Titanic shipping costs.

The Snapshot

- Ocean freight plays an important role in Australian ag commodities.

- Container rates have bounced higher again, to record levels.

- Accessing containers in Australia remains difficult.

- The cost of exporting through containers is likely to remain high throughout this year and into 2022.

- Bulk rates have risen globally but have been a little flat in Australia.

- The cost of exporting and importing goods is high, but not as high as during the commodities boom.

The Detail

The past year has been hectic. One of the most significant impacts of the lingering COVID pandemic has been on freight rates. The cost of freight is an area which we regularly cover. This is because we are so heavily reliant on exports for the majority of our commodities.

So as we approach the end of August, it was worthwhile to update.

Containers:

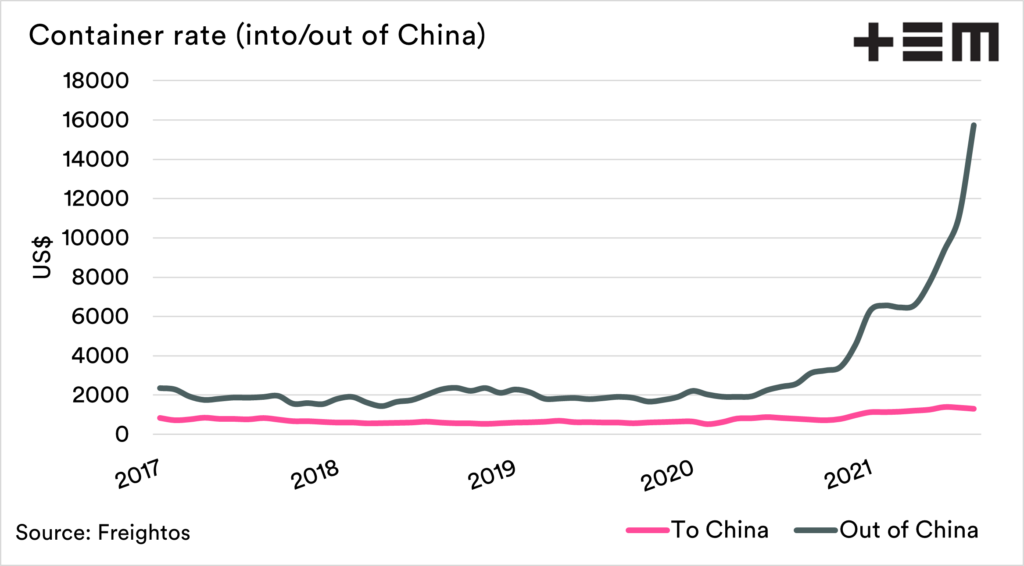

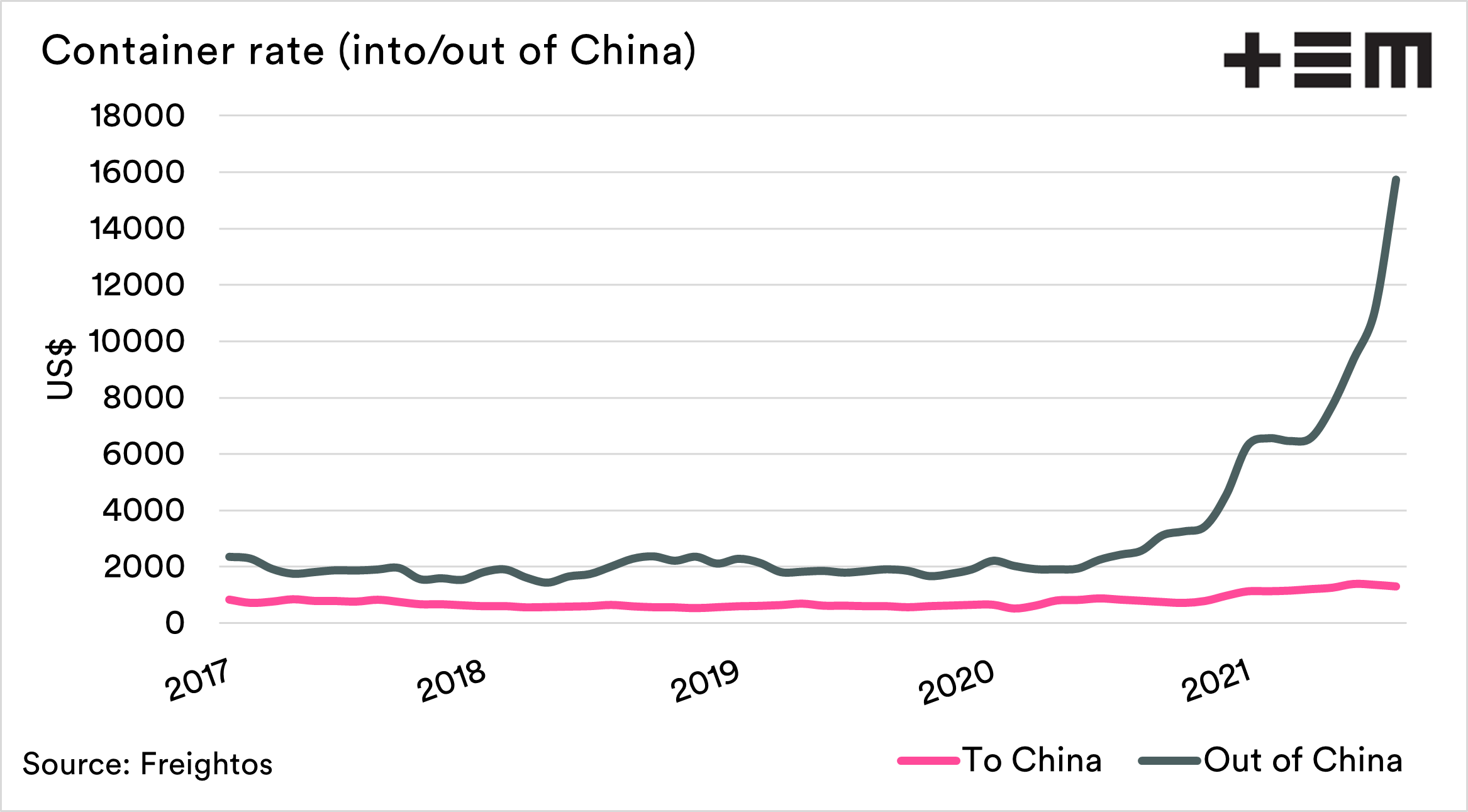

The container situation still remains very tight. Container rates into China have reached very high levels, with trade into China experiencing nowhere near the same lift. This is largely down to the positioning of empty containers and the COVID recovery being weighted towards China.

There are also major difficulties in getting empty containers within Australia, and rates have increased strongly in the quarter.

