit peturbed to see it considerbly higher than last time. So where are?

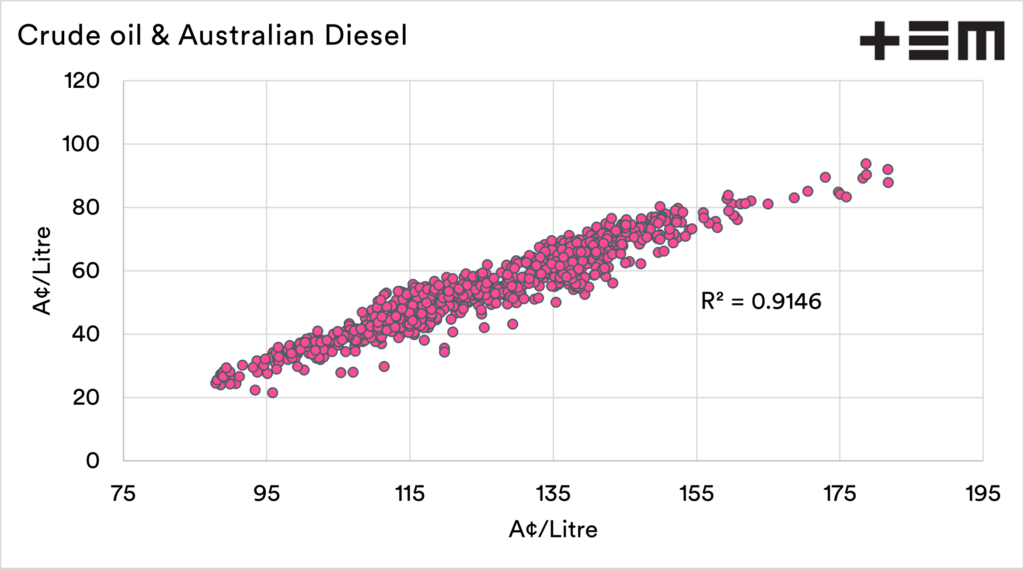

The diesel market in Australia very closely follows the crude oil market, which is pretty obvious due to the fact that diesel is a derivative of crude oil. Albeit with a huge amount of tax added on……

The crude oil market has rallied in recent weeks, in part because of risk premiums being added to the market as tensions remain between Russia/Ukraine and UAE/Yemen. This all adds to concerns at a time when demand is high.

This has lead to fuel prices hitting the highest decile 100 (since 2010). If these levels are maintained then its going to be a costly season with high chemical, labour and fertilizer prices.

The high correlation between physical fuel in Australia and crude provides the potential for hedging, however there are very large minimum requirements for fuel hedging with the major banks.