Market Morsel: Gaslighting Chem and Fert.

Market Morsel

The cost of energy is the key to most products. Our primary inputs are heavily driven by the price of energy, clearly diesel – but also chemicals like glyphosate and fertilizers.

We have written about this relationship a bunch of times, so we won’t go into a huge amount of detail in this article.

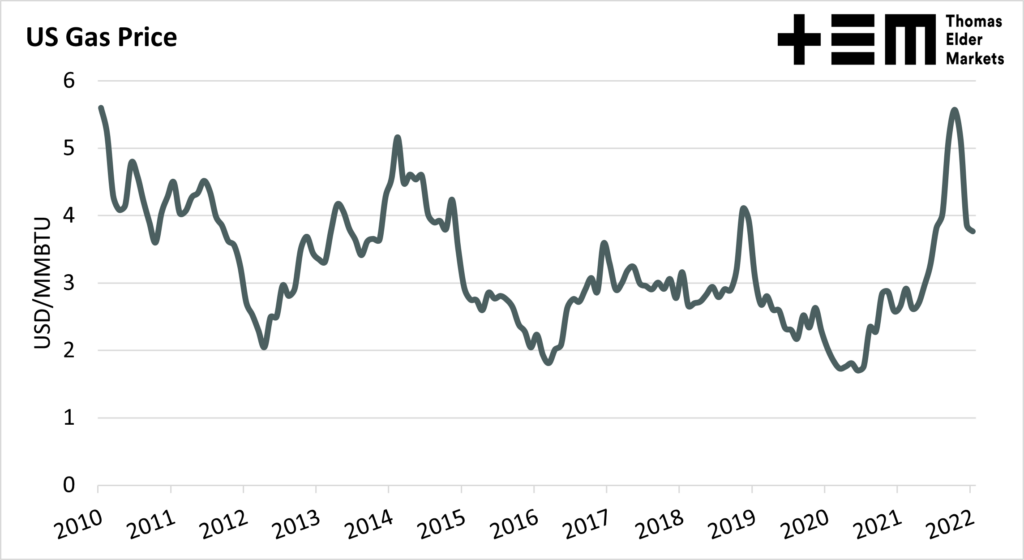

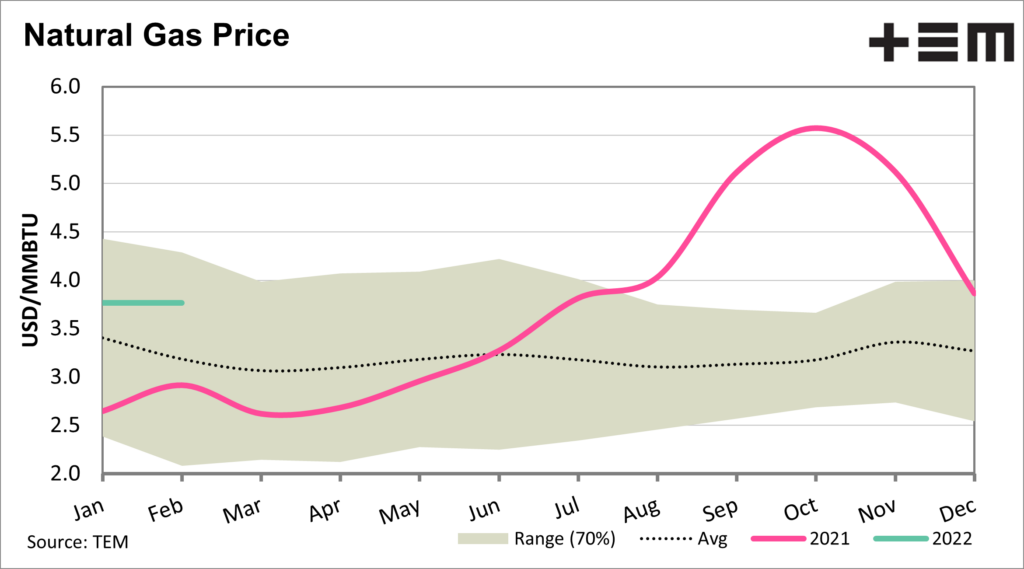

The US gas price has started to come under pressure in the past few weeks after hitting decade highs in the past quarter. Prices remain high compared to recent years but are at least now within the standard deviation. In the US, inventories are strong, and it is forecast to be milder, reducing demand for gas.