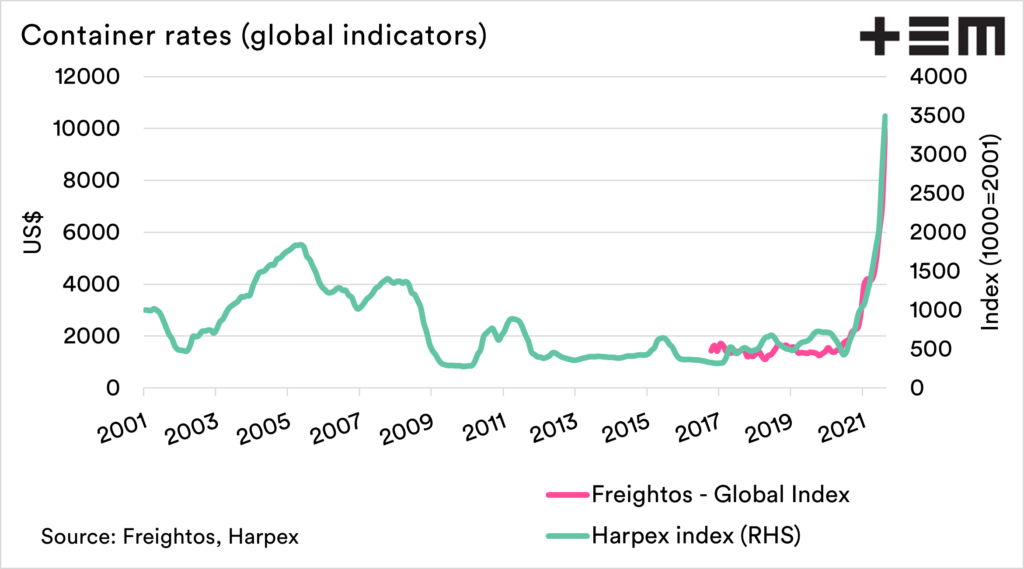

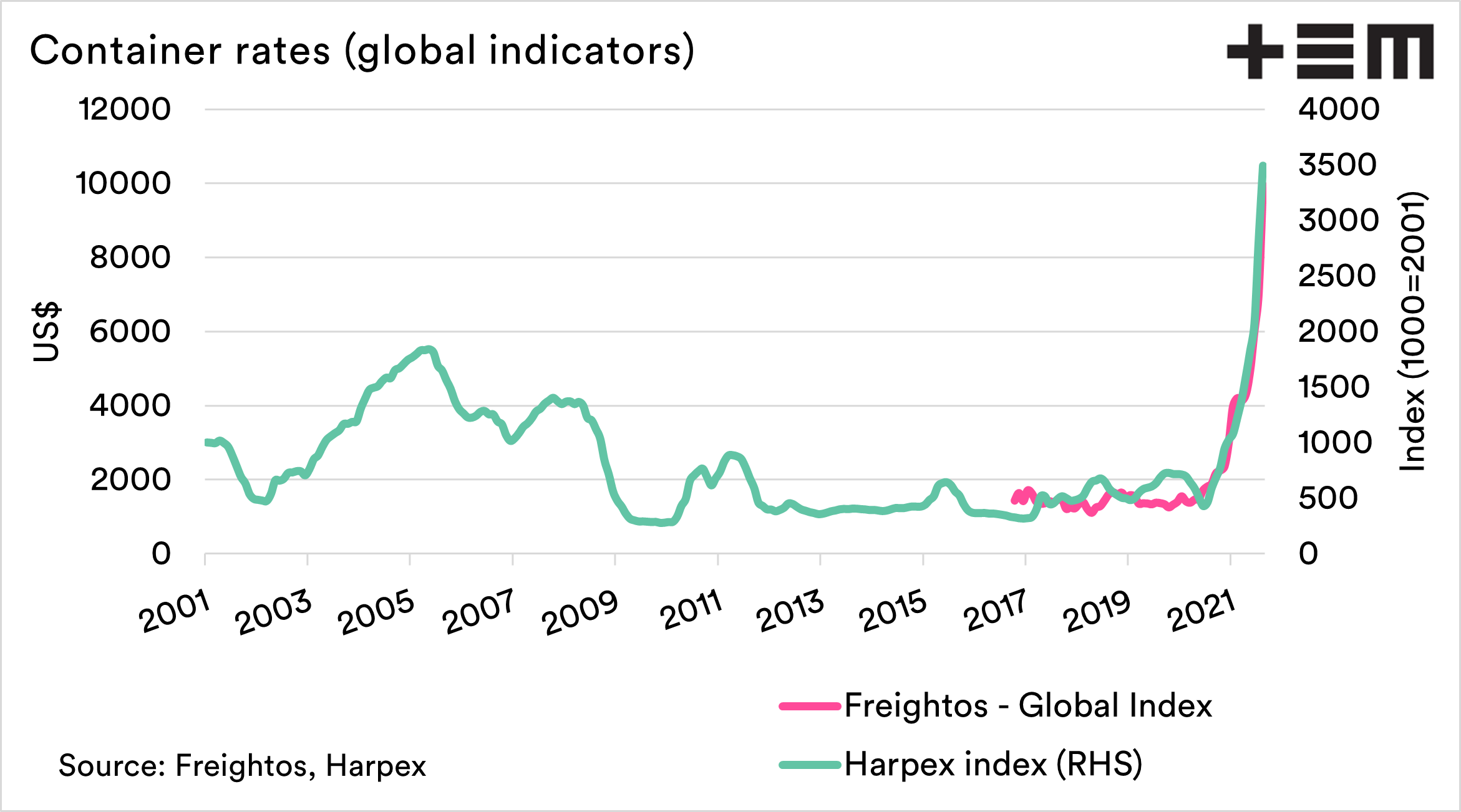

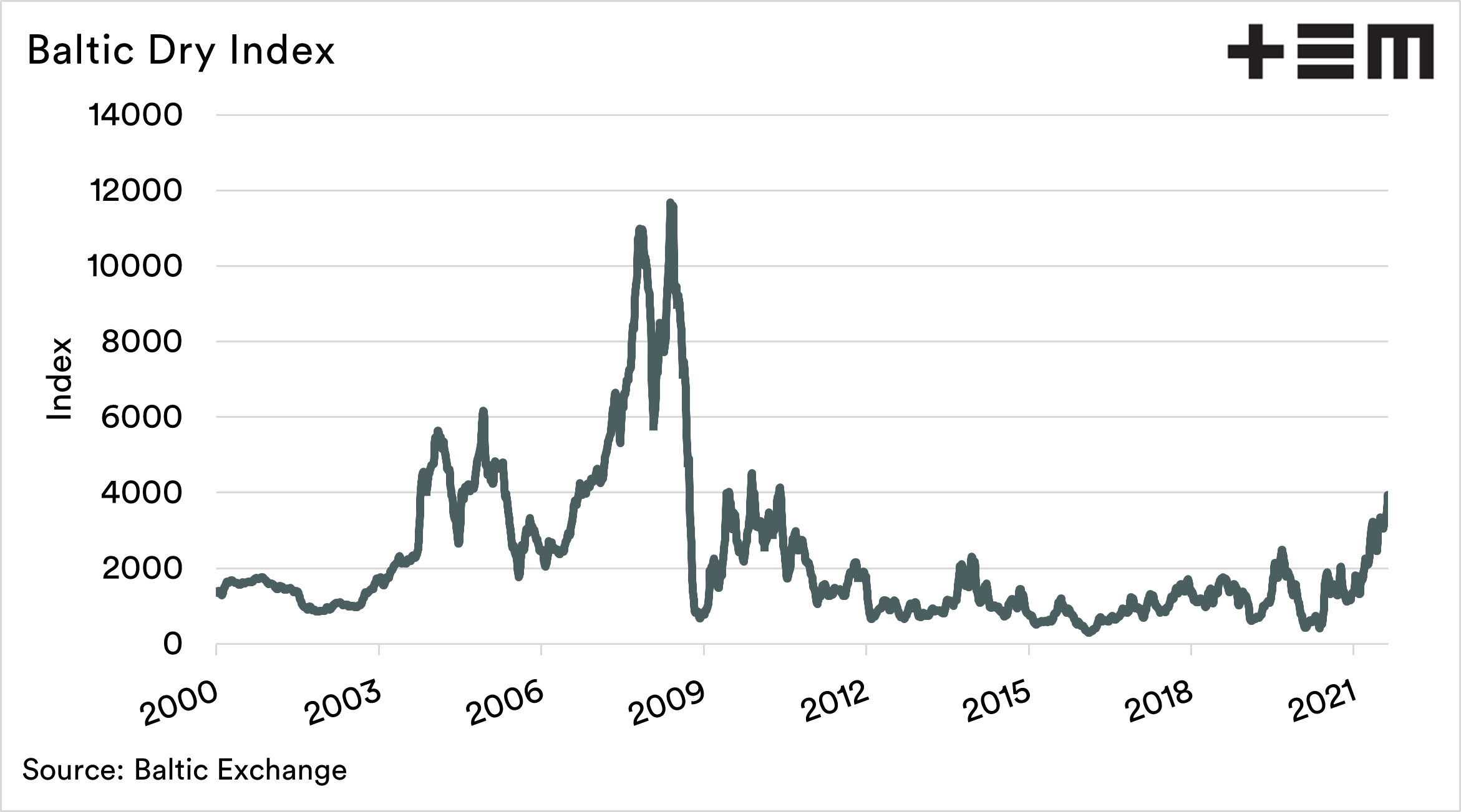

The chart below shows the global indicators for containers since 2001 to indicate how high pricing levels have got. The question is, how long before the pricing curtails demand?

A lot of our agricultural goods, especially pulses/grain are heavy and relatively low valued. However, a lot of containers are moving consumer goods, where freight might only be a small component.

You can fit around 22mt of grain in a container, so freight makes up a big chunk of the overall cost of the goods. If you look at consumer goods, t-shirts, crocs or iPhones, thousands of these products can fit in a container, and they have a high margin.

As consumer spending has increased this year, there hasn’t been a huge amount of rationing yet, as margins for consumers goods, in general, haven’t been destroyed.

I think we are likely to see high prices well into 2022, or until the world gets back to normality. I don’t think this is the new-norm.

