Market Morsel: Iran, Russia and Urea

Market Morsel

This week, Iran launched missiles towards Israel in an attack that seemed to be more successful than the previous attack.

In the past, I have spoken extensively about the linkages between energy and grain pricing. There is another impact, and that is on the fertiliser market.

Countries rich in natural gas focus on urea production because natural gas is the key ingredient and the largest cost in making urea. These countries can produce urea more cheaply, making them major exporters. Having access to large amounts of affordable natural gas makes it easier and more economical to manufacture urea in large quantities.

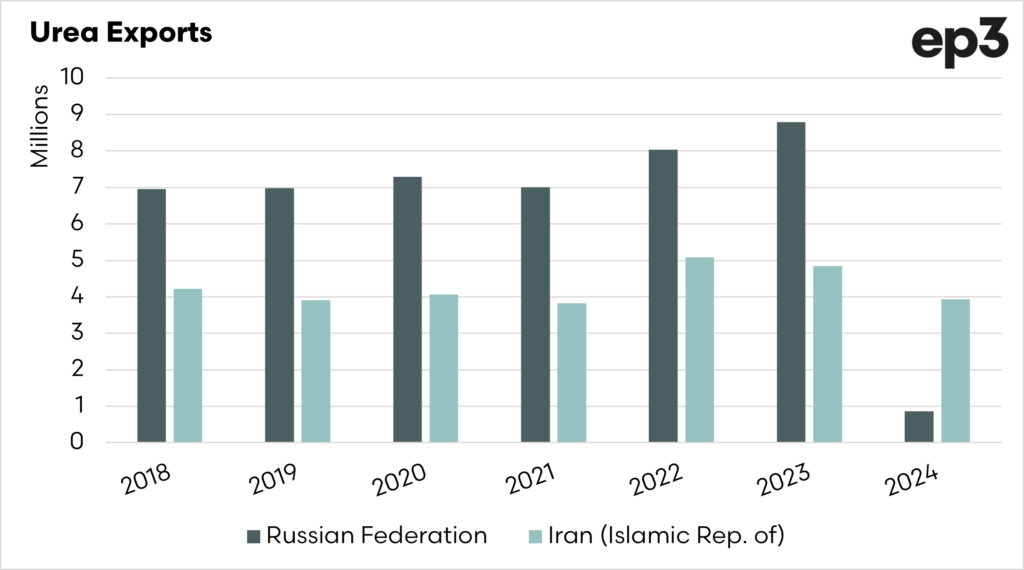

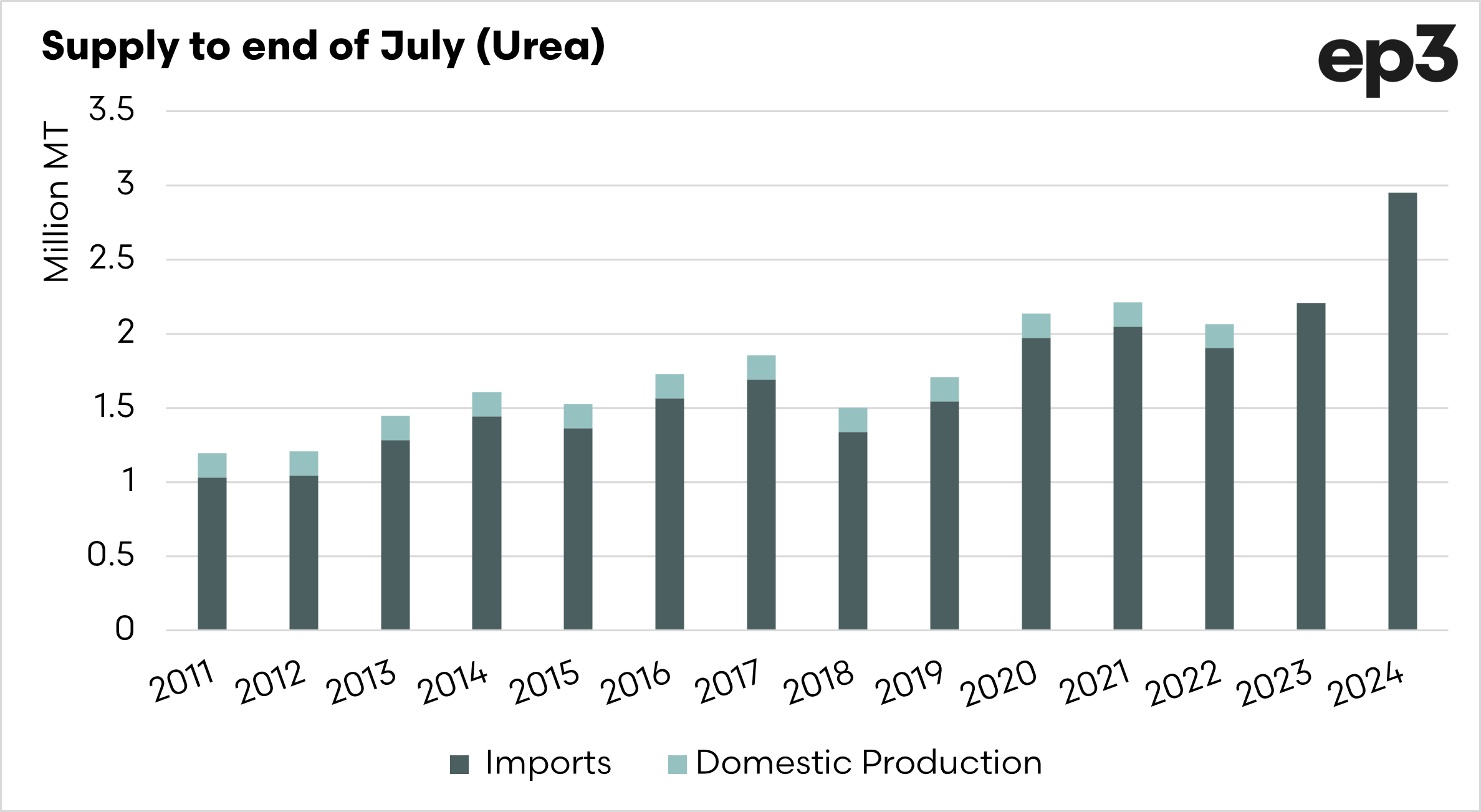