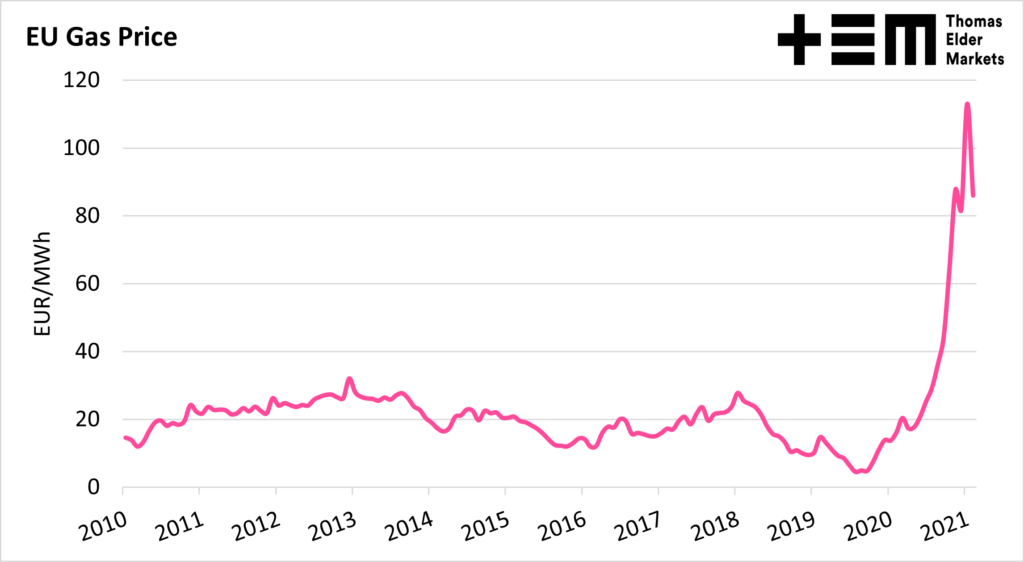

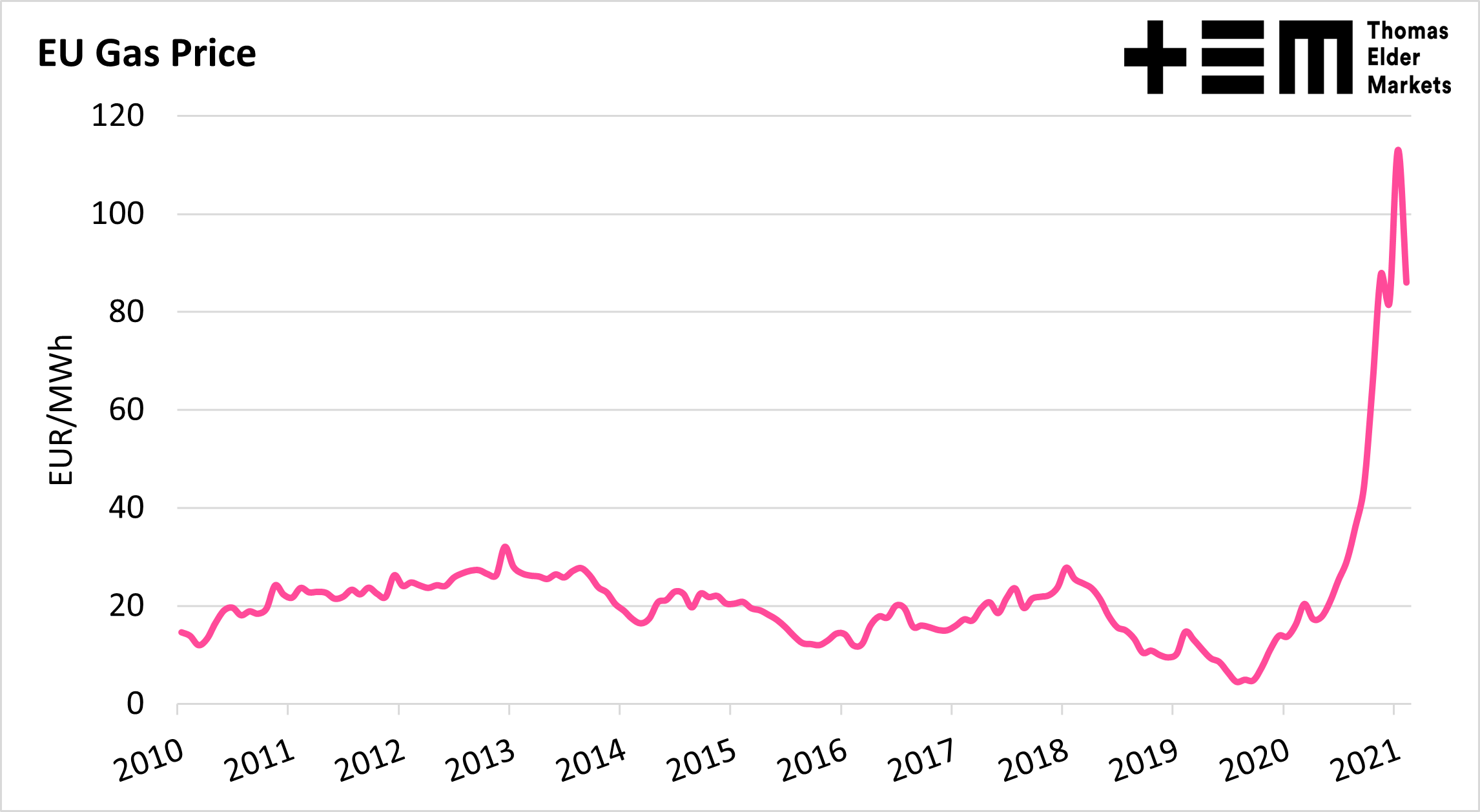

The picture is quite different from the US, with inventory below average and colder weather on the forecast. In Europe, the picture is not quite as rosy; whilst prices have retreated from highs, they are still at very inflated levels. The gas picture is not being helped by reduced supplies in pipelines from Russia.