Bulk

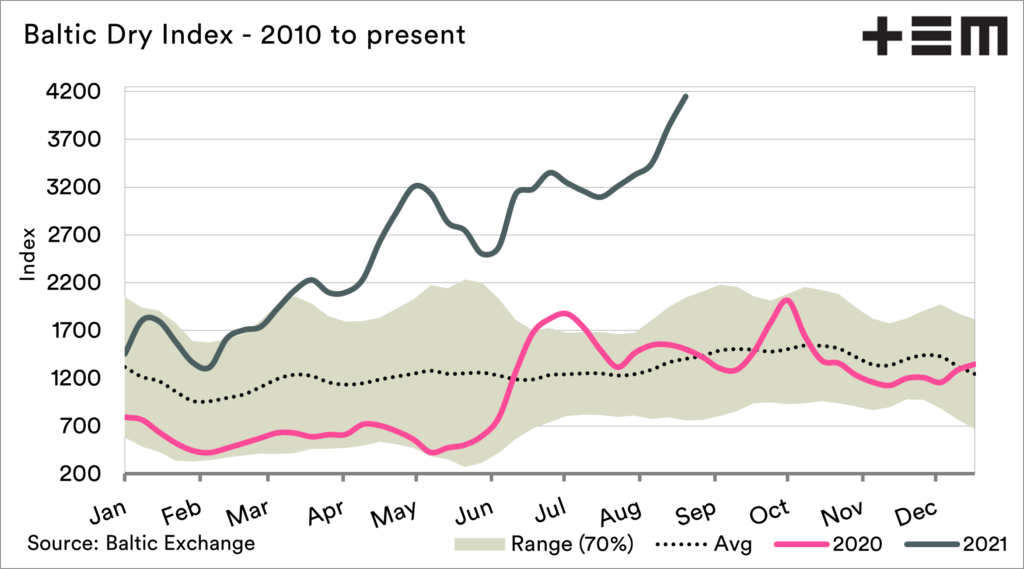

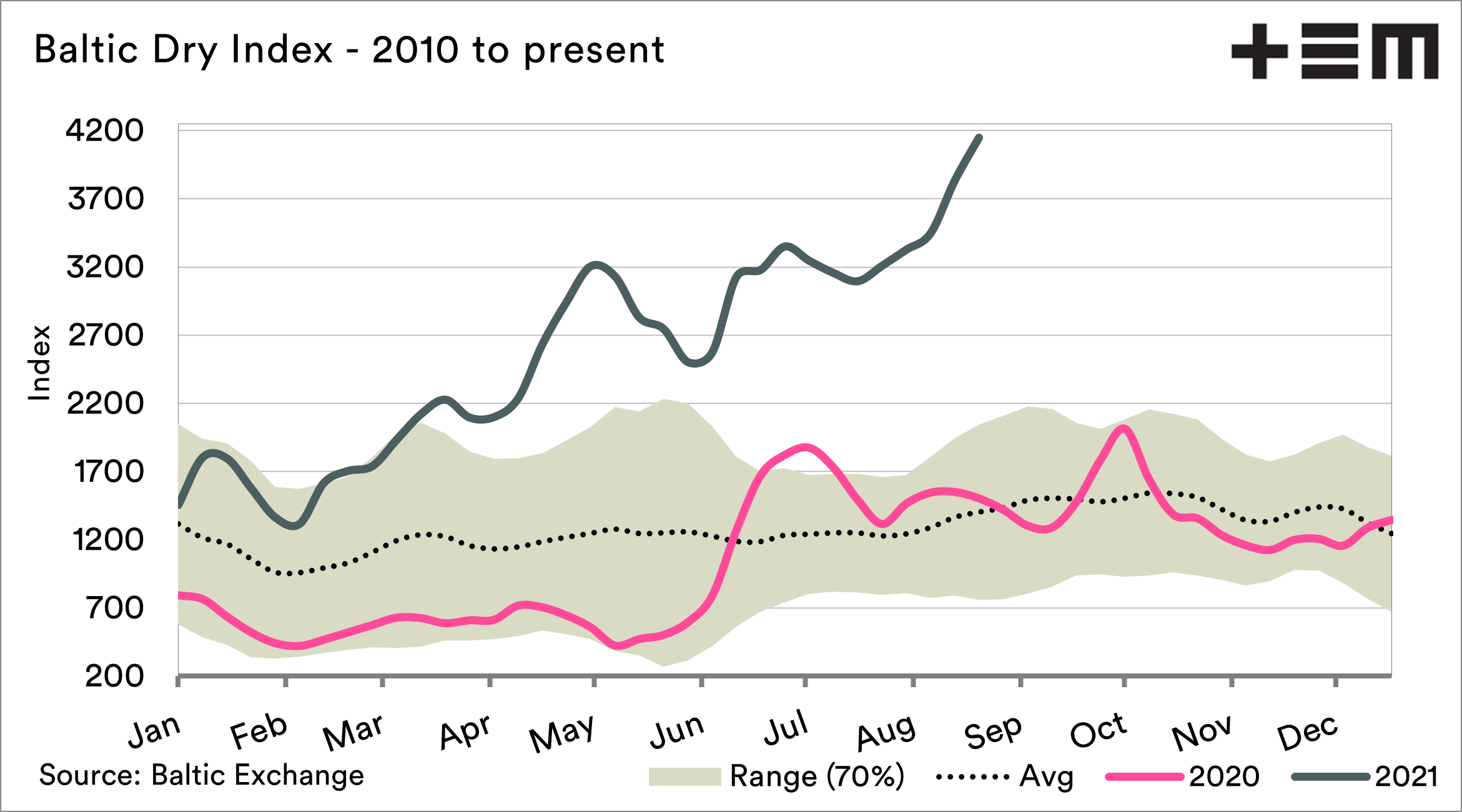

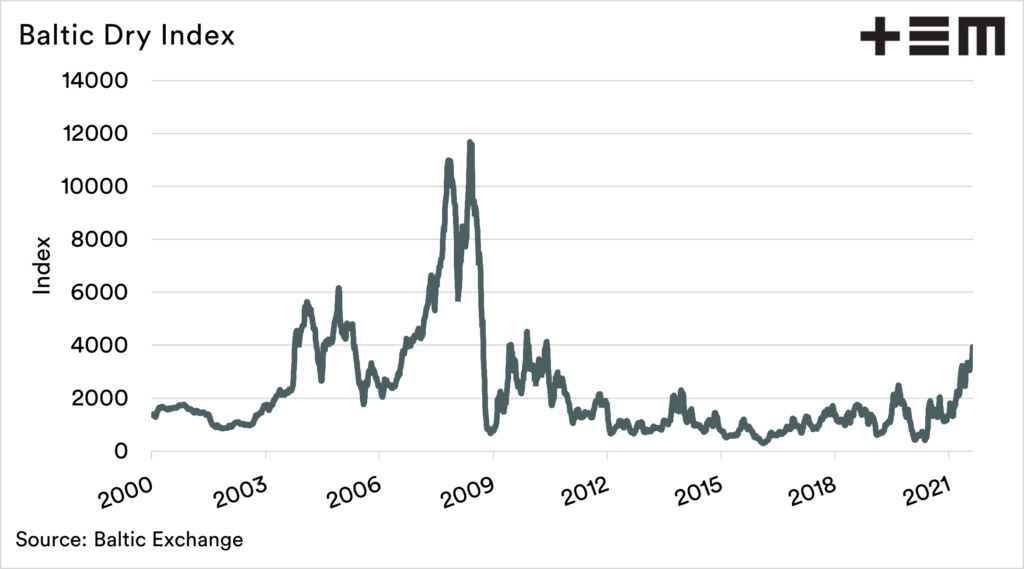

The majority of our grains are exported in bulk. The Baltic Dry Index (explainer here) has risen dramatically during August.

A high BDI means that freight will become more expensive, but in reality, our competitors will face the same higher prices. Luckily we are close to several large grain destinations.

The BDI is also considered a lead economic indicator, so a higher BDI could be a sign of improving economic conditions. The question is whether a recovery will be spread or focused more on China.

