Market Morsel: No stop in falling urea pricing.

Market Morsel

It’s nice to give some good news. In recent months we have been discussing the falling market for urea. April has not been an exception.

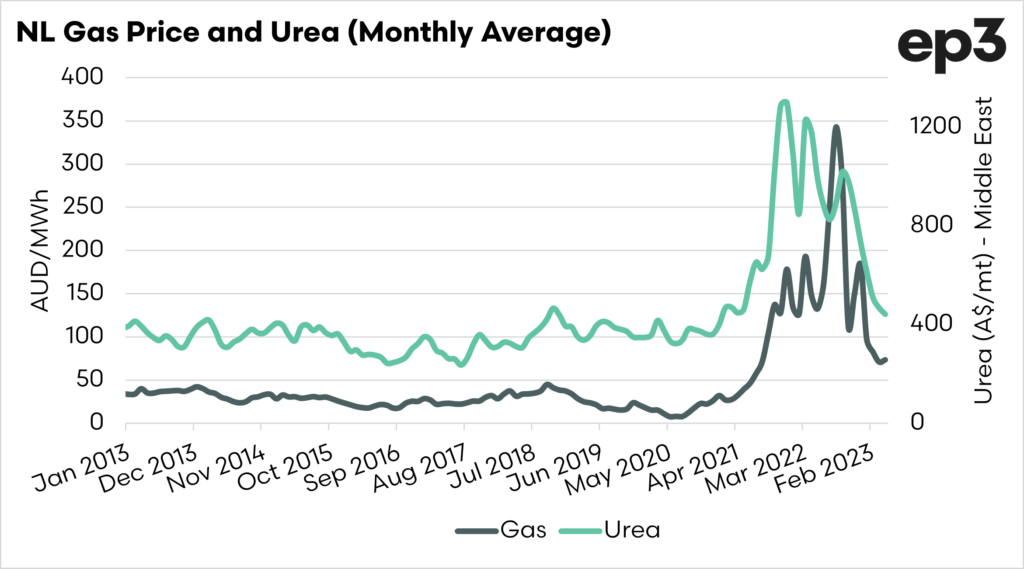

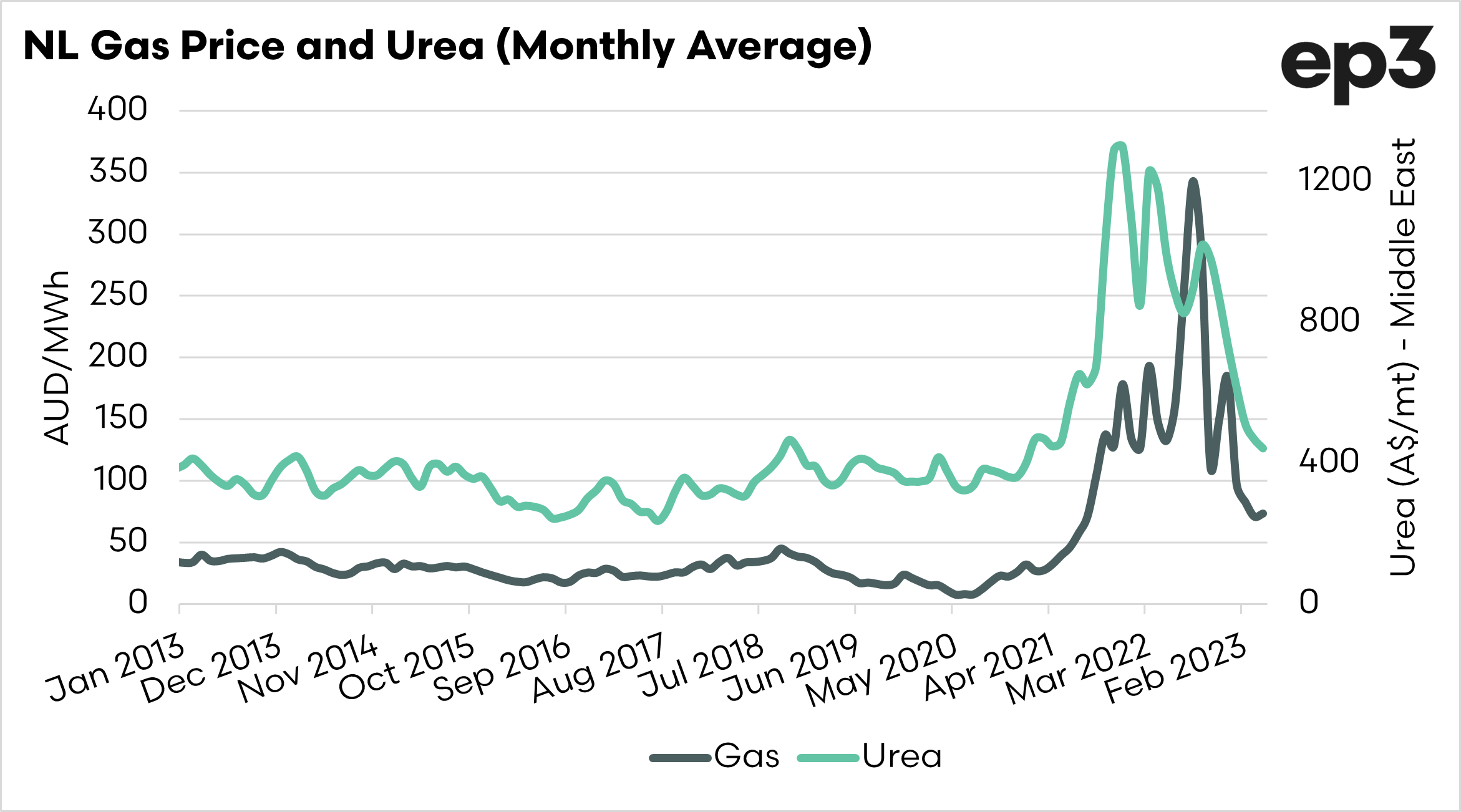

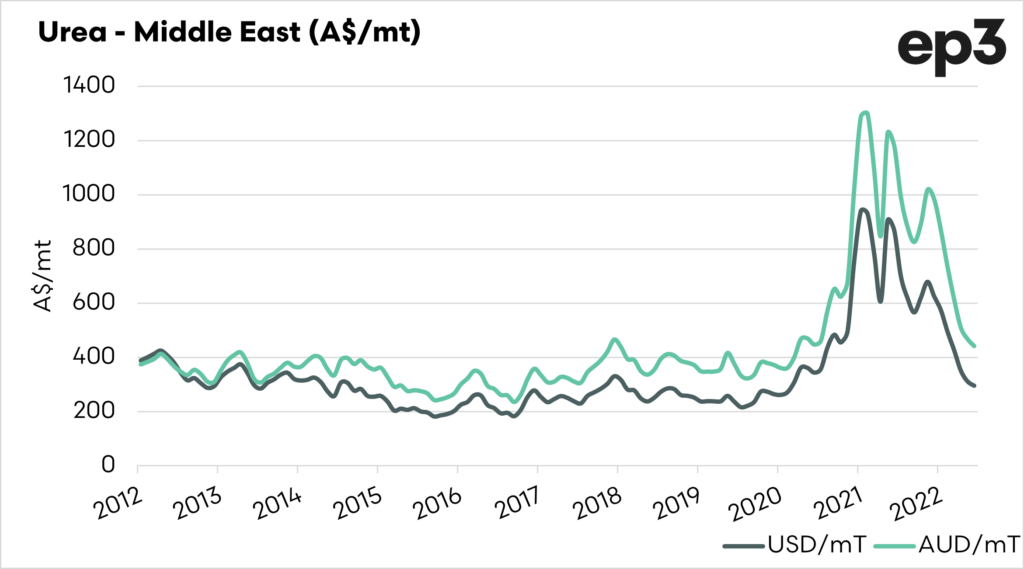

The big driver has been gas, which has fallen from the highs of 2022. Why is gas important? Gas is important to the price of urea because it is the main raw material used in the production of ammonia, which is a key component in urea fertilizer production. Natural gas is approximately 70% of the production costs of urea.

The critical numbers.