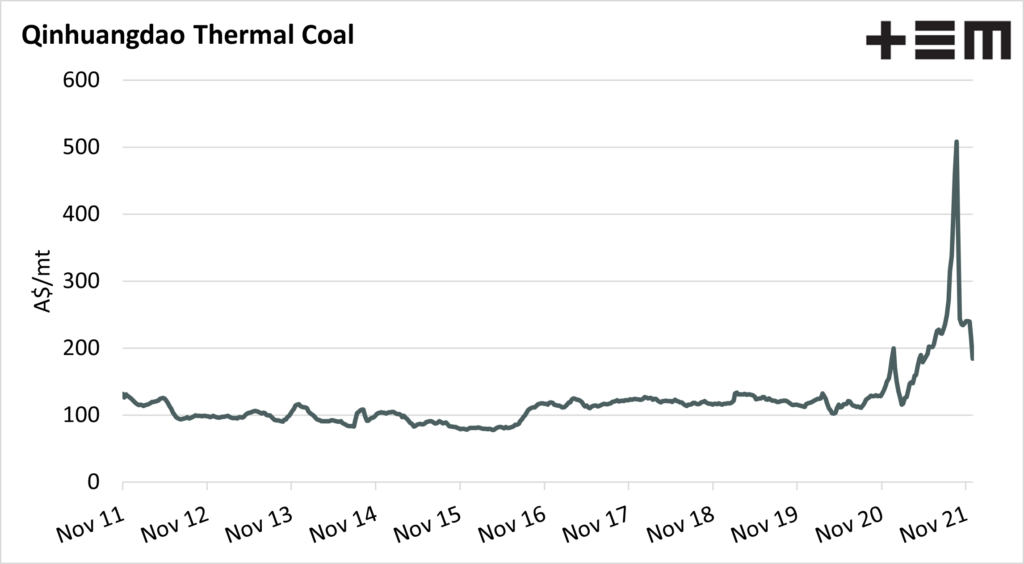

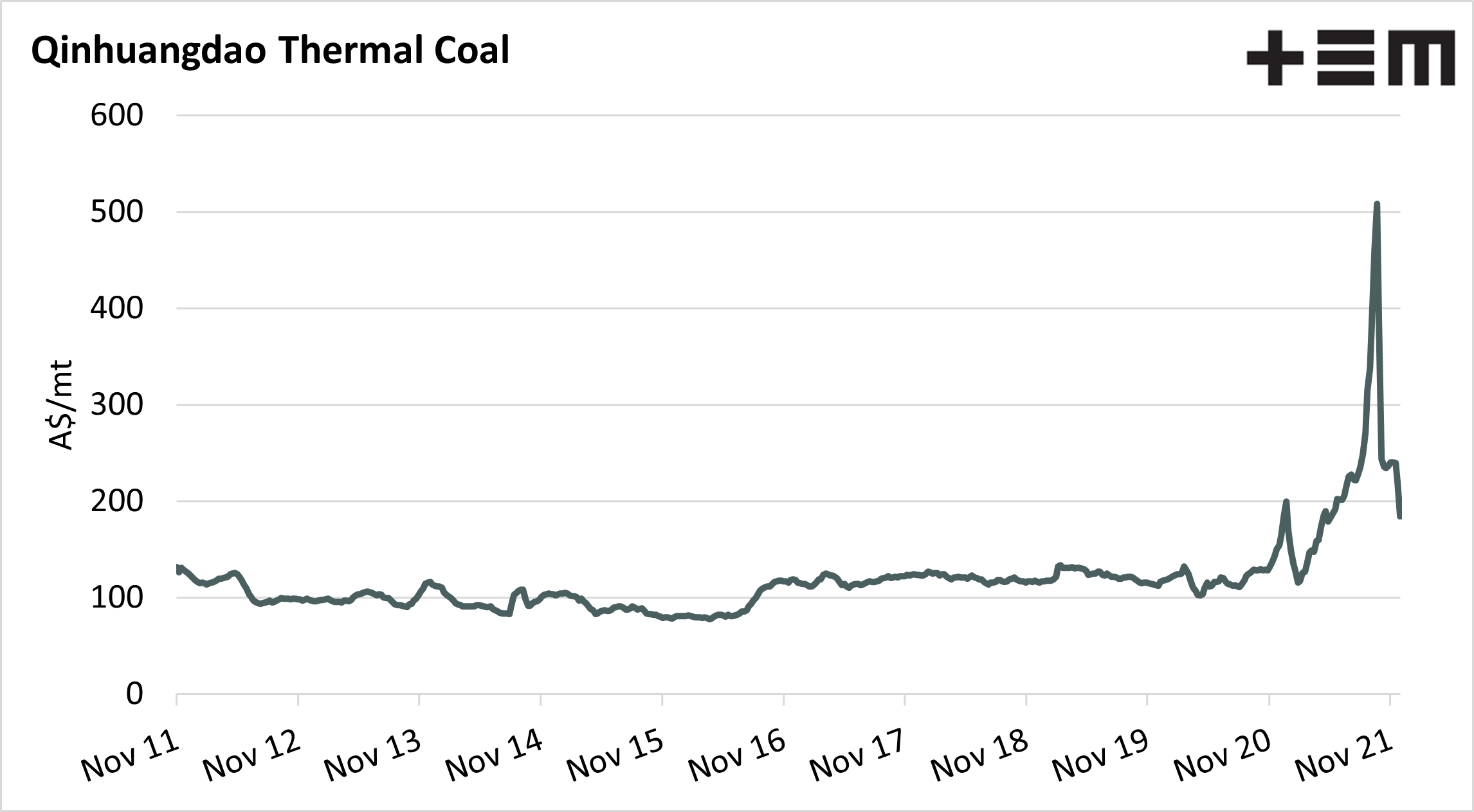

An additional energy source of importance for agriculture is coal, especially so in China. The price of coal in China has started levelling back closer to what are considered more normal levels. The high energy costs are what led to bans on fertilizer exports in late 2021.

Energy prices need to come back down to the agricultural input market back to more manageable pricing levels. Current energy pricing is a bit of a mixed bag.