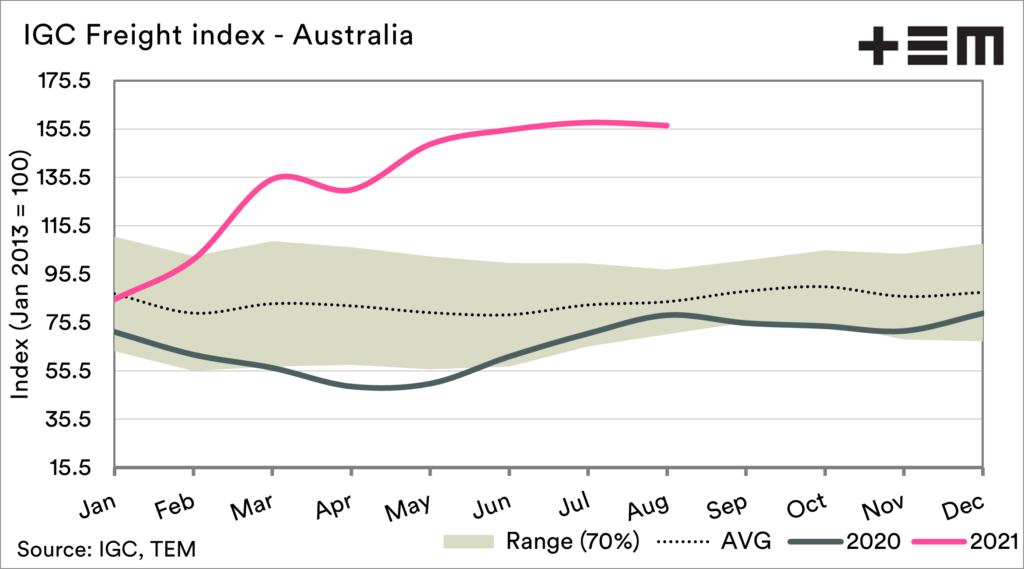

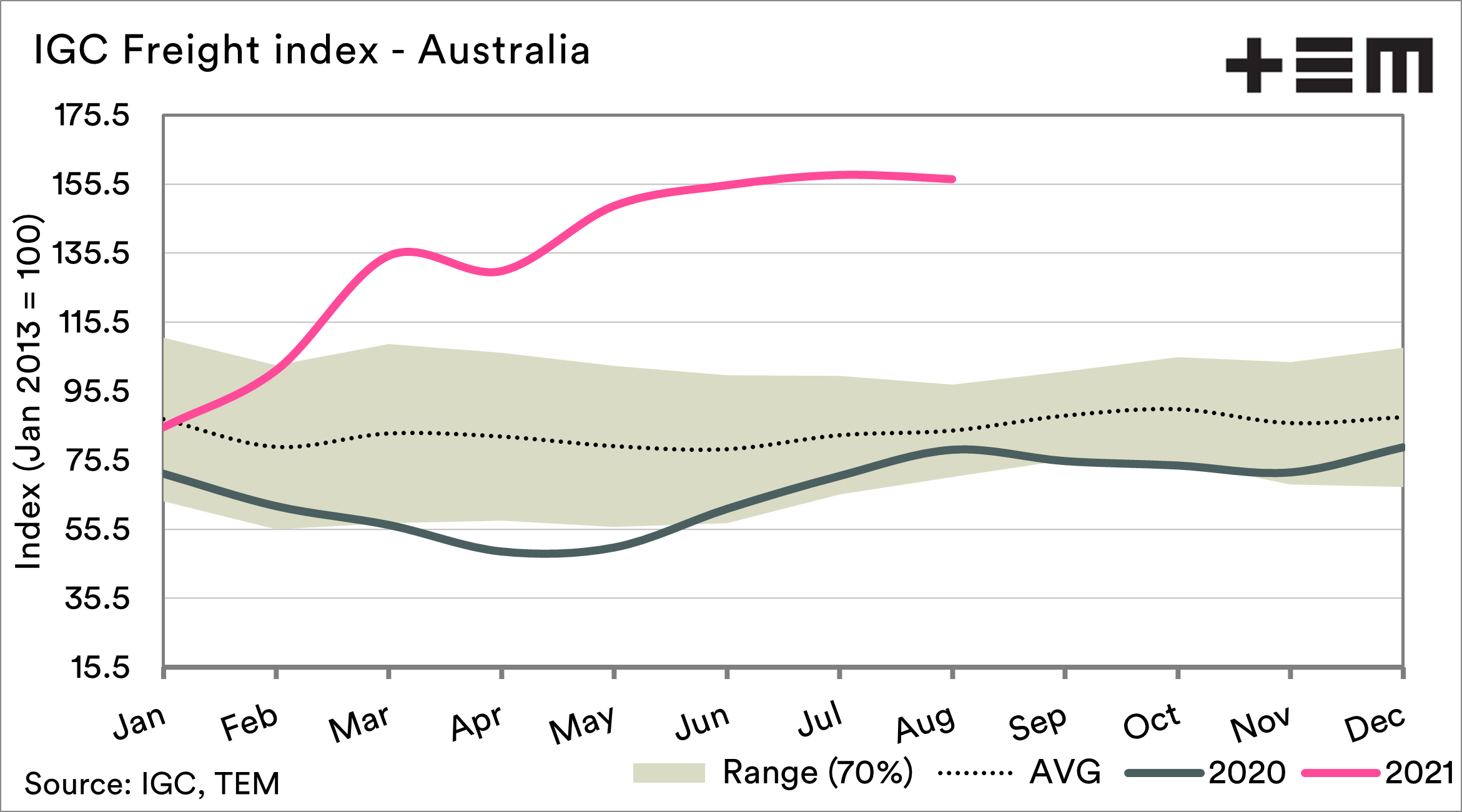

The local freight index for bulk ships ex Australia has seen pricing levels largely flatline compared to the overall picture. However, it remains at the highest levels since 2013.

It is important to note that bulk freight rates remain significantly lower than they were in the mid-2000s during the commodities boom.

It is important to note that while Australia has a competitive advantage to a number of countries, especially in South East Asia, we also import a number of products from distant shores.

Our fertilizer is a good example, with the majority arriving either from China or the middle east.