- During April, the price of urea loaded on a boat in the Middle East averaged A$441, down from A$467 the previous month.

- April 2023 pricing is down A$739 from April 2022.

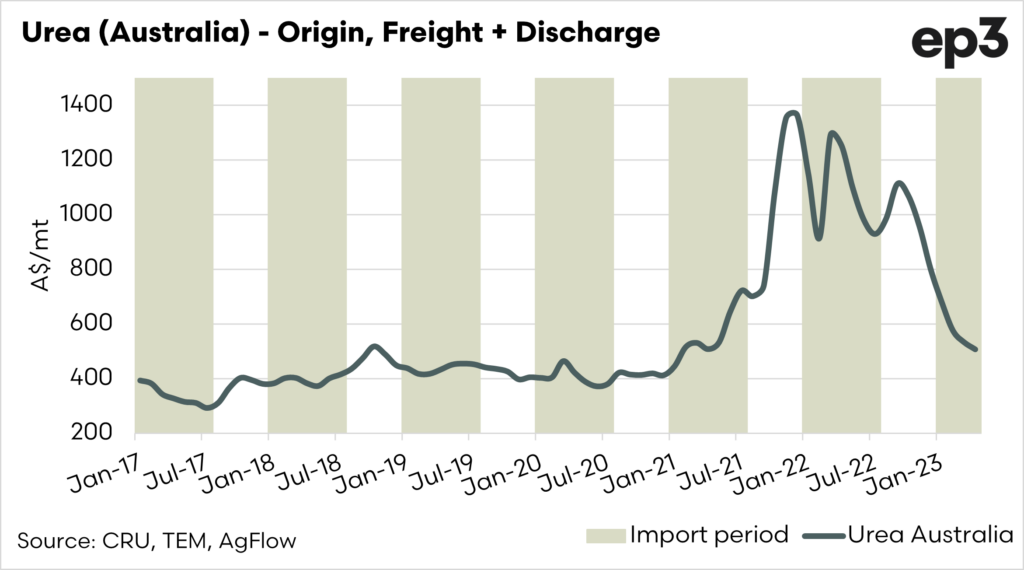

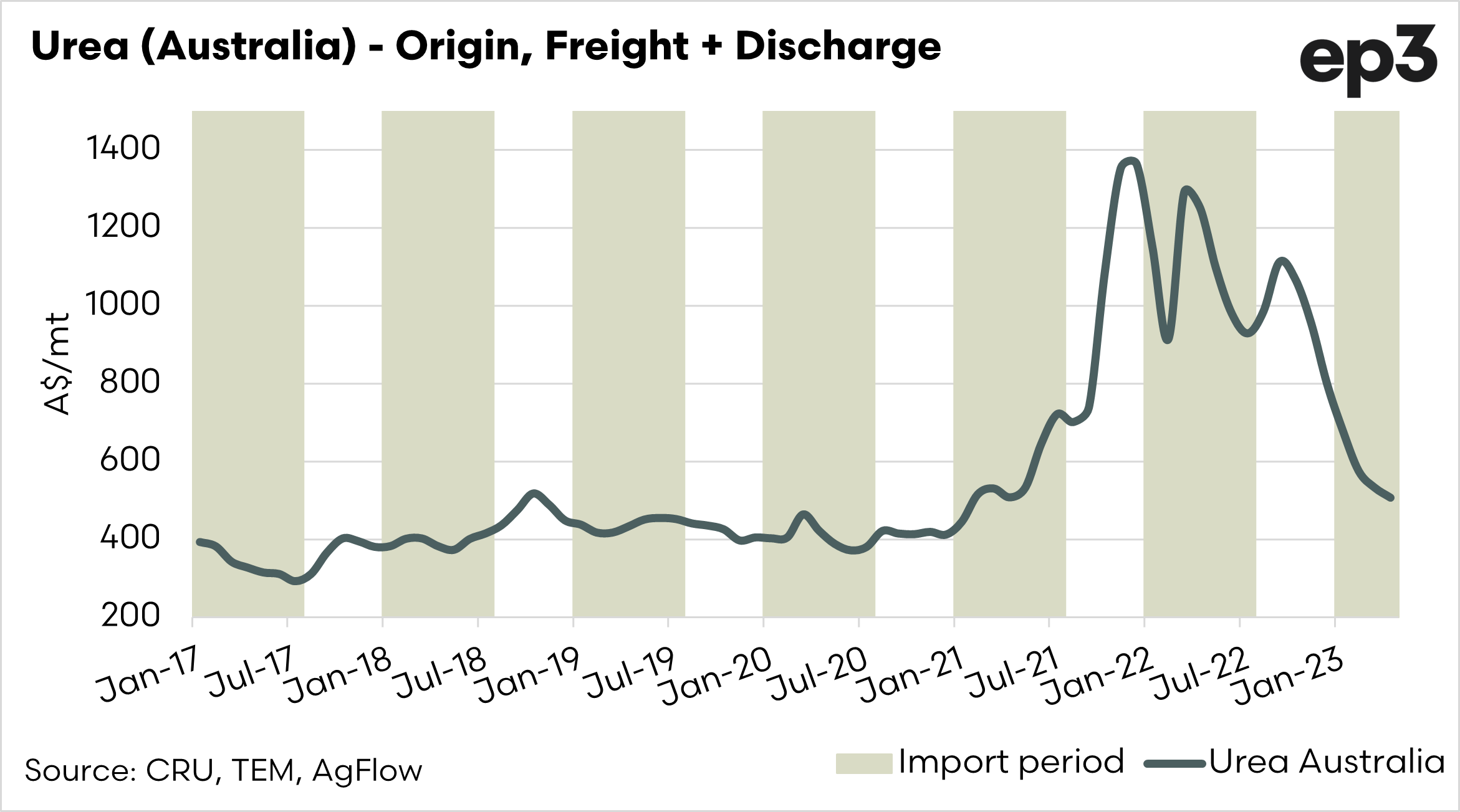

- The replacement value landed in Australia is approximately A$507 to A$530

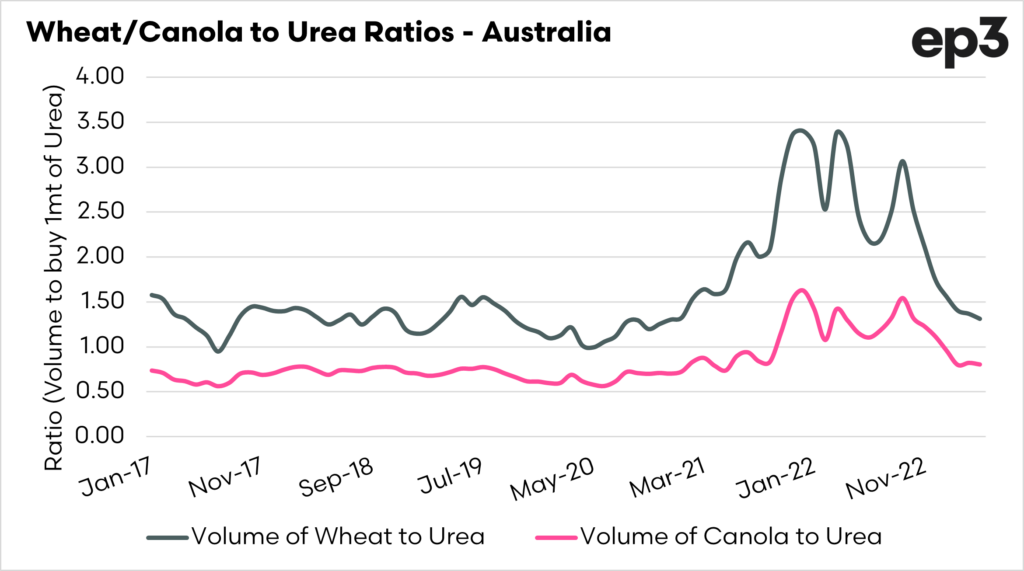

- The affordability of fertilizer has improved, with the ratio of fertilizer to canola/wheat moving back to traditional average levels.

Whilst grain prices have fallen from their highs, the reality is that the cost of producing has dropped, providing the falls in overseas markets are reflected within Australia.

Charts below for your viewing pleasure.