Many of the countries rich in natural gas also have a high degree of supply risk. Two of these nations in particular, are Russia and Iran. The escalating conflict in the Middle East and the war in Ukraine can potentially severely restrict fertiliser trade flows. In 2023, these two nations were responsible for 13.6mmt of the global trade in Urea, a substantial proportion of the total trade of 50-60mmt.

Iran and Russia could be considered pariah states in the global market, and if the conflict escalates, we could see urea supplies decline, which would impact price.

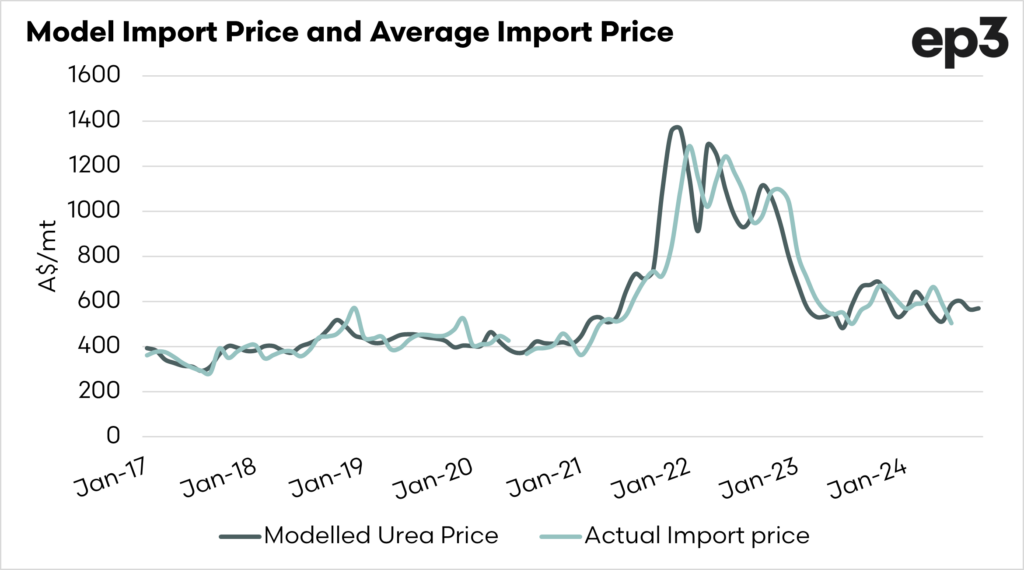

At the moment, urea pricing has increased during the past month, but still remains a long way from the high levels of recent years.